WOW.

MicroStrategy stock, $MSTR, just fell a MASSIVE -35% from its peak seen on November 21st.

That's ~$30 BILLION of market cap erased in 4 trading days as #Bitcoin fell ~9% from its high.

This is one $MSTR's largest 4-day drops in history.

What just happened?

(a thread)

MicroStrategy stock, $MSTR, just fell a MASSIVE -35% from its peak seen on November 21st.

That's ~$30 BILLION of market cap erased in 4 trading days as #Bitcoin fell ~9% from its high.

This is one $MSTR's largest 4-day drops in history.

What just happened?

(a thread)

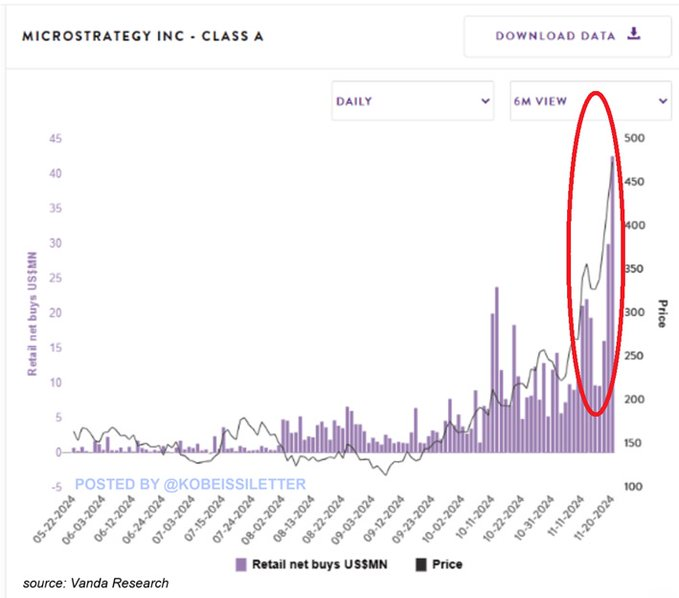

On Wednesday alone last week, retail investors bought ~$42 million worth of MicroStrategy stock, $MSTR.

This marked the largest daily retail buy on record and was 8 TIMES higher than the daily average seen in October.

Retail investors bought nearly $100 MILLION last week. x.com

This marked the largest daily retail buy on record and was 8 TIMES higher than the daily average seen in October.

Retail investors bought nearly $100 MILLION last week. x.com

Over the last 2 months, $MSTR has out performed Bitcoin by almost exactly 3 times.

While Bitcoin is up ~62%, $MSTR is up 181%, and this is expected.

However, over the last few days, this correlation has broadened and $MSTR is now trading with significantly more volatility. x.com

While Bitcoin is up ~62%, $MSTR is up 181%, and this is expected.

However, over the last few days, this correlation has broadened and $MSTR is now trading with significantly more volatility. x.com

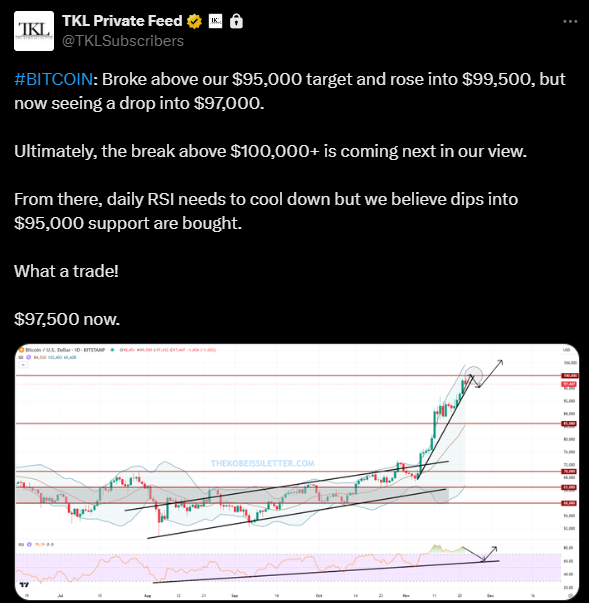

On November 22, we posted this update for our premium members.

We called for $100,000 Bitcoin, but ultimately a drop back below $95,000 was needed first.

The technical picture was VERY overbought.

Subscribe at the link below to access our alerts:

thekobeissiletter.com x.com

We called for $100,000 Bitcoin, but ultimately a drop back below $95,000 was needed first.

The technical picture was VERY overbought.

Subscribe at the link below to access our alerts:

thekobeissiletter.com x.com

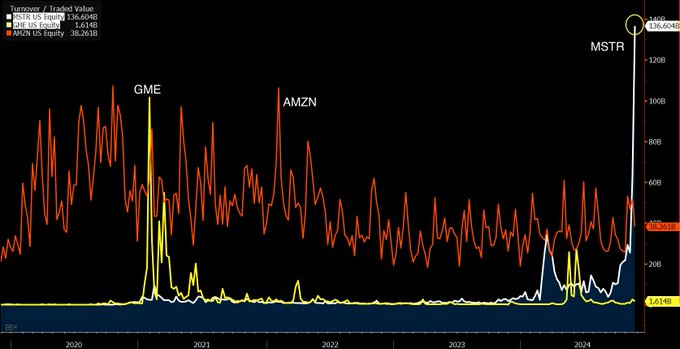

Euphoria in $MSTR even exceeded levels seen during the GameStop, $GME, meme stock frenzy.

Last week ALONE, $MSTR saw $136 BILLION of trading volume.

Not even Amazon, $AMZN, a company with a ~29x larger market cap has seen a week with this much volume.

The drop was overdue. x.com

Last week ALONE, $MSTR saw $136 BILLION of trading volume.

Not even Amazon, $AMZN, a company with a ~29x larger market cap has seen a week with this much volume.

The drop was overdue. x.com

The question is, what happens after this drop?

Bulls will argue that Saylor has transformed the business world and the stock is cheap.

Bears will argue that this is a textbook Ponzi scheme and capital is beginning to dry up.

Can Saylor continue to raise debt here? x.com

Bulls will argue that Saylor has transformed the business world and the stock is cheap.

Bears will argue that this is a textbook Ponzi scheme and capital is beginning to dry up.

Can Saylor continue to raise debt here? x.com

The recent surge in volatility is a huge opportunity for technical traders.

We expect heightened volatility in crypto and stocks into year-end.

Subscribe at the link below to access our alerts and analysis to see how we are trading this market:

thekobeissiletter.com

We expect heightened volatility in crypto and stocks into year-end.

Subscribe at the link below to access our alerts and analysis to see how we are trading this market:

thekobeissiletter.com

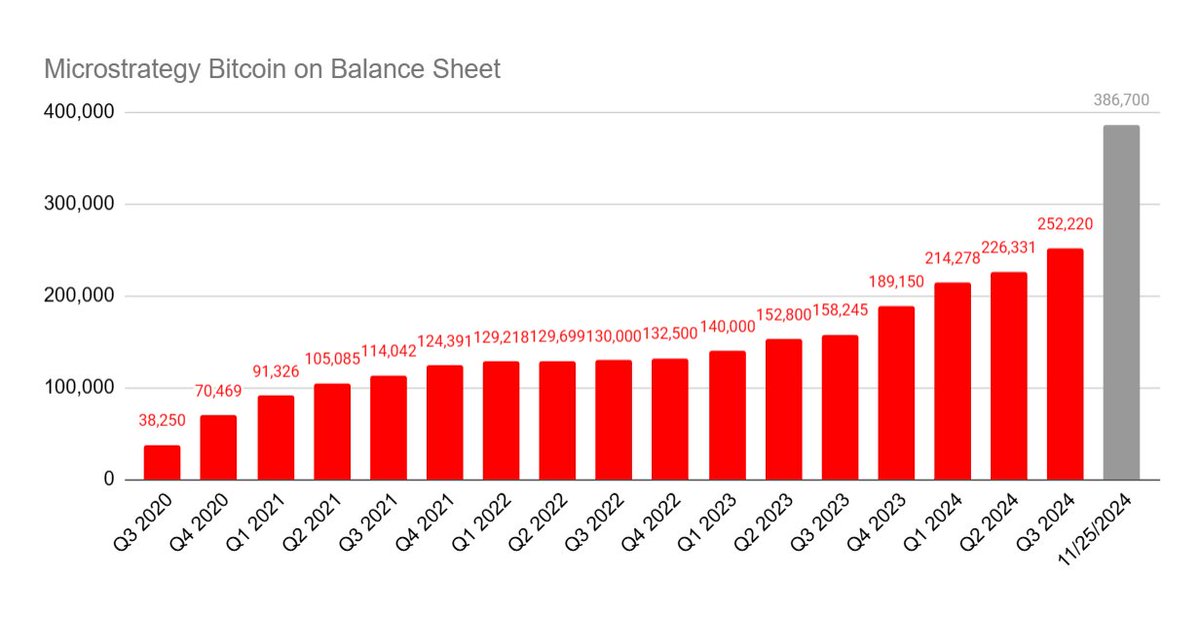

MicroStrategy's strategy is a simple cycle:

1. Borrow money through 0% convertible notes

2. Buy Bitcoin and drive price higher

3. Sell new shares at premium and buy more bitcoin

4. Repeat

If you think the cycle can go on, then the stock will likely continue to rise.

1. Borrow money through 0% convertible notes

2. Buy Bitcoin and drive price higher

3. Sell new shares at premium and buy more bitcoin

4. Repeat

If you think the cycle can go on, then the stock will likely continue to rise.

The most important question to ask here is if can Saylor continue to raise debt to buy #Bitcoin.

$MSTR upsized their $3 billion convertible notes offering due to strong demand.

Can this strong demand persist?

Follow us @KobeissiLetter for real time analysis as this develops. x.com

$MSTR upsized their $3 billion convertible notes offering due to strong demand.

Can this strong demand persist?

Follow us @KobeissiLetter for real time analysis as this develops. x.com

جاري تحميل الاقتراحات...