This has NEVER happened before:

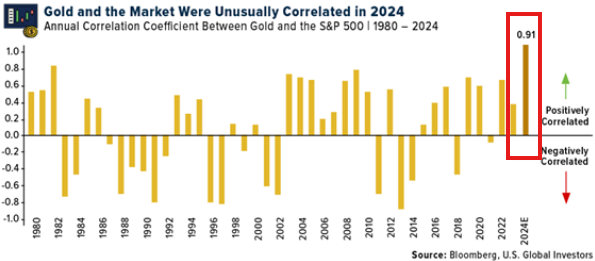

The correlation coefficient between Gold and the S&P 500 reached a record 0.91 in 2024.

This means that Gold and the S&P 500 were moving in TANDEM 91% of the time.

Why is the world's $18 trillion "safety trade" rising with stocks?

(a thread)

The correlation coefficient between Gold and the S&P 500 reached a record 0.91 in 2024.

This means that Gold and the S&P 500 were moving in TANDEM 91% of the time.

Why is the world's $18 trillion "safety trade" rising with stocks?

(a thread)

Below is a chart summarizing the S&P 500 to Gold correlation.

A correlation coefficient of 0.91 has never happened before.

Historically, gold and the S&P 500 are often negatively correlated.

This is because gold is a "safety" trade and stocks are a "risky" trade. x.com

A correlation coefficient of 0.91 has never happened before.

Historically, gold and the S&P 500 are often negatively correlated.

This is because gold is a "safety" trade and stocks are a "risky" trade. x.com

But, it gets even more unusual:

The Fed is cutting rates, the 10-year note yield is nearing 5%, and the US Dollar is at a fresh 26-month high.

Meanwhile, gold surged ~30% in 2024 in its best year since 2010.

Why is gold RISING as the Fed calls for a "soft landing? x.com

The Fed is cutting rates, the 10-year note yield is nearing 5%, and the US Dollar is at a fresh 26-month high.

Meanwhile, gold surged ~30% in 2024 in its best year since 2010.

Why is gold RISING as the Fed calls for a "soft landing? x.com

This has practically NEVER happened in recent history:

Since January 2024, gold is up ~31%, the 10-year note yield is up 22%, and the US Dollar Index is up 7%.

To truly understand how unprecedented, you must first understand their historical relationship.

Let us explain. x.com

Since January 2024, gold is up ~31%, the 10-year note yield is up 22%, and the US Dollar Index is up 7%.

To truly understand how unprecedented, you must first understand their historical relationship.

Let us explain. x.com

Gold and the US Dollar are almost always INVERSELY related.

When the US Dollar rises, gold falls, and vice-versa.

This makes sense because investors that want to buy Gold with USD must first purchase USD.

A higher USD makes it more expensive to buy USD-denominated gold. x.com

When the US Dollar rises, gold falls, and vice-versa.

This makes sense because investors that want to buy Gold with USD must first purchase USD.

A higher USD makes it more expensive to buy USD-denominated gold. x.com

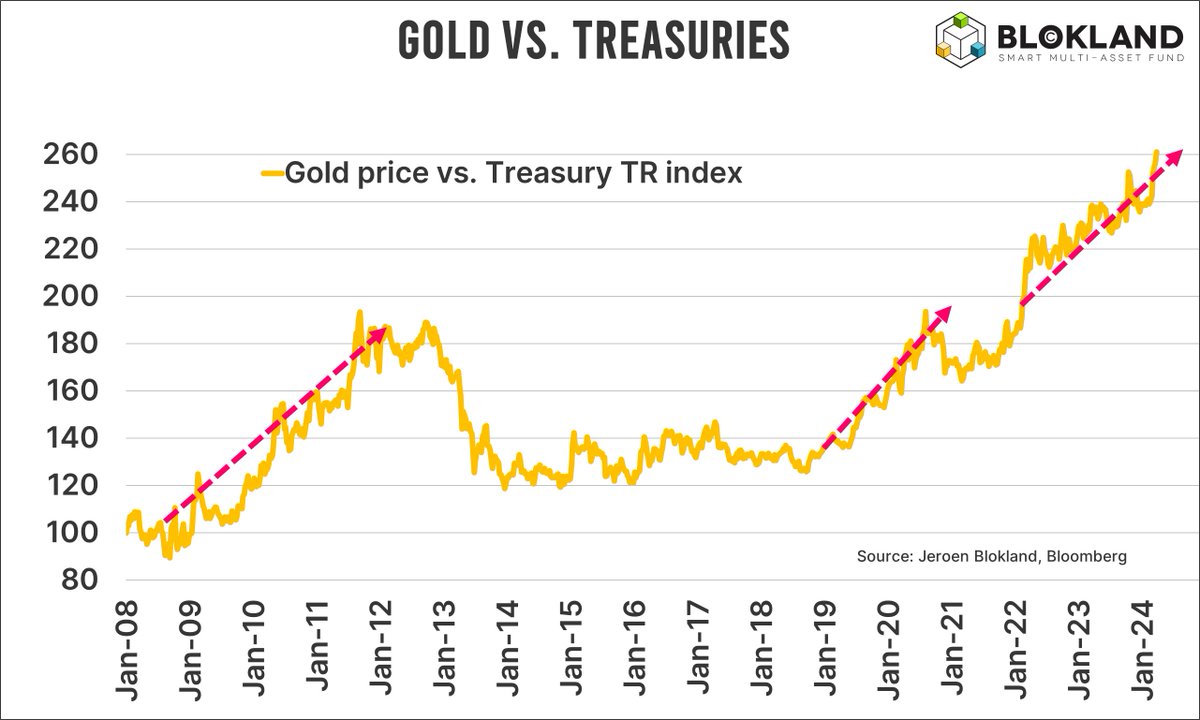

Higher treasury yields are typically bearish for gold because gold is a "zero-yield" asset.

Unlike bonds, gold does not pay interest which means the only return you can get is from price appreciation.

Interestingly, since 2008, gold has outperformed global govt bonds by 160%. x.com

Unlike bonds, gold does not pay interest which means the only return you can get is from price appreciation.

Interestingly, since 2008, gold has outperformed global govt bonds by 160%. x.com

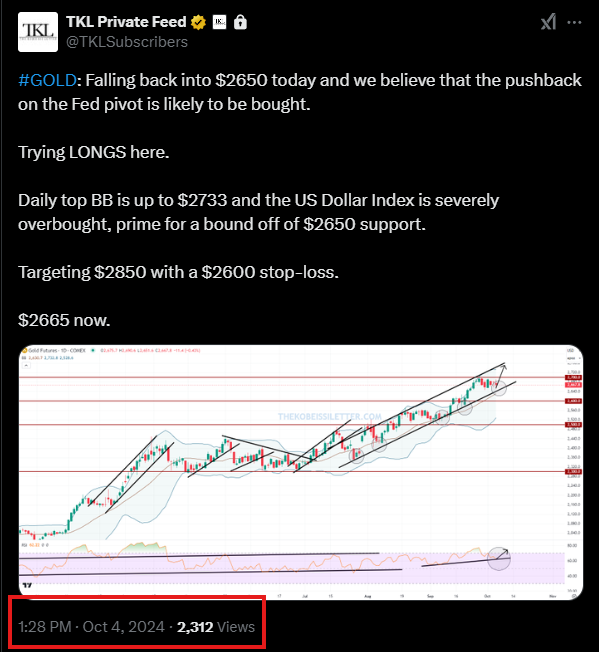

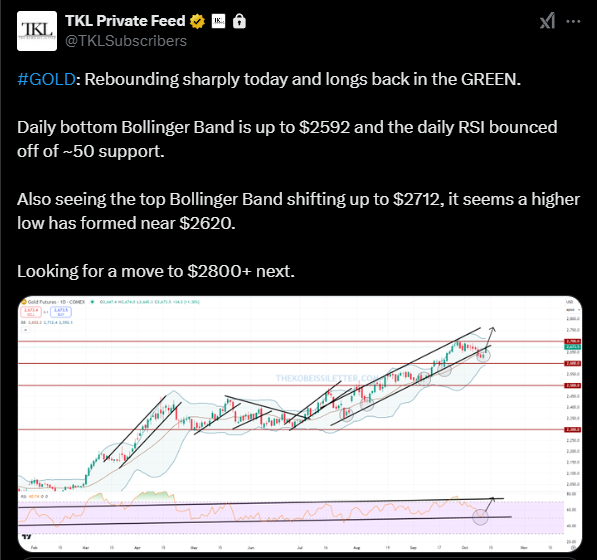

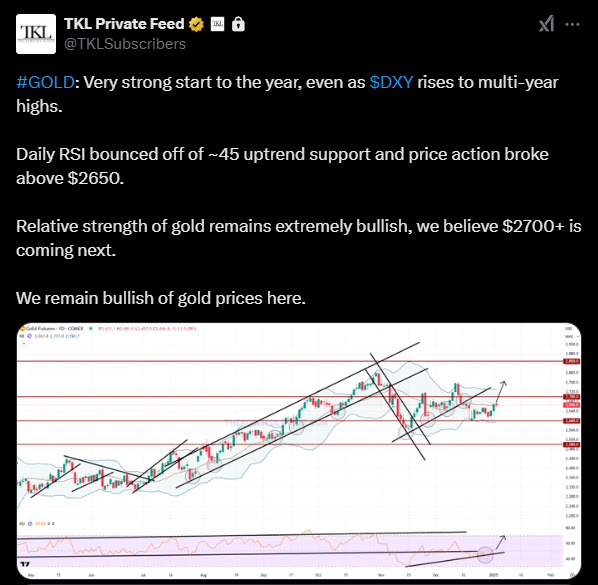

Our premium members got ahead of this through our alerts, buying dips into $2500 in September.

As seen below, we issued multiple bullish alerts throughout 2024, buying dips.

Our members capitalized on this rally.

Subscribe below to access our alerts:

thekobeissiletter.com x.com

As seen below, we issued multiple bullish alerts throughout 2024, buying dips.

Our members capitalized on this rally.

Subscribe below to access our alerts:

thekobeissiletter.com x.com

So this brings up the next question.

If the USD, yields, GDP growth, and the US economy are all considered "strong," why is gold rising?

Geopolitical tensions are one explanation.

But is this really enough for Gold to outperform the S&P 500 by ~10 percentage points in 2024?

If the USD, yields, GDP growth, and the US economy are all considered "strong," why is gold rising?

Geopolitical tensions are one explanation.

But is this really enough for Gold to outperform the S&P 500 by ~10 percentage points in 2024?

It really seems like the flight to safety is accelerating.

Central bank purchases hit 794 tonnes for the first 11 months of 2024, the 3rd largest this century.

These same central banks are calling for a "soft landing."

China is stocking up like never before as deflation hits. x.com

Central bank purchases hit 794 tonnes for the first 11 months of 2024, the 3rd largest this century.

These same central banks are calling for a "soft landing."

China is stocking up like never before as deflation hits. x.com

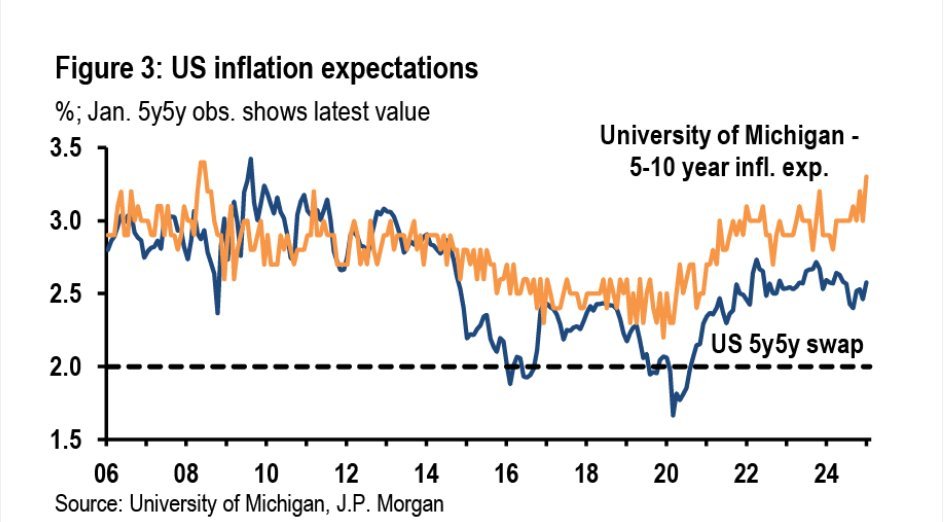

As we head into 2025, the rebound in inflation and rise in economic uncertainty explains some of this.

Gold has been pricing-in higher inflation and economic instability around the world.

US inflation expectations are rising as money supply growth hits a 20-month high. x.com

Gold has been pricing-in higher inflation and economic instability around the world.

US inflation expectations are rising as money supply growth hits a 20-month high. x.com

This week, we will receive CPI and PPI inflation data which will have massive implications.

This data sets the tone for the January Fed meeting and 2025 Fed outlook.

We are trading it.

Subscribe to our premium analysis and alerts at the link below:

thekobeissiletter.com

This data sets the tone for the January Fed meeting and 2025 Fed outlook.

We are trading it.

Subscribe to our premium analysis and alerts at the link below:

thekobeissiletter.com

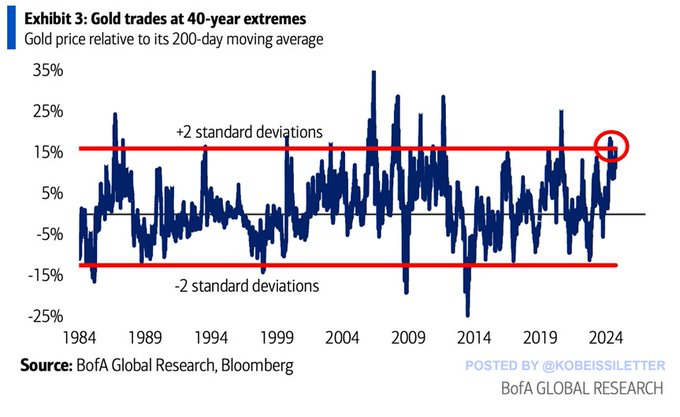

Lastly, here's a chart summarizing how historic 2024 was for gold.

In Q3 2024, gold traded ~15% above its 200-day moving average or 2 standard deviation.

This has only occurred 8 times over the last 40 years.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

In Q3 2024, gold traded ~15% above its 200-day moving average or 2 standard deviation.

This has only occurred 8 times over the last 40 years.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

جاري تحميل الاقتراحات...