👉 Manufacturing Witnessing Massive Upward Trajectory Growth 📈in India 🇮🇳

🌟5 Manufacturing Companies concall insights & results insights uncovered

👉 A Detailed Thread 👇..

#stockmarketcrash #StockMarket #stockmarketsindia #investing #manufacturer #manufacturing

🌟5 Manufacturing Companies concall insights & results insights uncovered

👉 A Detailed Thread 👇..

#stockmarketcrash #StockMarket #stockmarketsindia #investing #manufacturer #manufacturing

👉 Join Our Official Free Telegram Channel to have access of

🌟 Important Stock Market Updates

✨ Practical 💡ideas on Financial planning

🌟 Technical charts of companies

t.me

🌟 Important Stock Market Updates

✨ Practical 💡ideas on Financial planning

🌟 Technical charts of companies

t.me

1 PG Electroplast Ltd business model

It specializes in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM) and Plastic Injection Molding, catering to 50+ leading Indian and Global brands x.com

It specializes in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM) and Plastic Injection Molding, catering to 50+ leading Indian and Global brands x.com

👉Shareholding Pattern

⚡Promoter holding: 53.4 %

⚡Change in Prom Hold: -0.14 %

⚡DII holding: 9.80 %

⚡Chg in DII Hold: -0.09 %

⚡FII holding: 10.7 %

⚡Chg in FII Hold: -0.38 %

⚡Public holding: 25.9 % x.com

⚡Promoter holding: 53.4 %

⚡Change in Prom Hold: -0.14 %

⚡DII holding: 9.80 %

⚡Chg in DII Hold: -0.09 %

⚡FII holding: 10.7 %

⚡Chg in FII Hold: -0.38 %

⚡Public holding: 25.9 % x.com

👉 Manufacturing Capabilities

⚡Product Assemblies

⚡Plastic Moulding

⚡Sheet Metal Components

⚡PCB Assemblies

⚡Specialized AC Components

⚡PU & Powder Paintshops

⚡Tool Manufacturing x.com

⚡Product Assemblies

⚡Plastic Moulding

⚡Sheet Metal Components

⚡PCB Assemblies

⚡Specialized AC Components

⚡PU & Powder Paintshops

⚡Tool Manufacturing x.com

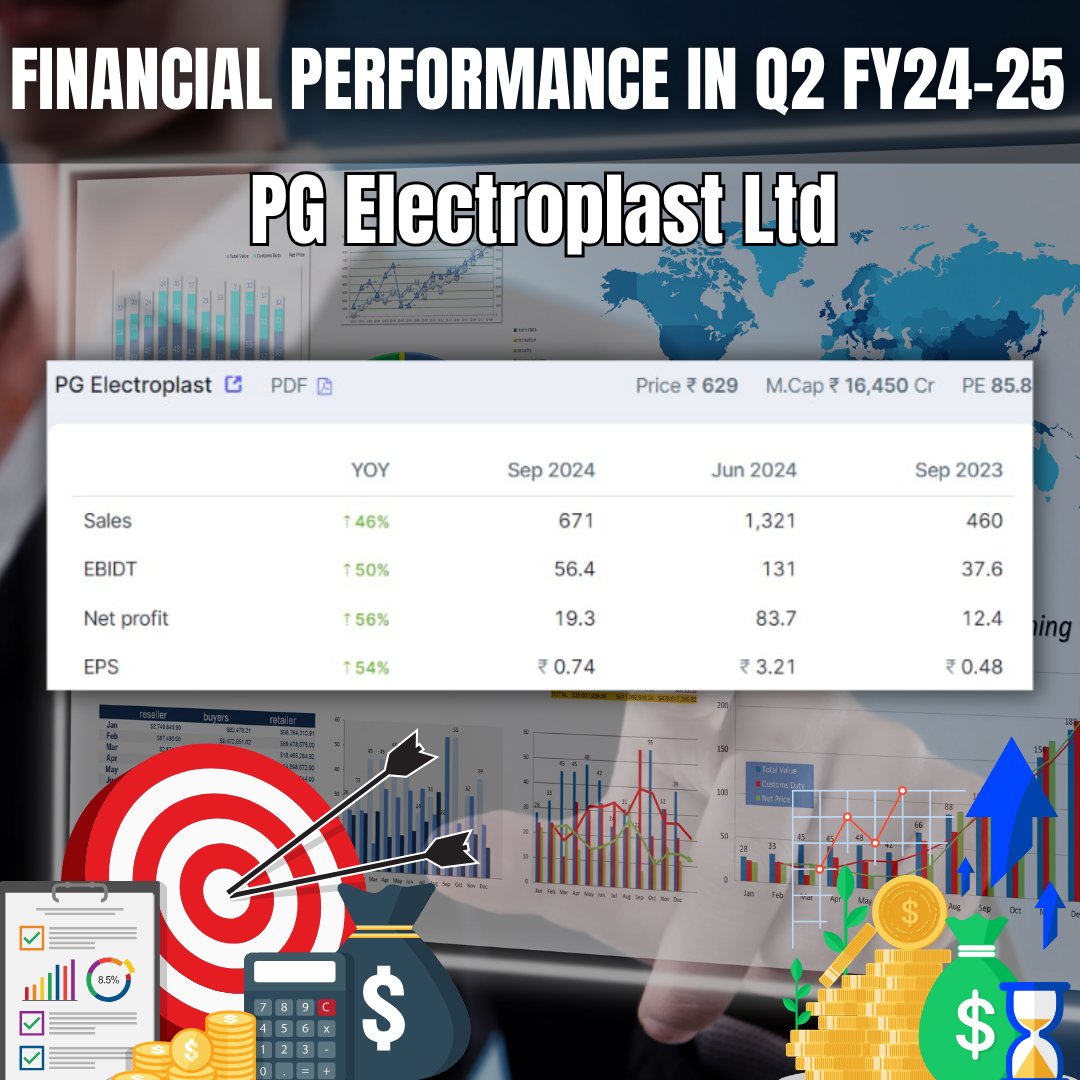

👉Major Highlights

⚡1HFY2025 has been a robust growth period as Consolidated Revenues grew 75.0% and closed at INR 1991.98 crores for the company. This is despite the TV business shift to Goodworth Electronics – 50% JV.

⚡The Product business contributed 68% of the total revenues in 1HFY2025. Room AC business at INR 1118 crores grew 143% during the period while the Washing Machines business had a

growth of 41% YoY.

⚡1HFY2025 has been a robust growth period as Consolidated Revenues grew 75.0% and closed at INR 1991.98 crores for the company. This is despite the TV business shift to Goodworth Electronics – 50% JV.

⚡The Product business contributed 68% of the total revenues in 1HFY2025. Room AC business at INR 1118 crores grew 143% during the period while the Washing Machines business had a

growth of 41% YoY.

2 EPack Durables Ltd business model

EPACK Durable is an Original Design Manufacturer (ODM) of room air conditioners (RAC). x.com

EPACK Durable is an Original Design Manufacturer (ODM) of room air conditioners (RAC). x.com

👉Shareholder Pattern

⚡Promoter holding: 48.1 %

⚡Change in Prom Hold: -0.08 %

⚡DII holding: 10.6 %

⚡Chg in DII Hold: -5.43 %

⚡FII holding: 1.97 %

⚡Chg in FII Hold: 1.24 %

⚡Public holding: 39.4 % x.com

⚡Promoter holding: 48.1 %

⚡Change in Prom Hold: -0.08 %

⚡DII holding: 10.6 %

⚡Chg in DII Hold: -5.43 %

⚡FII holding: 1.97 %

⚡Chg in FII Hold: 1.24 %

⚡Public holding: 39.4 % x.com

👉Marquee Client

Voltas, Haier, Philips, Godrej, Daikin, Havells, Bosch &

Siemens, Bajaj, Crompton & Greaves, Blue Star x.com

Voltas, Haier, Philips, Godrej, Daikin, Havells, Bosch &

Siemens, Bajaj, Crompton & Greaves, Blue Star x.com

👉 Operation Highlights

⚡The Product business contributed 98% of the total revenues.

⚡The revenue from Room Air Conditioners contributed 81% of the total product and grew by 101% on YoY basis.

⚡Sricity plant has now become operational for all product lines.

⚡About 80-85% of the company’s revenues come from the sale of RACs and their components and the balance from small Domestic Appliances

⚡The Product business contributed 98% of the total revenues.

⚡The revenue from Room Air Conditioners contributed 81% of the total product and grew by 101% on YoY basis.

⚡Sricity plant has now become operational for all product lines.

⚡About 80-85% of the company’s revenues come from the sale of RACs and their components and the balance from small Domestic Appliances

3 Lumax Auto Technologies business model

It is engaged in the business of manufacturing and supplying of Automotive Lamps, Plastic Moulded Parts, and Frame Chassis to two, three, and four-wheeler segments x.com

It is engaged in the business of manufacturing and supplying of Automotive Lamps, Plastic Moulded Parts, and Frame Chassis to two, three, and four-wheeler segments x.com

👉 Shareholding Pattern

⚡Promoter holding: 56.0 %

⚡Change in Prom Hold: 0.00 %

⚡DII holding: 16.2 %

⚡Chg in DII Hold: 0.32 %

⚡FII holding: 5.74 %

⚡Chg in FII Hold: -1.19 %

⚡Public holding: 22.1 % x.com

⚡Promoter holding: 56.0 %

⚡Change in Prom Hold: 0.00 %

⚡DII holding: 16.2 %

⚡Chg in DII Hold: 0.32 %

⚡FII holding: 5.74 %

⚡Chg in FII Hold: -1.19 %

⚡Public holding: 22.1 % x.com

👉 Mechatronics

⚡Addition of new customers & new

product addition

⚡Order book of ~Rs. 175 crs

⚡Key Customers: MSIL, Honda, Toyota,

Daimler x.com

⚡Addition of new customers & new

product addition

⚡Order book of ~Rs. 175 crs

⚡Key Customers: MSIL, Honda, Toyota,

Daimler x.com

4 Dixon Technologies India Ltd business model

It is a Electronic Manufacturing Services (EMS) company with operations in the electronic products vertical such as consumer electronics, lighting, home appliance, closed-circuit television cameras (CCTVs), and mobile phones. x.com

It is a Electronic Manufacturing Services (EMS) company with operations in the electronic products vertical such as consumer electronics, lighting, home appliance, closed-circuit television cameras (CCTVs), and mobile phones. x.com

👉Shareholder Pattern

⚡Promoter holding: 32.9 %

⚡Change in Prom Hold: -0.35 %

⚡DII holding: 23.1 %

⚡Chg in DII Hold: -2.94 %

⚡FII holding: 22.7 %

⚡Chg in FII Hold: 3.36 %

⚡Public holding: 21.3 % x.com

⚡Promoter holding: 32.9 %

⚡Change in Prom Hold: -0.35 %

⚡DII holding: 23.1 %

⚡Chg in DII Hold: -2.94 %

⚡FII holding: 22.7 %

⚡Chg in FII Hold: 3.36 %

⚡Public holding: 21.3 % x.com

👉Mobile Phones and EMS Segment Performance

⚡Revenues for the mobile segment were ₹9,444 crores, with an operating profit of ₹308 crores, reflecting a 235% and 231% growth YoY, respectively.

⚡Acquired Ismartu on August 13, 2024, contributing approximately ₹1,100 crores in revenue from 800K smartphones in Q2.

⚡Revenues for the mobile segment were ₹9,444 crores, with an operating profit of ₹308 crores, reflecting a 235% and 231% growth YoY, respectively.

⚡Acquired Ismartu on August 13, 2024, contributing approximately ₹1,100 crores in revenue from 800K smartphones in Q2.

⭐Wearables and Hearables

⚡Revenues were ₹263 crores with a healthy operating margin.

⚡Rexxam Dixon Electronic JV achieved revenues of ₹90 crores. x.com

⚡Revenues were ₹263 crores with a healthy operating margin.

⚡Rexxam Dixon Electronic JV achieved revenues of ₹90 crores. x.com

Follow 👉🌟 @FinAspiration 👈. For more insights related to the Finance and Stock market concepts which is simplified in easy to Understand manner ✨. x.com

The content in this post is only for educational purpose and not investment advice. Please consult your financial advisors before investing.

X is Free Education, but 99% Don't know the best stock market handles helping retail investors , here are the 14 best handles to learn from.

@FinTaxCoach

@RupeezyOfficial

@deepak4748

@Chart_Wallah108

@caniravkaria

@vandit_jain1994

@Anvith_

@AmannaPrerana

@EquityInsightss

@iramyram

@raghavwadhwa

@priceNpedia

@Breakoutrade94

@Stock_Precision

@FinTaxCoach

@RupeezyOfficial

@deepak4748

@Chart_Wallah108

@caniravkaria

@vandit_jain1994

@Anvith_

@AmannaPrerana

@EquityInsightss

@iramyram

@raghavwadhwa

@priceNpedia

@Breakoutrade94

@Stock_Precision

جاري تحميل الاقتراحات...