You may have heard of it before, but many people don't understand how it works or why it matters.

To multiply your investment significantly, focus on mastering one key topic:

➜ Bitcoin Dominance

To multiply your investment significantly, focus on mastering one key topic:

➜ Bitcoin Dominance

Bitcoin dominance is calculated using the formula:

Bitcoin dominance = Bitcoin market cap / total market cap.

For example, if the BTC capitalization is $50 million and the total market capitalization is $100 million, then Bitcoin dominance will be 50%.

Bitcoin dominance = Bitcoin market cap / total market cap.

For example, if the BTC capitalization is $50 million and the total market capitalization is $100 million, then Bitcoin dominance will be 50%.

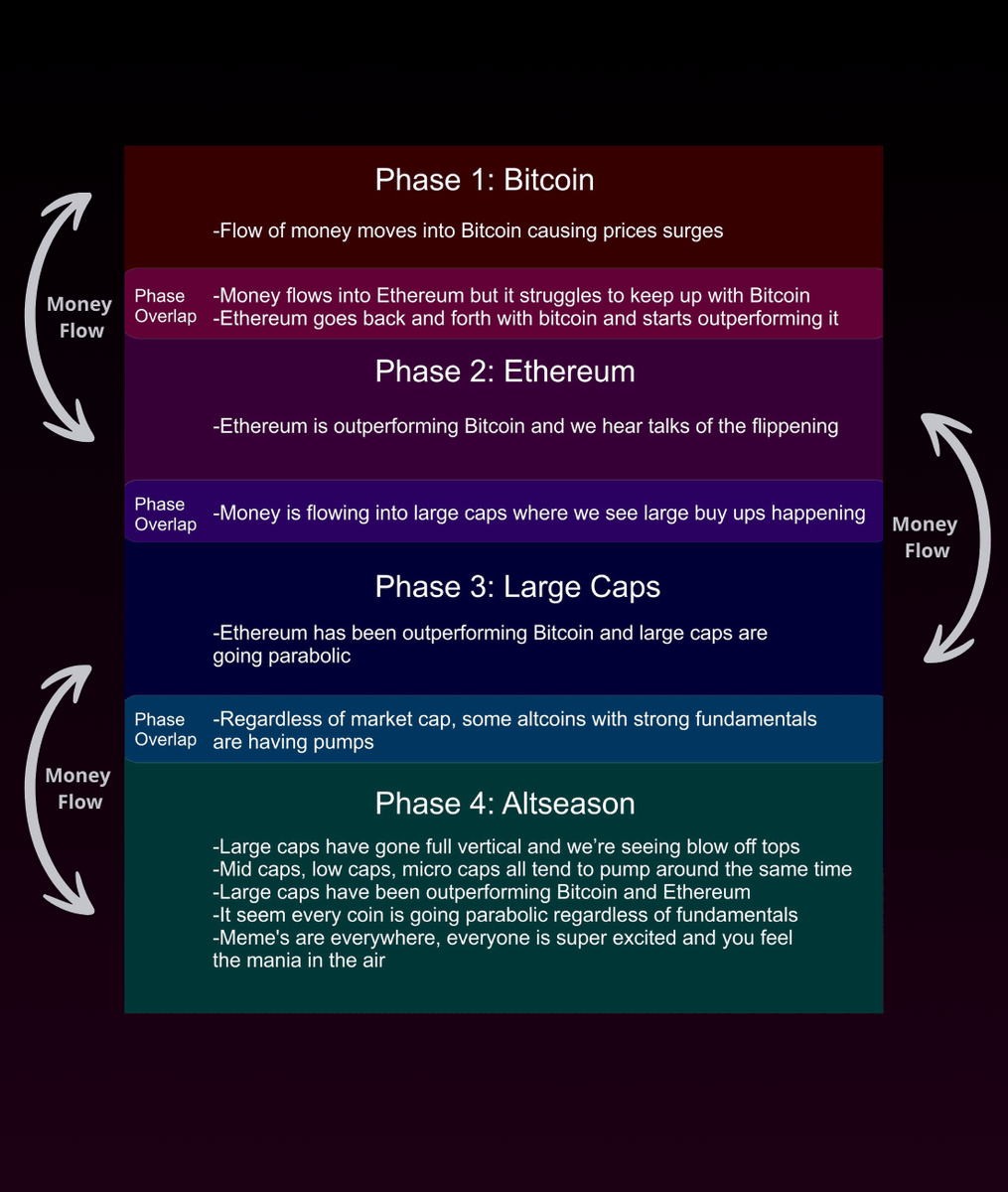

➤ Reversal patterns, indicating a change in market trends in the opposite direction.

This knowledge is important for understanding risks and helps to timely invest in promising currencies and profit from price differences.

➤ The emergence of new altcoins and the peak in demand for them.

➤ The beginning of a short-term phase of price consolidation.

During a bear market, the rise of BTC dominance can predict this consolidation.

This knowledge is important for understanding risks and helps to timely invest in promising currencies and profit from price differences.

➤ The emergence of new altcoins and the peak in demand for them.

➤ The beginning of a short-term phase of price consolidation.

During a bear market, the rise of BTC dominance can predict this consolidation.

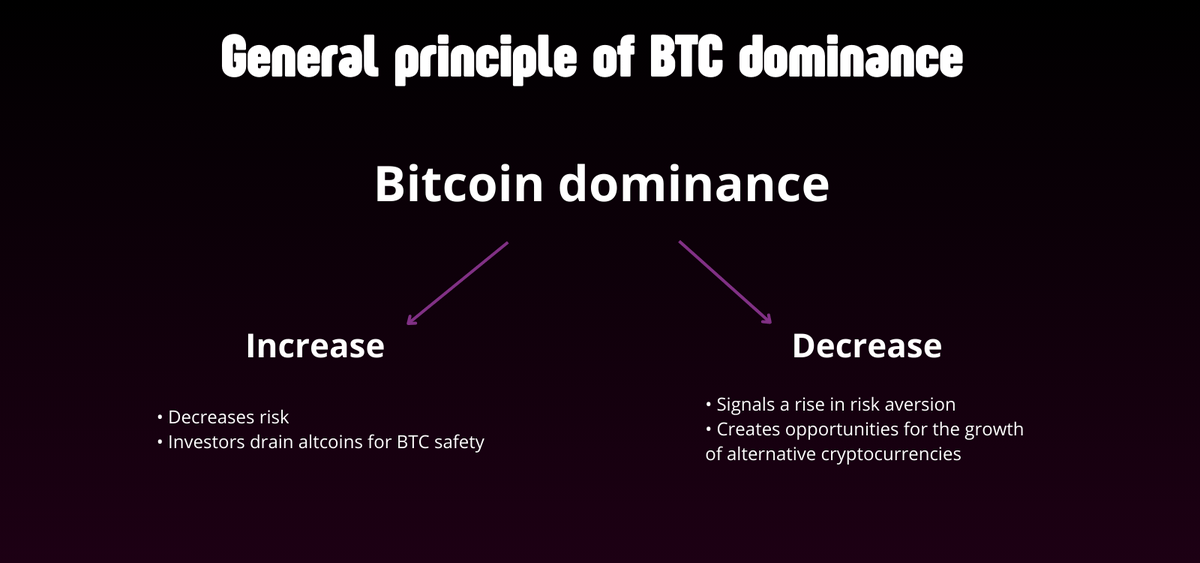

◢ General principle

Bitcoin is known as one of the strongest and safest assets out there. Many people trust it for its stability. This also helps us understand how strong the overall market is because money tends to go to the safest option first.

General principle of BTC dominance:

✓ If Bitcoin dominates the market, this may indicate investors' preference for stability and a conservative approach.

✓ At the same time, Bitcoin's low market share may mean increased interest in altcoins and a desire to take more risks.

Bitcoin is known as one of the strongest and safest assets out there. Many people trust it for its stability. This also helps us understand how strong the overall market is because money tends to go to the safest option first.

General principle of BTC dominance:

✓ If Bitcoin dominates the market, this may indicate investors' preference for stability and a conservative approach.

✓ At the same time, Bitcoin's low market share may mean increased interest in altcoins and a desire to take more risks.

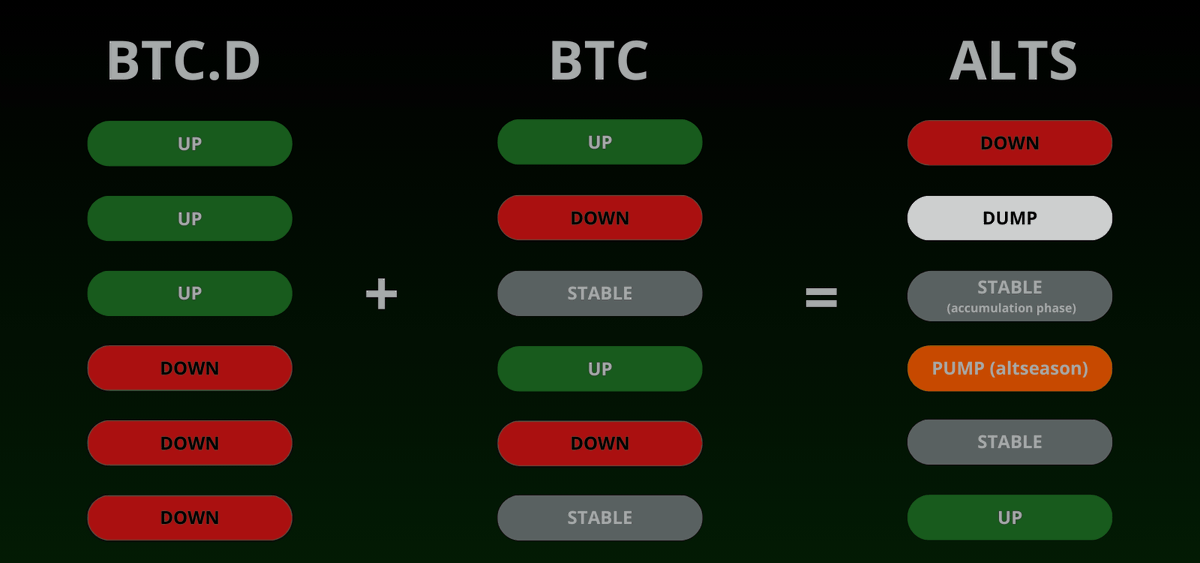

Some traders consider not only the price of Bitcoin, but also its market share to make informed decisions.

➜ A comprehensive analysis of Bitcoin's dominance and its price can provide clues about the advisability of investing in altcoins.

➜ A comprehensive analysis of Bitcoin's dominance and its price can provide clues about the advisability of investing in altcoins.

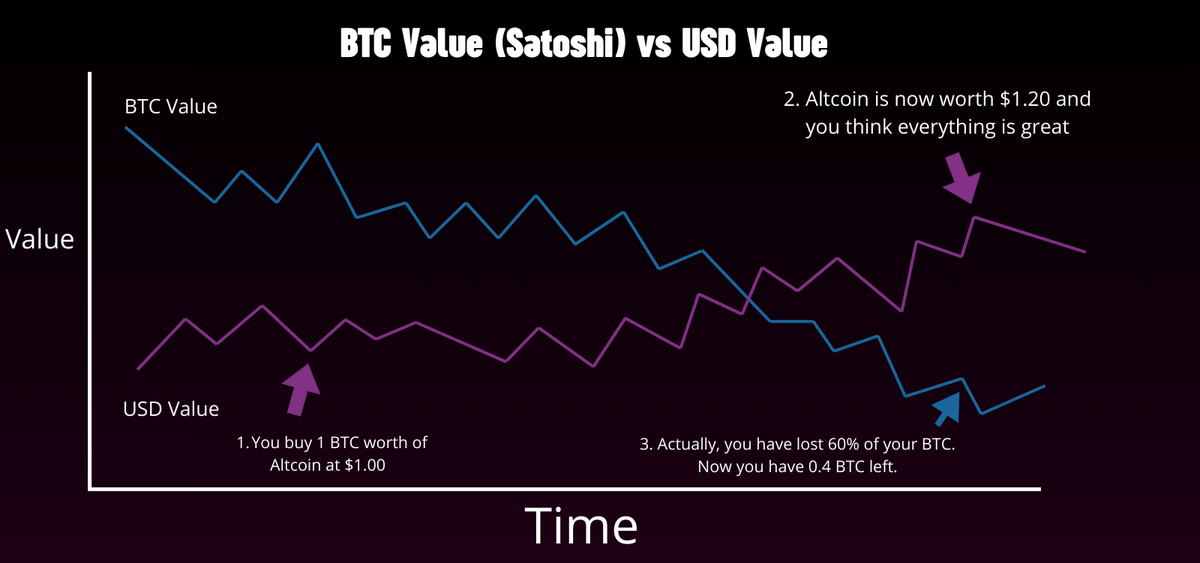

If your altcoin isn't outperforming Bitcoin in value, it might not be worth holding onto.

Always compare the satoshi value to the USD value of your altcoin. If it's performing better than Bitcoin, that's a positive signal.

Always compare the satoshi value to the USD value of your altcoin. If it's performing better than Bitcoin, that's a positive signal.

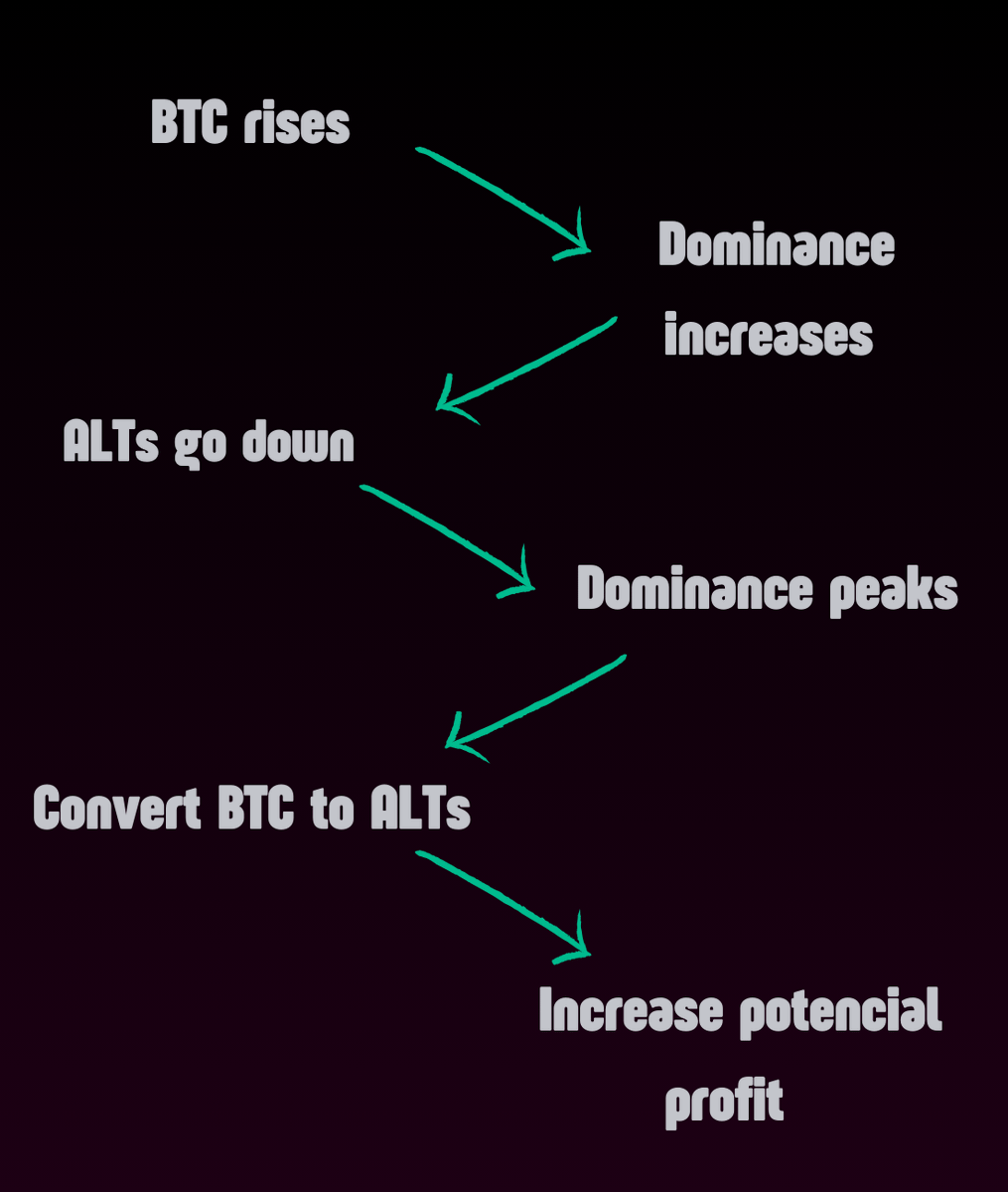

So here is the strategy to get more potencial gains:

➜ When Bitcoin rises, its dominance also increases

➜ Altcoins typically lose value compared to Bitcoin

➜ Bitcoin dominance eventually reaches its peak

➜ At this point, you have the opportunity to convert your Bitcoin to altcoins, potentially increasing your holdings and gains

➜ When Bitcoin rises, its dominance also increases

➜ Altcoins typically lose value compared to Bitcoin

➜ Bitcoin dominance eventually reaches its peak

➜ At this point, you have the opportunity to convert your Bitcoin to altcoins, potentially increasing your holdings and gains

In the past and even now, this strategy continues to be effective due to Bitcoin's position as a market leader.

Particularly in the initial phases of a bull market or brief reversal, Bitcoin often outperforms nearly all other cryptocurrencies.

Particularly in the initial phases of a bull market or brief reversal, Bitcoin often outperforms nearly all other cryptocurrencies.

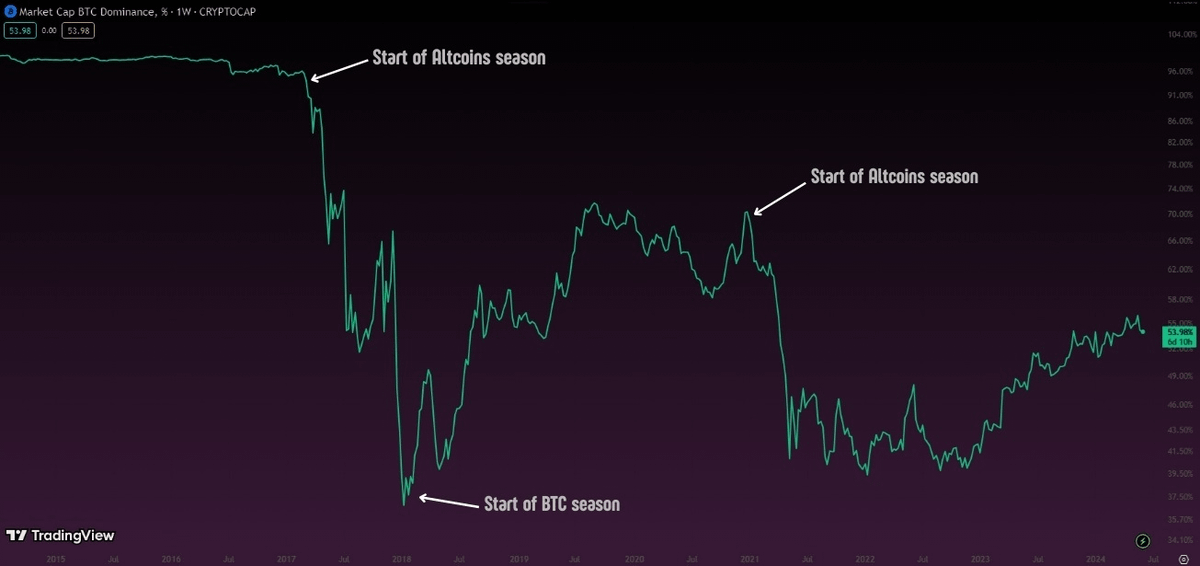

◢ When to convert?

➜ The question that everyone has is: How do you know when to convert $BTC to altcoins?

✓ Answer: By utilizing classic support and resistance levels, we can pinpoint potential shifts between altseasons or BTC dominance.

This chart demonstrates how key resistance and support levels are valuable indicators for forecasting altcoin or BTC seasons.

➜ The question that everyone has is: How do you know when to convert $BTC to altcoins?

✓ Answer: By utilizing classic support and resistance levels, we can pinpoint potential shifts between altseasons or BTC dominance.

This chart demonstrates how key resistance and support levels are valuable indicators for forecasting altcoin or BTC seasons.

Bitcoin's dominance helps track changes in market cycles. Some traders use it to adjust trading strategies, while others use it to manage diversified portfolios.

It is important to note that Bitcoin dominance does not guarantee the performance of Bitcoin itself or other cryptocurrencies, but only serves as a guide when planning a trading approach.

It is important to note that Bitcoin dominance does not guarantee the performance of Bitcoin itself or other cryptocurrencies, but only serves as a guide when planning a trading approach.

I hope you've found this thread helpful.

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

x.com

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

x.com

جاري تحميل الاقتراحات...