👉 Manufacturing Theme Has Huge Growth Potential in India 🇮🇳

✨5 Manufacturing Stocks to focus

👉 A Thread 🧵👇

#stockmarketcrash #stockmarketsindia #StocksInFocus #StockMarket #StockToWatch #investing #Investments #makeinindia #Manufacturing

✨5 Manufacturing Stocks to focus

👉 A Thread 🧵👇

#stockmarketcrash #stockmarketsindia #StocksInFocus #StockMarket #StockToWatch #investing #Investments #makeinindia #Manufacturing

1 Amber enterprises India Ltd business model

The company is a prominent solution provider for the Air conditioner OEM/ODM Industry in India x.com

The company is a prominent solution provider for the Air conditioner OEM/ODM Industry in India x.com

👉Key ratios

⚡Market Cap: ₹ 22,305 Cr.

⚡Current Price: ₹ 6,595

⚡Stock P/E: 100

⚡ROCE: 10.2 %

⚡ROE: 6.74 %

⚡Debt to equity: 0.96

⚡Profit Var 3Yrs: 16.3 %

⚡Sales growth 3Years: 30.5 % x.com

⚡Market Cap: ₹ 22,305 Cr.

⚡Current Price: ₹ 6,595

⚡Stock P/E: 100

⚡ROCE: 10.2 %

⚡ROE: 6.74 %

⚡Debt to equity: 0.96

⚡Profit Var 3Yrs: 16.3 %

⚡Sales growth 3Years: 30.5 % x.com

👉Growth initiatives undertaken by the company

⚡New Manufacturing Plants: Amber is investing in expanding its manufacturing capacity. A new plant for Ascent Circuits in Tamil Nadu, expected to be operational by September 2025

⚡Consumer Durables: Amber is targeting growth in the air conditioner and washing machine markets.

⚡New Manufacturing Plants: Amber is investing in expanding its manufacturing capacity. A new plant for Ascent Circuits in Tamil Nadu, expected to be operational by September 2025

⚡Consumer Durables: Amber is targeting growth in the air conditioner and washing machine markets.

👉Shareholding Pattern

⚡Promoter holding: 39.7 %

⚡Change in Prom Hold: -0.07 %

⚡FII holding: 28.6 %

⚡Chg in FII Hold: 2.17 %

⚡DII holding: 19.1 %

⚡Chg in DII Hold: 1.31 %

⚡Public holding: 12.6 % x.com

⚡Promoter holding: 39.7 %

⚡Change in Prom Hold: -0.07 %

⚡FII holding: 28.6 %

⚡Chg in FII Hold: 2.17 %

⚡DII holding: 19.1 %

⚡Chg in DII Hold: 1.31 %

⚡Public holding: 12.6 % x.com

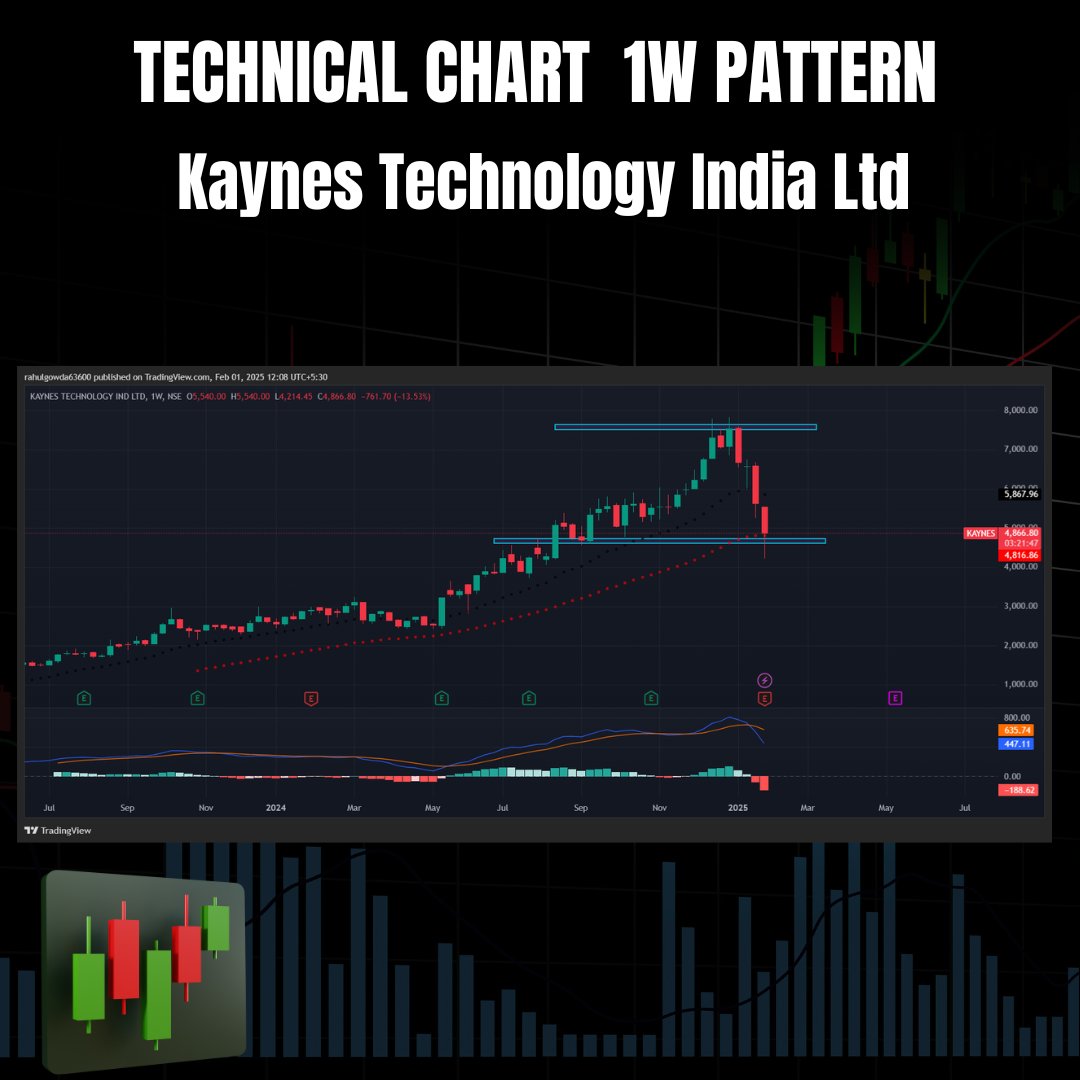

👉Kaynes Technology India Ltd business model

The company provides conceptual design, process engineering, integrated manufacturing, and life-cycle support for major players in the automotive, industrial, aerospace and defense, outer-space, nuclear, medical, railways, Internet of Things ("IoT"), Information Technology ("IT") and other segments

The company provides conceptual design, process engineering, integrated manufacturing, and life-cycle support for major players in the automotive, industrial, aerospace and defense, outer-space, nuclear, medical, railways, Internet of Things ("IoT"), Information Technology ("IT") and other segments

👉Key ratios

⚡Market Cap: ₹ 31,697 Cr.

⚡Current Price: ₹ 4,952

⚡Stock P/E: 123

⚡ROCE: 14.5 %

⚡ROE: 10.5 %

⚡Debt to equity: 0.27

⚡Profit Var 3Yrs: 165 %

⚡Sales growth 3Years: 62.5 % x.com

⚡Market Cap: ₹ 31,697 Cr.

⚡Current Price: ₹ 4,952

⚡Stock P/E: 123

⚡ROCE: 14.5 %

⚡ROE: 10.5 %

⚡Debt to equity: 0.27

⚡Profit Var 3Yrs: 165 %

⚡Sales growth 3Years: 62.5 % x.com

👉Shareholder Pattern

⚡Promoter holding: 57.8 %

⚡Change in Prom Hold: 0.00 %

⚡FII holding: 14.8 %

⚡Chg in FII Hold: -0.08 %

⚡DII holding: 15.0 %

⚡Chg in DII Hold: -1.03 %

⚡Public holding: 12.4 % x.com

⚡Promoter holding: 57.8 %

⚡Change in Prom Hold: 0.00 %

⚡FII holding: 14.8 %

⚡Chg in FII Hold: -0.08 %

⚡DII holding: 15.0 %

⚡Chg in DII Hold: -1.03 %

⚡Public holding: 12.4 % x.com

👉Growth initiatives undertaken by the company

⚡Digicom Electronics Inc.: The acquisition of Digicom Electronics Inc. (USA) enhances Kaynes' electronics manufacturing capabilities and provides access to new technologies and markets.

⚡Smart Meters: Kaynes is aiming to become the largest smart meter manufacturer in India, capitalizing on the huge domestic opportunities and export potential in this segment.

⚡Digicom Electronics Inc.: The acquisition of Digicom Electronics Inc. (USA) enhances Kaynes' electronics manufacturing capabilities and provides access to new technologies and markets.

⚡Smart Meters: Kaynes is aiming to become the largest smart meter manufacturer in India, capitalizing on the huge domestic opportunities and export potential in this segment.

👉Dixon Technologies India Ltd business model

is a Electronic Manufacturing Services (EMS) company with operations in the electronic products vertical such as consumer electronics, lighting, home appliance, closed-circuit television cameras (CCTVs), and mobile phones x.com

is a Electronic Manufacturing Services (EMS) company with operations in the electronic products vertical such as consumer electronics, lighting, home appliance, closed-circuit television cameras (CCTVs), and mobile phones x.com

👉Key ratios

⚡Market Cap: ₹ 90,664 Cr.

⚡Current Price: ₹ 15,093

⚡Stock P/E: 143

⚡ROCE: 29.2 %

⚡ROE: 24.7 %

⚡Debt to equity: 0.36

⚡Profit Var 3Yrs: 32.1 %

⚡Sales growth 3Years: 40.0 % x.com

⚡Market Cap: ₹ 90,664 Cr.

⚡Current Price: ₹ 15,093

⚡Stock P/E: 143

⚡ROCE: 29.2 %

⚡ROE: 24.7 %

⚡Debt to equity: 0.36

⚡Profit Var 3Yrs: 32.1 %

⚡Sales growth 3Years: 40.0 % x.com

👉 Shareholder Pattern

⚡Promoter holding: 32.4 %

⚡Change in Prom Hold: -0.47 %

⚡FII holding: 23.2 %

⚡Chg in FII Hold: 0.53 %

⚡DII holding: 22.6 %

⚡Chg in DII Hold: -0.53 %

⚡Public holding: 21.7 % x.com

⚡Promoter holding: 32.4 %

⚡Change in Prom Hold: -0.47 %

⚡FII holding: 23.2 %

⚡Chg in FII Hold: 0.53 %

⚡DII holding: 22.6 %

⚡Chg in DII Hold: -0.53 %

⚡Public holding: 21.7 % x.com

👉Growth initiatives undertaken by the company

⚡Joint Ventures: Dixon Technologies has formed a joint venture with Vivo India for manufacturing electronic devices

⚡Capacity Expansion: Dixon Technologies has been continuously expanding its manufacturing capacity to meet the growing demand for its products.

⚡Joint Ventures: Dixon Technologies has formed a joint venture with Vivo India for manufacturing electronic devices

⚡Capacity Expansion: Dixon Technologies has been continuously expanding its manufacturing capacity to meet the growing demand for its products.

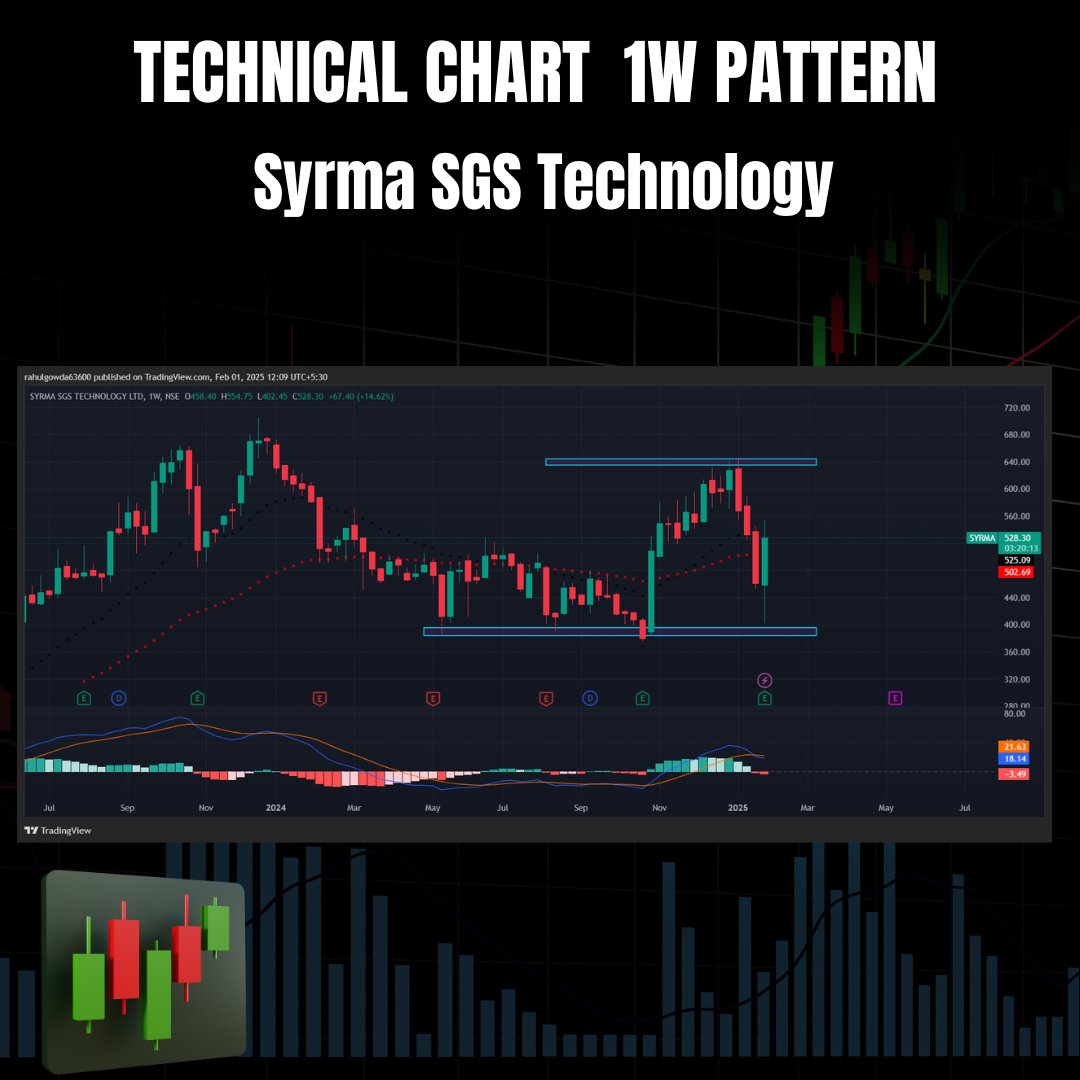

👉Syrma SGS Technology business model

The company provides integrated services and solutions to original equipment manufacturers (OEMs) from the initial product concept stage to volume production through concept co-creation and product realization x.com

The company provides integrated services and solutions to original equipment manufacturers (OEMs) from the initial product concept stage to volume production through concept co-creation and product realization x.com

👉Key ratios

⚡Market Cap: ₹ 9,604 Cr.

⚡Current Price: ₹ 541

⚡Stock P/E: 68.2

⚡ROCE: 9.84 %

⚡ROE: 6.81 %

⚡Debt to equity: 0.40

⚡Profit Var 3Yrs: 19.8 %

⚡Sales growth 3Years: 52.7 % x.com

⚡Market Cap: ₹ 9,604 Cr.

⚡Current Price: ₹ 541

⚡Stock P/E: 68.2

⚡ROCE: 9.84 %

⚡ROE: 6.81 %

⚡Debt to equity: 0.40

⚡Profit Var 3Yrs: 19.8 %

⚡Sales growth 3Years: 52.7 % x.com

👉Shareholder Pattern

⚡Promoter holding: 46.6 %

⚡Change in Prom Hold: -0.31 %

⚡FII holding: 8.49 %

⚡Chg in FII Hold: -1.83 %

⚡DII holding: 7.46 %

⚡Chg in DII Hold: 1.02 %

⚡Public holding: 37.4 % x.com

⚡Promoter holding: 46.6 %

⚡Change in Prom Hold: -0.31 %

⚡FII holding: 8.49 %

⚡Chg in FII Hold: -1.83 %

⚡DII holding: 7.46 %

⚡Chg in DII Hold: 1.02 %

⚡Public holding: 37.4 % x.com

👉Growth initiatives undertaken by the company

⚡Expanding manufacturing capabilities: The company has inaugurated a new assembly line for laptops in Chennai, with a production capacity of 100,000 units annually, scalable to 1 million units.

⚡Participating in PLI schemes: Syrma SGS is a beneficiary of the Production Linked Incentive (PLI) 2.0 scheme for IT Hardware.

⚡Expanding manufacturing capabilities: The company has inaugurated a new assembly line for laptops in Chennai, with a production capacity of 100,000 units annually, scalable to 1 million units.

⚡Participating in PLI schemes: Syrma SGS is a beneficiary of the Production Linked Incentive (PLI) 2.0 scheme for IT Hardware.

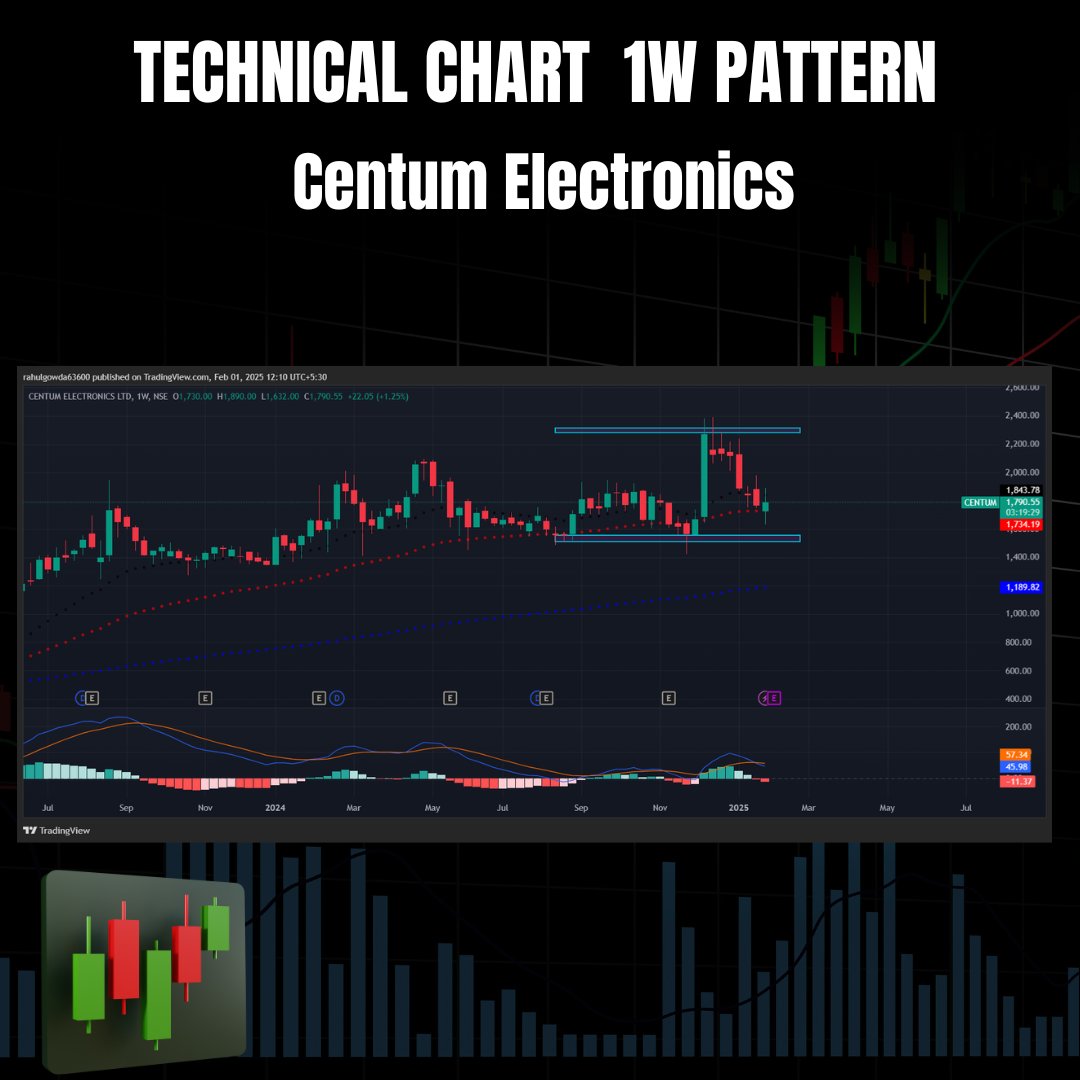

👉Centum Electronics business model

offers entire spectrum of design services and manufacturing of systems, subsystems for mission critical products in Defence, Space, Aerospace, Industrial, Transportation and Medical sectors. x.com

offers entire spectrum of design services and manufacturing of systems, subsystems for mission critical products in Defence, Space, Aerospace, Industrial, Transportation and Medical sectors. x.com

👉Key ratios

⚡Market Cap: ₹ 2,374 Cr.

⚡Current Price: ₹ 1,841

⚡Stock P/E

⚡ROCE: 10.1 %

⚡ROE: -3.65 %

⚡Debt to equity: 1.32

⚡Profit Var 3Yrs: %

⚡Sales growth 3Years: 10.1 % x.com

⚡Market Cap: ₹ 2,374 Cr.

⚡Current Price: ₹ 1,841

⚡Stock P/E

⚡ROCE: 10.1 %

⚡ROE: -3.65 %

⚡Debt to equity: 1.32

⚡Profit Var 3Yrs: %

⚡Sales growth 3Years: 10.1 % x.com

👉Shareholder Pattern

⚡Promoter holding: 58.8 %

⚡Change in Prom Hold: 0.00 %

⚡FII holding: 1.03 %

⚡Chg in FII Hold: 0.65 %

⚡DII holding: 8.06 %

⚡Chg in DII Hold: -0.47 %

⚡Public holding: 32.2 % x.com

⚡Promoter holding: 58.8 %

⚡Change in Prom Hold: 0.00 %

⚡FII holding: 1.03 %

⚡Chg in FII Hold: 0.65 %

⚡DII holding: 8.06 %

⚡Chg in DII Hold: -0.47 %

⚡Public holding: 32.2 % x.com

👉Growth initiatives undertaken by the company

⚡Strengthening Design and Product Development: Centum has consistently invested in enhancing its design and product development capabilities.

⚡Global Expansion: The company has focused on expanding its global footprint with operations in North America, EMEA, and Asia

⚡Strengthening Design and Product Development: Centum has consistently invested in enhancing its design and product development capabilities.

⚡Global Expansion: The company has focused on expanding its global footprint with operations in North America, EMEA, and Asia

Follow 👉🌟 @FinAspiration 👈. For more insights related to the Finance and Stock market concepts which is simplified in easy to Understand manner ✨. x.com

🔴 Disclaimer : The content in this post is only for educational purpose and not investment advice. Please consult your financial advisors before investing.

👉🏻 Best X handle's to learn from .

@FinTaxCoach

@AshDevanampriya

@titan_traderss

@RupeezyOfficial

@Chart_Wallah108

@vandit_jain1994

@Anvith_

@caniravkaria

@iramyram

@deepak4748

@logical_traderr

@Breakoutrade94

@EquityInsightss

@FinTaxCoach

@AshDevanampriya

@titan_traderss

@RupeezyOfficial

@Chart_Wallah108

@vandit_jain1994

@Anvith_

@caniravkaria

@iramyram

@deepak4748

@logical_traderr

@Breakoutrade94

@EquityInsightss

جاري تحميل الاقتراحات...