China is in an economic "death spiral."

Today, the yield on their 10-year government bond fell below 1.60% for the first time in HISTORY.

Even as China rolls out pandemic-like stimulus, their real estate market is weaker than 2008.

Has China's recession begun?

(a thread)

Today, the yield on their 10-year government bond fell below 1.60% for the first time in HISTORY.

Even as China rolls out pandemic-like stimulus, their real estate market is weaker than 2008.

Has China's recession begun?

(a thread)

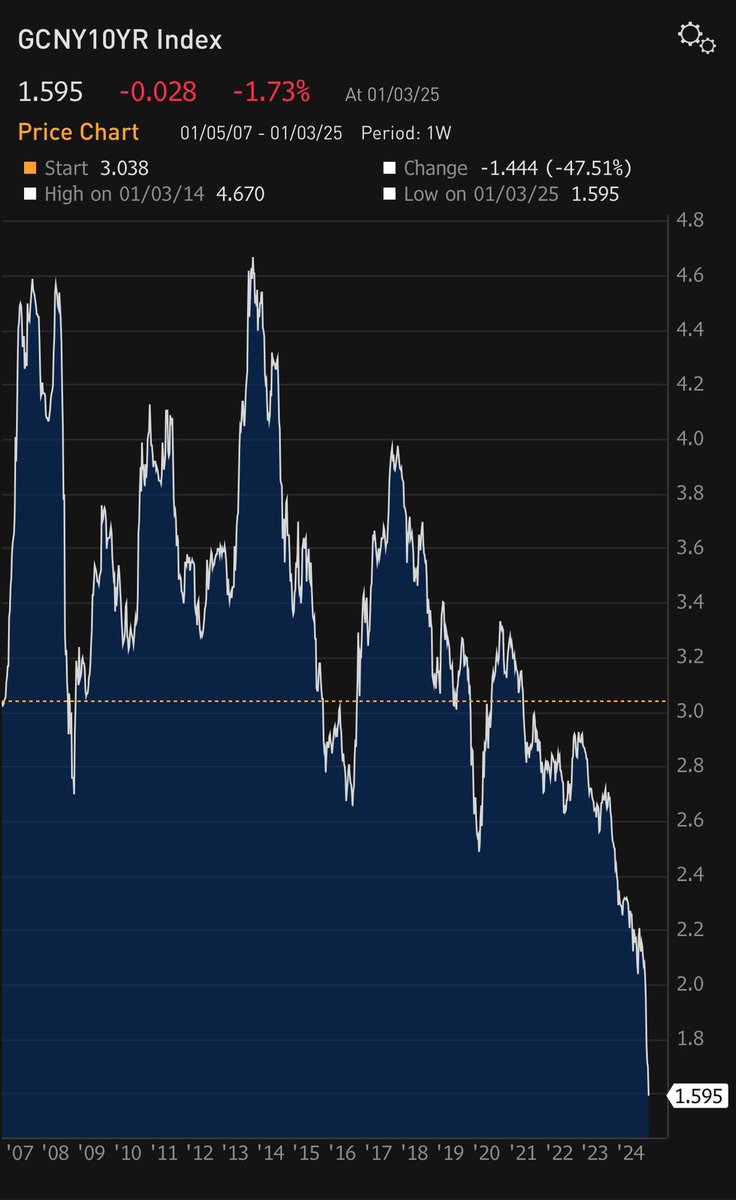

For some background, here is China's 10-year government bond yield.

It's now down more than 100 basis points in one year and moving exactly OPPOSITE as US rates.

As the US deals with inflation, China is dealing with severe deflation, which is arguably even worse. x.com

It's now down more than 100 basis points in one year and moving exactly OPPOSITE as US rates.

As the US deals with inflation, China is dealing with severe deflation, which is arguably even worse. x.com

In fact, the US versus China 10Y bond spread is now at 296 basis points, the largest difference in history.

This means that investors can obtain nearly 300 basis points MORE for a risk free investment in the US than China.

Who would ever choose the Chinese government bond? x.com

This means that investors can obtain nearly 300 basis points MORE for a risk free investment in the US than China.

Who would ever choose the Chinese government bond? x.com

Bond yields don't just fall off a cliff like this when things are "normal."

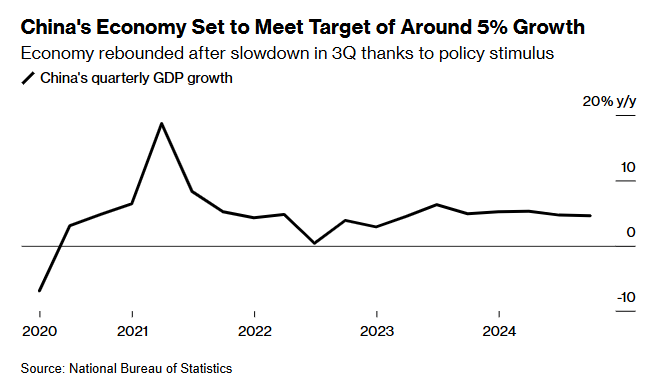

Investors will point to the 5% GDP growth in China for reassurance.

The question is, how accurate is this number and can the economy rally grow by 5% per year in this environment?

Something is off. x.com

Investors will point to the 5% GDP growth in China for reassurance.

The question is, how accurate is this number and can the economy rally grow by 5% per year in this environment?

Something is off. x.com

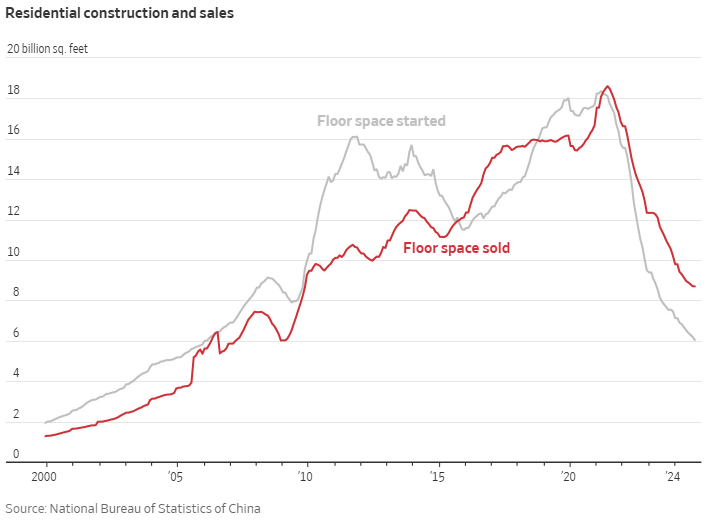

China's real estate crash has destroyed $18 TRILLION of wealth since 2021, according to Barclays.

Their HY Real Estate index has dropped over 80% from its all time high.

Home sales are down over 50% in just 3 years.

How can GDP grow by 5% per year in this market? x.com

Their HY Real Estate index has dropped over 80% from its all time high.

Home sales are down over 50% in just 3 years.

How can GDP grow by 5% per year in this market? x.com

In a last ditch effort, China began stimulus in Q3 2024:

1. Cutting reserve requirements by 0.5%

2. Cut 7-day RRP rate by 0.2%

3. Lowering mortgage rates

4. Injecting $142 billion into banks

5. Implement "forceful" rate cuts

We questioned if this would be a long-term solution.

1. Cutting reserve requirements by 0.5%

2. Cut 7-day RRP rate by 0.2%

3. Lowering mortgage rates

4. Injecting $142 billion into banks

5. Implement "forceful" rate cuts

We questioned if this would be a long-term solution.

Simultaneously, China is stocking up on gold, leading to record high prices even as the US Dollar rises.

Our premium members got ahead of this and bought gold in 2024.

Recently, we alerted a buy at $2600 as seen below.

Subscribe to access our alerts:

thekobeissiletter.com x.com

Our premium members got ahead of this and bought gold in 2024.

Recently, we alerted a buy at $2600 as seen below.

Subscribe to access our alerts:

thekobeissiletter.com x.com

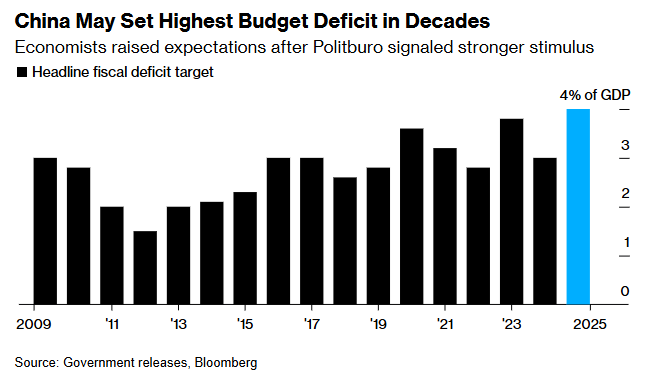

As a result of widespread stimulus, China's budget deficit is set to hit 4% in 2025.

This would be their highest annual deficit since a major tax reform in 1994.

It would also break Chinese policymakers’ tradition of capping it at 3%.

This is not a "normal" economy. x.com

This would be their highest annual deficit since a major tax reform in 1994.

It would also break Chinese policymakers’ tradition of capping it at 3%.

This is not a "normal" economy. x.com

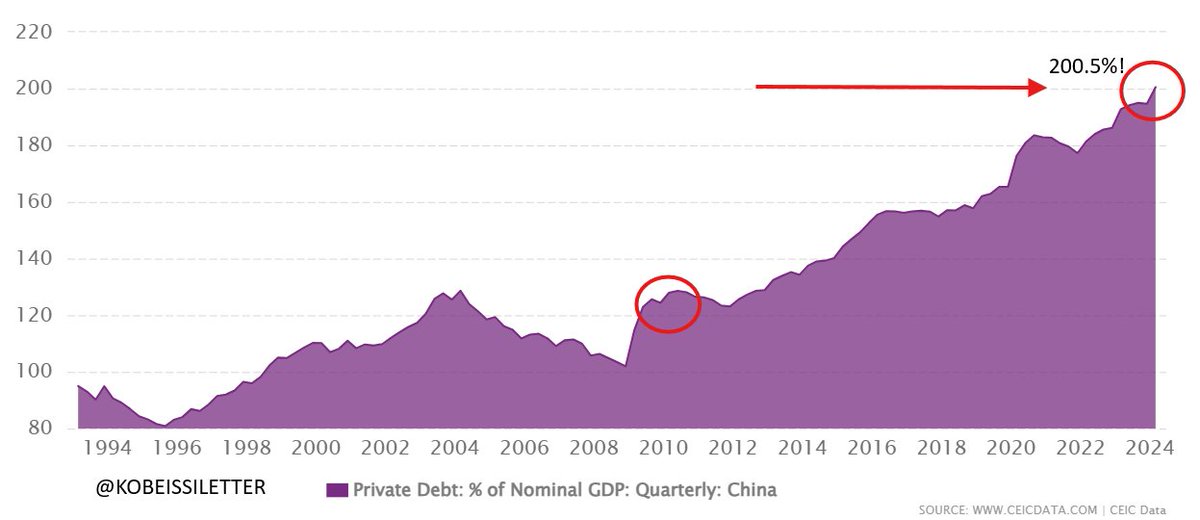

Even more alarming, China's private sector debt as a % of GDP is now above 200% for the first time in history.

This is ~70 percentage points higher than the peak of the 2008 Financial Crisis.

By comparison, this metric has fallen by ~20 percentage points since 2008 in the US. x.com

This is ~70 percentage points higher than the peak of the 2008 Financial Crisis.

By comparison, this metric has fallen by ~20 percentage points since 2008 in the US. x.com

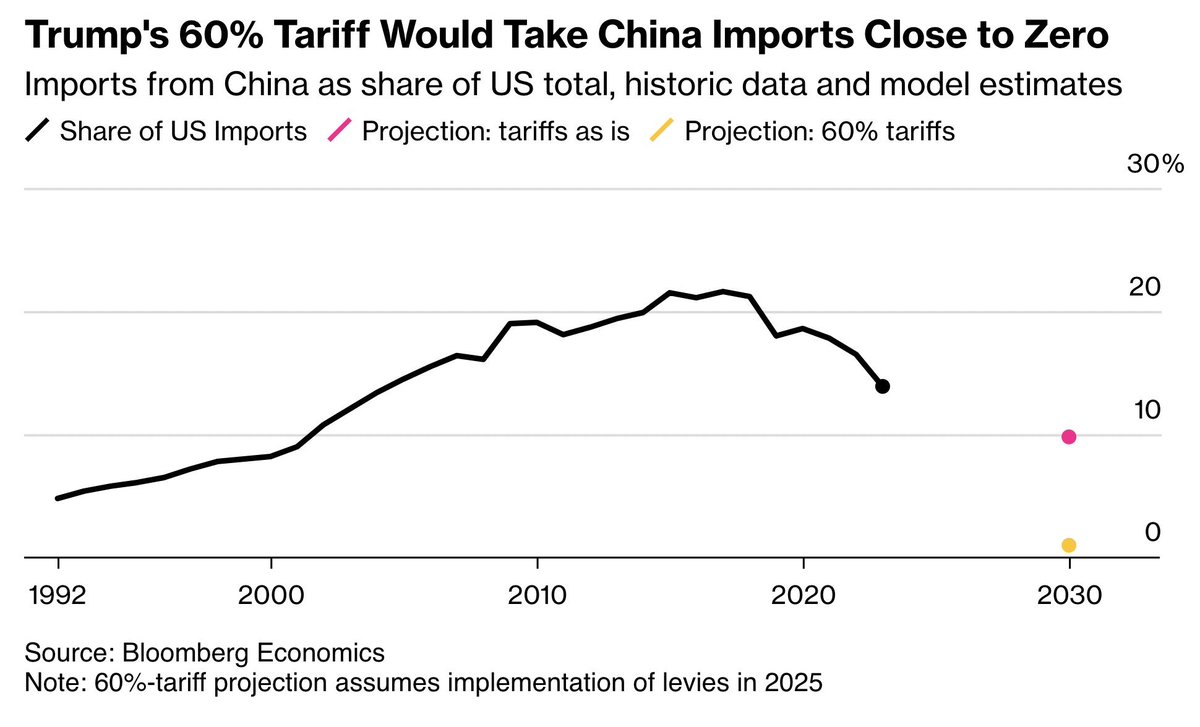

Add in upcoming Trump tariffs on China and their economy is in even more trouble.

In early-2024, Trump pitched a 60% tariff on all Chinese imports.

That would shrink a $575 billion trade pipeline to practically nothing, Bloomberg analysis shows. x.com

In early-2024, Trump pitched a 60% tariff on all Chinese imports.

That would shrink a $575 billion trade pipeline to practically nothing, Bloomberg analysis shows. x.com

The economic swings coming in China will not be isolated.

They will impact global equity, commodity, and bond markets.

We expect more volatility as China attempts to rescue its economy.

Subscribe at the link below to see how we are trading this:

thekobeissiletter.com

They will impact global equity, commodity, and bond markets.

We expect more volatility as China attempts to rescue its economy.

Subscribe at the link below to see how we are trading this:

thekobeissiletter.com

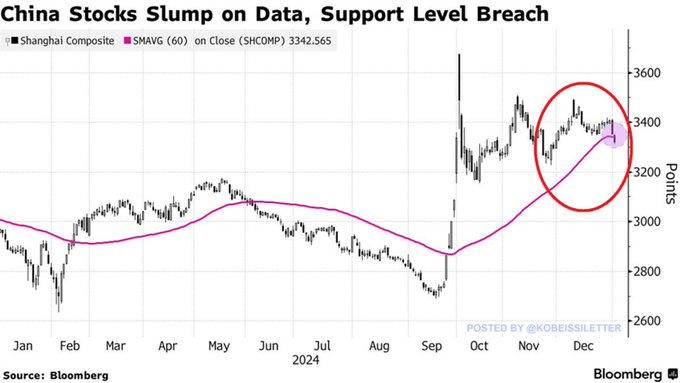

Lastly, yesterday China began the year with a -2.9% drop in its stock market.

This marked the largest drop on a year’s first trading day in 10 years.

Investors in Chinese assets are looking to de-risk.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

This marked the largest drop on a year’s first trading day in 10 years.

Investors in Chinese assets are looking to de-risk.

Follow us @KobeissiLetter for real time analysis as this develops. x.com

جاري تحميل الاقتراحات...