Top 5 Fastest Growing Data Center Stocks to Add to Your Watchlist In 2025📊

Bookmark and analyse these stocks!

A thread on 5 stocks🧵

#StockMarket #StocksInFocus #Stocks

Bookmark and analyse these stocks!

A thread on 5 stocks🧵

#StockMarket #StocksInFocus #Stocks

India's data center market is experiencing rapid growth, driven by increasing digitalisation, cloud adoption, and government initiatives.

With global attention focused on the country, India has emerged as one of the fastest-growing data center markets worldwide.

This growth has been possible due to the growth that Indian data center companies have shown over the past year.

With global attention focused on the country, India has emerged as one of the fastest-growing data center markets worldwide.

This growth has been possible due to the growth that Indian data center companies have shown over the past year.

The growth is further supported by the Indian government and several states as they are providing incentives for data center investments, including tax benefits, land and power subsidies, and supportive policies.

Going ahead, the country is also expected to see rapid growth in infrastructure, with 35+ data centers with 5.7+ million sq. ft. and 987+ megawatt (MW) capacity have been announced for 2026 and beyond.

Keeping these developments and growth plans in mind, today we will be having a look at some of the data center stocks, which have shown tremendous growth in the past year.

Going ahead, the country is also expected to see rapid growth in infrastructure, with 35+ data centers with 5.7+ million sq. ft. and 987+ megawatt (MW) capacity have been announced for 2026 and beyond.

Keeping these developments and growth plans in mind, today we will be having a look at some of the data center stocks, which have shown tremendous growth in the past year.

1. Aurionpro Solutions

Aurionpro Solutions provides business solutions in the fields of transaction banking, customer experience (ACE Platform), smart city and smart transportation, and cybersecurity.

The company offers software products and consulting services to the banking industry in India and abroad.

Coming to Aurionpro's financials, the revenue for the company grew by 32% YoY to Rs 2.8 bn, in Q2 FY25.

Aurionpro Solutions provides business solutions in the fields of transaction banking, customer experience (ACE Platform), smart city and smart transportation, and cybersecurity.

The company offers software products and consulting services to the banking industry in India and abroad.

Coming to Aurionpro's financials, the revenue for the company grew by 32% YoY to Rs 2.8 bn, in Q2 FY25.

The operating profit for the quarter rose by 23% YoY to Rs 560 m, with the operating profit margin at 20.3%, versus 22%, in Q2 FY24.

The operating profit margin during the quarter was impacted by rapid growth and increased investments in product development and market expansion.

The net profit for the quarter increased by 34% YoY to Rs 460 m, with the net profit margin at 16.5%, slightly above the guided range of 15-16%.

Here is the table showing the annual financial performance of the company.

The operating profit margin during the quarter was impacted by rapid growth and increased investments in product development and market expansion.

The net profit for the quarter increased by 34% YoY to Rs 460 m, with the net profit margin at 16.5%, slightly above the guided range of 15-16%.

Here is the table showing the annual financial performance of the company.

Moreover, in the data center segment, the company aims to develop specialised solutions and expand its services portfolio to cater to the rising demand for hybrid cloud infrastructure.

The company is confident of achieving guided growth of over 30% for FY25 while maintaining earnings margins.echnology innovation segments guided.

Going forward, Aurionpro Solutions plans to leverage its strengths in banking software, enterprise AI, and transit technology while exploring new markets and expanding its offerings.

The company is also expanding its footprint in high-growth regions such as Southeast Asia, the Middle East, and the Americas, where it has already established strong pipelines.

Moreover, in the data center segment, the company aims to develop productised solutions and expand its services portfolio to cater to the rising demand for hybrid cloud infrastructure.

The company is confident of achieving a guided growth of over 30% for FY25 while maintaining earnings margins.

The company is confident of achieving guided growth of over 30% for FY25 while maintaining earnings margins.echnology innovation segments guided.

Going forward, Aurionpro Solutions plans to leverage its strengths in banking software, enterprise AI, and transit technology while exploring new markets and expanding its offerings.

The company is also expanding its footprint in high-growth regions such as Southeast Asia, the Middle East, and the Americas, where it has already established strong pipelines.

Moreover, in the data center segment, the company aims to develop productised solutions and expand its services portfolio to cater to the rising demand for hybrid cloud infrastructure.

The company is confident of achieving a guided growth of over 30% for FY25 while maintaining earnings margins.

2. Cummins India

Cummins India designs, manufactures, distributes, and services diesel and alternative fuel engines from 2.8 to 95 litres, diesel and alternative-fuelled power generator sets of up to 3,000 kW (3,750 kVA), as well as related components and technology.

Cummins is a provider of backup power solutions for the data center industry, with the largest dedicated support network coverage in the world. This makes Cummins India, one a key beneficiary of the booming data center investment wave.

Cummins is a provider of backup power solutions for the data center industry, with the largest dedicated support network coverage in the world. This makes Cummins India a key beneficiary of the booming data center investment wave.

Cummins India designs, manufactures, distributes, and services diesel and alternative fuel engines from 2.8 to 95 litres, diesel and alternative-fuelled power generator sets of up to 3,000 kW (3,750 kVA), as well as related components and technology.

Cummins is a provider of backup power solutions for the data center industry, with the largest dedicated support network coverage in the world. This makes Cummins India, one a key beneficiary of the booming data center investment wave.

Cummins is a provider of backup power solutions for the data center industry, with the largest dedicated support network coverage in the world. This makes Cummins India a key beneficiary of the booming data center investment wave.

Coming to its financials, Cummins India reported an increase in sales of 31% YoY to Rs 24.9 bn, in Q2 FY25 from Rs 19 bn, in the same quarter last year.

The operating profit for the quarter saw an increase of 42% YoY to Rs 4.8 bn, while the operating profit margin for the quarter stood at 19%, versus 18%, in Q2 FY24.

Profit after tax for the quarter was Rs 4.5 bn, a 37.5% increase compared to the same quarter last year. The net margin for the quarter stood at 18.1% versus 17.3%, in Q2 FY24.

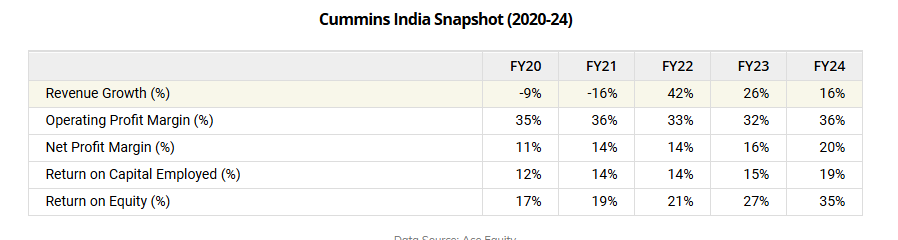

Here is the table showing the annual financial performance of the company.

The operating profit for the quarter saw an increase of 42% YoY to Rs 4.8 bn, while the operating profit margin for the quarter stood at 19%, versus 18%, in Q2 FY24.

Profit after tax for the quarter was Rs 4.5 bn, a 37.5% increase compared to the same quarter last year. The net margin for the quarter stood at 18.1% versus 17.3%, in Q2 FY24.

Here is the table showing the annual financial performance of the company.

Cummins India's share price has grown by 80.7%, in past one year. Over the past 3 years and 5 years, the share price has grown by a CAGR of 53% and 43%, respectively.

Coming to the management's guidance, it has acknowledged the pressure on the gross margin, attributing it to the product mix and project execution.

It anticipates that gross margins will stabilize as the product mix normalises and ongoing cost reduction efforts materialise.

Additionally, the management is also focused on maintaining the operating margins through operational efficiencies and cost management strategies.

It anticipates that gross margins will stabilise as the product mix normalises and ongoing cost reduction efforts materialise.

Coming to the management's guidance, it has acknowledged the pressure on the gross margin, attributing it to the product mix and project execution.

It anticipates that gross margins will stabilize as the product mix normalises and ongoing cost reduction efforts materialise.

Additionally, the management is also focused on maintaining the operating margins through operational efficiencies and cost management strategies.

It anticipates that gross margins will stabilise as the product mix normalises and ongoing cost reduction efforts materialise.

3. ABB India

ABB India stands out as a strong contender to benefit from the growing investments in the data center space due to its wide range of solutions tailored to the unique needs of data centers.

In the area of power distribution, ABB India offers an extensive portfolio that includes transformers, circuit breakers, switchgear, and remote power panels.

Its high-efficiency transformers are particularly noteworthy for their ability to minimise energy losses, making them ideal for modern data centers.

Coming to the financials, ABB India has registered a sales growth of 5.2% YoY to Rs 29.1 bn.

The operating profit increased 23% YoY to Rs 5.4 bn. The operating margin in turn also increased to 19%, from 16%, in Q2 FY24.

ABB India stands out as a strong contender to benefit from the growing investments in the data center space due to its wide range of solutions tailored to the unique needs of data centers.

In the area of power distribution, ABB India offers an extensive portfolio that includes transformers, circuit breakers, switchgear, and remote power panels.

Its high-efficiency transformers are particularly noteworthy for their ability to minimise energy losses, making them ideal for modern data centers.

Coming to the financials, ABB India has registered a sales growth of 5.2% YoY to Rs 29.1 bn.

The operating profit increased 23% YoY to Rs 5.4 bn. The operating margin in turn also increased to 19%, from 16%, in Q2 FY24.

The management has recognised the increase in the operating profit margin, expecting it to stabilise as commodity prices normalise.

The net profit for the quarter stood at Rs 4.4 bn, an increase of 21% YoY. The net profit margin for the quarter stood at Rs 15.1%, versus 13.1%, in in Q2 FY24.

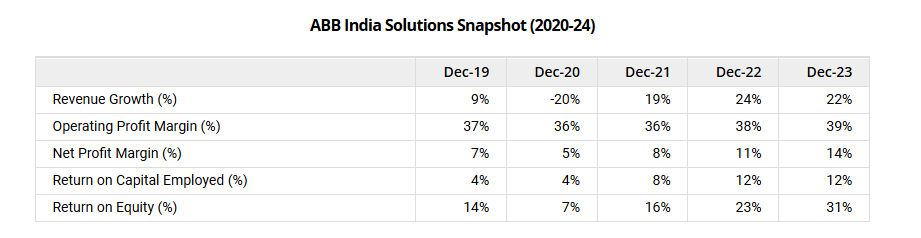

Here is the table showing the annual financial performance of the company.

The net profit for the quarter stood at Rs 4.4 bn, an increase of 21% YoY. The net profit margin for the quarter stood at Rs 15.1%, versus 13.1%, in in Q2 FY24.

Here is the table showing the annual financial performance of the company.

Over the past 3 years and 5 years, the share price has grown by a CAGR of 46% and 41%, respectively.

Looking ahead, ABB India is positioned well for future growth with a diverse portfolio, strong market demand, and a commitment to sustainability.

The management is optimistic about continued growth driven by strong pipeline and market demand.

The management is optimistic about continued growth driven by a strong pipeline and market demand.rategic partnerships.a strong

Looking ahead, ABB India is positioned well for future growth with a diverse portfolio, strong market demand, and a commitment to sustainability.

The management is optimistic about continued growth driven by strong pipeline and market demand.

The management is optimistic about continued growth driven by a strong pipeline and market demand.rategic partnerships.a strong

4. Voltas

Voltas manufactures and sells a diverse range of products, including air coolers, air conditioners, washing machines, and dishwashers.

Its prominence in the commercial air conditioning segment is underscored by its specialised cooling solutions tailored for data centers.

It's strong presence in the data center space positions Voltas to benefit significantly as India's total data center investments are projected to surpass US$ 100 bn by 2027

Voltas manufactures and sells a diverse range of products, including air coolers, air conditioners, washing machines, and dishwashers.

Its prominence in the commercial air conditioning segment is underscored by its specialised cooling solutions tailored for data centers.

It's strong presence in the data center space positions Voltas to benefit significantly as India's total data center investments are projected to surpass US$ 100 bn by 2027

Coming to the financial performance of Voltas, in Q2 FY25, it reported an increase in sales of 14.2% YoY to Rs 26.1 bn.

The operating profit for the period saw a massive increase of 251% YoY to Rs 1.3 bn. The operating margin in turn also increased to 5%, from 2%, in Q2 FY24.

The net profit after tax surged by 214% to Rs 1.3 bn. The net profit margin also rose to 5.1%, versus 1.6%, in Q2 FY24.

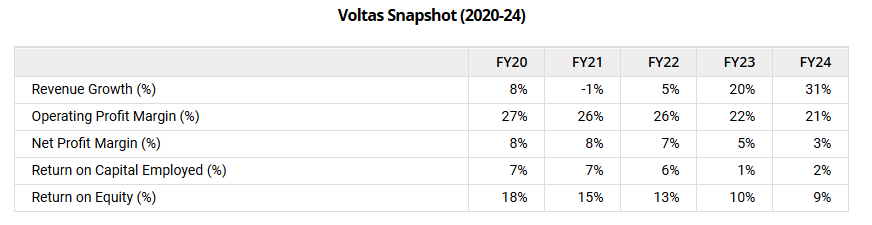

Here is the table showing the annual financial performance of the company.

The operating profit for the period saw a massive increase of 251% YoY to Rs 1.3 bn. The operating margin in turn also increased to 5%, from 2%, in Q2 FY24.

The net profit after tax surged by 214% to Rs 1.3 bn. The net profit margin also rose to 5.1%, versus 1.6%, in Q2 FY24.

Here is the table showing the annual financial performance of the company.

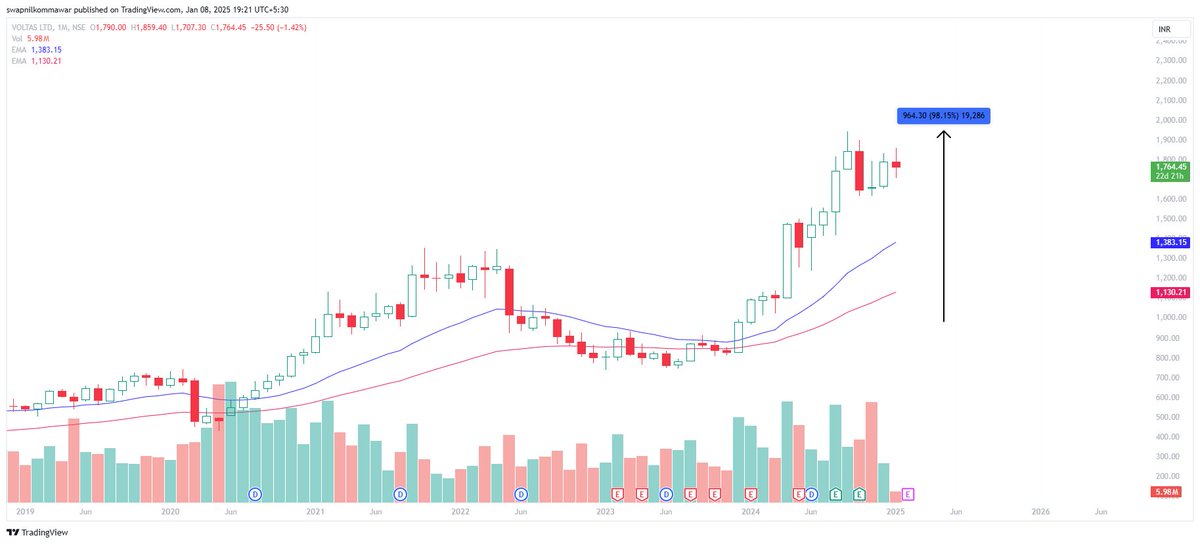

Voltas' share price, in the past one year has increased 103.8%. In the past 3 and 5 years, the share price has grown by a CAGR of 12% and 21%, respectively.

Going forward, the company anticipates a lean season for cooling products in Q3 FY25, with a slight expectation of the festive period boosting demand.

The management acknowledges the impact of external factors, including geopolitical tensions and inflation on business performance.

The management acknowledges the impact of external factors, including geopolitical tensions and inflation, on business performance.,

Going forward, the company anticipates a lean season for cooling products in Q3 FY25, with a slight expectation of the festive period boosting demand.

The management acknowledges the impact of external factors, including geopolitical tensions and inflation on business performance.

The management acknowledges the impact of external factors, including geopolitical tensions and inflation, on business performance.,

5. Anant Raj

Anant Raj is primarily engaged in the development and construction of IT parks, hospitality projects, office complexes, shopping malls, and residential projects in the State of Delhi, Haryana, Andhra Pradesh, Rajasthan, and NCR.

The company has successfully developed more than 20 million square feet (MSF) of real estate projects in the housing, commercial, parks, shopping malls, hospitality, residential, and affordable housing sub-segments.

Additionally, the company has forayed into a data centre with commercial property of potential leasable area of 5.66 msf to be converted into a 300-megawatt (MW) data center. The company has tied up with key government agencies.

Anant Raj is primarily engaged in the development and construction of IT parks, hospitality projects, office complexes, shopping malls, and residential projects in the State of Delhi, Haryana, Andhra Pradesh, Rajasthan, and NCR.

The company has successfully developed more than 20 million square feet (MSF) of real estate projects in the housing, commercial, parks, shopping malls, hospitality, residential, and affordable housing sub-segments.

Additionally, the company has forayed into a data centre with commercial property of potential leasable area of 5.66 msf to be converted into a 300-megawatt (MW) data center. The company has tied up with key government agencies.

Coming to its financials, Anant Raj achieved a revenue of Rs 5.1 bn, a growth of 55% YoY for Q2 FY25.

The operating profit stood at Rs 1.1 bn for Q2 FY25, with a YoY growth of 40%. The operating margin saw a decline to 22% versus 24%, in Q2 FY25.

The net profit after tax for Q2 FY25 was Rs 1 bn, indicating a remarkable 75% growth YoY. The net margin increased to 20.7% versus 18.1%, in Q2 FY24.

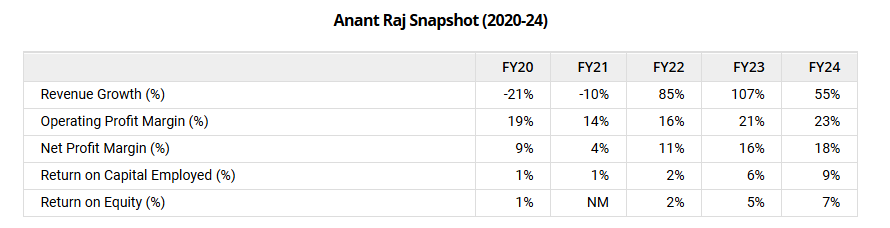

Here is the table showing the annual financial performance of the company.

The operating profit stood at Rs 1.1 bn for Q2 FY25, with a YoY growth of 40%. The operating margin saw a decline to 22% versus 24%, in Q2 FY25.

The net profit after tax for Q2 FY25 was Rs 1 bn, indicating a remarkable 75% growth YoY. The net margin increased to 20.7% versus 18.1%, in Q2 FY24.

Here is the table showing the annual financial performance of the company.

Anant Raj's share price has shown tremendous growth in the past year, rising an impressive 173%. While over the course of 3 years and 5 years, the share price has increased by 128% and 118%, respectively.

During the quarter, the company has observed an increase in the contribution of data center revenues.

The company has announced a fund-raising programme as part of its growth strategies, focused on the data center business worth Rs 21 bn. The company is planning to raise Rs 20 bn from the market, while the promoters are planning to contribute the rest.

During the quarter, the company has observed an increase in the contribution of data center revenues.

The company has announced a fund-raising programme as part of its growth strategies, focused on the data center business worth Rs 21 bn. The company is planning to raise Rs 20 bn from the market, while the promoters are planning to contribute the rest.

Going forward, the company plans to compete with major players in the cloud space, leveraging partnerships for technical support infrastructure while maintaining ownership of the infrastructure.

The management has acknowledged the competition in the data center space while remaining confident in the company's established capabilities and infrastructure space.

The management has acknowledged the competition in the data center space while remaining confident in the company's established capabilities and infrastructure space.

The growth of India's data center industry is driven by demand from BFSI, technology, and telecommunications sectors, supported by state-level incentives. However, unreliable high-speed internet and inconsistent state regulations pose challenges, requiring operators to navigate varying rules on taxes, energy, and sustainability. Hence, it is crucial to weigh the industry's pros and cons and assess companies carefully.

جاري تحميل الاقتراحات...