🌟 Fundamentally Strong Stocks Under RS 1000

👉 5 Stocks To Focus 🔥

🌟 A Detailed Thread 🧵👇

#stockmarketcrash #StockMarketIndia #StockMarket #StocksInFocus #Stocks #Investing #investments

👉 5 Stocks To Focus 🔥

🌟 A Detailed Thread 🧵👇

#stockmarketcrash #StockMarketIndia #StockMarket #StocksInFocus #Stocks #Investing #investments

1 CG Power & Industrial Solutions Ltd Business model

CG Power & Industrial Solutions is a global enterprise providing end-to-end solutions to utilities, industries and consumers for the management and application of efficient and sustainable electrical energy. x.com

CG Power & Industrial Solutions is a global enterprise providing end-to-end solutions to utilities, industries and consumers for the management and application of efficient and sustainable electrical energy. x.com

👉 Product & Services Portfolio

⚡Transformers

⚡Switchgear

⚡Circuit Breakers

⚡Surge Arresters

⚡Power Transmission & Distribution

⚡Motors

⚡Drives & Automation

⚡Railways

⚡Consumer Appliances (Fans, Pumps, Water Heaters) x.com

⚡Transformers

⚡Switchgear

⚡Circuit Breakers

⚡Surge Arresters

⚡Power Transmission & Distribution

⚡Motors

⚡Drives & Automation

⚡Railways

⚡Consumer Appliances (Fans, Pumps, Water Heaters) x.com

👉Growth strategies

⚡Innovation and Technology:

Investing in research and development to develop cutting-edge products and solutions in areas like renewable energy, smart grids, and digitalization.

⚡Operational Excellence:

Implementing lean manufacturing principles and supply chain optimization to improve efficiency and reduce costs.

⚡Innovation and Technology:

Investing in research and development to develop cutting-edge products and solutions in areas like renewable energy, smart grids, and digitalization.

⚡Operational Excellence:

Implementing lean manufacturing principles and supply chain optimization to improve efficiency and reduce costs.

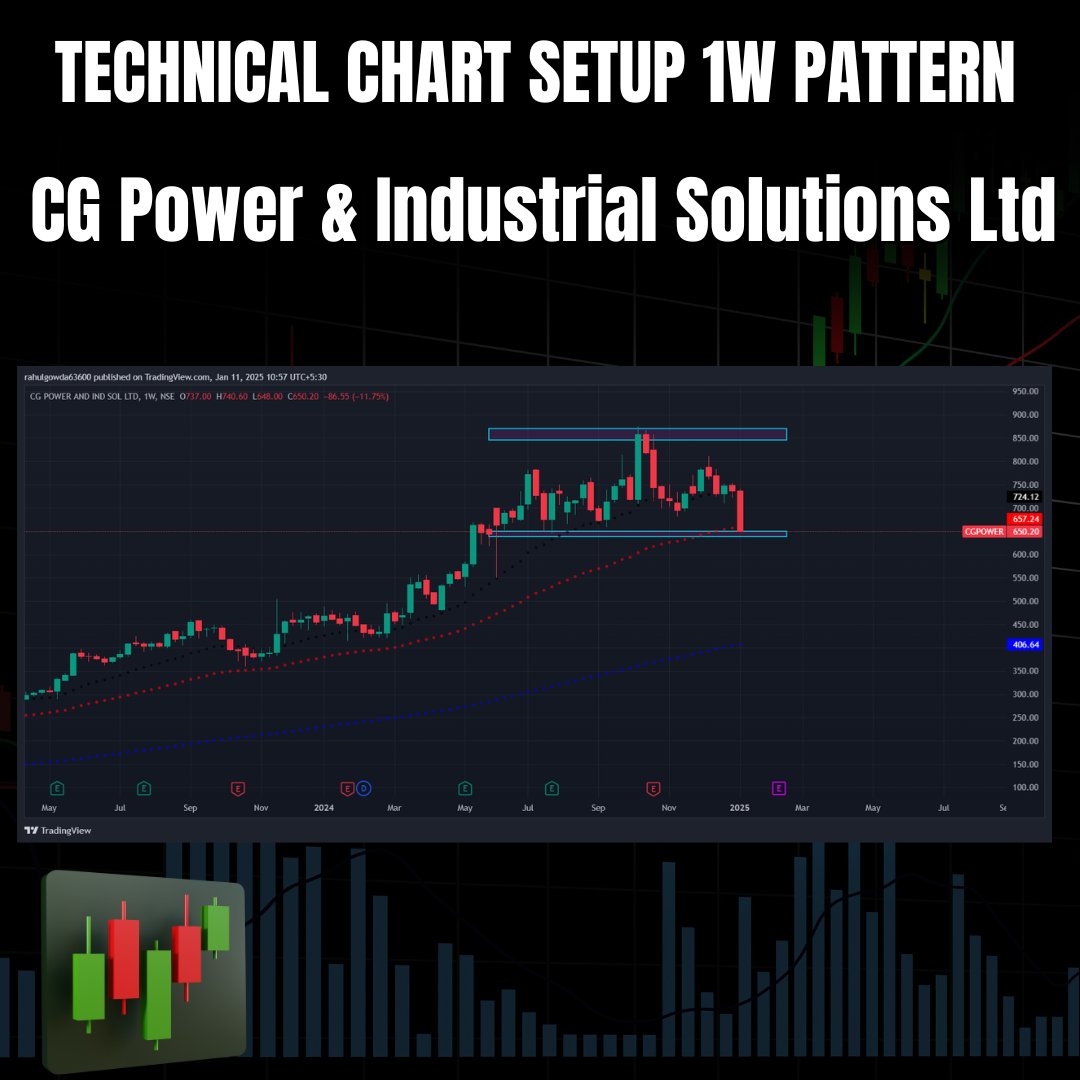

👉Key ratios

⚡Market Cap: ₹ 99,400 Cr.

⚡Current Price: ₹ 650

⚡Stock P/E: 111

⚡ROCE: 46.6 %

⚡ROE: 57.8 %

⚡Debt to equity: 0.01

⚡Profit Var 3Yrs: 141 %

⚡Sales growth 3Years: 39.5 % x.com

⚡Market Cap: ₹ 99,400 Cr.

⚡Current Price: ₹ 650

⚡Stock P/E: 111

⚡ROCE: 46.6 %

⚡ROE: 57.8 %

⚡Debt to equity: 0.01

⚡Profit Var 3Yrs: 141 %

⚡Sales growth 3Years: 39.5 % x.com

2 Motilal Oswal Financial service Ltd business model

it is a well-diversified financial services firm. The company has a network spread 550+ cities and towns comprising 2,500+ Business Locations operated by their Business Partners and 16,00,000+ customers. x.com

it is a well-diversified financial services firm. The company has a network spread 550+ cities and towns comprising 2,500+ Business Locations operated by their Business Partners and 16,00,000+ customers. x.com

👉product portfolio

⚡Stockbroking

⚡Mutual Funds

⚡Exchange-traded funds

⚡Index funds

⚡Fund of funds

⚡Commodity broker

⚡Asset management

⚡Investment management

⚡Wealth management

⚡Risk management

⚡Investment banking x.com

⚡Stockbroking

⚡Mutual Funds

⚡Exchange-traded funds

⚡Index funds

⚡Fund of funds

⚡Commodity broker

⚡Asset management

⚡Investment management

⚡Wealth management

⚡Risk management

⚡Investment banking x.com

👉Growth strategies

⚡Expanding Broking and Wealth Management Businesses:

Retail Broking: MOFSL aims to increase its market share in retail broking through its robust online platform, mobile app, and a wide network of branches.

⚡Strengthening Asset Management Business:

Mutual Funds: MOFSL Asset Management Company (MOAMC) has a strong track record in managing equity and equity-oriented mutual funds

⚡Expanding Broking and Wealth Management Businesses:

Retail Broking: MOFSL aims to increase its market share in retail broking through its robust online platform, mobile app, and a wide network of branches.

⚡Strengthening Asset Management Business:

Mutual Funds: MOFSL Asset Management Company (MOAMC) has a strong track record in managing equity and equity-oriented mutual funds

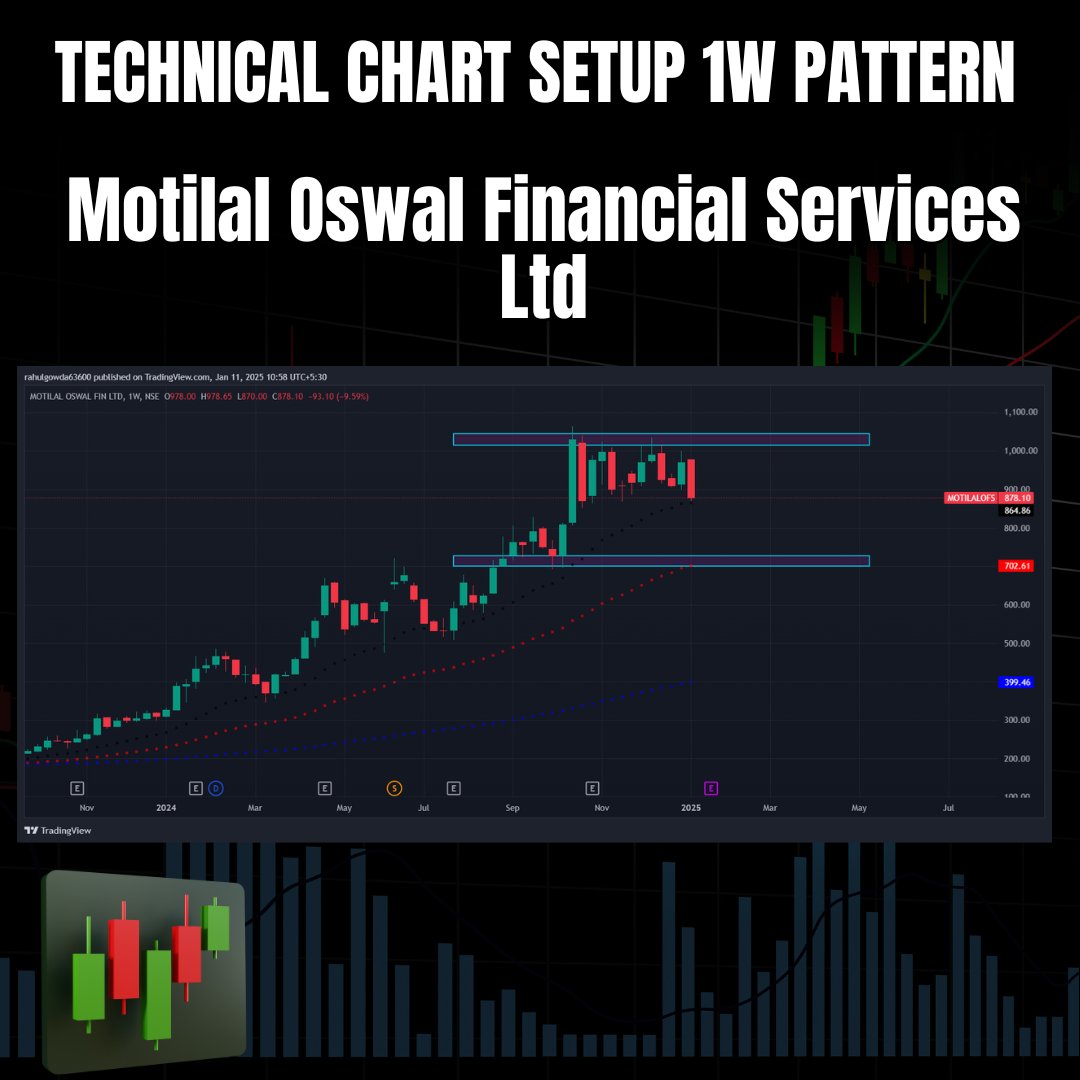

👉Key ratios

⚡Market Cap: ₹ 52,623 Cr.

⚡Current Price: ₹ 878

⚡Stock P/E: 15.6

⚡ROCE: 20.7 %

⚡ROE; 32.6 %

⚡Debt to equity: 1.41

⚡Profit Var 3Yrs: 22.5 %

⚡Sales growth 3Years: 24.9 % x.com

⚡Market Cap: ₹ 52,623 Cr.

⚡Current Price: ₹ 878

⚡Stock P/E: 15.6

⚡ROCE: 20.7 %

⚡ROE; 32.6 %

⚡Debt to equity: 1.41

⚡Profit Var 3Yrs: 22.5 %

⚡Sales growth 3Years: 24.9 % x.com

👉 Product & services Portfolio

⭐Brands:

⚡Killer

⚡Integriti

⚡LawmanPg3

⚡Easies

⭐Product Categories:

⚡Jeans

⚡Trousers

⚡Shirts

⚡T-shirts

⚡Jackets

⭐Services: x.com

⭐Brands:

⚡Killer

⚡Integriti

⚡LawmanPg3

⚡Easies

⭐Product Categories:

⚡Jeans

⚡Trousers

⚡Shirts

⚡T-shirts

⚡Jackets

⭐Services: x.com

👉Growth strategies

⚡Aggressive Store Expansion: KKCL plans to significantly increase its retail footprint through a combination of exclusive brand outlets (EBOs) and multi-brand outlets (MBOs).

⚡Omnichannel Presence: The company is committed to strengthening its online presence and integrating it with its offline channels to create a seamless omnichannel experience for customers

⚡Aggressive Store Expansion: KKCL plans to significantly increase its retail footprint through a combination of exclusive brand outlets (EBOs) and multi-brand outlets (MBOs).

⚡Omnichannel Presence: The company is committed to strengthening its online presence and integrating it with its offline channels to create a seamless omnichannel experience for customers

👉Key ratios

⚡Market Cap: ₹ 3,381 Cr.

⚡Current Price: ₹ 549

⚡Stock P/E: 21.0

⚡ROCE: 31.0 %

⚡ROE: 25.1 %

⚡Debt to equity: 0.11

⚡Profit Var 3Yrs: 98.9 %

⚡Sales growth 3Years: 41.6 % x.com

⚡Market Cap: ₹ 3,381 Cr.

⚡Current Price: ₹ 549

⚡Stock P/E: 21.0

⚡ROCE: 31.0 %

⚡ROE: 25.1 %

⚡Debt to equity: 0.11

⚡Profit Var 3Yrs: 98.9 %

⚡Sales growth 3Years: 41.6 % x.com

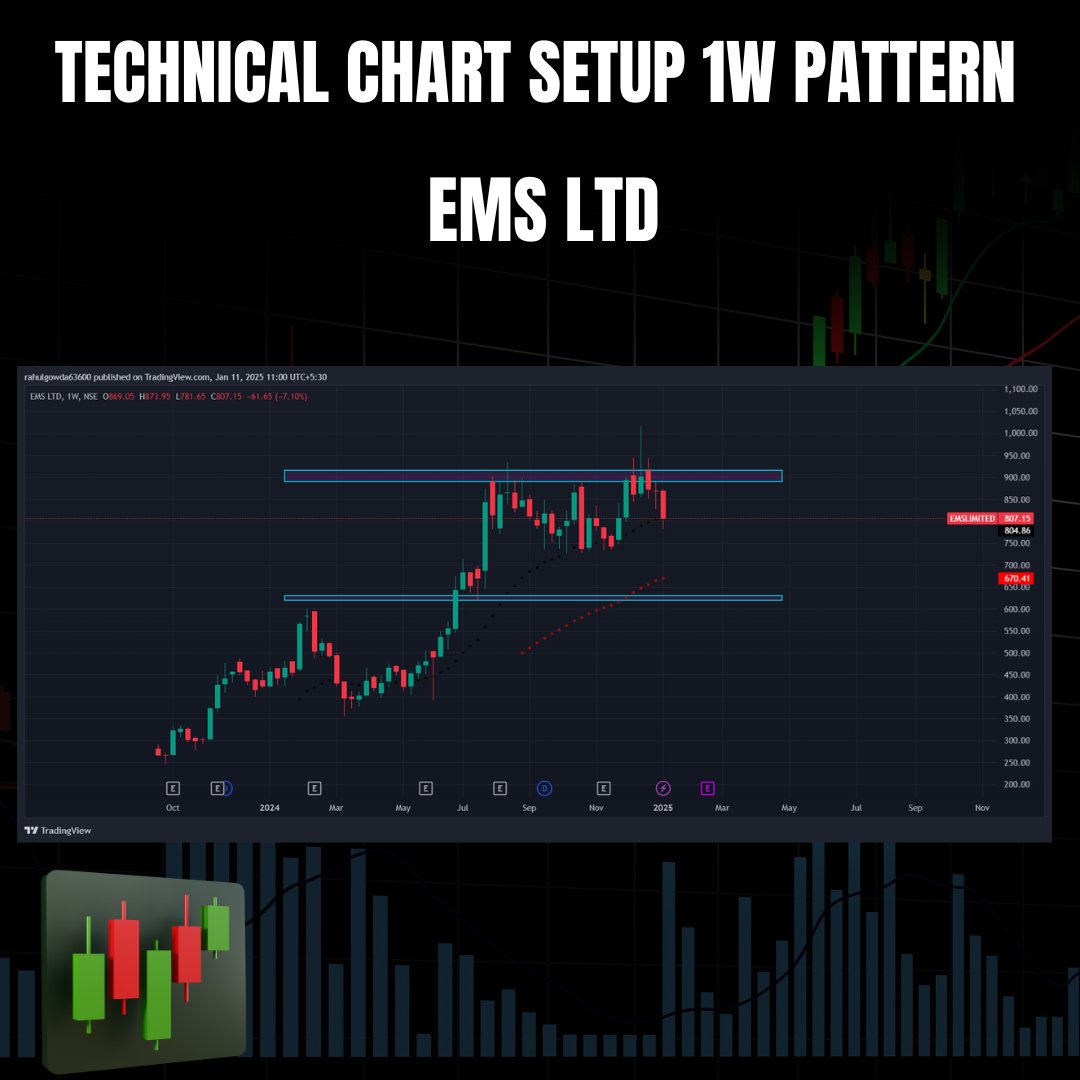

4 EMS Ltd business model

EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water

EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water

👉 Products & services Portfolio

⭐Water & Wastewater Treatment:

⚡Water Treatment Plants (WTPs)

⚡Wastewater Treatment Plants (WWTPs)

⚡Sewage Treatment Plants (STPs)

⚡Common Effluent Treatment Plants (CETPs)

⚡Tertiary Treatment Plants

⚡Water Transmission & Distribution Systems

⚡Elevated & Ground Level Reservoirs

⭐Water & Wastewater Treatment:

⚡Water Treatment Plants (WTPs)

⚡Wastewater Treatment Plants (WWTPs)

⚡Sewage Treatment Plants (STPs)

⚡Common Effluent Treatment Plants (CETPs)

⚡Tertiary Treatment Plants

⚡Water Transmission & Distribution Systems

⚡Elevated & Ground Level Reservoirs

👉Growth strategies

⚡Focus on High-Margin Projects: The company prioritizes projects in the water sector, particularly in sewerage and wastewater treatment, that offer high-margin potential

⚡Organic Growth: EMS Ltd. plans to achieve substantial organic growth through expanding its order book and executing projects efficiently

⚡Focus on High-Margin Projects: The company prioritizes projects in the water sector, particularly in sewerage and wastewater treatment, that offer high-margin potential

⚡Organic Growth: EMS Ltd. plans to achieve substantial organic growth through expanding its order book and executing projects efficiently

👉Key ratios

⚡Market Cap: ₹ 4,482 Cr.

⚡Current Price: ₹ 807

⚡Stock P/E: 26.1

⚡ROCE: 29.3 %

⚡ROE: 22.9 %

⚡Debt to equity: 0.09

⚡Profit Var 3Yrs: 27.1 %

⚡Sales growth 3Years: 33.9 % x.com

⚡Market Cap: ₹ 4,482 Cr.

⚡Current Price: ₹ 807

⚡Stock P/E: 26.1

⚡ROCE: 29.3 %

⚡ROE: 22.9 %

⚡Debt to equity: 0.09

⚡Profit Var 3Yrs: 27.1 %

⚡Sales growth 3Years: 33.9 % x.com

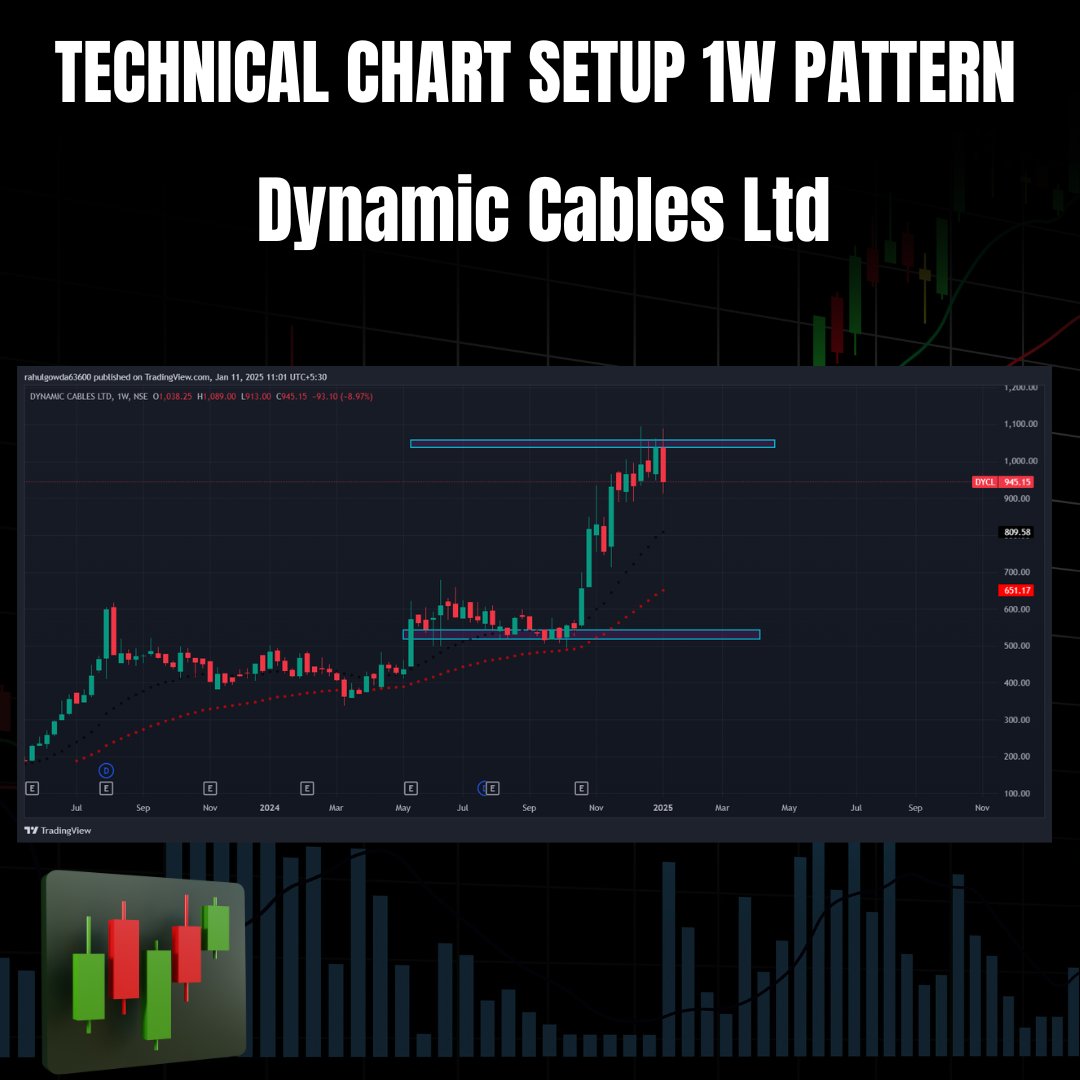

5 Dynamic Cables Ltd business model

Dynamic Cables Ltd. is a manufacturer of power infra cables that includes LT, HT, EHVC, Power control & instrumentation cables, flexible & industrial cables, solar cables and railway signaling cables. x.com

Dynamic Cables Ltd. is a manufacturer of power infra cables that includes LT, HT, EHVC, Power control & instrumentation cables, flexible & industrial cables, solar cables and railway signaling cables. x.com

👉Products & services Portfolio

⚡Power Cables

⚡Aerial Bunched Cables

⚡Conductors

⚡Control & Instrumentation Cables

⚡Flexible & Industrial Cables

⚡Solar Cables

⚡Railway Signalling Cables

⚡Bare Conductors x.com

⚡Power Cables

⚡Aerial Bunched Cables

⚡Conductors

⚡Control & Instrumentation Cables

⚡Flexible & Industrial Cables

⚡Solar Cables

⚡Railway Signalling Cables

⚡Bare Conductors x.com

👉Growth strategies

⚡Capacity Expansion: Increasing production capacity to meet growing demand, both domestically and internationally.

⚡Technological Upgradation: Investing in research and development to improve product quality, efficiency, and innovation. x.com

⚡Capacity Expansion: Increasing production capacity to meet growing demand, both domestically and internationally.

⚡Technological Upgradation: Investing in research and development to improve product quality, efficiency, and innovation. x.com

👉Key ratios

⚡Market Cap: ₹ 2,290 Cr.

⚡Current Price: ₹ 945

⚡Stock P/E: 49.0

⚡ROCE: 24.1 %

⚡ROE: 19.3 %

⚡Debt to equity: 0.35

⚡Profit Var 3Yrs: 56.6 %

⚡Sales growth 3Years: 30.9 % x.com

⚡Market Cap: ₹ 2,290 Cr.

⚡Current Price: ₹ 945

⚡Stock P/E: 49.0

⚡ROCE: 24.1 %

⚡ROE: 19.3 %

⚡Debt to equity: 0.35

⚡Profit Var 3Yrs: 56.6 %

⚡Sales growth 3Years: 30.9 % x.com

Follow 👉🌟 @FinAspiration 👈. For more insights related to the Finance and Stock market concepts which is simplified in easy to Understand manner ✨. x.com

🔴 Disclaimer : The content in this post is only for educational purpose and not investment advice. Please consult your financial advisors before investing.

جاري تحميل الاقتراحات...