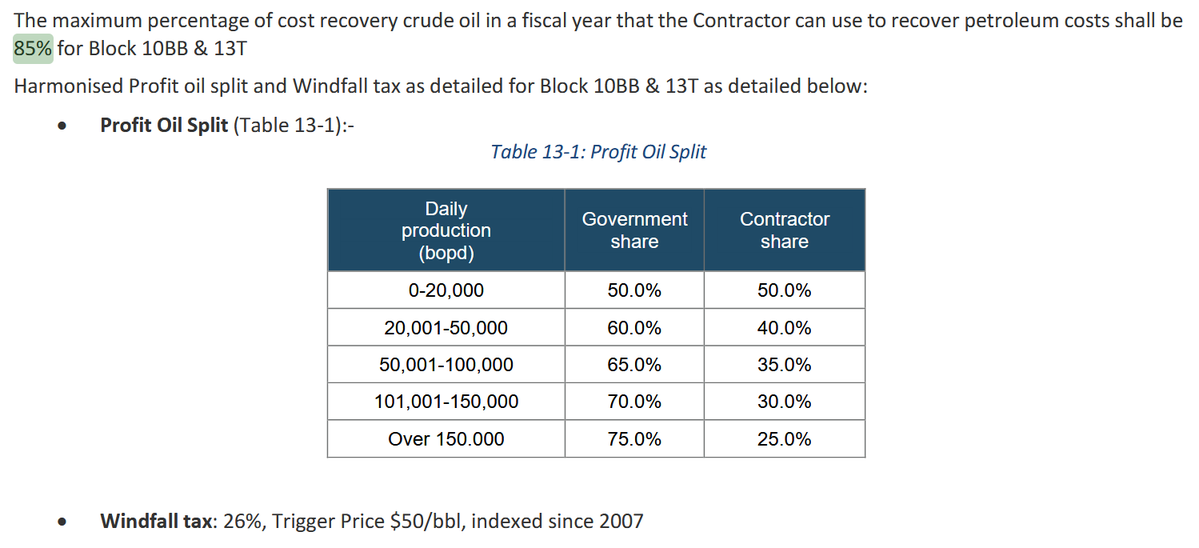

The 85% cost recovery sounds very high considering they are also getting tax waivers. Initially it was 55-65% but the FDP is requesting for 85%.

18/n

18/n

جاري تحميل الاقتراحات...