ICT 2022 Model - Weekly Review 11

In this thread, I will walk you through this week's price action of #NQ and show you on which days the model presented itself.

A tip from myself is to open your charts and watch for the setups yourself - study!

⭣ THREAD ⭣

In this thread, I will walk you through this week's price action of #NQ and show you on which days the model presented itself.

A tip from myself is to open your charts and watch for the setups yourself - study!

⭣ THREAD ⭣

Tuesday - 11.06.2024 #NQ

1st Trade

- Buyside Liquidity (15min Relative Equal Highs) taken and also rejected 1H FVG

- Displacement lower created a FVG

- Market Structure Shift

- Price came back into a premium to the FVG

- Short entry at the low of the FVG targeting the low-hanging objective - 1.21R

- Target 2 - 1.98R

- Target 3 (Low of Day) - 3.38R

The trade happened right after the 09:30 AM opening, and I recommend every beginner to wait the first few minutes before taking a trade, which I also prefer.

Also, if you take a counter-trend trade like in this example, you should take your profits faster and not shoot for home runs.

3/8

1st Trade

- Buyside Liquidity (15min Relative Equal Highs) taken and also rejected 1H FVG

- Displacement lower created a FVG

- Market Structure Shift

- Price came back into a premium to the FVG

- Short entry at the low of the FVG targeting the low-hanging objective - 1.21R

- Target 2 - 1.98R

- Target 3 (Low of Day) - 3.38R

The trade happened right after the 09:30 AM opening, and I recommend every beginner to wait the first few minutes before taking a trade, which I also prefer.

Also, if you take a counter-trend trade like in this example, you should take your profits faster and not shoot for home runs.

3/8

Tuesday - 11.06.2024 #NQ

2nd Trade

- Sellside Liquidity (Low of Day) taken and also rejected 1H FVG

- Displacement higher created two FVGs

- Market Structure Shift

- Price did NOT* come back into a discount to the first FVG

- Long entry at the high of the second FVG targeting the low-hanging objective - 1.55R

- Target 2 - 2.46R

- Target 3 - 2.8R

- Target 4 (High of Day) - 4.07R

- Target 5 (Previous Day High) - 4.87R

*To get an entry, it's best to enter at the last FVG because price often will not come back into a discount like in this example. It's important to note that your stop-loss must be placed that allows price to come back into the first FVG.

If you look closely, the model presented itself also a few minutes earlier. An entry in that case would have resulted in a loss. That's why I also like to watch the 2min and 3min TF, which gives you further confirmation.

4/8

2nd Trade

- Sellside Liquidity (Low of Day) taken and also rejected 1H FVG

- Displacement higher created two FVGs

- Market Structure Shift

- Price did NOT* come back into a discount to the first FVG

- Long entry at the high of the second FVG targeting the low-hanging objective - 1.55R

- Target 2 - 2.46R

- Target 3 - 2.8R

- Target 4 (High of Day) - 4.07R

- Target 5 (Previous Day High) - 4.87R

*To get an entry, it's best to enter at the last FVG because price often will not come back into a discount like in this example. It's important to note that your stop-loss must be placed that allows price to come back into the first FVG.

If you look closely, the model presented itself also a few minutes earlier. An entry in that case would have resulted in a loss. That's why I also like to watch the 2min and 3min TF, which gives you further confirmation.

4/8

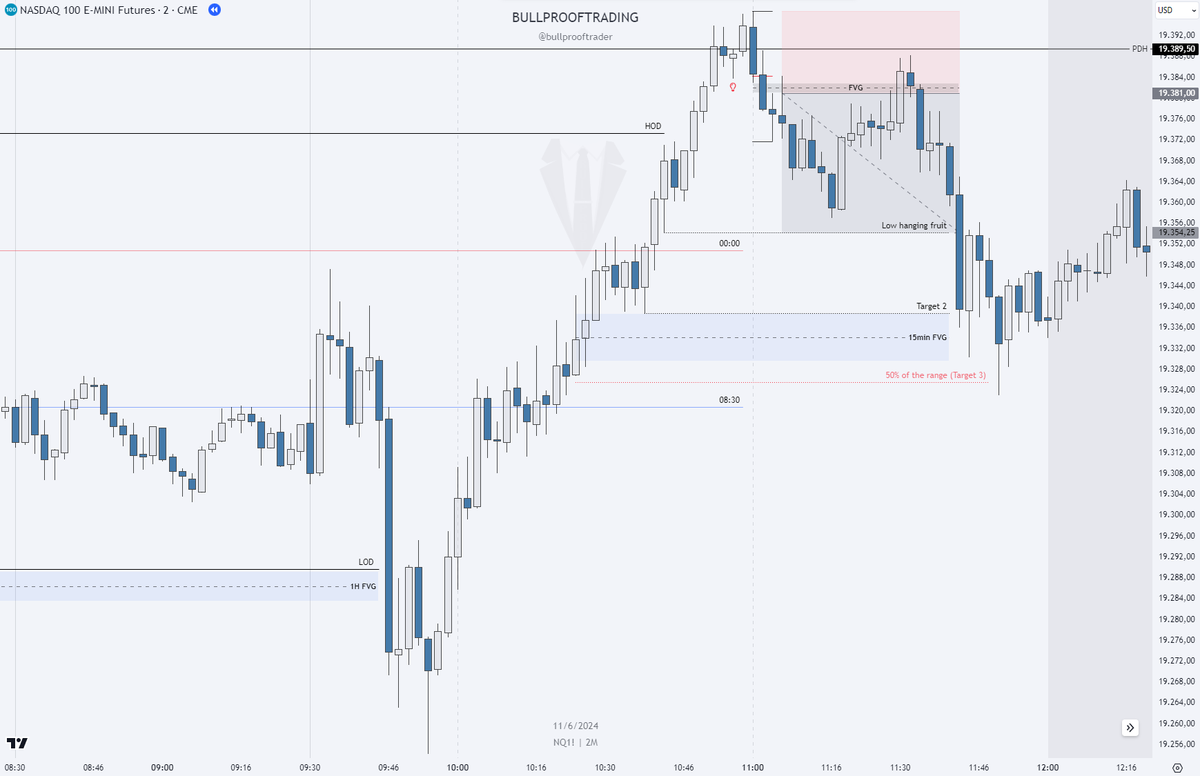

Tuesday - 11.06.2024 #NQ

3rd Trade

- Buyside Liquidity (High of Day and Previous Day High) taken

- Displacement lower created a FVG

- Market Structure Shift

- Price came back into a premium to the FVG

- Short entry at the low of the FVG targeting the low-hanging objective - 1.7R

- Target 2 - 2.68R

- Target 3 (50% of the 15min range) - 3.52R

The same trade also happened on the 1min TF - study!

5/8

3rd Trade

- Buyside Liquidity (High of Day and Previous Day High) taken

- Displacement lower created a FVG

- Market Structure Shift

- Price came back into a premium to the FVG

- Short entry at the low of the FVG targeting the low-hanging objective - 1.7R

- Target 2 - 2.68R

- Target 3 (50% of the 15min range) - 3.52R

The same trade also happened on the 1min TF - study!

5/8

Wednesday - 12.06.2024 #NQ

- Sellside Liquidity (5min Low) taken and also rejected 15min FVG

- Displacement higher created two FVGs

- Market Structure Shift

- Price did NOT* come back into a discount

- Long entry at the high of the first FVG targeting the low-hanging objective - 0.54R

- Target 2 (High of Day) - 1.1R

*Price often will not come back into a discount like in this example. It's important to note that your stop-loss must be placed that allows price to come back into the first FVG.

Also, the trade happened right after the 09:30 AM opening, and I recommend every beginner to wait the first few minutes before taking a trade, which I also prefer.

The same trade also happened on the 3min and 2min TF - study!

6/8

- Sellside Liquidity (5min Low) taken and also rejected 15min FVG

- Displacement higher created two FVGs

- Market Structure Shift

- Price did NOT* come back into a discount

- Long entry at the high of the first FVG targeting the low-hanging objective - 0.54R

- Target 2 (High of Day) - 1.1R

*Price often will not come back into a discount like in this example. It's important to note that your stop-loss must be placed that allows price to come back into the first FVG.

Also, the trade happened right after the 09:30 AM opening, and I recommend every beginner to wait the first few minutes before taking a trade, which I also prefer.

The same trade also happened on the 3min and 2min TF - study!

6/8

Thursday - 13.06.2024 #NQ

- Sellside Liquidity (Low of Day) taken and also rejected 15min FVG

- Displacement higher created three FVGs

- Market Structure Shift

- Price came back into a discount to the first FVG

- Long entry at the high of the first FVG targeting the low-hanging objective - 1.38R

- Target 2 (50% of the 15min range) - 1.98R

After Wednesday's big moves, chances were high that we would see choppy price action, so I was not trading on this day. Still, price presented this nice setup.

The same trade also happened on the 3min and 2min TF - study!

7/8

- Sellside Liquidity (Low of Day) taken and also rejected 15min FVG

- Displacement higher created three FVGs

- Market Structure Shift

- Price came back into a discount to the first FVG

- Long entry at the high of the first FVG targeting the low-hanging objective - 1.38R

- Target 2 (50% of the 15min range) - 1.98R

After Wednesday's big moves, chances were high that we would see choppy price action, so I was not trading on this day. Still, price presented this nice setup.

The same trade also happened on the 3min and 2min TF - study!

7/8

جاري تحميل الاقتراحات...