🚨 Bitcoin Rally After Rate Cuts! Don’t FOMO Just Yet🚨

#Bitcoin broke past $64K after the Fed announced a 50 basis point rate cut. After months of a slow market, things are heating up.

But is it really time to FOMO into trades?

Here’s why I’m still cautious, and how I’m preparing for the rest of this bull run.

Let’s dive in!🧵👇

#Bitcoin broke past $64K after the Fed announced a 50 basis point rate cut. After months of a slow market, things are heating up.

But is it really time to FOMO into trades?

Here’s why I’m still cautious, and how I’m preparing for the rest of this bull run.

Let’s dive in!🧵👇

1/x The Fed just kicked off a rate cut cycle with a major 50 basis point cut, and Bitcoin jumped fast.

While the market reacted sharply, Bitcoin is still in a choppy range. We haven’t broken above $64,900 - the key level we need for a confirmed breakout.

Until that happens, I’m staying cautious.

While the market reacted sharply, Bitcoin is still in a choppy range. We haven’t broken above $64,900 - the key level we need for a confirmed breakout.

Until that happens, I’m staying cautious.

2/x There’s a lot of hype around this rate cut. Jerome Powell signaled another 50 bps could be coming by year-end, either as two 25-point cuts or a larger one.

But even with Bitcoin at $63K, we haven't yet broken the downtrend that started back in March.

For now, it’s too early to call this the start of a full-on bull run.

But even with Bitcoin at $63K, we haven't yet broken the downtrend that started back in March.

For now, it’s too early to call this the start of a full-on bull run.

3/x Now let’s look at the bigger picture.

Sure, we’ve had a nice rally, but I’m not FOMOing in just yet. Why?

Because this could be short-lived if the broader macro picture (unemployment, inflation, recession risks) doesn’t hold up.

So what’s the real impact of these rate cuts?

Sure, we’ve had a nice rally, but I’m not FOMOing in just yet. Why?

Because this could be short-lived if the broader macro picture (unemployment, inflation, recession risks) doesn’t hold up.

So what’s the real impact of these rate cuts?

4/x Some bears are sounding alarms, saying rate cuts like these are a precursor to a recession.

Historically, when the Fed cuts by 200 basis points or more in a year, a recession often follows. But it's not always so clear-cut.

x.com

Historically, when the Fed cuts by 200 basis points or more in a year, a recession often follows. But it's not always so clear-cut.

x.com

5/x Recessions can take months or even years to unfold. While cuts like this often signal a recession, the timing can vary.

The Fed is projecting 150 bps in cuts by the end of 2025, not the full 200 the market expects. That means the market might be overreacting to the Fed’s actions.

The Fed is projecting 150 bps in cuts by the end of 2025, not the full 200 the market expects. That means the market might be overreacting to the Fed’s actions.

6/x Right now, prediction markets say there’s a 61% chance we’ll see a recession by August 2025.

But it’s not a done deal. The unemployment rate is the key. If it stays below 4.4%, the Fed may slow down cuts and delay a recession. If it rises, recession risks increase.

But it’s not a done deal. The unemployment rate is the key. If it stays below 4.4%, the Fed may slow down cuts and delay a recession. If it rises, recession risks increase.

7/x If we look at the last 13 rate cut cycles, 8 of them led to recessions within 12 months.

But when you exclude big outliers like the 2008 financial crisis or 2020 COVID crash, it’s more like a 50/50 chance of a recession.

Timing a recession is hard - and it’s not always immediate.

But when you exclude big outliers like the 2008 financial crisis or 2020 COVID crash, it’s more like a 50/50 chance of a recession.

Timing a recession is hard - and it’s not always immediate.

8/x Let’s talk about who decides a recession.

It’s not some automatic signal. The National Bureau of Economic Research (NBER) decides after looking at the facts, and they often announce it months late.

Remember the 2020 pandemic recession? The NBER didn’t call it until 4 months after it started. In 2008, they waited a full year to do so.

It’s not some automatic signal. The National Bureau of Economic Research (NBER) decides after looking at the facts, and they often announce it months late.

Remember the 2020 pandemic recession? The NBER didn’t call it until 4 months after it started. In 2008, they waited a full year to do so.

9/x That means waiting for an official recession announcement can leave you way behind. By the time it’s official, the market has usually already priced it in.

So don’t rely on recession calls to time your trades - you’ll be late to the party.

So don’t rely on recession calls to time your trades - you’ll be late to the party.

10/x The key metric to watch? Unemployment.

Fed Chair Jerome Powell has been clear: as long as unemployment stays below 4.4%, they won’t rush into aggressive rate cuts.

As mentioned earlier, if unemployment rises above 4.5%, recession risks shoot up and we could see it hit as early as 2025.

This is the number to watch.

Fed Chair Jerome Powell has been clear: as long as unemployment stays below 4.4%, they won’t rush into aggressive rate cuts.

As mentioned earlier, if unemployment rises above 4.5%, recession risks shoot up and we could see it hit as early as 2025.

This is the number to watch.

11/x For the bears, the bottom line is: recession is inevitable, but it’s all about timing. Will it come in 2025, or will it get delayed to 2026?

The unemployment rate is the key to figuring that out. The next few months will be crucial.

The unemployment rate is the key to figuring that out. The next few months will be crucial.

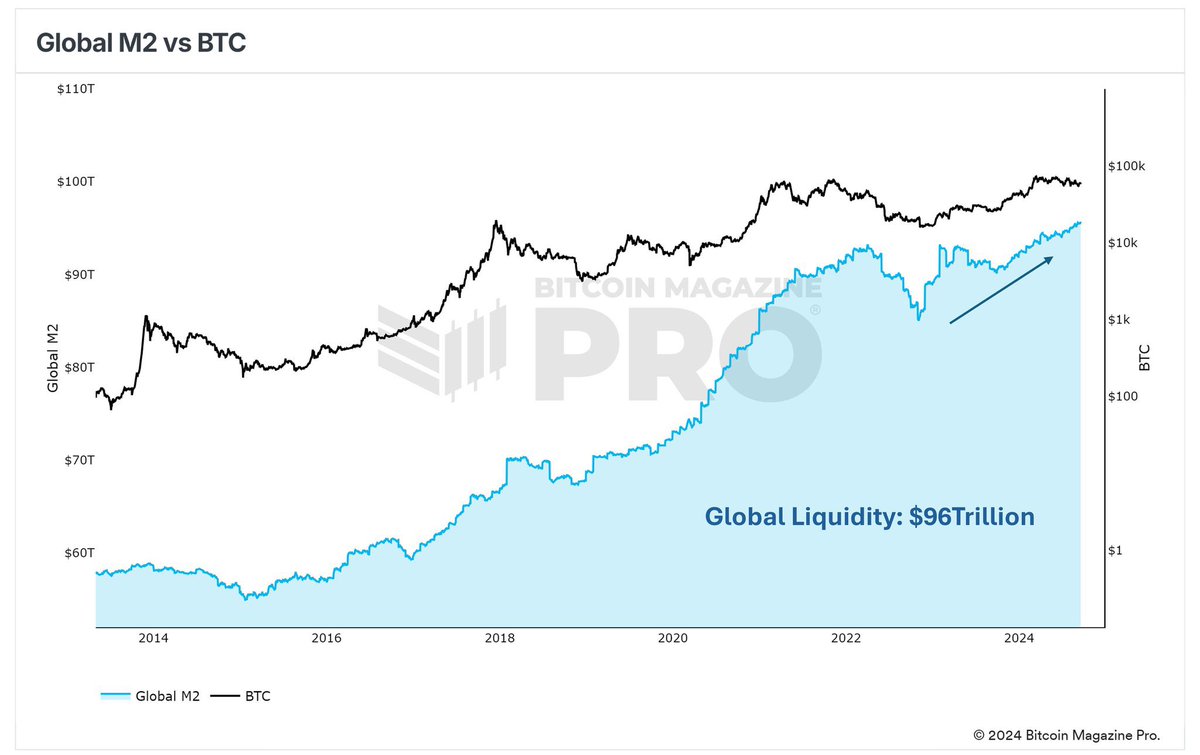

12/x Here’s why I’m still bullish - if we avoid a recession and the cuts aren’t too aggressive, liquidity will flow into the market. And when that happens, Bitcoin tends to thrive.

Historically, when the M2 money supply (global liquidity) rises, Bitcoin follows with strong upward moves.

Just a few days ago, Global M2 hit an all-time high.

If history is to repeat itself, then this signals a strong Bitcoin uptrend is on the way.

Historically, when the M2 money supply (global liquidity) rises, Bitcoin follows with strong upward moves.

Just a few days ago, Global M2 hit an all-time high.

If history is to repeat itself, then this signals a strong Bitcoin uptrend is on the way.

13/x The S&P 500 typically does well within 12 months of rate cuts, averaging positive returns. And when the S&P is up, Bitcoin tends to follow.

We could see a 12-15 month bull market leading into the end of 2025, with a recession possibly hitting later in 2026.

We could see a 12-15 month bull market leading into the end of 2025, with a recession possibly hitting later in 2026.

14/x Let’s discuss Bitcoin for the short to medium term, we need to break $64,900-$65,000 to confirm a new uptrend.

If Bitcoin can close above $65K, we’ll get our first higher high since March, signaling a real bull run.

But until we break that level, it’s just noise and we need to thread carefully.

If Bitcoin can close above $65K, we’ll get our first higher high since March, signaling a real bull run.

But until we break that level, it’s just noise and we need to thread carefully.

15/x So what am I doing until then? My current strategy is as follows:

1️⃣ Hold spot positions: Bitcoin, Ethereum, Solana.

2️⃣ Avoid leverage: Too much volatility right now.

3️⃣ DCA into strong sectors: Memecoins, AI, Gaming, RWAs, and select Layer 1s (TON, Kaspa, Fantom).

4️⃣ Protect your psyche: Patience is key. Things should clear up by November.

1️⃣ Hold spot positions: Bitcoin, Ethereum, Solana.

2️⃣ Avoid leverage: Too much volatility right now.

3️⃣ DCA into strong sectors: Memecoins, AI, Gaming, RWAs, and select Layer 1s (TON, Kaspa, Fantom).

4️⃣ Protect your psyche: Patience is key. Things should clear up by November.

16/x Summary of Key Takeaways

• The Fed’s rate cuts have pushed Bitcoin to $63K, but we’re still in a choppy range - don’t FOMO just yet.

• Watch for $65K - a breakout above this is needed to confirm a bull run.

• The unemployment rate is the key metric. If it stays below 4.4%, the recession might be delayed until 2026.

• Be patient and follow the macro trends - liquidity and market timing will be crucial for the rest of this bull run.

In times like these, be cautious but keep an eye out for opportunities - timing is everything.

With that in mind, how are you preparing your portfolio?

Drop your strategies below 👇

• The Fed’s rate cuts have pushed Bitcoin to $63K, but we’re still in a choppy range - don’t FOMO just yet.

• Watch for $65K - a breakout above this is needed to confirm a bull run.

• The unemployment rate is the key metric. If it stays below 4.4%, the recession might be delayed until 2026.

• Be patient and follow the macro trends - liquidity and market timing will be crucial for the rest of this bull run.

In times like these, be cautious but keep an eye out for opportunities - timing is everything.

With that in mind, how are you preparing your portfolio?

Drop your strategies below 👇

17/x Before we wrap up, I have an exciting announcement!

We’re launching The Coiners - a new community for trading and mentorship. Follow us on Twitter at @Coiners_io

Tomorrow, we’re hosting a free workshop. We’ll cover everything you need to set up for the next bull run.

Link to sign up ➡️ lu.ma

Join us and level up your crypto game!

We’re launching The Coiners - a new community for trading and mentorship. Follow us on Twitter at @Coiners_io

Tomorrow, we’re hosting a free workshop. We’ll cover everything you need to set up for the next bull run.

Link to sign up ➡️ lu.ma

Join us and level up your crypto game!

جاري تحميل الاقتراحات...