Here's what's covered : (from an order flow perspective)

Identifying a FVG imbalance

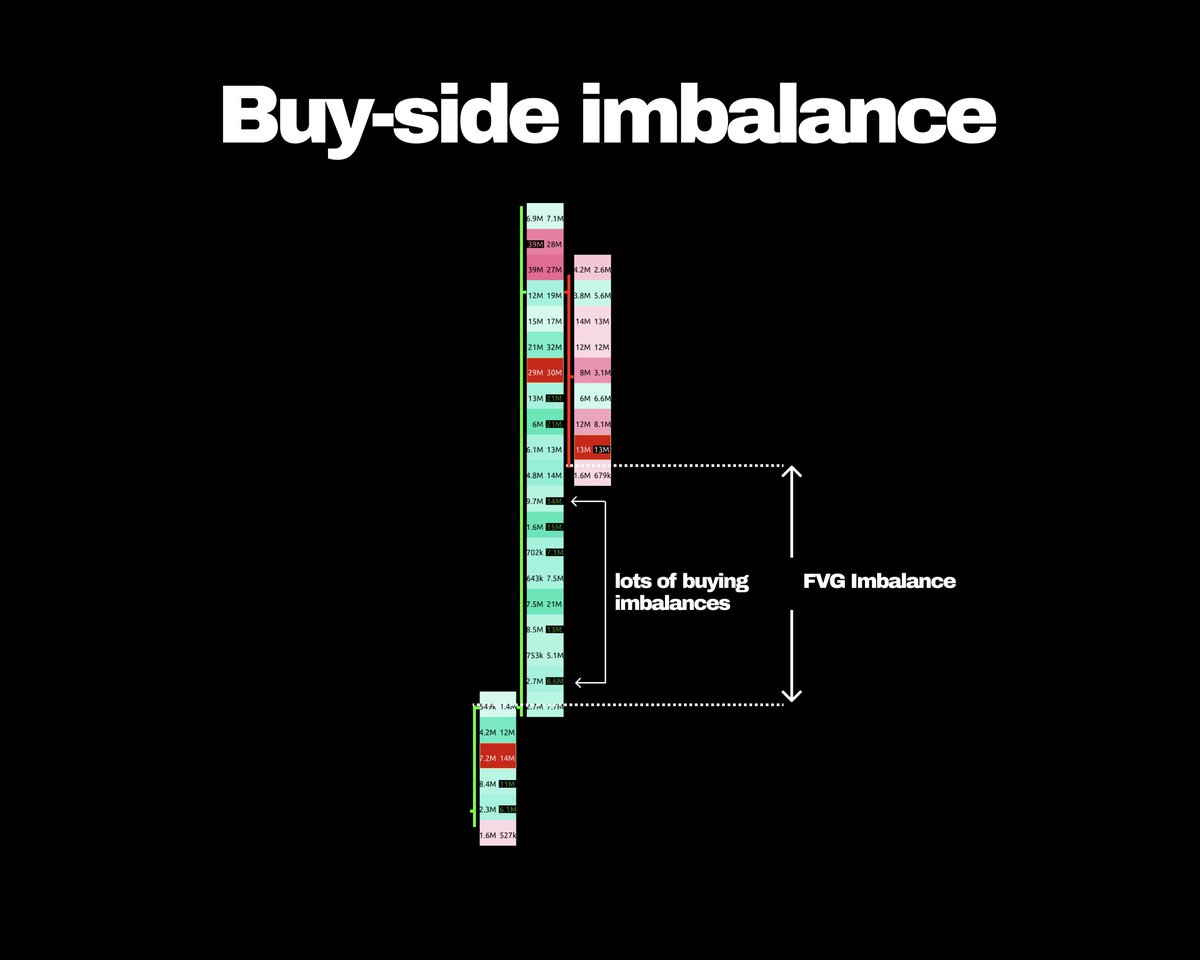

Buy-side and Sell-side imbalance

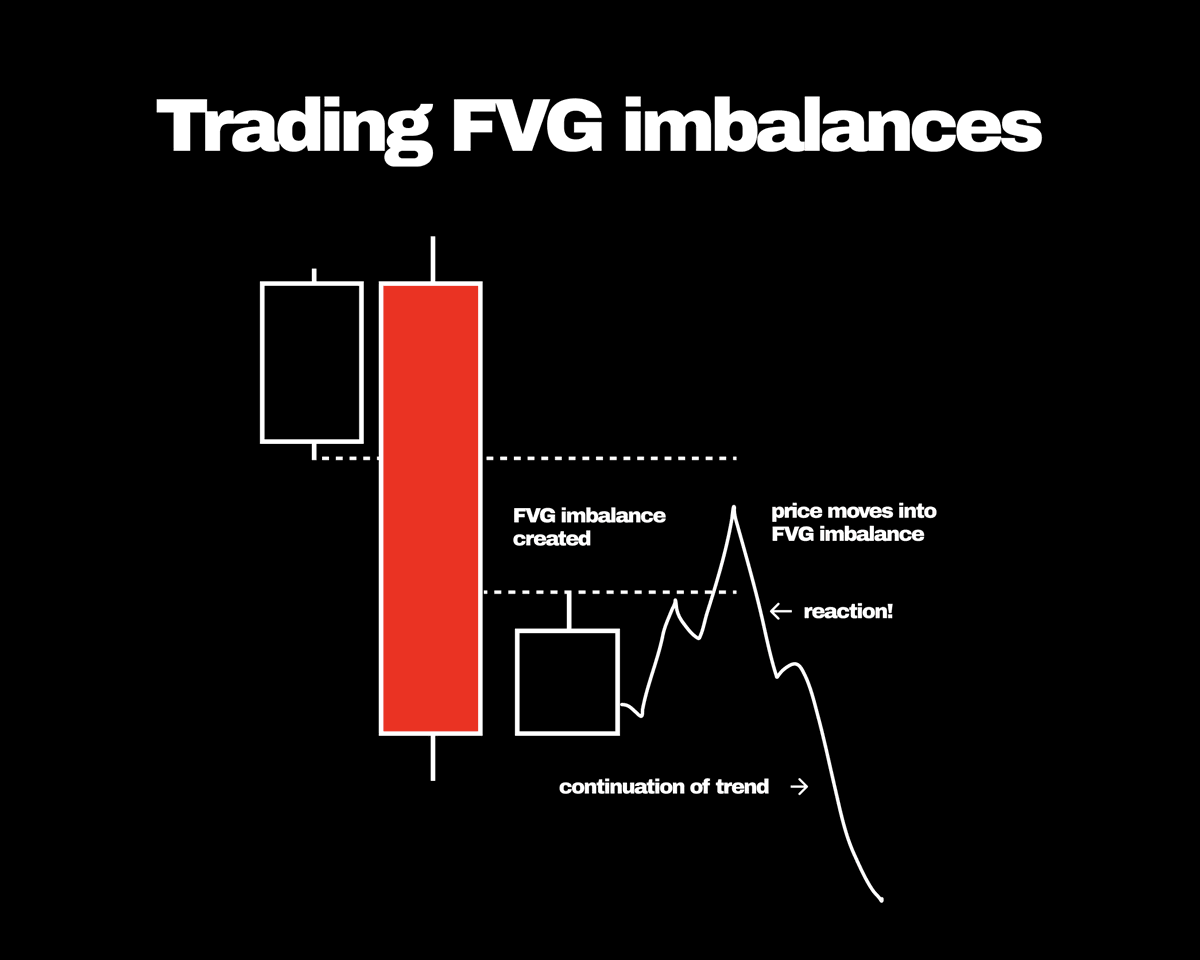

Trading FVG imbalances

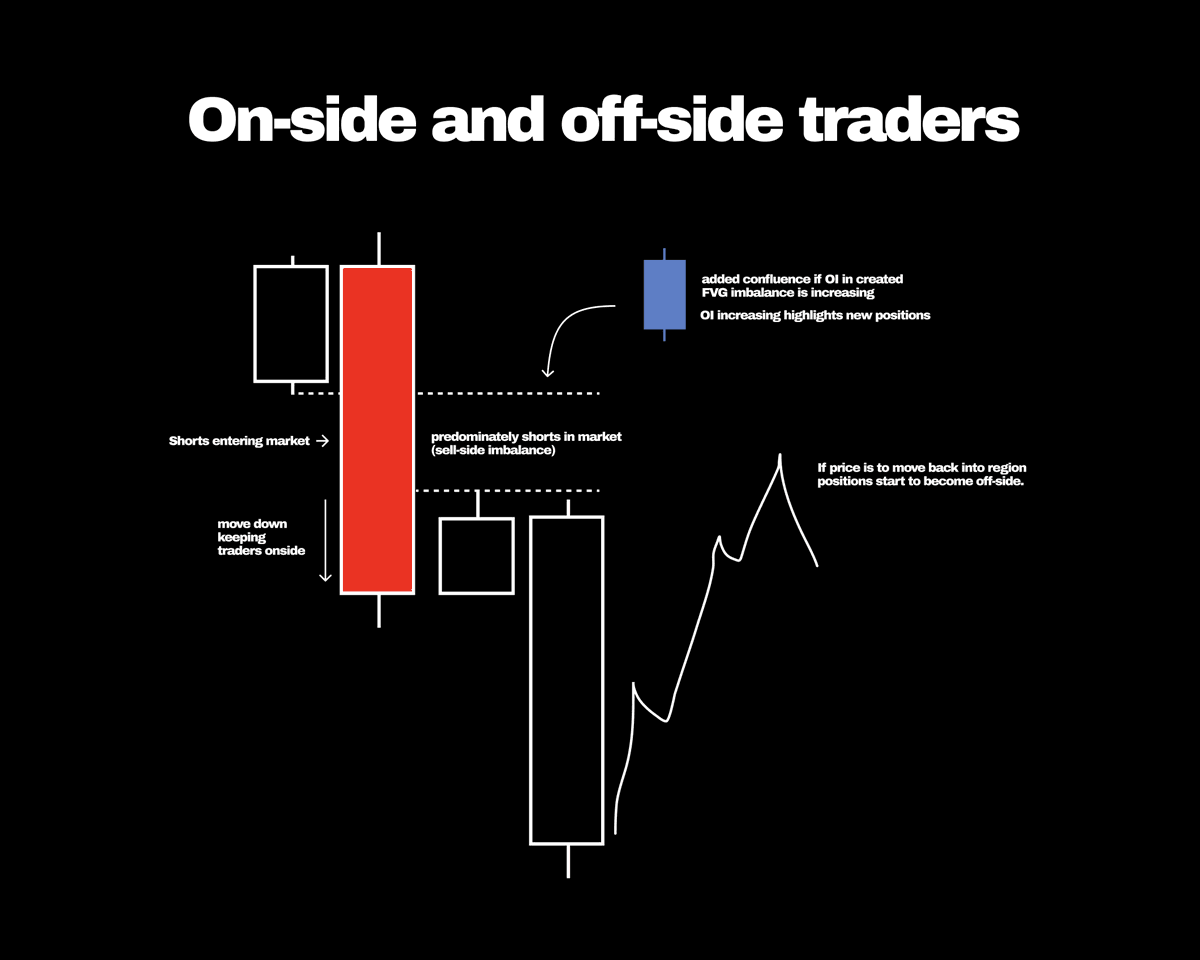

Understanding onside and offside orders

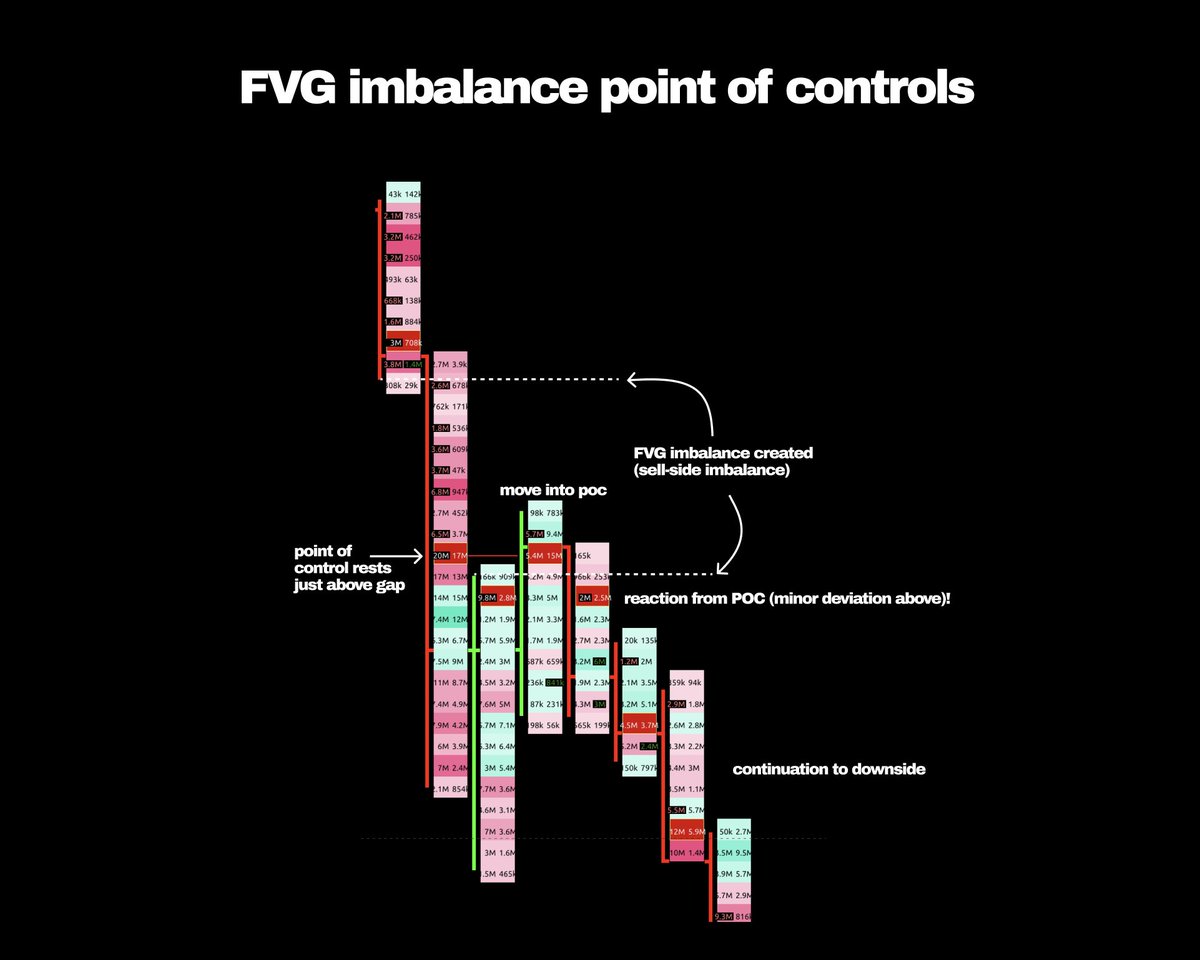

Point of controls inside of candles

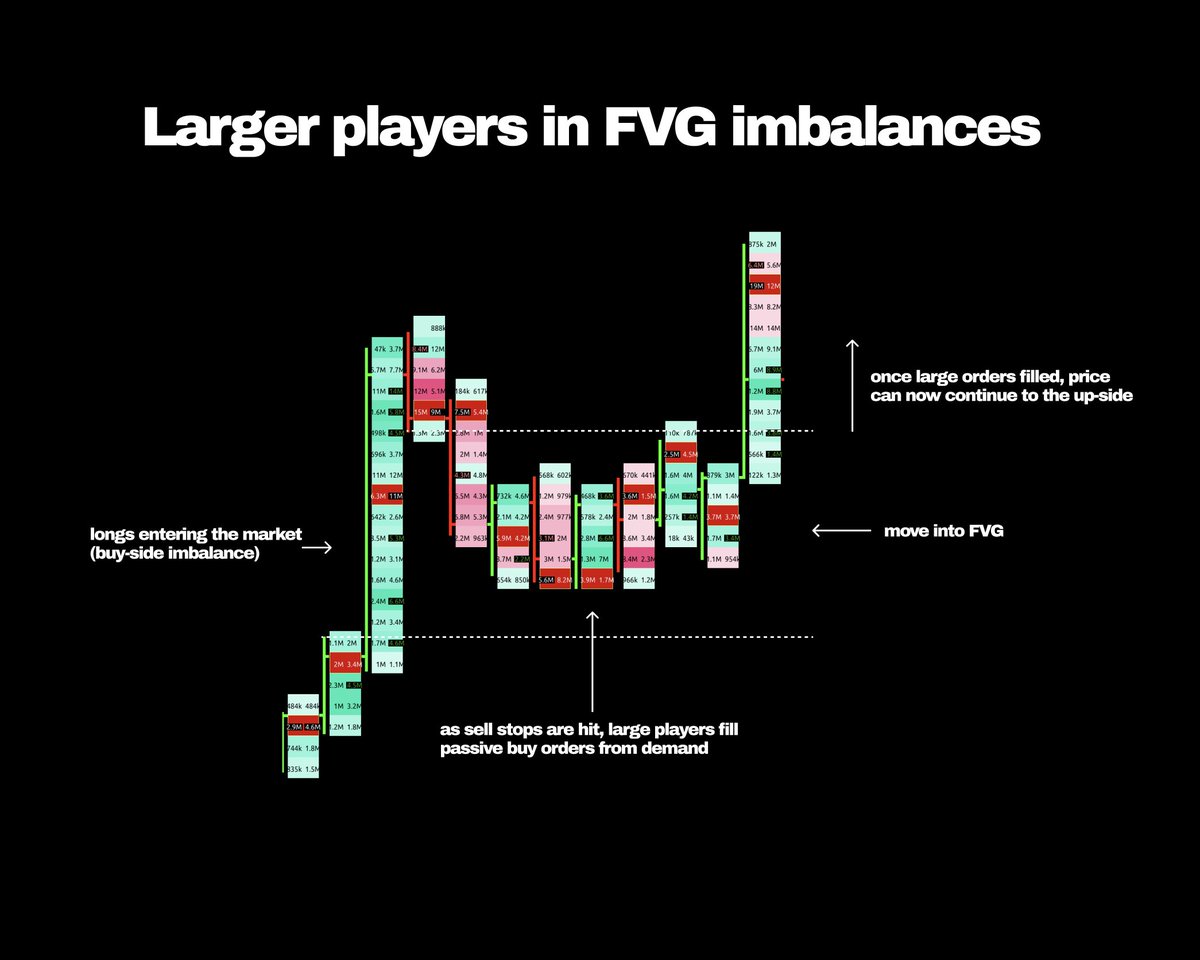

Where larger players position orders

Identifying a FVG imbalance

Buy-side and Sell-side imbalance

Trading FVG imbalances

Understanding onside and offside orders

Point of controls inside of candles

Where larger players position orders

Hope you enjoyed the deep dive into FVG imbalances from an order flow perspective.

If you liked it, likes, comments, and follows make these detailed threads worth while to create.

Stay smart. Trade safe.

Exotick

If you liked it, likes, comments, and follows make these detailed threads worth while to create.

Stay smart. Trade safe.

Exotick

جاري تحميل الاقتراحات...