Shocking stat of the day:

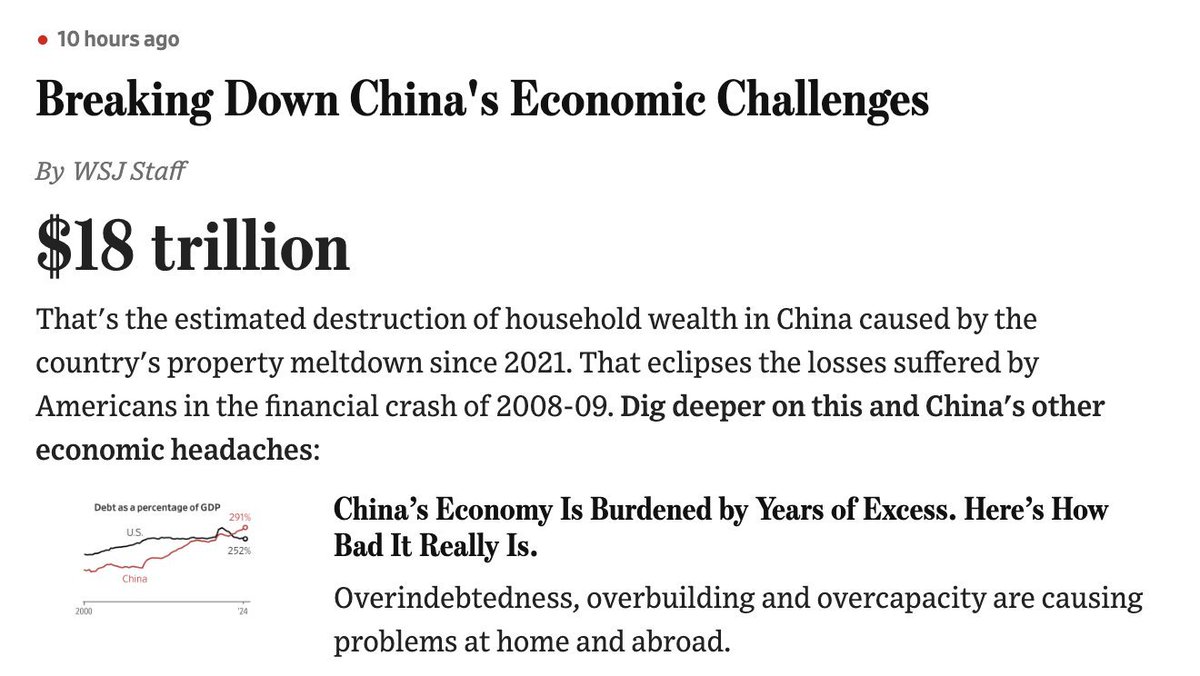

Since 2021, China's real estate collapse has destroyed $18 TRILLION of Chinese household wealth.

To put this in perspective, the US saw $11 trillion of household wealth destroyed in 2008.

Is China's real estate sector in a depression?

(a thread)

Since 2021, China's real estate collapse has destroyed $18 TRILLION of Chinese household wealth.

To put this in perspective, the US saw $11 trillion of household wealth destroyed in 2008.

Is China's real estate sector in a depression?

(a thread)

China's real estate collapse has vaporized TRILLIONS of dollars of household wealth.

In fact, since 2021 China's real estate collapse has erased $60,000 PER HOUSEHOLD.

That's a larger loss than the fall in US real estate during 2008, the country's worst recession in history. x.com

In fact, since 2021 China's real estate collapse has erased $60,000 PER HOUSEHOLD.

That's a larger loss than the fall in US real estate during 2008, the country's worst recession in history. x.com

If you adjust 2008 losses in the US for inflation, it equals ~$17 trillion today.

This means that China has lost more in their real estate bust than the US in 2008, even adjusting for inflation.

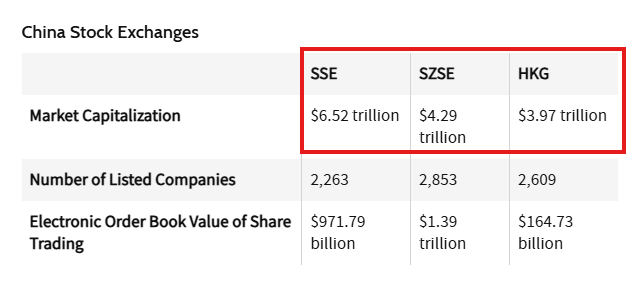

They have lost more on real estate than the value of ALL stocks listed in China. x.com

This means that China has lost more in their real estate bust than the US in 2008, even adjusting for inflation.

They have lost more on real estate than the value of ALL stocks listed in China. x.com

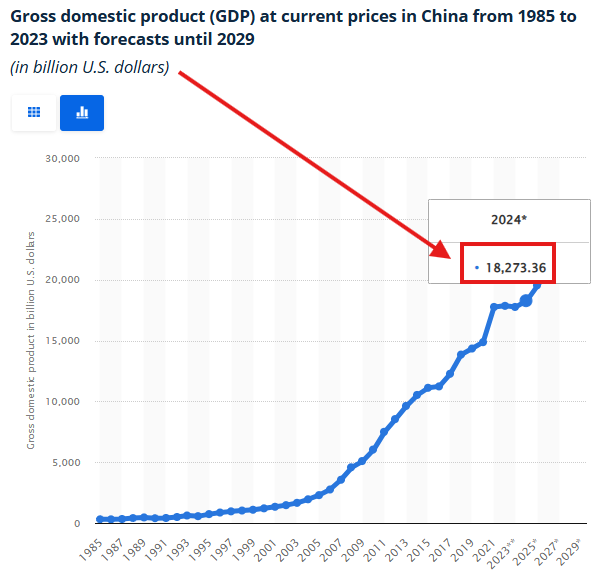

In 2024, China's GDP was roughly $18.3 trillion USD.

Therefore, the losses in China's real estate sector since 2024 are roughly the same as their entire economic output for 2024.

This is, by far, China's largest real estate crisis ever and it's barely getting any attention. x.com

Therefore, the losses in China's real estate sector since 2024 are roughly the same as their entire economic output for 2024.

This is, by far, China's largest real estate crisis ever and it's barely getting any attention. x.com

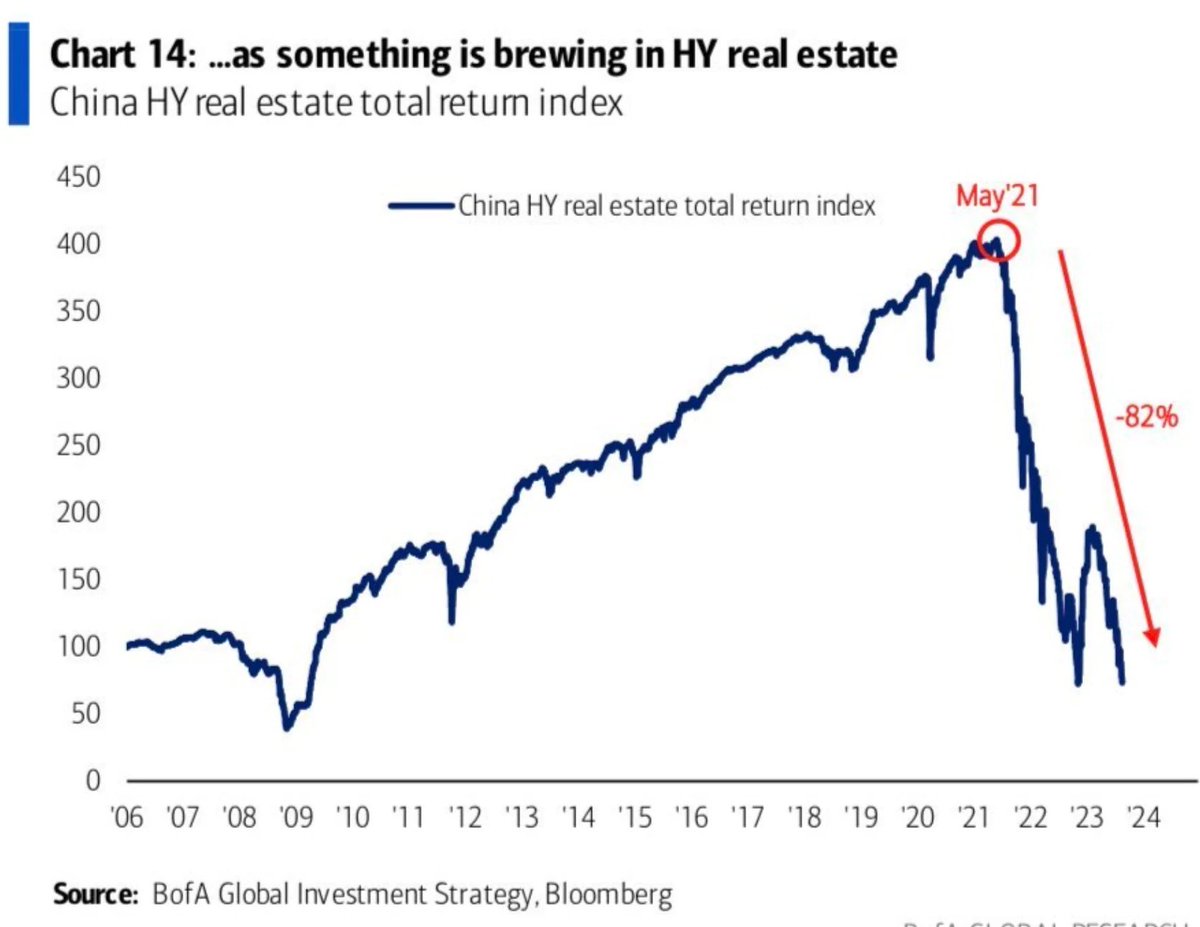

To put things into perspective, China's HY real estate sector entered 2024 down -82% in just 2.5 years.

Meanwhile, one of China's largest property developers, Evergrande, filed Chapter 15 bankruptcy.

Real estate demand in China collapsed with the onset of deflation. x.com

Meanwhile, one of China's largest property developers, Evergrande, filed Chapter 15 bankruptcy.

Real estate demand in China collapsed with the onset of deflation. x.com

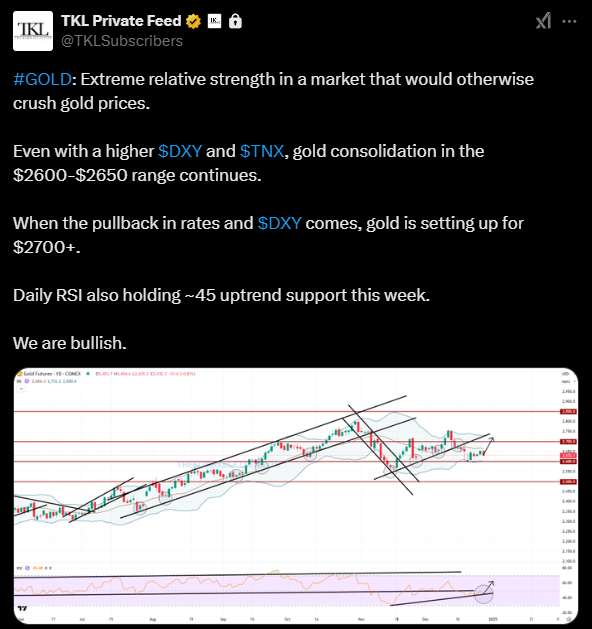

As a hedge, China's central bank has been stocking up on physical gold at record levels since 2021.

Our premium members got ahead of this and bought gold in 2024.

Recently, we alerted a buy at $2600 as seen below.

Subscribe to access our alerts:

thekobeissiletter.com x.com

Our premium members got ahead of this and bought gold in 2024.

Recently, we alerted a buy at $2600 as seen below.

Subscribe to access our alerts:

thekobeissiletter.com x.com

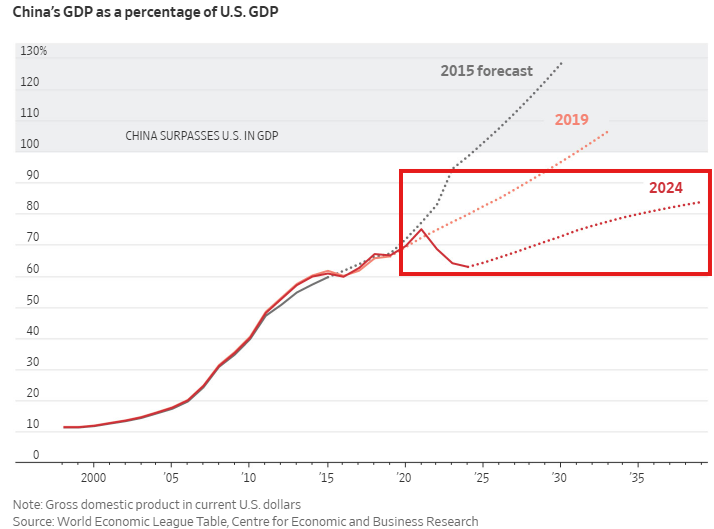

Heading into the 2020s, everyone was calling for China's GDP to surpass the US.

However, due to this collapse, China's GDP is now less than 70% of the US' GDP.

Even by 2040, projections show it is unlikely that China will surpass the United States.

This is their depression. x.com

However, due to this collapse, China's GDP is now less than 70% of the US' GDP.

Even by 2040, projections show it is unlikely that China will surpass the United States.

This is their depression. x.com

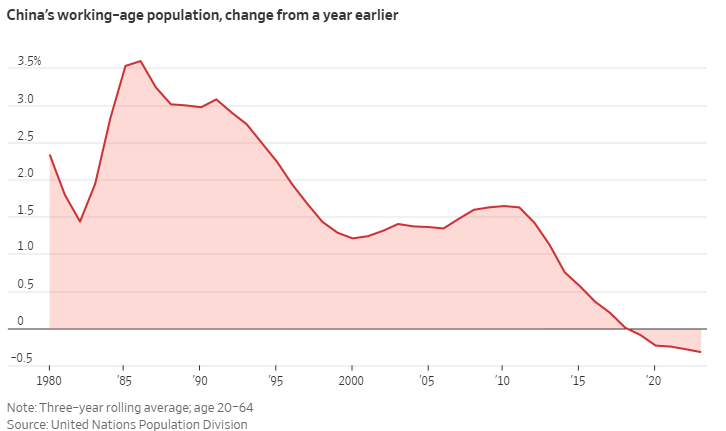

Making things worse, China's working age population is now DECLINING for the first time in history.

China's population dynamics which have shifted due to policies in the 1990s and early-2000s are hurting the economy.

The workforce in China is literally shrinking right now. x.com

China's population dynamics which have shifted due to policies in the 1990s and early-2000s are hurting the economy.

The workforce in China is literally shrinking right now. x.com

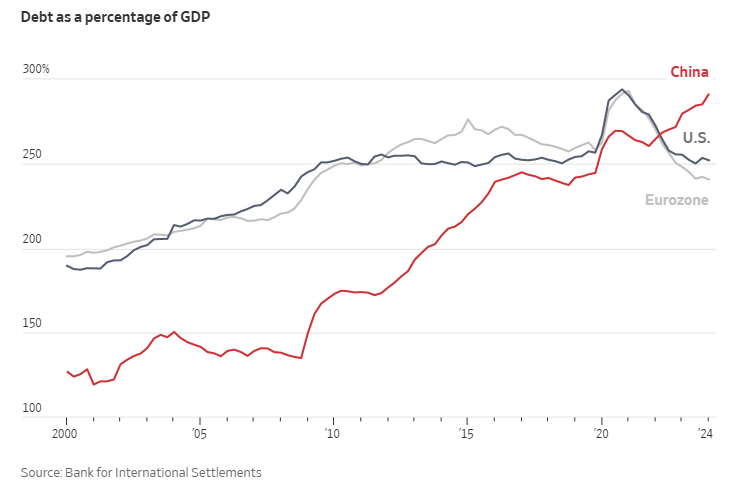

To counter this, China continues to issue hundreds of billions of Dollars worth of stimulus.

Borrowing by government, households and corporations in China is approaching 300% of its annual GDP.

This metric is now ~40 percentage points higher than the United States. x.com

Borrowing by government, households and corporations in China is approaching 300% of its annual GDP.

This metric is now ~40 percentage points higher than the United States. x.com

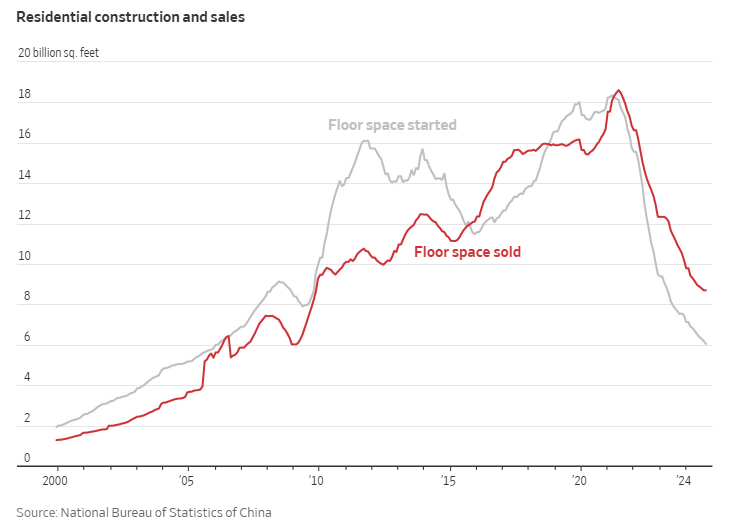

Needless to say, construction and sales of residential buildings has come to a halt.

Here's a chart showing floor space started and sold.

Starts have fallen by ~12 BILLION square feet since the peak in 2021 and it's only getting worse.

China needs a MAJOR restructuring. x.com

Here's a chart showing floor space started and sold.

Starts have fallen by ~12 BILLION square feet since the peak in 2021 and it's only getting worse.

China needs a MAJOR restructuring. x.com

The implications of China's real estate collapse will spread well beyond real estate in China.

As we head into 2025, we are positioning ourselves for more volatility in the market.

Subscribe at the link below to access our premium analysis and alerts:

thekobeissiletter.com

As we head into 2025, we are positioning ourselves for more volatility in the market.

Subscribe at the link below to access our premium analysis and alerts:

thekobeissiletter.com

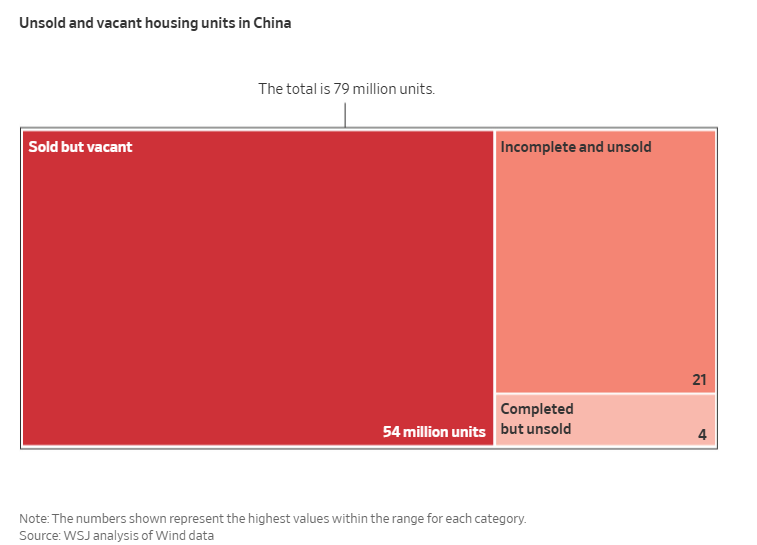

Lastly, the boom and bust has led to a huge overhang of empty property, per the WSJ.

There are now a RECORD 54 million units that are sold but vacant in China.

China needs a major economic restructuring.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

There are now a RECORD 54 million units that are sold but vacant in China.

China needs a major economic restructuring.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

جاري تحميل الاقتراحات...