P/E Ratio ⏭️ Future Growth👉💰

Forward PE !!

Deep Dive 👇

Forward PE !!

Deep Dive 👇

Forward PE tells us whether there is any valuation gap or not in the particular counter.

Because if we are going to invest or trade something then we will only go if there is a chance for us to make money.

So, to understand whether to consider the stock or not we need to learn about Forward PE.

Because if we are going to invest or trade something then we will only go if there is a chance for us to make money.

So, to understand whether to consider the stock or not we need to learn about Forward PE.

Forward PE is extrapolated no. based on future earnings estimates.

If we understand how to calculate normal PE then calculating Forward PE will be easy.

P/E ratio = Current stock price / EPS (Earnings per share) of the year.

Here, Current stock price is the price at which trading is going on or the latest close price of a stock and EPS is Earning per share of recent 4 quarters which is also know as TTM EPS (Trailing 12 months ).

Lets move on to understand Forward PE.

If we understand how to calculate normal PE then calculating Forward PE will be easy.

P/E ratio = Current stock price / EPS (Earnings per share) of the year.

Here, Current stock price is the price at which trading is going on or the latest close price of a stock and EPS is Earning per share of recent 4 quarters which is also know as TTM EPS (Trailing 12 months ).

Lets move on to understand Forward PE.

Forward P/E = Price / EPS

So we need future earnings of let’s say next 4 quarters instead of recent 4 quarters for calculating forward PE.

Ways to calculate the Future EPS: (Note- It’s will always be an estimate so one has to keep that in mind)

⚡️ Multiplying the latest quarter EPS by 4 as assumption here will be that they will do at least this much in coming quarters.

⚡️Adding last 2 quarters EPS and then multiply by 2 will give you full EPS. This is more conservative approach.

⚡️ Digging into earnings con calls and PPTs to find what the company is expecting in coming years and then using that data calculating the estimates EPS for the year. This will be a more accurate way but needs more efforts. Lets dive deep in the methods more.

So we need future earnings of let’s say next 4 quarters instead of recent 4 quarters for calculating forward PE.

Ways to calculate the Future EPS: (Note- It’s will always be an estimate so one has to keep that in mind)

⚡️ Multiplying the latest quarter EPS by 4 as assumption here will be that they will do at least this much in coming quarters.

⚡️Adding last 2 quarters EPS and then multiply by 2 will give you full EPS. This is more conservative approach.

⚡️ Digging into earnings con calls and PPTs to find what the company is expecting in coming years and then using that data calculating the estimates EPS for the year. This will be a more accurate way but needs more efforts. Lets dive deep in the methods more.

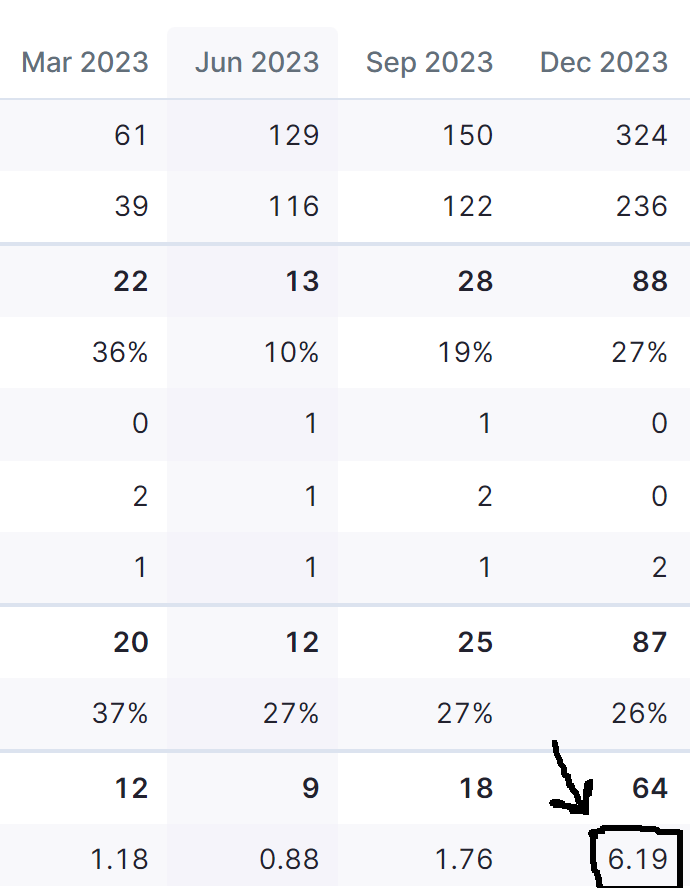

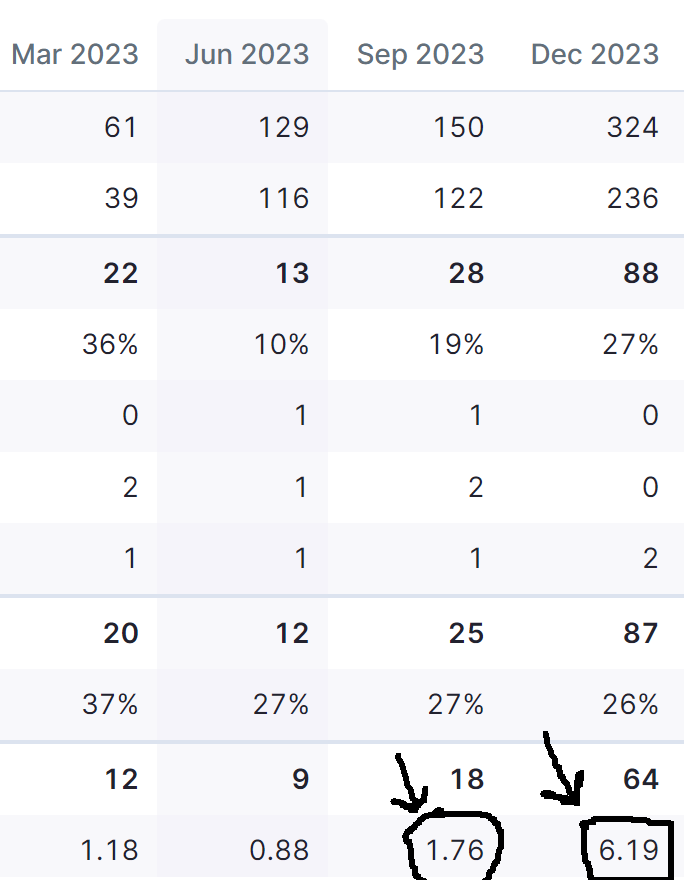

Method 1: Current EPS * 4

This is the simplest method, Lets see with an example.

Now in this example the company started walking on growth trajectory with earnings picked up in recent quarter.

Before calculation, we have to study the company to some extent to see whether they can maintain the earnings going forward or not.

If yes , then lets proceed

Current Qtr EPS- 6.19

Forward EPS- 6.19* 4 = 24.76

Forward PE- Current price/ Estimated EPS

Forward PE= 570/24.76 = 23.02

This is how we calculate that the company if keeps on performing this is how PE will look one year down the line if the price stays at same place.

This is the simplest method, Lets see with an example.

Now in this example the company started walking on growth trajectory with earnings picked up in recent quarter.

Before calculation, we have to study the company to some extent to see whether they can maintain the earnings going forward or not.

If yes , then lets proceed

Current Qtr EPS- 6.19

Forward EPS- 6.19* 4 = 24.76

Forward PE- Current price/ Estimated EPS

Forward PE= 570/24.76 = 23.02

This is how we calculate that the company if keeps on performing this is how PE will look one year down the line if the price stays at same place.

First method works best when we understand that the company has started walking on the growth trajectory and this is the first quarter with new growth and they are expecting to grow further or maintain around the same.

Then the second method works best when the company is already walking on the growth path , in that case we can take recent 2 quarters to estimate better.

Understand one thing, we have to also keep updating it as per every successive quarter earnings.

Then the second method works best when the company is already walking on the growth path , in that case we can take recent 2 quarters to estimate better.

Understand one thing, we have to also keep updating it as per every successive quarter earnings.

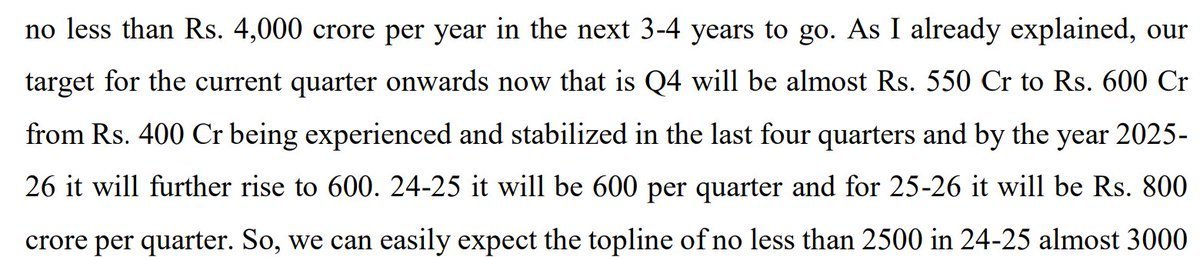

Method 3: Through companies guidance or Order book

In this method we try to understand what company is saying and looking forward to and then we use that to estimate the Forward EPS.

Now the company estimated a Top line/Revenue of around 2500 Cr. So, we have to calculate the EPS based on last years PAT margins to make an estimate.

This EPS will be used to calculate the Forward PE.

Source - Company Con-call Transcript

In this method we try to understand what company is saying and looking forward to and then we use that to estimate the Forward EPS.

Now the company estimated a Top line/Revenue of around 2500 Cr. So, we have to calculate the EPS based on last years PAT margins to make an estimate.

This EPS will be used to calculate the Forward PE.

Source - Company Con-call Transcript

Conclusion: Forward PE can be a really powerful ratio if we can understand the P/E ratio at which the sector and the company comfortable trades.

This will give you a map on whether there is a valuation gap in the current and future or not.

At last we can use technical analysis to time our entries when the counter shows signs of momentum.

Also its better to verify through con calls or other sources whether the current quarter earnings is on off or a growth trajectory.

This will give you a map on whether there is a valuation gap in the current and future or not.

At last we can use technical analysis to time our entries when the counter shows signs of momentum.

Also its better to verify through con calls or other sources whether the current quarter earnings is on off or a growth trajectory.

If you found this useful,

1. Follow me @ItsVinay01 for similar knowledge based threads.

2. Bookmark it and Retweet !

Disclaimer: Everything shared above is for learning purpose only and nothing is in any form any advice.

1. Follow me @ItsVinay01 for similar knowledge based threads.

2. Bookmark it and Retweet !

Disclaimer: Everything shared above is for learning purpose only and nothing is in any form any advice.

جاري تحميل الاقتراحات...