⚡️ IPOs are buzzing

Here's a crisp guide with rules & case studies to master IPO breakouts!

Credits: @swing_ka_sultan

✅ telegram.me

👇👇

Here's a crisp guide with rules & case studies to master IPO breakouts!

Credits: @swing_ka_sultan

✅ telegram.me

👇👇

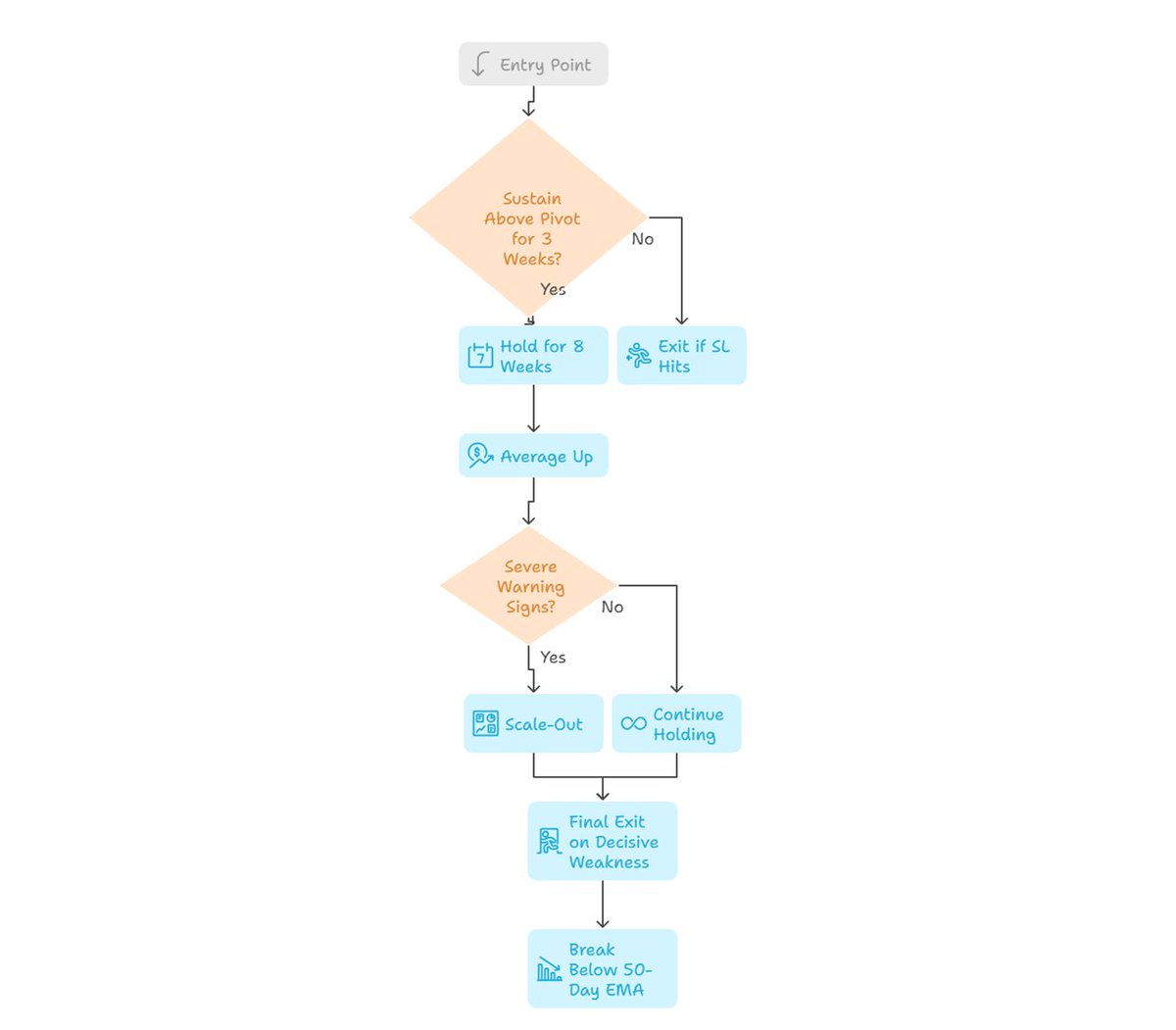

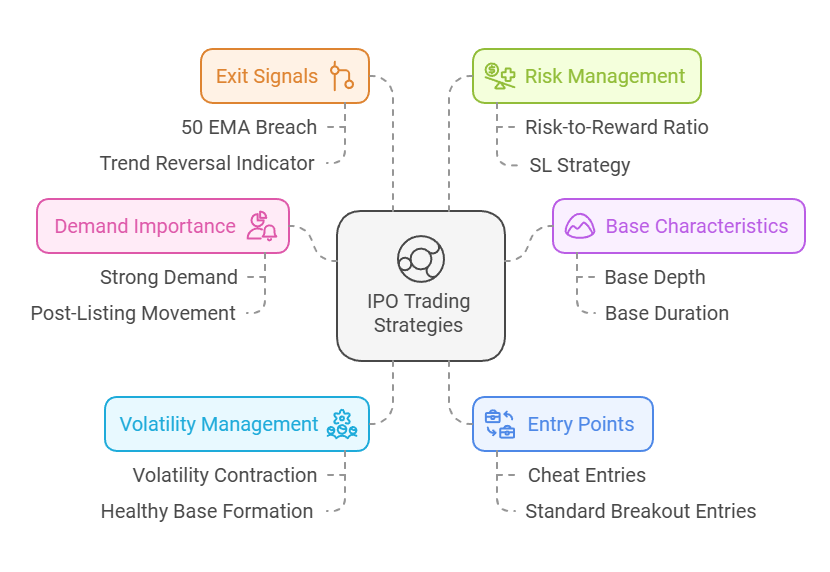

➱ Trade Management Rules

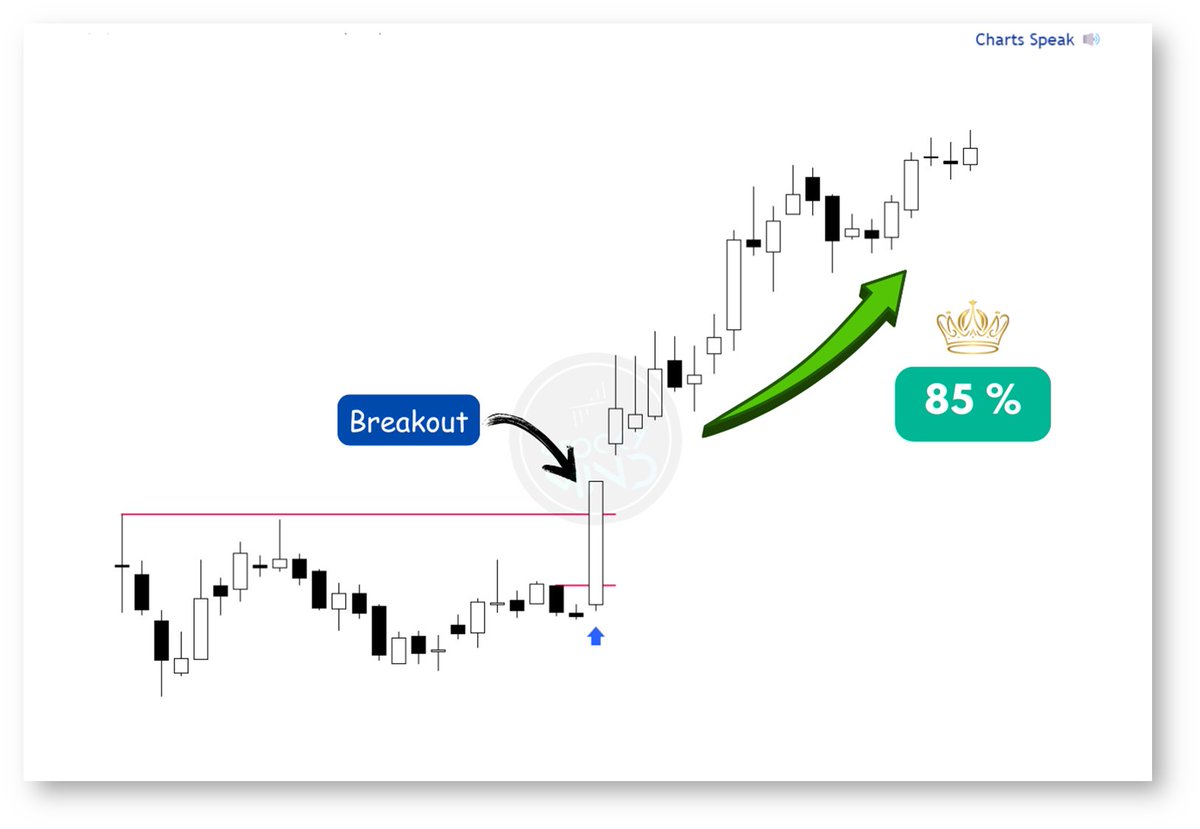

1️⃣ Entry: Breakout of the left side high into new ground.

2️⃣ Cheat entries: Allowed to preempt trades with risk at breakout levels.

3️⃣ Hold for 8 weeks if the stock sustains above the pivot for 3 weeks.

Exit if SL hits.

4️⃣ Average up: Use valid entries like bases, 3-week tight patterns, shakeouts, or continuation setups.

5️⃣ Scale-out: Reduce position on severe warning signs; exit entirely on decisive weakness.

6️⃣ Final exit: Decisive break below the 50-day EMA.

1️⃣ Entry: Breakout of the left side high into new ground.

2️⃣ Cheat entries: Allowed to preempt trades with risk at breakout levels.

3️⃣ Hold for 8 weeks if the stock sustains above the pivot for 3 weeks.

Exit if SL hits.

4️⃣ Average up: Use valid entries like bases, 3-week tight patterns, shakeouts, or continuation setups.

5️⃣ Scale-out: Reduce position on severe warning signs; exit entirely on decisive weakness.

6️⃣ Final exit: Decisive break below the 50-day EMA.

Let's dive into some examples,

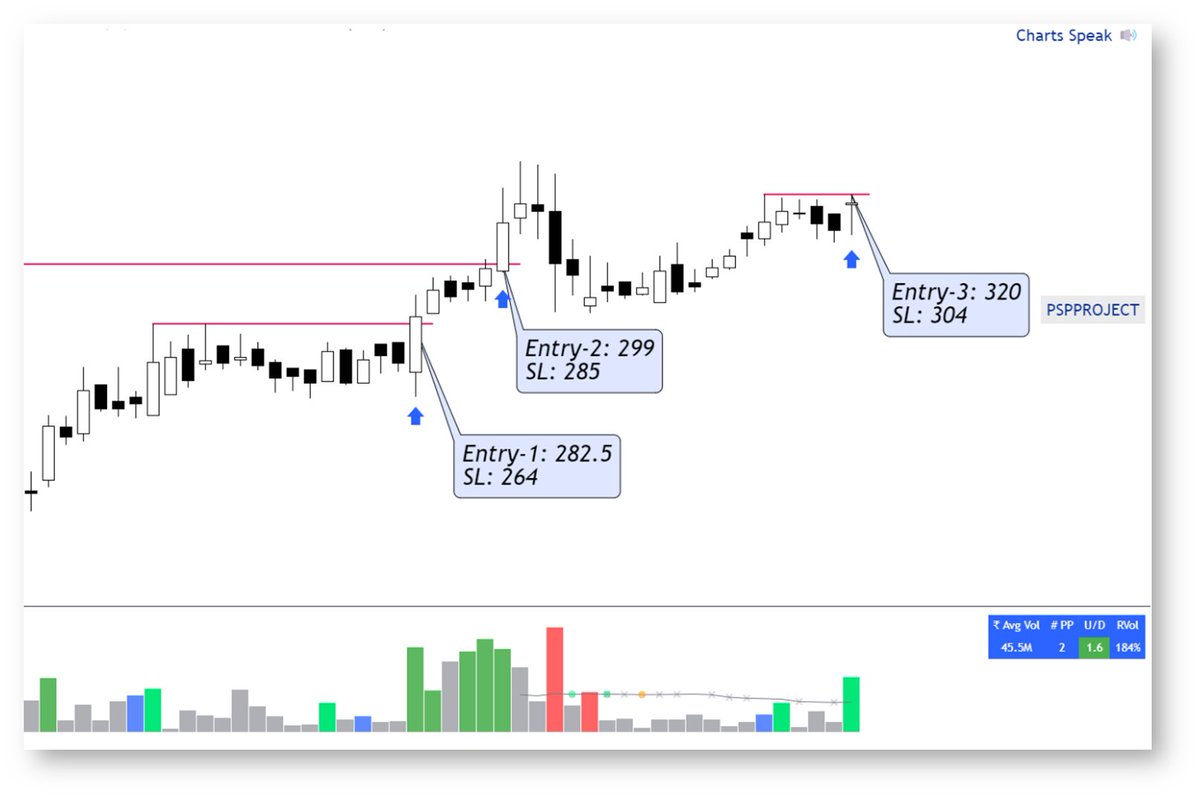

⇛ Case Study-1

PSPPROJECT (May 2017)

Listed at a 7% discount & surged 67% in 4 weeks, showing strong demand despite the weak debut.

1️⃣ Base Formation

Depth: 20% (ideal).

Duration: 6 weeks.

Features: Volatility contraction with a 3WTC + 3IB setup.

2️⃣ Entries

Cheat Entry 1: ₹282.5 (SL: ₹264).

Entry 2: ₹317.5 (SL: ₹292).

⇛ Case Study-1

PSPPROJECT (May 2017)

Listed at a 7% discount & surged 67% in 4 weeks, showing strong demand despite the weak debut.

1️⃣ Base Formation

Depth: 20% (ideal).

Duration: 6 weeks.

Features: Volatility contraction with a 3WTC + 3IB setup.

2️⃣ Entries

Cheat Entry 1: ₹282.5 (SL: ₹264).

Entry 2: ₹317.5 (SL: ₹292).

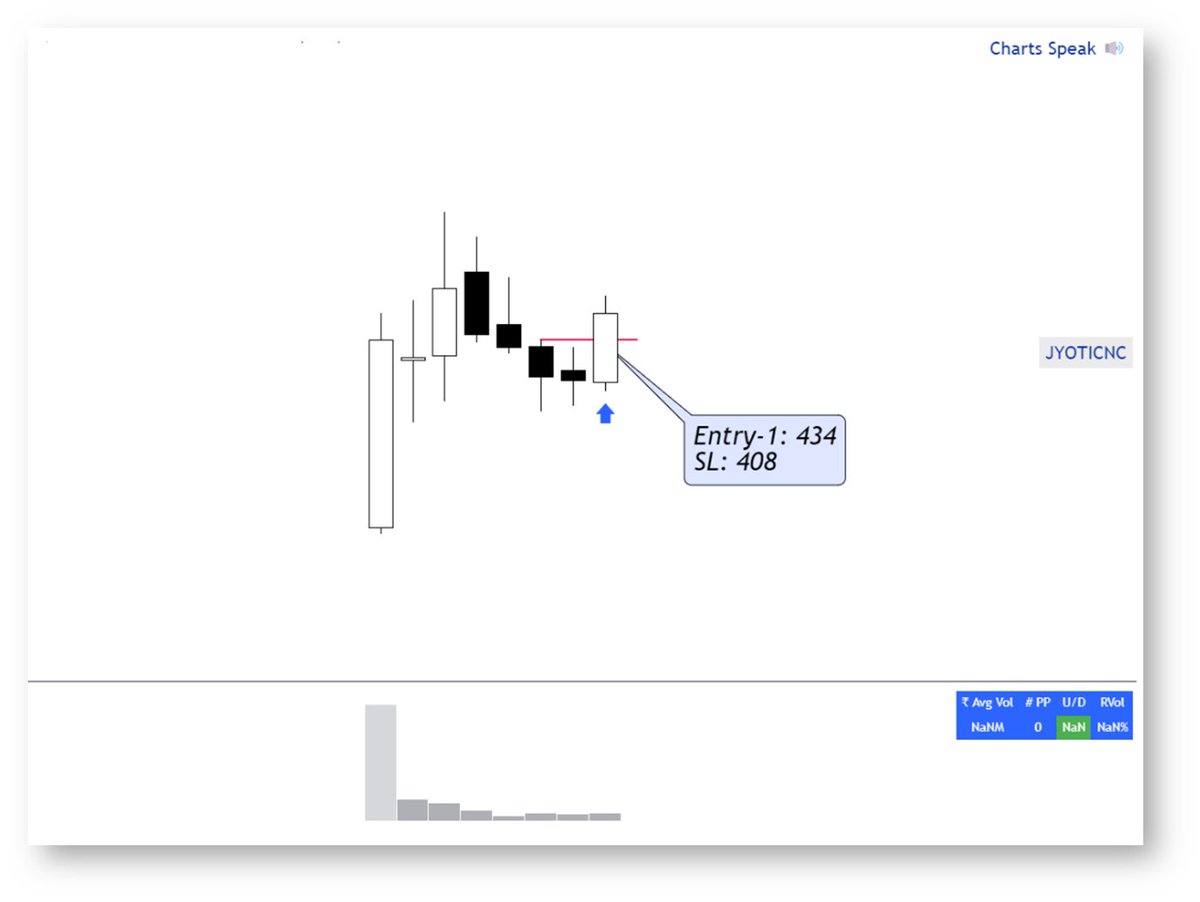

⇛ Case study-2

EMSLIMITED (21 Sept 2023)

🚀 EMS Limited IPO listed at a 33% premium and surged 35% in 2 weeks, signalling strong demand.

1️⃣ Base Formation

Depth: 17% (ideal).

Duration: 4 weeks.

Features: Volatility contraction, bounce from 61% Fibonacci level & IPO day high, with a Weekly NR7 + IB setup.

2️⃣ Entries

Cheat Entry 1: ₹305 (SL: ₹292).

Entry 2: ₹334 (SL: ₹315).

EMSLIMITED (21 Sept 2023)

🚀 EMS Limited IPO listed at a 33% premium and surged 35% in 2 weeks, signalling strong demand.

1️⃣ Base Formation

Depth: 17% (ideal).

Duration: 4 weeks.

Features: Volatility contraction, bounce from 61% Fibonacci level & IPO day high, with a Weekly NR7 + IB setup.

2️⃣ Entries

Cheat Entry 1: ₹305 (SL: ₹292).

Entry 2: ₹334 (SL: ₹315).

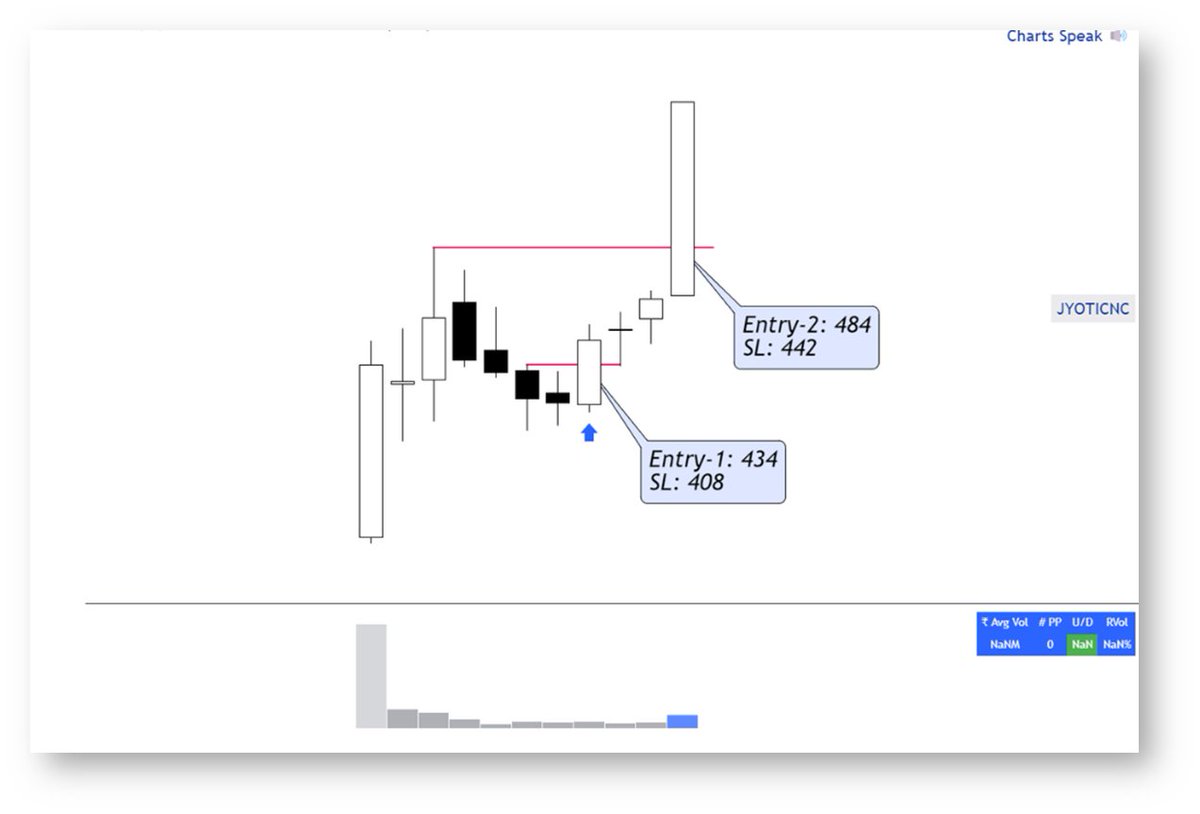

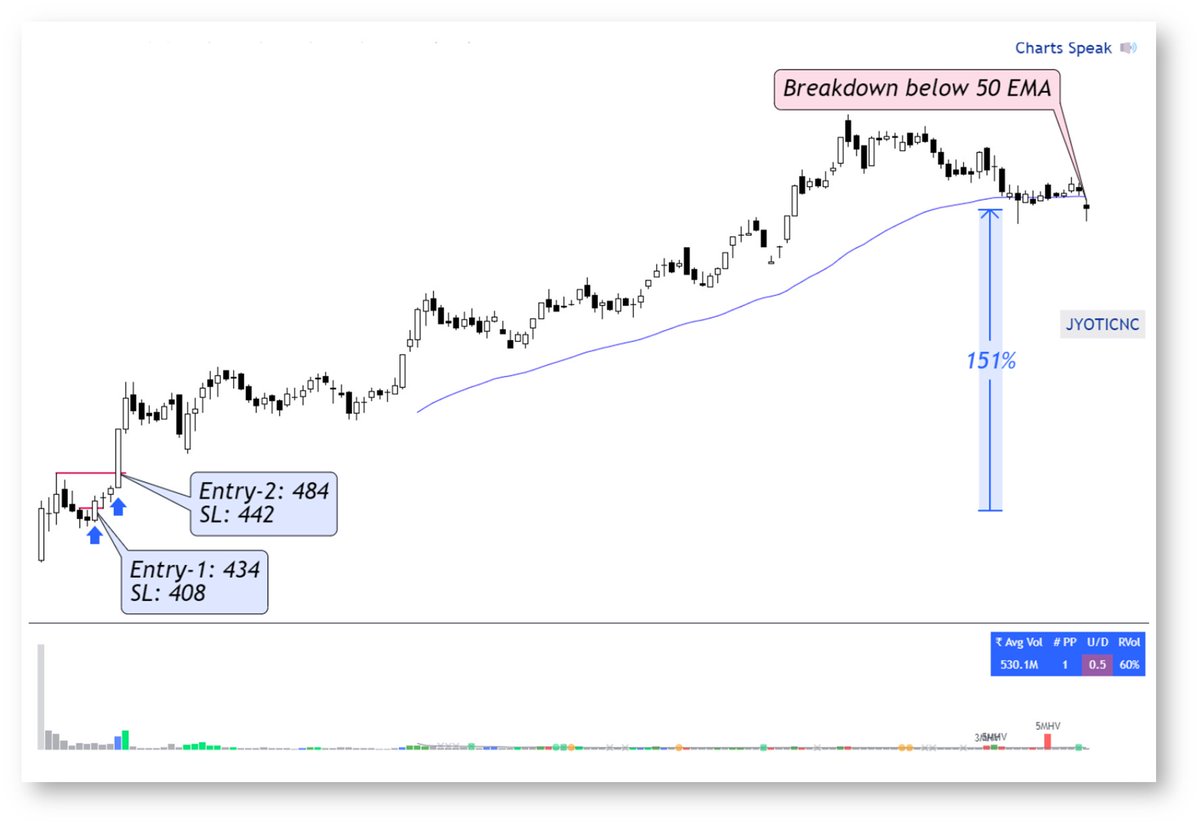

⇛ Case study-3

ROUTE (21 Sept 2020)

🚀 ROUTE IPO listed at a 105% premium and surged 35% in 2 weeks, signalling strong demand.

1️⃣ Base Formation

Depth: 30% (not ideal).

Duration: 5 weeks.

Features: Strong bounce from lows on good volume.

2️⃣ Entries

Cheat Entry 1: ₹827 (SL: ₹755).

Entry 2: ₹965 (SL: ₹870).

ROUTE (21 Sept 2020)

🚀 ROUTE IPO listed at a 105% premium and surged 35% in 2 weeks, signalling strong demand.

1️⃣ Base Formation

Depth: 30% (not ideal).

Duration: 5 weeks.

Features: Strong bounce from lows on good volume.

2️⃣ Entries

Cheat Entry 1: ₹827 (SL: ₹755).

Entry 2: ₹965 (SL: ₹870).

✨ Learnings:

✔ Strong demand post-listing matters

Even if an IPO lists at a discount or with weak initial demand, a strong move post-listing, like in PSPPROJECT, can indicate a potential winning setup.

Always focus on price action and volume post-listing.

#IPO #Trading #StockMarket

✔ Strong demand post-listing matters

Even if an IPO lists at a discount or with weak initial demand, a strong move post-listing, like in PSPPROJECT, can indicate a potential winning setup.

Always focus on price action and volume post-listing.

#IPO #Trading #StockMarket

✔ Depth & duration of the base are important

Depths between 15%-25% and durations between 2-6 weeks, like in EMSLIMITED, often lead to good setups.

Depths between 15%-25% and durations between 2-6 weeks, like in EMSLIMITED, often lead to good setups.

✔ Key Entry Points

Cheat entries before the breakout, followed by standard breakout entries, provide multiple chances to get in.

Always define SL based on the formation's low or volatility expansion point.

Cheat entries before the breakout, followed by standard breakout entries, provide multiple chances to get in.

Always define SL based on the formation's low or volatility expansion point.

✔ Look for volatility contraction.

The presence of volatility contraction after the initial surge, as seen in multiple cases, indicates a healthy base formation and provides lower-risk entry points.

The presence of volatility contraction after the initial surge, as seen in multiple cases, indicates a healthy base formation and provides lower-risk entry points.

✔ Don’t Let Fear of Volatility Shake You

IPO stocks can experience sharp pullbacks post-breakout.

Patience and discipline are essential to follow the SL strategy.

As shown in PSPPROJECT and ROUTE, staying the course often pays off.

IPO stocks can experience sharp pullbacks post-breakout.

Patience and discipline are essential to follow the SL strategy.

As shown in PSPPROJECT and ROUTE, staying the course often pays off.

✔ Use 50 EMA for exit signals

The 50 EMA often serves as a reliable exit signal.

A breach of this moving average indicates a potential trend reversal, as demonstrated in the above case studies.

The 50 EMA often serves as a reliable exit signal.

A breach of this moving average indicates a potential trend reversal, as demonstrated in the above case studies.

✔ Stick to your risk-to-reward strategy

Managing entries and exits with a clear risk-to-reward ratio is essential.

Always ensure that your SL aligns with your risk tolerance, aiming for at least 2-3x rewards on successful trades.

Managing entries and exits with a clear risk-to-reward ratio is essential.

Always ensure that your SL aligns with your risk tolerance, aiming for at least 2-3x rewards on successful trades.

If you found it informative 😍

1▹ Follow:

@StockyMind 🤝 @DSS_Rajput007

2▹ Like & Retweet 🩷 🔁 🔖

3▹ Join: telegram.me

x.com

1▹ Follow:

@StockyMind 🤝 @DSS_Rajput007

2▹ Like & Retweet 🩷 🔁 🔖

3▹ Join: telegram.me

x.com

جاري تحميل الاقتراحات...