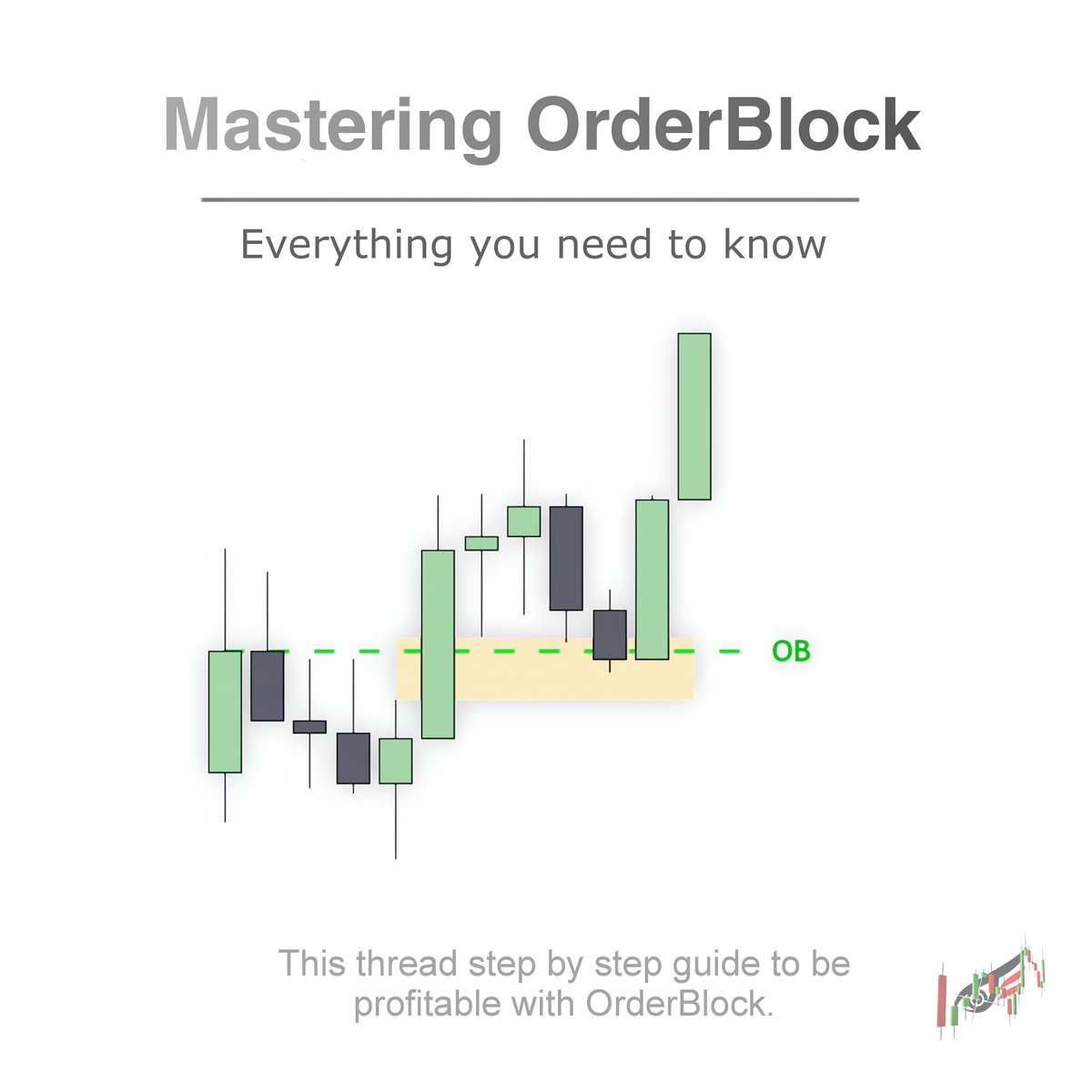

What are Order Blocks?

Order blocks are important areas in the market where big traders, like banks or institutions, place a lot of buy or sell orders.

These areas are found at certain price levels in the market.

Order blocks can affect how prices move, how people feel about the market, and the availability of trades.

Order blocks are important areas in the market where big traders, like banks or institutions, place a lot of buy or sell orders.

These areas are found at certain price levels in the market.

Order blocks can affect how prices move, how people feel about the market, and the availability of trades.

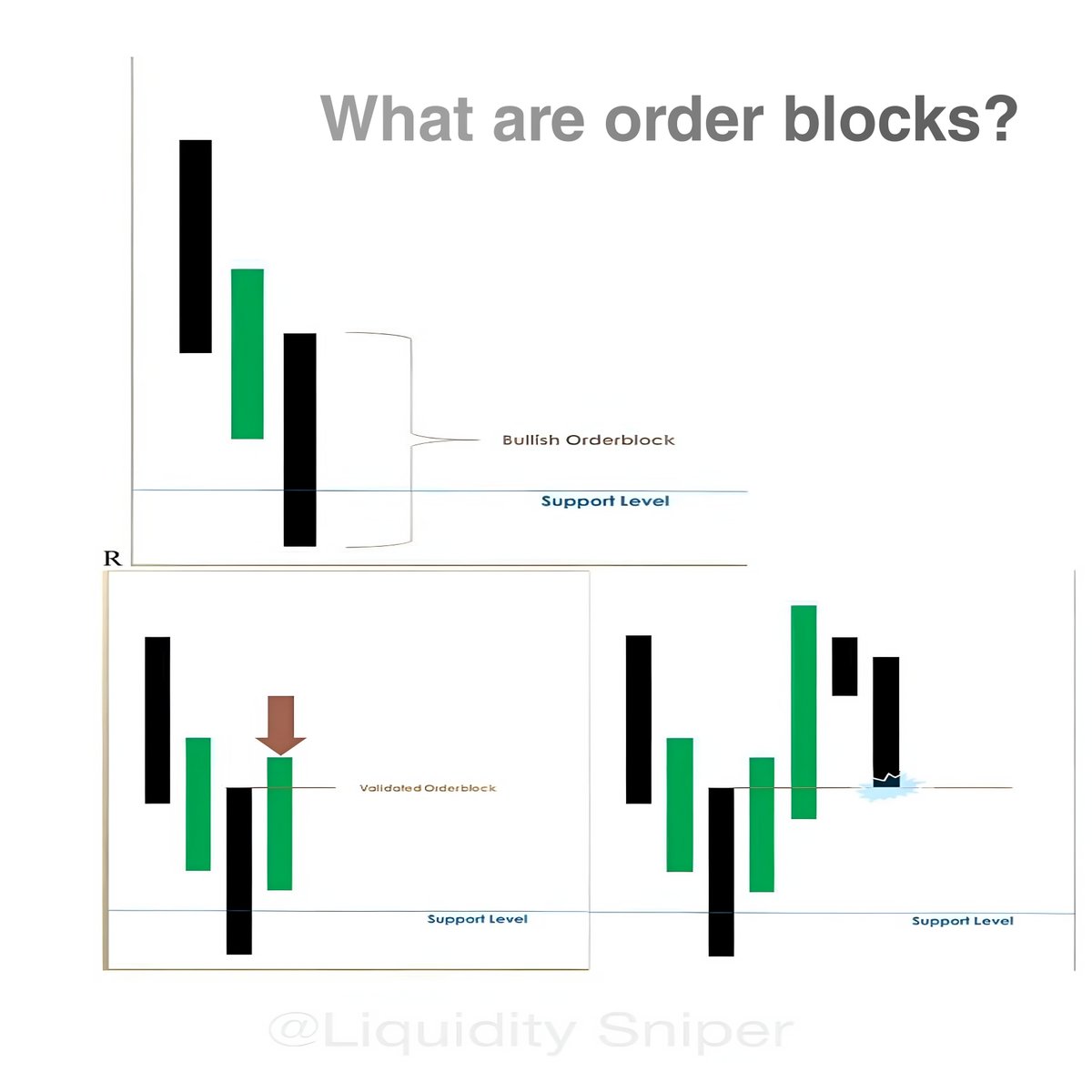

ICT Order Blocks:

Order blocks can be found on different time frames, ranging from 15-minute charts to daily or weekly charts.

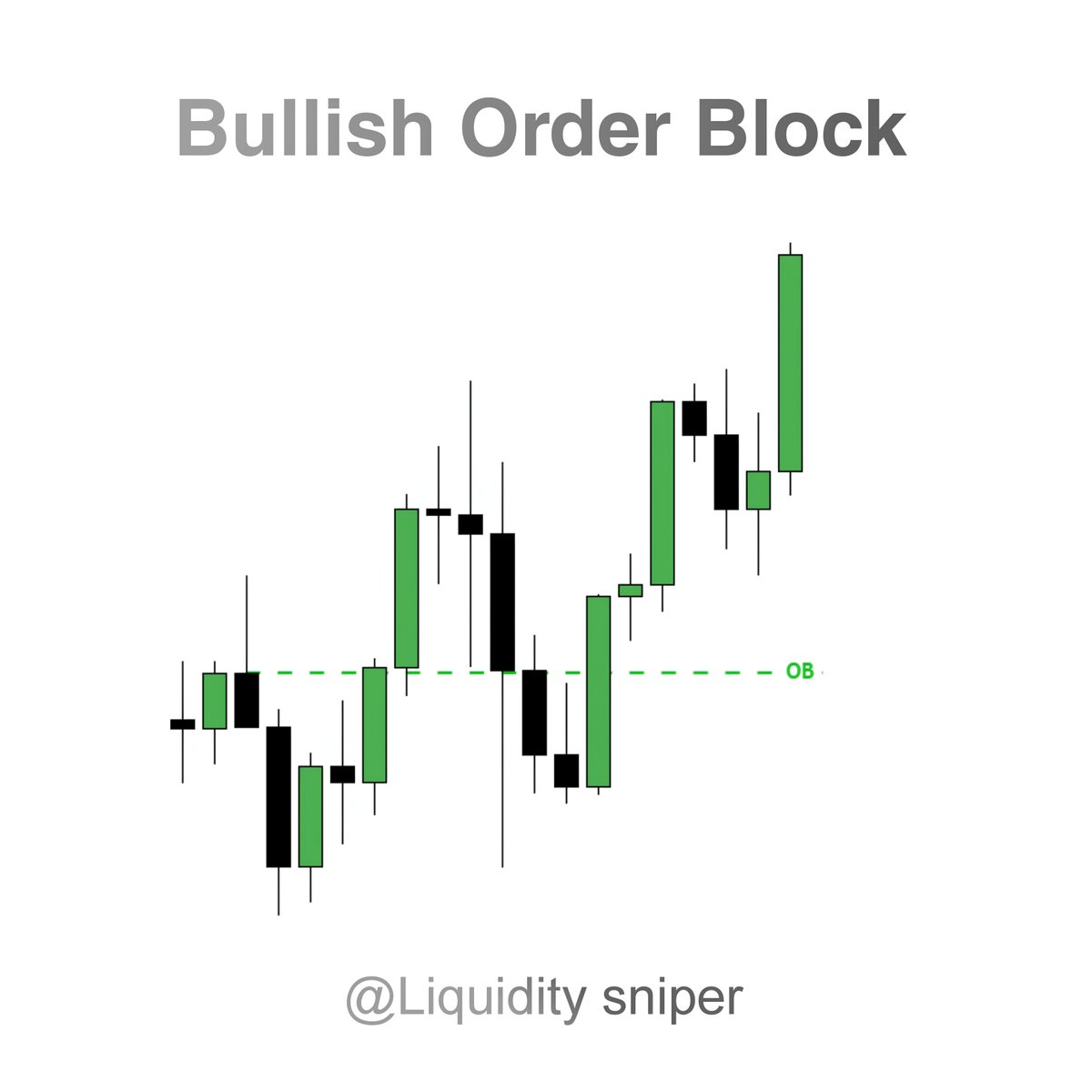

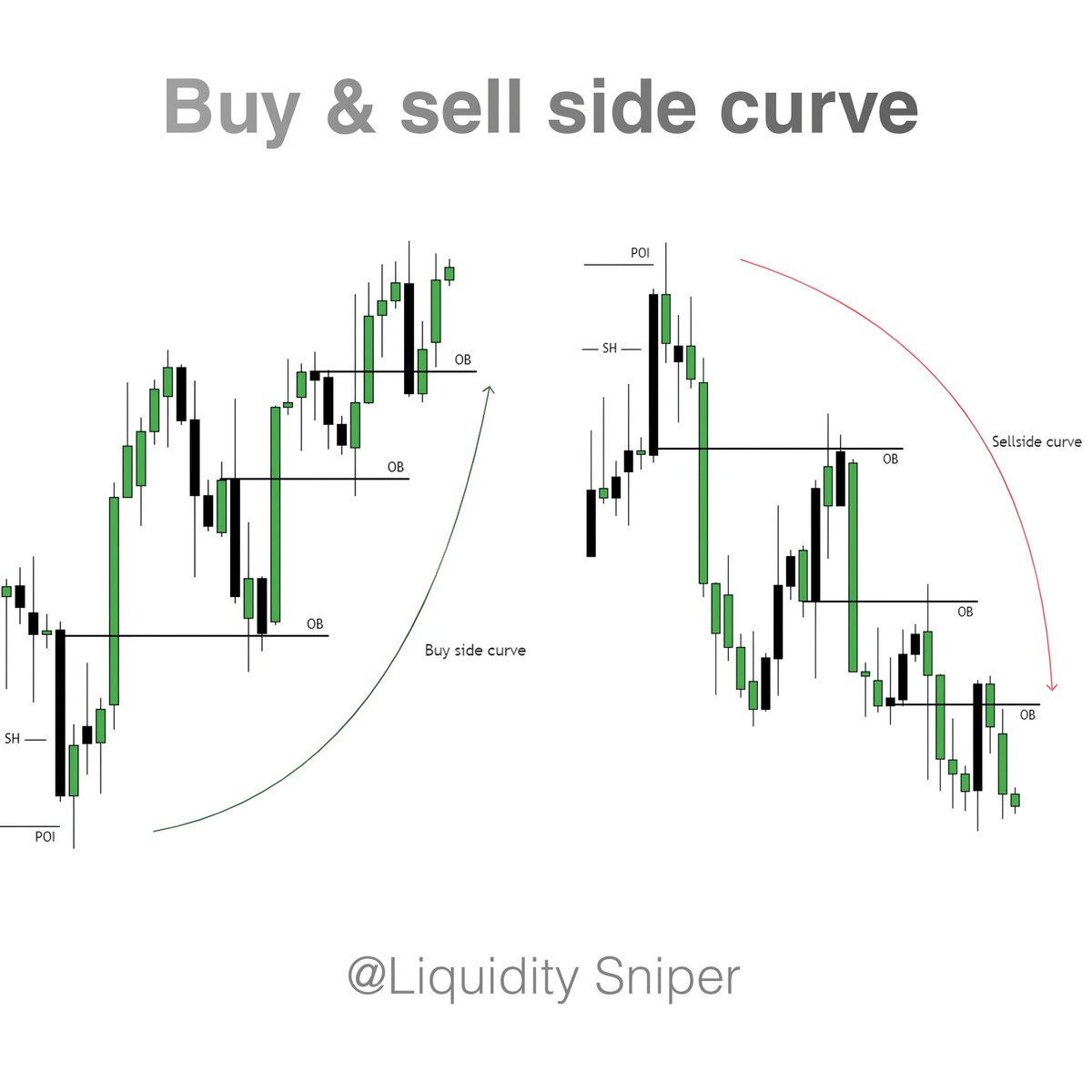

There are two main types of order blocks:

Bullish Order Blocks and Bearish Order Blocks. x.com

Order blocks can be found on different time frames, ranging from 15-minute charts to daily or weekly charts.

There are two main types of order blocks:

Bullish Order Blocks and Bearish Order Blocks. x.com

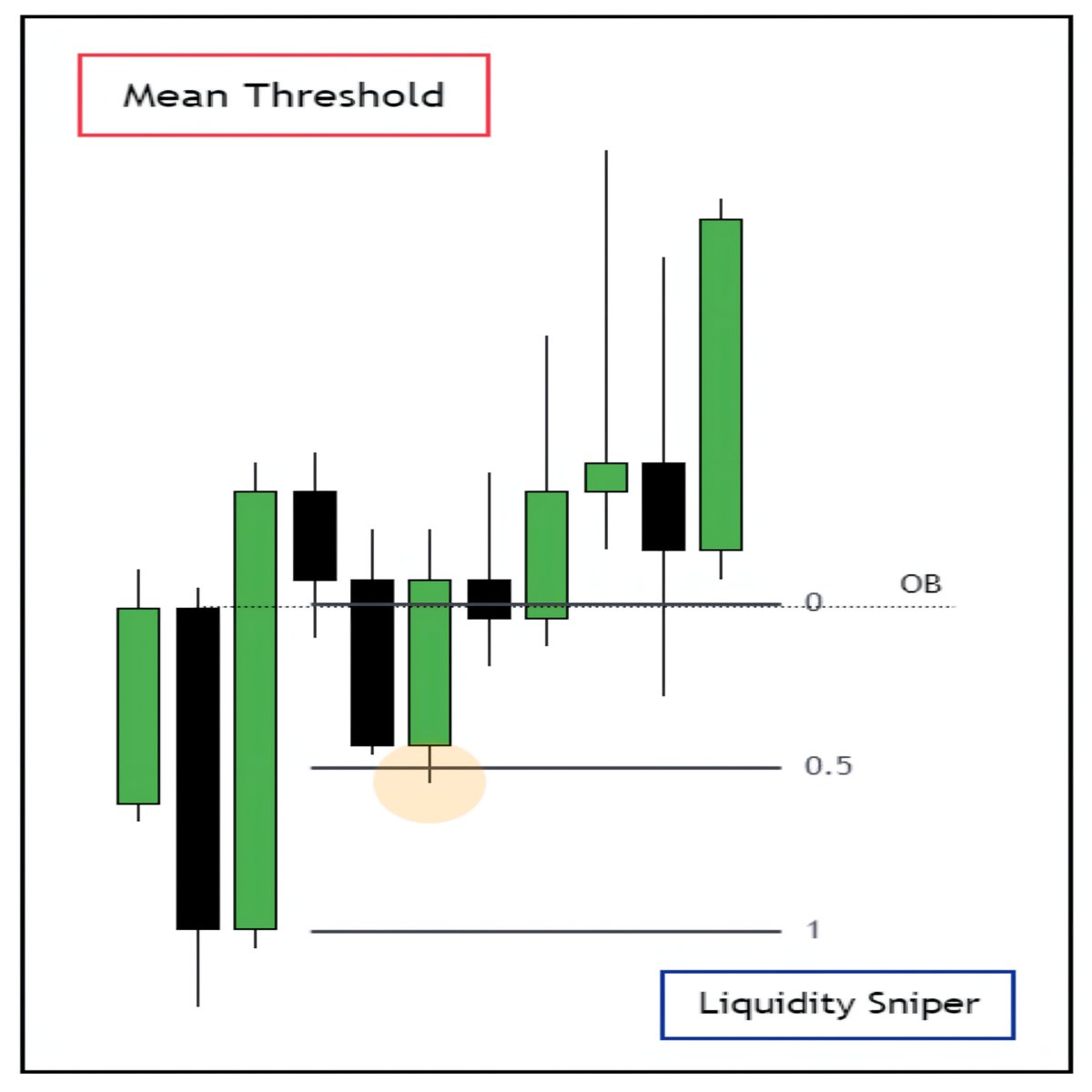

Mean Threshold:

The mean threshold is the middle point of a candle body (ignoring the wicks).

Use the Fibonacci tool to mark the high and low of the body; the 50% level is the mean threshold.

If the price closes above or below it, the order block is more likely to fail.

If the price stays near it, the order block is likely to hold strong.

The mean threshold is the middle point of a candle body (ignoring the wicks).

Use the Fibonacci tool to mark the high and low of the body; the 50% level is the mean threshold.

If the price closes above or below it, the order block is more likely to fail.

If the price stays near it, the order block is likely to hold strong.

Dear Traders,

Starting January 16, 2025, the prices for 100K and 60K High Stakes accounts will be updated to $545 and $329, respectively.

Now, you can buy:

60K account for just $270

100K account for $445

Through this exclusive link: the5ers.com x.com

Starting January 16, 2025, the prices for 100K and 60K High Stakes accounts will be updated to $545 and $329, respectively.

Now, you can buy:

60K account for just $270

100K account for $445

Through this exclusive link: the5ers.com x.com

جاري تحميل الاقتراحات...