🌟 Sector: Auto Ancillary

👉 5 Small Cap 🚗 Auto Ancillary Stocks 🔥

⭐ A Thread 🧵👇

#StockMarket #StockMarketIndia #investing #Investments #Automotive #autoancillary #Automotive

👉 5 Small Cap 🚗 Auto Ancillary Stocks 🔥

⭐ A Thread 🧵👇

#StockMarket #StockMarketIndia #investing #Investments #Automotive #autoancillary #Automotive

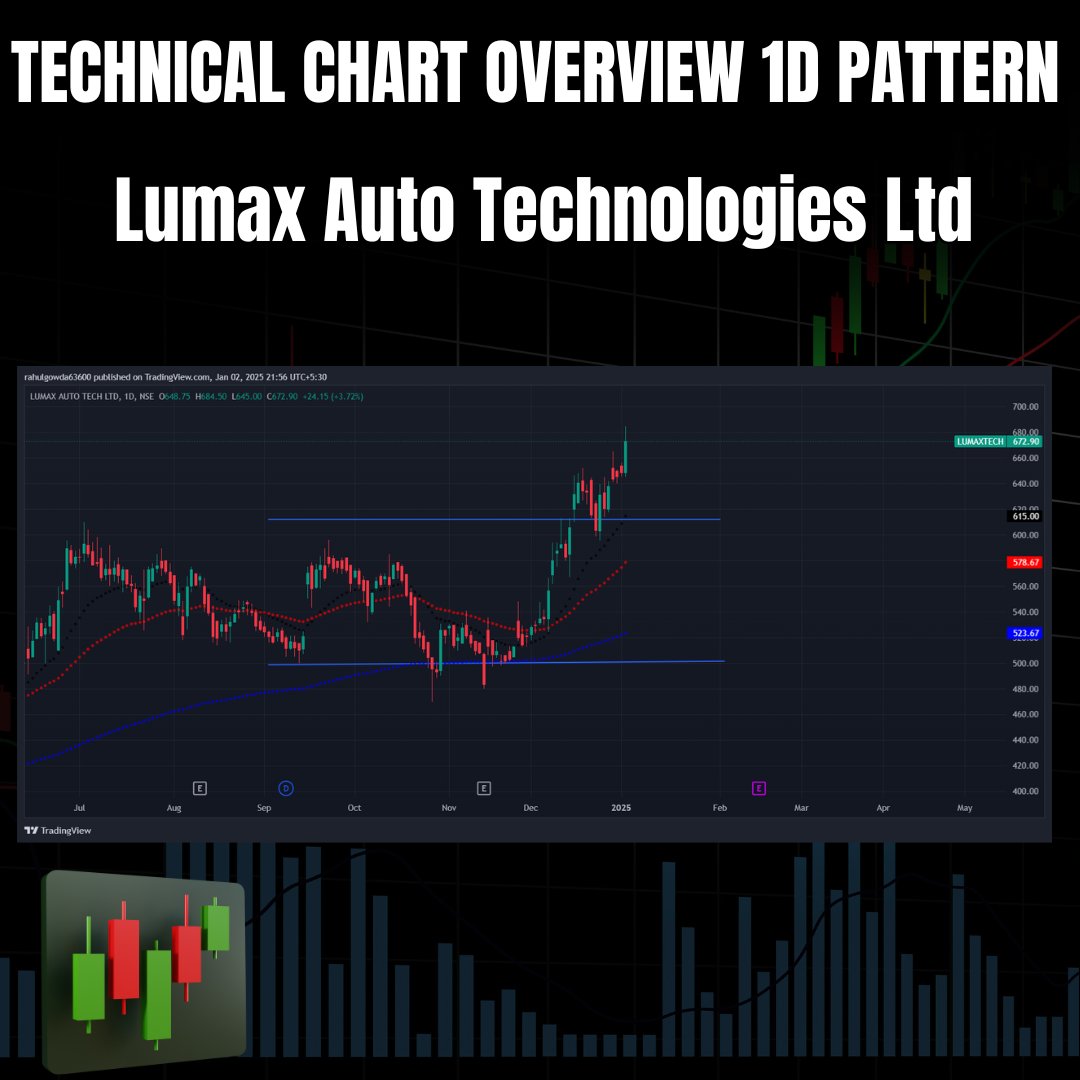

1 Lumax Auto Technologies Ltd Focus area in auto ancillary sector

⚡Automotive Lighting: This is a core area for Lumax, encompassing a wide range of products like headlamps, tail lamps, fog lamps, and interior lighting systems. x.com

⚡Automotive Lighting: This is a core area for Lumax, encompassing a wide range of products like headlamps, tail lamps, fog lamps, and interior lighting systems. x.com

👉Projects undertaken by the company in auto ancillary sector

Advanced Driver-Assistance Systems (ADAS): Lumax has been investing in the development and production of ADAS components, such as advanced lighting systems, cameras, and sensors x.com

Advanced Driver-Assistance Systems (ADAS): Lumax has been investing in the development and production of ADAS components, such as advanced lighting systems, cameras, and sensors x.com

👉 Product Portfolio

⚡Automotive Lighting Solutions

⚡Air Intake Systems

⚡Urea Tanks

⚡Integrated Plastic Modules

⚡Gear Shifters

⚡Transmission Products x.com

⚡Automotive Lighting Solutions

⚡Air Intake Systems

⚡Urea Tanks

⚡Integrated Plastic Modules

⚡Gear Shifters

⚡Transmission Products x.com

👉Key ratios

⚡Market Cap: ₹ 4,593 Cr.

⚡Current Price: ₹ 673

⚡Stock P/E: 29.6

⚡ROCE: 17.7 %

⚡ROE: 17.9 %

⚡Debt to equity: 0.92

⚡Profit Var 3Yrs: 41.2 %

⚡Sales growth 3Years: 36.6 % x.com

⚡Market Cap: ₹ 4,593 Cr.

⚡Current Price: ₹ 673

⚡Stock P/E: 29.6

⚡ROCE: 17.7 %

⚡ROE: 17.9 %

⚡Debt to equity: 0.92

⚡Profit Var 3Yrs: 41.2 %

⚡Sales growth 3Years: 36.6 % x.com

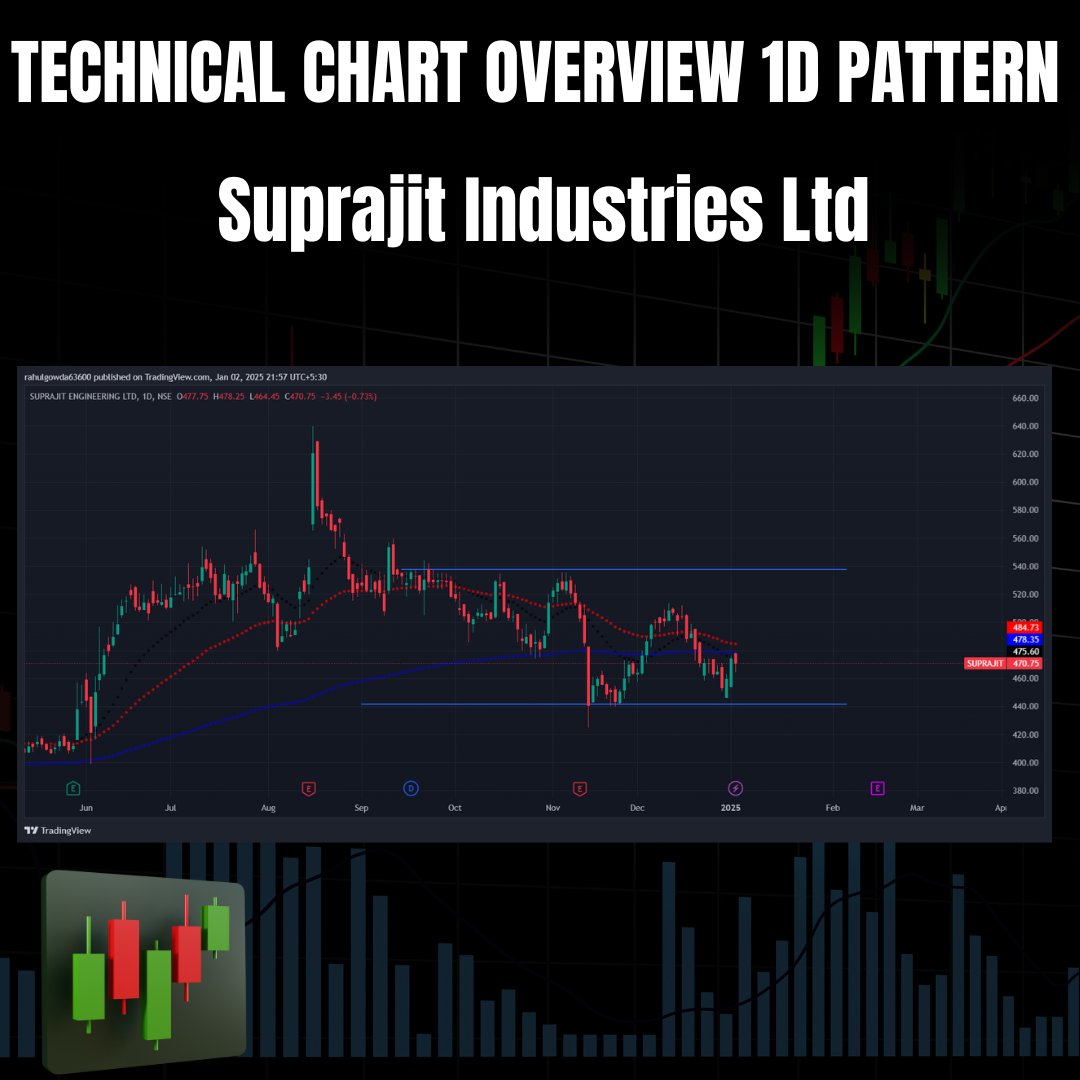

2 Suprajit Industries Ltd Focus area in auto ancillary sector

⚡Control Cables: They are a major manufacturer of a wide range of control cables used in various automotive applications, including brake cables x.com

⚡Control Cables: They are a major manufacturer of a wide range of control cables used in various automotive applications, including brake cables x.com

👉 Product Portfolio

⚡Braking Systems

⚡Control Cables

⚡Display Cluster and Telematics

⚡Friction Products

⚡Gear Box

⚡Gear Shifter Systems

⚡Lighting Systems x.com

⚡Braking Systems

⚡Control Cables

⚡Display Cluster and Telematics

⚡Friction Products

⚡Gear Box

⚡Gear Shifter Systems

⚡Lighting Systems x.com

👉Projects undertaken by the company in auto ancillary sector

Automotive Cables: Suprajit is a major player in the automotive cable market, supplying various types of cables for diverse applications like engine management, powertrain, and safety systems x.com

Automotive Cables: Suprajit is a major player in the automotive cable market, supplying various types of cables for diverse applications like engine management, powertrain, and safety systems x.com

👉Key ratios

⚡Market Cap: ₹ 6,527 Cr.

⚡Current Price: ₹ 471

⚡Stock P/E: 47.3

⚡ROCE: 13.9 %

⚡ROE: 13.0 %

⚡Debt to equity: 0.70

⚡Profit Var 3Yrs: 5.51 %

⚡Sales growth 3Years: 20.8 % x.com

⚡Market Cap: ₹ 6,527 Cr.

⚡Current Price: ₹ 471

⚡Stock P/E: 47.3

⚡ROCE: 13.9 %

⚡ROE: 13.0 %

⚡Debt to equity: 0.70

⚡Profit Var 3Yrs: 5.51 %

⚡Sales growth 3Years: 20.8 % x.com

3 Jamna Auto Technologies Ltd Focus area in auto ancillary sector

⚡Manufacturing of Suspension Systems: JAI specializes in the design and production of various types of suspension systems for commercial vehicles x.com

⚡Manufacturing of Suspension Systems: JAI specializes in the design and production of various types of suspension systems for commercial vehicles x.com

👉Projects undertaken by the company in auto ancillary sector

Supply of suspension components to major OEMs: JAI supplies suspension components to major OEMs in India and abroad, including Tata Motors, Ashok Leyland, Volvo Eicher, and Scania x.com

Supply of suspension components to major OEMs: JAI supplies suspension components to major OEMs in India and abroad, including Tata Motors, Ashok Leyland, Volvo Eicher, and Scania x.com

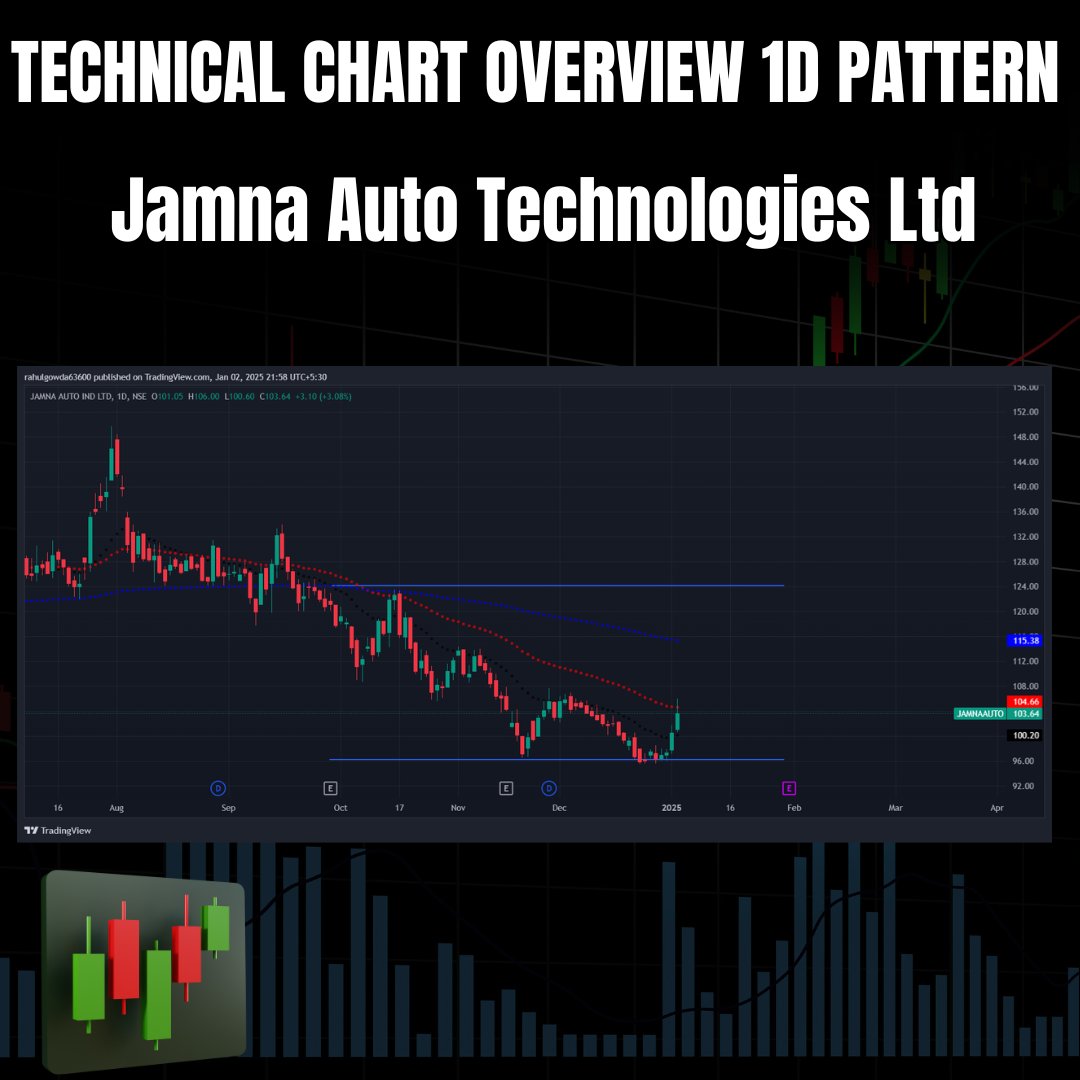

👉Key ratios

⚡Market Cap: ₹ 4,155 Cr.

⚡Current Price: ₹ 104

⚡Stock P/E: 21.2

⚡ROCE: 30.7 %

⚡ROE: 24.5 %

⚡Debt to equity: 0.13

⚡Profit Var 3Yrs: 41.2 %

⚡Sales growth 3Years: 31.0 % x.com

⚡Market Cap: ₹ 4,155 Cr.

⚡Current Price: ₹ 104

⚡Stock P/E: 21.2

⚡ROCE: 30.7 %

⚡ROE: 24.5 %

⚡Debt to equity: 0.13

⚡Profit Var 3Yrs: 41.2 %

⚡Sales growth 3Years: 31.0 % x.com

4 Subros Ltd Focus area in auto ancillary sector

Subros Ltd.'s primary focus area in the auto ancillary sector is the design, development, and manufacturing of automotive air-conditioning systems. x.com

Subros Ltd.'s primary focus area in the auto ancillary sector is the design, development, and manufacturing of automotive air-conditioning systems. x.com

👉 Product portfolio

⚡Automotive Air Conditioning Systems

⚡Bus Air Conditioning Systems

⚡Rail Air Conditioning Systems

⚡Residential & Commercial Cooling Products

⚡Transport Refrigeration Systems x.com

⚡Automotive Air Conditioning Systems

⚡Bus Air Conditioning Systems

⚡Rail Air Conditioning Systems

⚡Residential & Commercial Cooling Products

⚡Transport Refrigeration Systems x.com

👉Projects undertaken by the company in auto ancillary sector

Development of India's first indigenously designed and manufactured automotive air conditioning system: This project marked a significant milestone for the Indian automotive industry x.com

Development of India's first indigenously designed and manufactured automotive air conditioning system: This project marked a significant milestone for the Indian automotive industry x.com

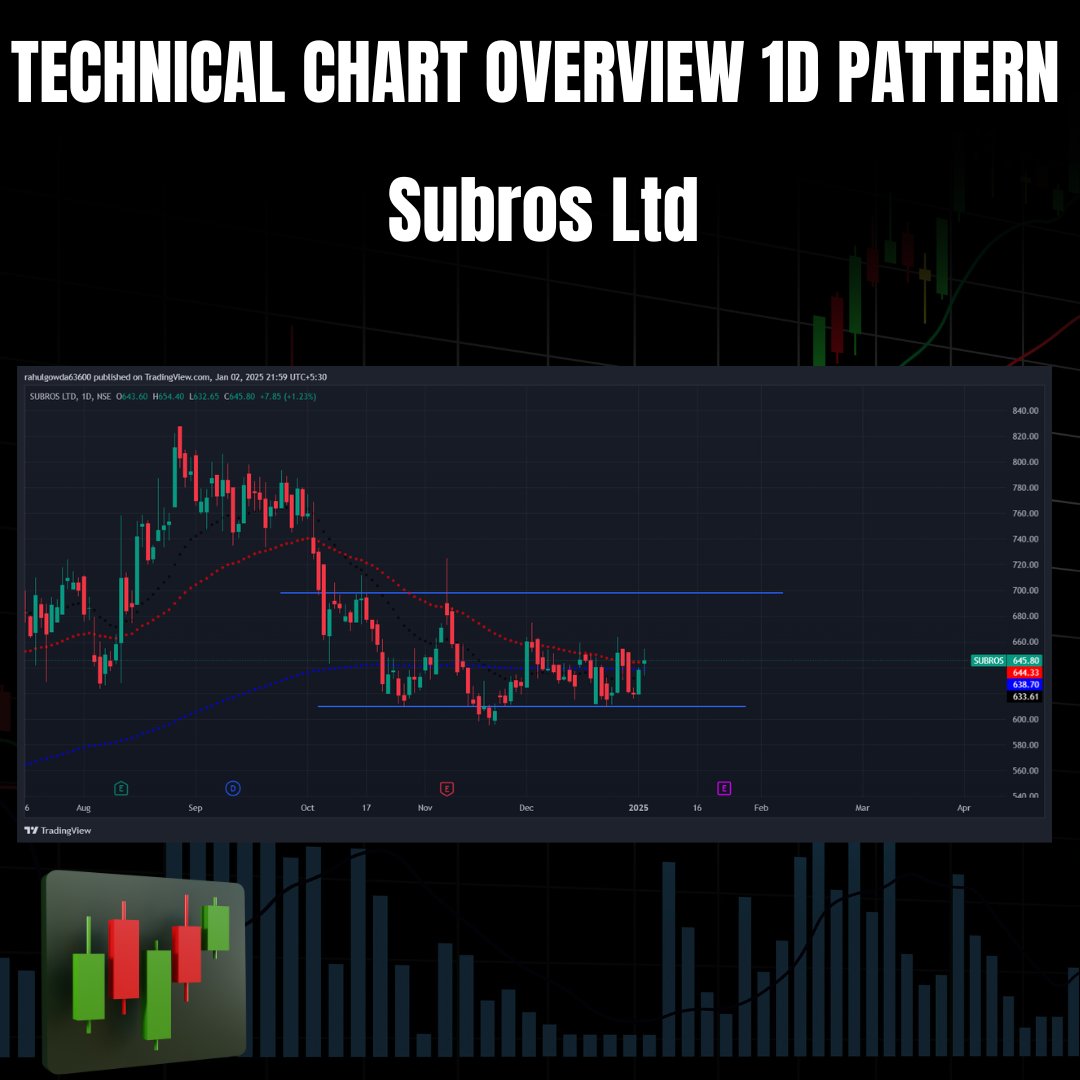

👉Key ratios

⚡Market Cap: ₹ 4,212 Cr.

⚡Current Price: ₹ 646

⚡Stock P/E: 32.7

⚡ROCE: 16.3 %

⚡ROE: 10.6 %

⚡Debt to equity: 0.02

⚡Profit Var 3Yrs: 26.5 %

⚡Sales growth 3Years: 19.6 % x.com

⚡Market Cap: ₹ 4,212 Cr.

⚡Current Price: ₹ 646

⚡Stock P/E: 32.7

⚡ROCE: 16.3 %

⚡ROE: 10.6 %

⚡Debt to equity: 0.02

⚡Profit Var 3Yrs: 26.5 %

⚡Sales growth 3Years: 19.6 % x.com

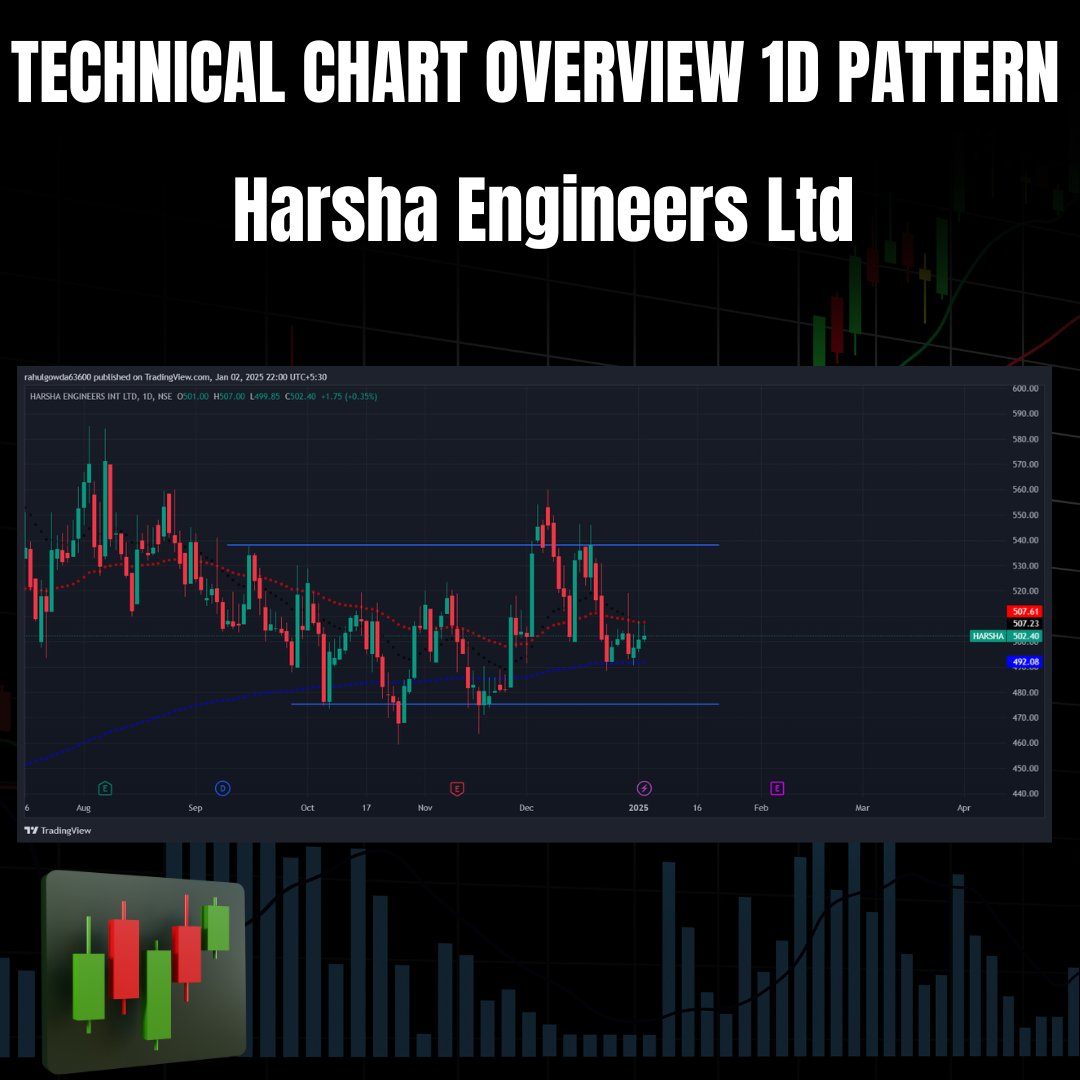

5 Harsha Engineers Ltd Focus area in auto ancillary sector

⚡Precision Bearing Cages: They are a leading manufacturer of these components, which are essential for the smooth operation of bearings in various applications, including automobiles. x.com

⚡Precision Bearing Cages: They are a leading manufacturer of these components, which are essential for the smooth operation of bearings in various applications, including automobiles. x.com

👉Projects undertaken by the company in auto ancillary sector

Bearing Cages: HEIL manufactures a wide range of bearing cages for various automotive applications, including engine components, transmissions, and steering systems x.com

Bearing Cages: HEIL manufactures a wide range of bearing cages for various automotive applications, including engine components, transmissions, and steering systems x.com

👉Key ratios

⚡Market Cap: ₹ 4,570 Cr.

⚡Current Price: ₹ 502

⚡Stock P/E: 32.9

⚡ROCE: 13.4 %

⚡ROE: 10.6 %

⚡Debt to equity: 0.06

⚡Profit Var 3Yrs: 48.9 %

⚡Sales growth 3Years: 22.9 % x.com

⚡Market Cap: ₹ 4,570 Cr.

⚡Current Price: ₹ 502

⚡Stock P/E: 32.9

⚡ROCE: 13.4 %

⚡ROE: 10.6 %

⚡Debt to equity: 0.06

⚡Profit Var 3Yrs: 48.9 %

⚡Sales growth 3Years: 22.9 % x.com

Follow 👉🌟 @FinAspiration 👈. For more insights related to the Finance and Stock market concepts which is simplified in easy to Understand manner ✨. x.com

The content in this post is only for educational purpose and not investment advice. Please consult your financial advisors before investing.

جاري تحميل الاقتراحات...