Many traders believe that high market cap tokens have limited growth potential because they think you need a huge amount of money for the price to increase significantly.

This idea overlooks the influence of liquidity, which allows prices to rise with smaller investments.

This idea overlooks the influence of liquidity, which allows prices to rise with smaller investments.

This view is incorrect.

Here's why:

First, understand the basics:

- Market cap

- Price

- Liquidity

Here's why:

First, understand the basics:

- Market cap

- Price

- Liquidity

The price of a token is determined by supply and demand in the market.

Factors influencing this include recent market orders, trading volume, market sentiment, and liquidity.

The displayed price on an exchange is based on the last transaction between a buyer and seller.

Factors influencing this include recent market orders, trading volume, market sentiment, and liquidity.

The displayed price on an exchange is based on the last transaction between a buyer and seller.

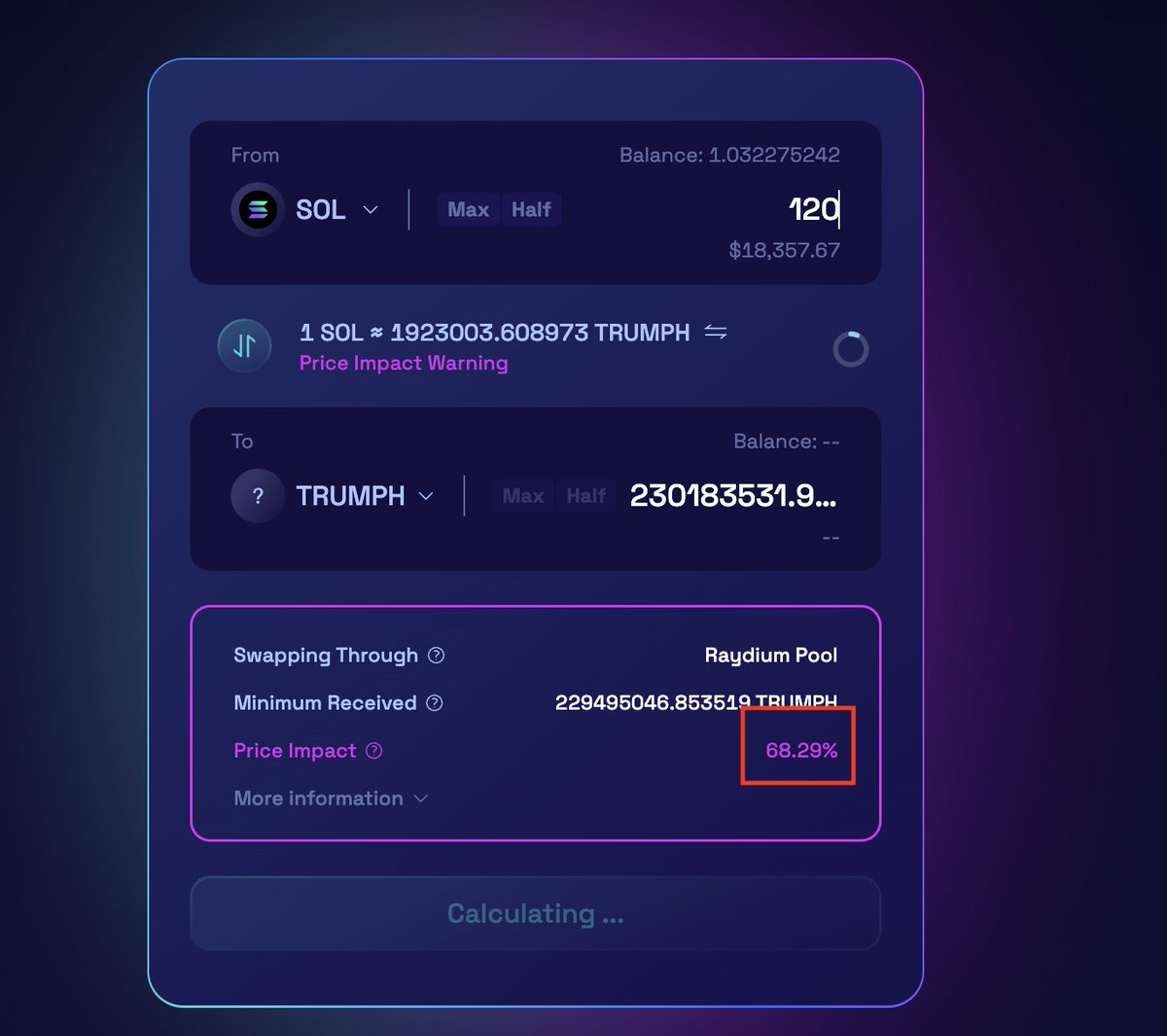

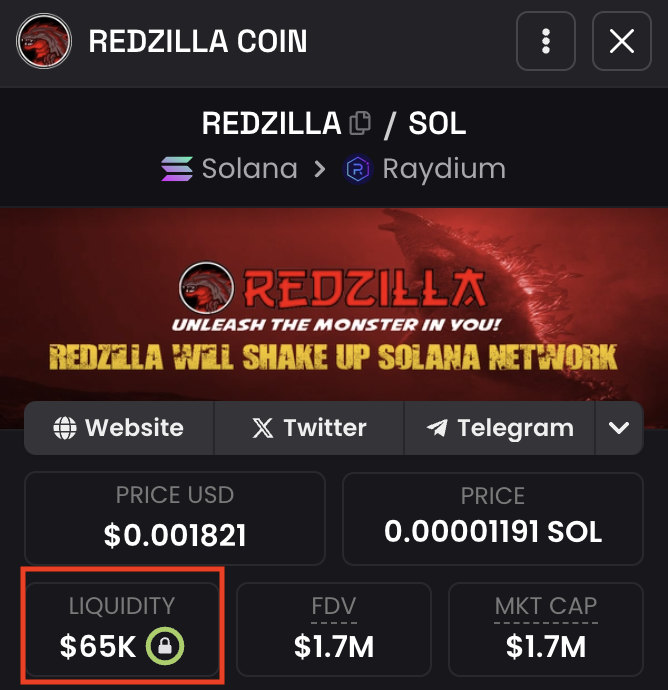

Liquidity in cryptocurrency is the ease of buying or selling a token without affecting its price.

High liquidity means many buyers and sellers, leading to quick transactions and minimal price changes.

Low liquidity causes larger price swings and makes transactions harder.

High liquidity means many buyers and sellers, leading to quick transactions and minimal price changes.

Low liquidity causes larger price swings and makes transactions harder.

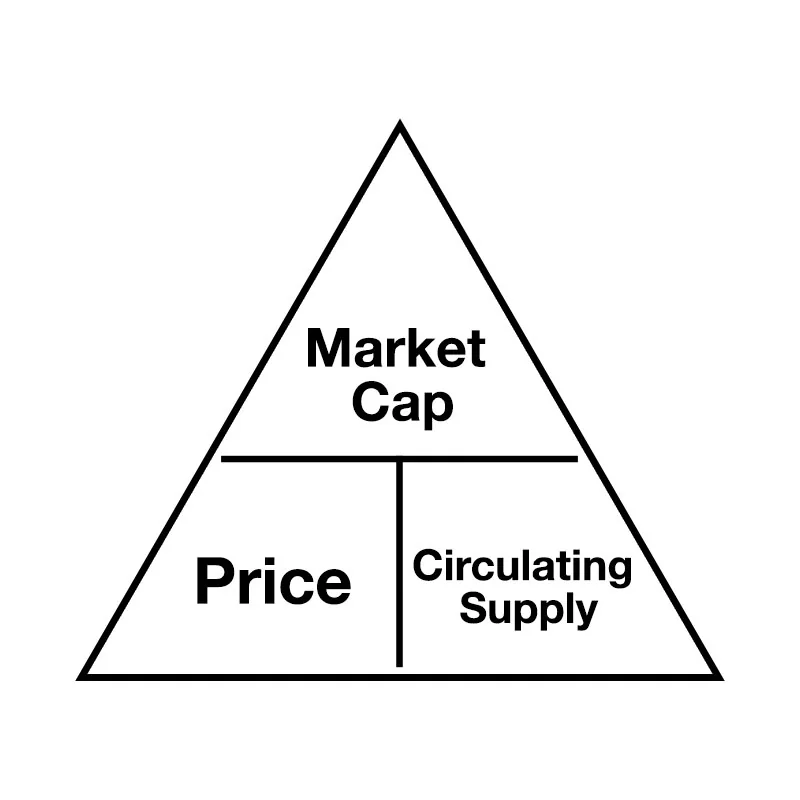

Imagine a token priced at $1, with a market cap of $1 billion.

However, only $100 million worth of this token is available for trading on an exchange.

Here's the breakdown:

- Price per token: $1

- Total market cap: $1 billion

- Available liquidity on exchange: $100 million

However, only $100 million worth of this token is available for trading on an exchange.

Here's the breakdown:

- Price per token: $1

- Total market cap: $1 billion

- Available liquidity on exchange: $100 million

Now, if someone buys $50 million worth of the token:

- The price of each token will double to $2.

- Despite only investing $50 million, the market cap of the token will increase to $2 billion.

- The price of each token will double to $2.

- Despite only investing $50 million, the market cap of the token will increase to $2 billion.

This price increase happens because the available liquidity on the exchange is limited, allowing smaller investments to have a larger impact on the token's price.

Big players understand this and use it to manipulate the market, as I explained in the thread below.👇

Big players understand this and use it to manipulate the market, as I explained in the thread below.👇

Some memecoin creators manipulate prices by listing on a few decentralized exchanges with small liquidity pools, causing FOMO.

You don’t need billions to impact a token’s price

Limited liquidity and high demand can drive prices up quick.

Keep this in mind during your research.

You don’t need billions to impact a token’s price

Limited liquidity and high demand can drive prices up quick.

Keep this in mind during your research.

Everything in this thread is my personal view and is not financial advice.

For more alpha threads, latest airdrops, my trades, charts & calls, industry news & whale wallet tracking:

Join our free TG: t.me

For more alpha threads, latest airdrops, my trades, charts & calls, industry news & whale wallet tracking:

Join our free TG: t.me

I hope you've found this thread helpful.

Follow me @DamiDefi for more.

Like & RT the quote below if you can, it means a lot:

Follow me @DamiDefi for more.

Like & RT the quote below if you can, it means a lot:

جاري تحميل الاقتراحات...