Interest rates are actually UP since the Fed cut rates last week.

In fact, some products have seen interest rise 20+ bps over the last week, even as the Fed cut rates by 50 bps.

How's this possible?

Here's how we knew the move was coming and capitalized on it.

(a thread)

In fact, some products have seen interest rise 20+ bps over the last week, even as the Fed cut rates by 50 bps.

How's this possible?

Here's how we knew the move was coming and capitalized on it.

(a thread)

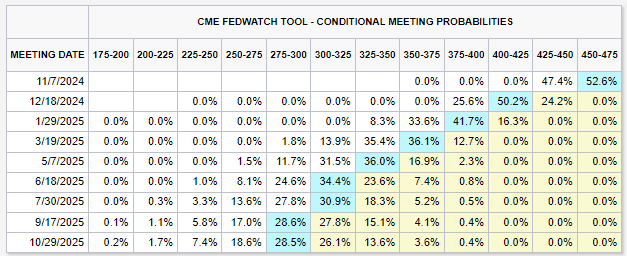

Leading into the September 18th Fed decision, the market was fixated on what the Fed would do.

Trading was entirely about if the Fed would cut 25 or 50 basis points.

In reality, we knew it wouldn't matter for price action.

That's exactly what we told our premium members.

Trading was entirely about if the Fed would cut 25 or 50 basis points.

In reality, we knew it wouldn't matter for price action.

That's exactly what we told our premium members.

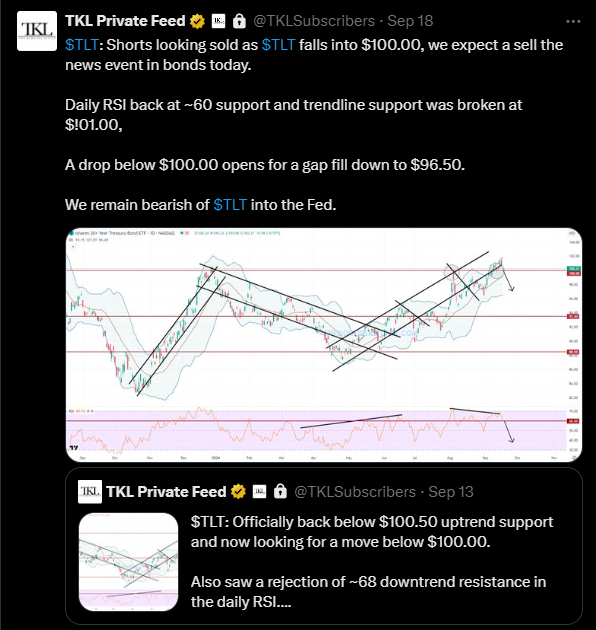

Here was the headline of our bond market analysis on September 16th for our premium members.

We called for a "sell the news" event in bonds after the decision.

To receive our alerts and reports in advance, see thekobeissiletter.com

Here's how we knew it would happen.

We called for a "sell the news" event in bonds after the decision.

To receive our alerts and reports in advance, see thekobeissiletter.com

Here's how we knew it would happen.

1 hour before the Fed meeting, we posted this trade alert for our premium members.

We called for a drop below $100.00 to open for $96.50 and reaffirmed our "sell the news" view.

That's exactly what happened.

To join this feed, see thekobeissiletter.com

We called for a drop below $100.00 to open for $96.50 and reaffirmed our "sell the news" view.

That's exactly what happened.

To join this feed, see thekobeissiletter.com

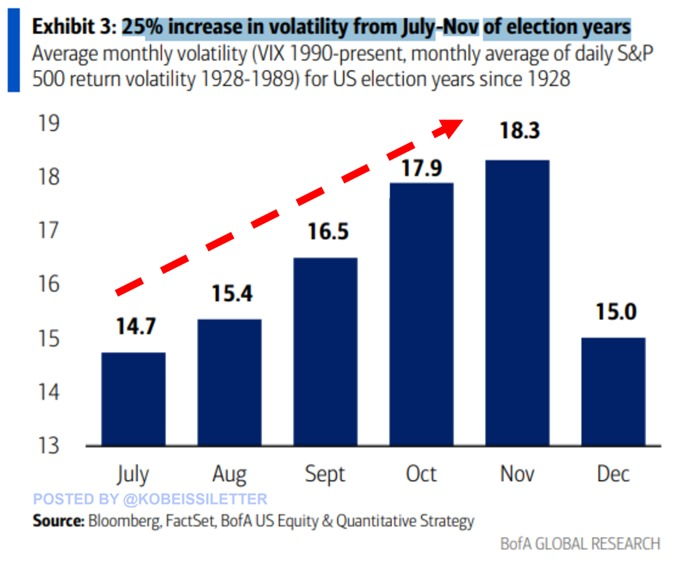

We always say it: volatility is opportunity for investors and traders.

Getting ahead of the next big move will be crucial into year-end.

Interested in receiving our analysis and trade alerts?

Subscribe now for instant access at the link below:

thekobeissiletter.com

Getting ahead of the next big move will be crucial into year-end.

Interested in receiving our analysis and trade alerts?

Subscribe now for instant access at the link below:

thekobeissiletter.com

جاري تحميل الاقتراحات...