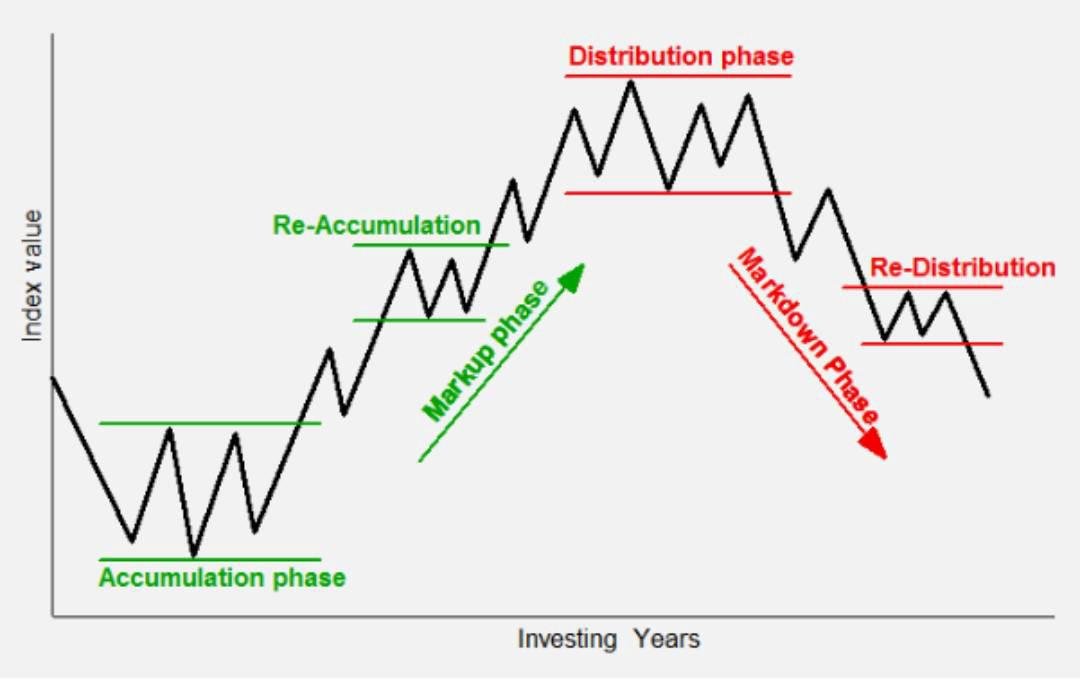

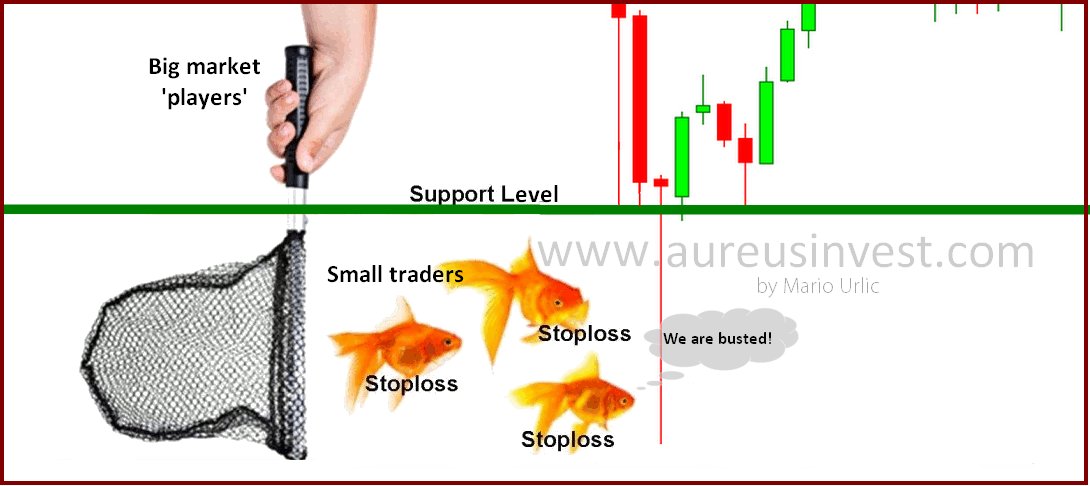

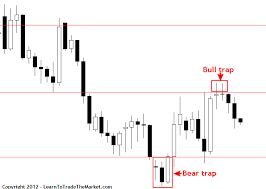

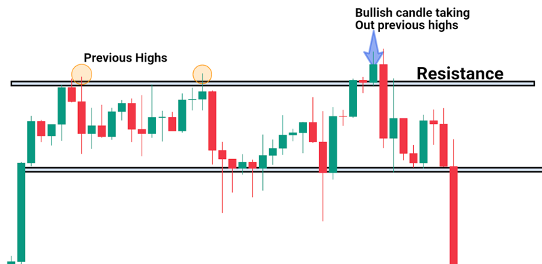

People often throw around terms like whales, smart money, and insiders & how they shape and skew the market.

But very few truly grasp the depth of their actions.

For most investors, they end up on the chopping block, serving as exit liquidity for these big players.

But very few truly grasp the depth of their actions.

For most investors, they end up on the chopping block, serving as exit liquidity for these big players.

That's it for now.

Everything in this thread is my personal view and is not financial advice.

For more alpha threads, latest airdrops, my trades, charts & calls, industry news & whale wallet tracking:

Join our free TG: t.me

Everything in this thread is my personal view and is not financial advice.

For more alpha threads, latest airdrops, my trades, charts & calls, industry news & whale wallet tracking:

Join our free TG: t.me

I hope you've found this thread helpful.

Follow me @DamiDefi for more.

Like & RT the quote below if you can, it means a lot:

Follow me @DamiDefi for more.

Like & RT the quote below if you can, it means a lot:

جاري تحميل الاقتراحات...