🔱 Monday

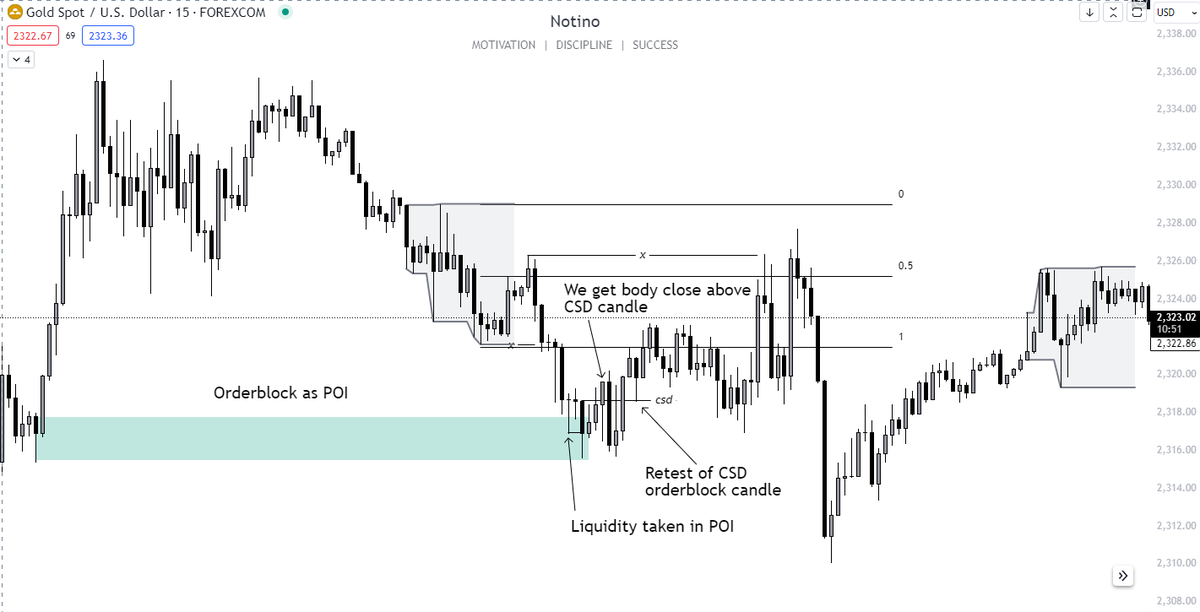

🔱 We took out asian session low and tapped into orderblock which is POI.

🔱 We got liquidity sweep in POI and potential CSD candidate. CSD is confirmed once body closed above bearish candle and we can long it to liquidity resting

at 50% of asian session range (which is quality liquidity).

🔱 Second target would be asian session high which in this case didn't hit but 50% asian session range should bring you nice amount of pips or 2R.

🔱 We took out asian session low and tapped into orderblock which is POI.

🔱 We got liquidity sweep in POI and potential CSD candidate. CSD is confirmed once body closed above bearish candle and we can long it to liquidity resting

at 50% of asian session range (which is quality liquidity).

🔱 Second target would be asian session high which in this case didn't hit but 50% asian session range should bring you nice amount of pips or 2R.

🔱 Tuesday (LOTW)

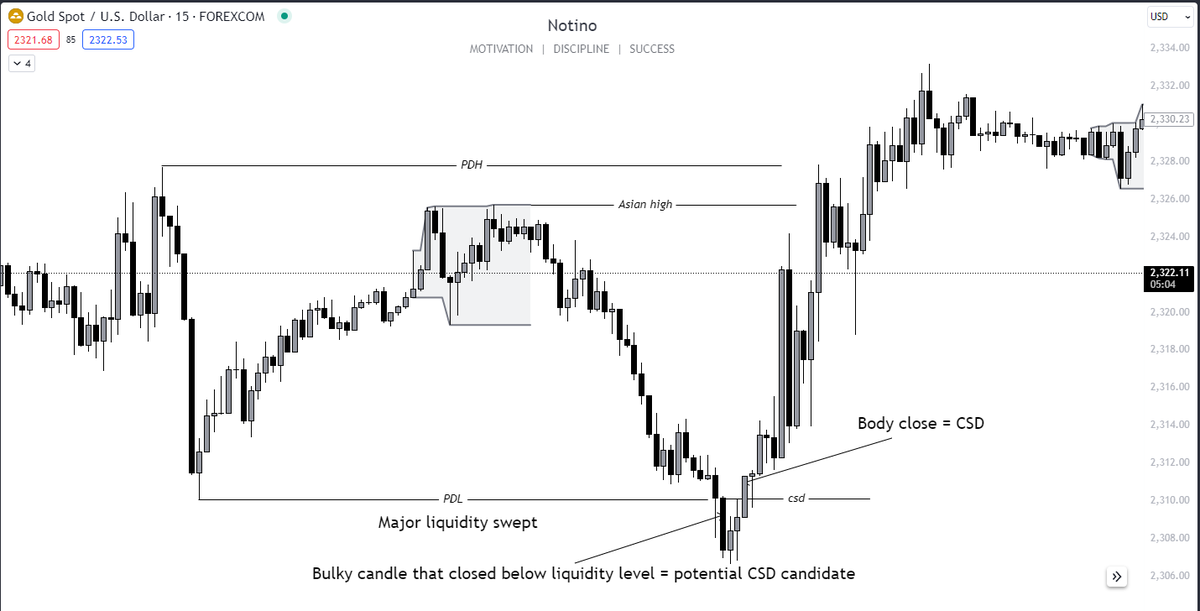

🔱 I told in weekly analysis that Tuesday could make potential low of the week which it did that's why I had long bias towards Thursday.

🔱 This is clearest example of them all. Previous daily low (Monday low) swept, bulky down candle that becomes potential CSD candidate and once it got closed by up candle body it is confirmed as CSD.

🔱 First target since this is high probability that lotw is in by now is asian high then previous daily high (PDH).

🔱 I told in weekly analysis that Tuesday could make potential low of the week which it did that's why I had long bias towards Thursday.

🔱 This is clearest example of them all. Previous daily low (Monday low) swept, bulky down candle that becomes potential CSD candidate and once it got closed by up candle body it is confirmed as CSD.

🔱 First target since this is high probability that lotw is in by now is asian high then previous daily high (PDH).

🔱 Thursday

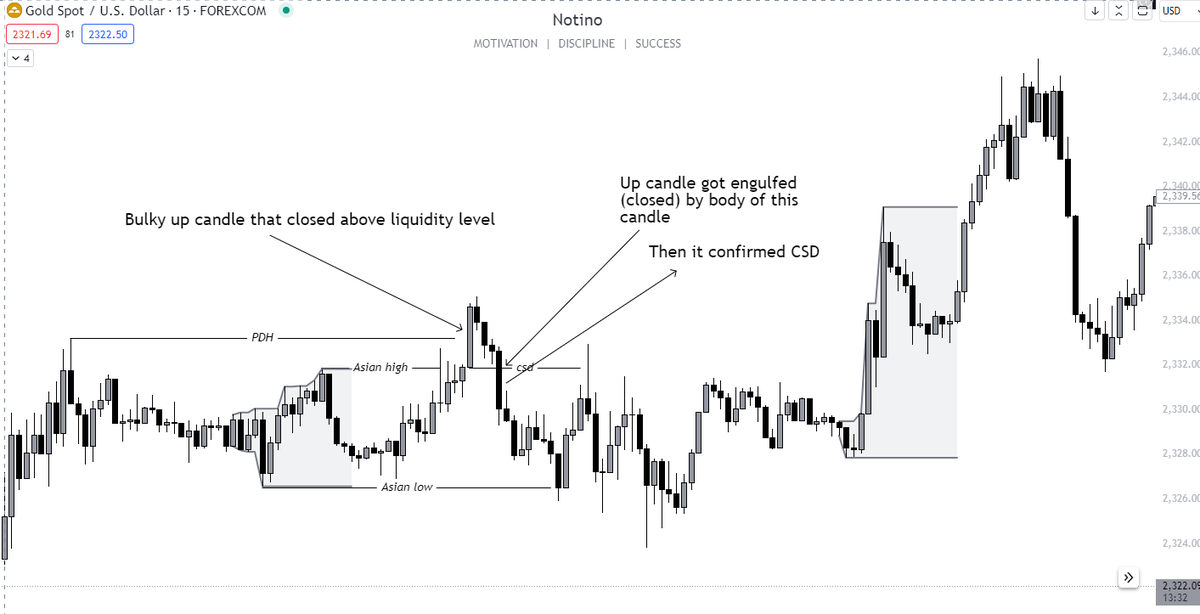

🔱 Here is also one beauty I took and shared.

🔱 We took out asian session liquidity resting at 50% of it. CSD candidate formed, waiting for it to be confirmed. Once confirmed I entered on retest of it on limit entry.

🔱 Since Wednesday was bank holiday and range delayed weekly profile and shorts were to be expected so still longs are in play that's why I was bullish biased again.

🔱 Here is also one beauty I took and shared.

🔱 We took out asian session liquidity resting at 50% of it. CSD candidate formed, waiting for it to be confirmed. Once confirmed I entered on retest of it on limit entry.

🔱 Since Wednesday was bank holiday and range delayed weekly profile and shorts were to be expected so still longs are in play that's why I was bullish biased again.

🔱 Friday

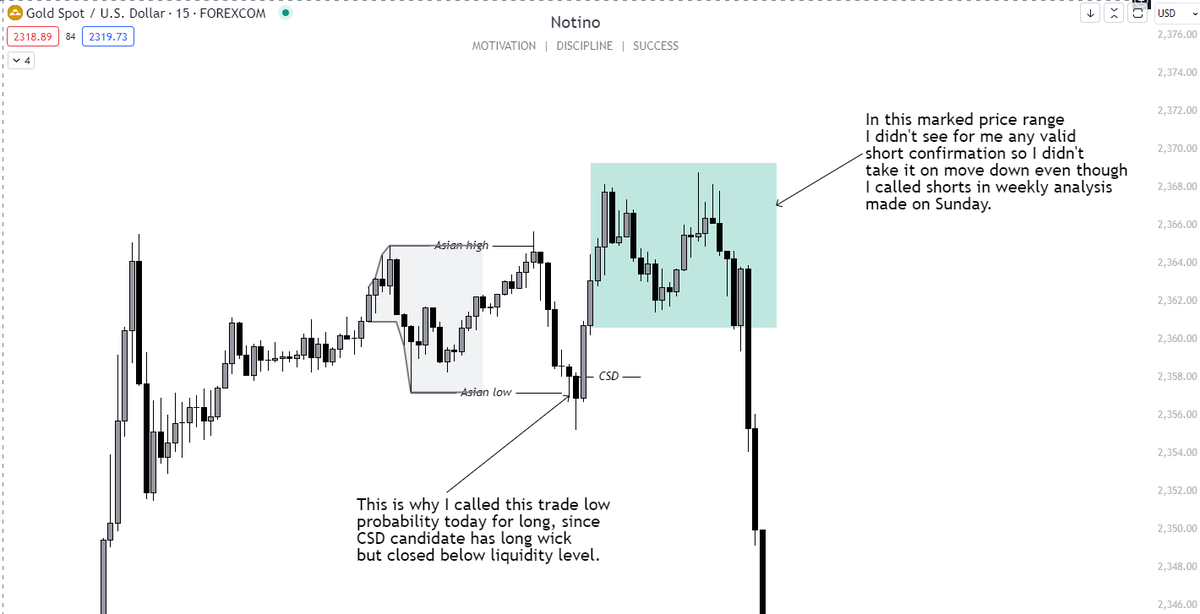

🔱 Today was a bit messy day, I should have expected that but got caught in being bullish again even though I charted out in weekly analysis how it would play out at bearish daily orderblock and it played out exactly like that but it was great week nonetheless.

🔱 Only thing I saw today was potential bullish CSD which I took but didn't went all the way to my target at 2376.

🔱 For shorts I didn't see anything really that I would qualify as CSD so I didn't participate in it.

🔱 Today was a bit messy day, I should have expected that but got caught in being bullish again even though I charted out in weekly analysis how it would play out at bearish daily orderblock and it played out exactly like that but it was great week nonetheless.

🔱 Only thing I saw today was potential bullish CSD which I took but didn't went all the way to my target at 2376.

🔱 For shorts I didn't see anything really that I would qualify as CSD so I didn't participate in it.

This took me some time to gather and make for you guys, I would really appreciate if you show some support by leaving a like 🩷 and follow if you are new.

I will provide much more insights and threads so prepare notes🗒️🤝

I will provide much more insights and threads so prepare notes🗒️🤝

جاري تحميل الاقتراحات...