Before I begin, I have a favor to ask...

I spent a lot of time writing this thread, trying to make it genuinely useful for you, so if it's not too much trouble, please bookmark it, retweet, leave a comment, or simply hit like 🤍

I spent a lot of time writing this thread, trying to make it genuinely useful for you, so if it's not too much trouble, please bookmark it, retweet, leave a comment, or simply hit like 🤍

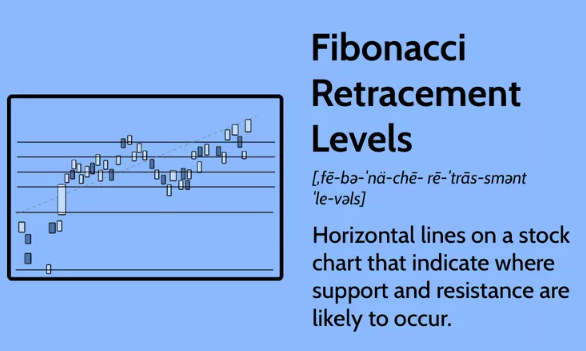

1/➮ What are Fibonacci levels?

✧ It's flat lines marking potential support and resistance points where prices might reverse

✧ The key to successfully using Fibonacci is to apply it in a trending market

✧ A long position at a Fibonacci support level during an upward trend and the opposite for a short position

✧ It's flat lines marking potential support and resistance points where prices might reverse

✧ The key to successfully using Fibonacci is to apply it in a trending market

✧ A long position at a Fibonacci support level during an upward trend and the opposite for a short position

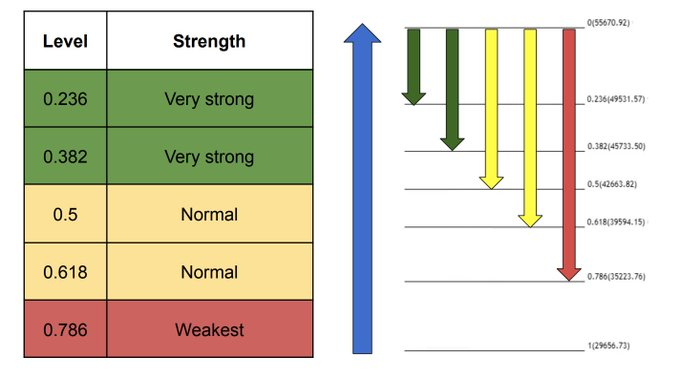

2/➮ Why do we use Fibonacci levels?

✧ There are two main reasons why we use Fibonacci levels:

1. Strength of a move in the market

2. High probability support and resistance

Now, let's explain each one separately👇

✧ There are two main reasons why we use Fibonacci levels:

1. Strength of a move in the market

2. High probability support and resistance

Now, let's explain each one separately👇

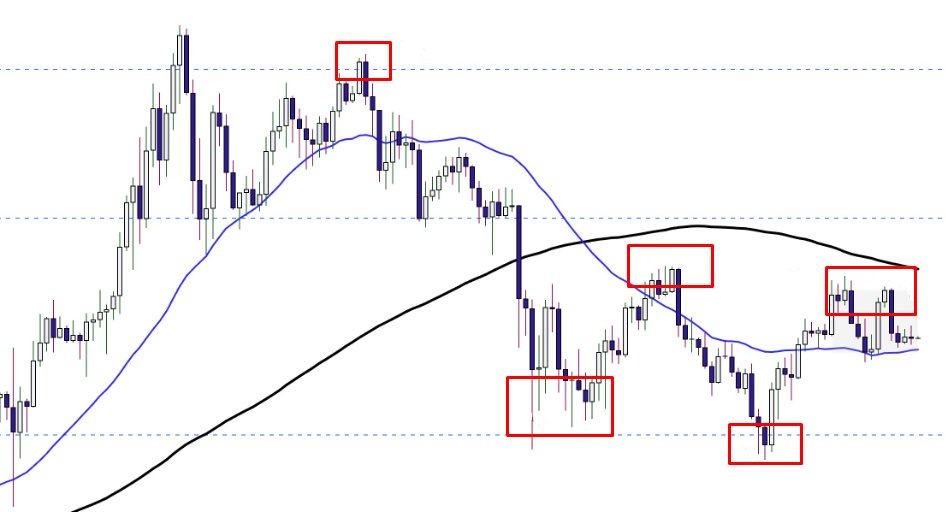

6/➮ Now, we can move on to practice.

✧ I will cover the three main situations where employing Fibonacci levels can assist in identifying optimal entry points:

1. Uptrend

2. Downtrend

3. Golden Pocket

Let's dive in👇

✧ I will cover the three main situations where employing Fibonacci levels can assist in identifying optimal entry points:

1. Uptrend

2. Downtrend

3. Golden Pocket

Let's dive in👇

And finally, I want to add:

No indicator is a panacea, and I am generally skeptical of t/a.

I use them simply as auxiliary tools to find the best entry and tp.

Look at the bigger picture, evaluate fundamentals: vesting, community, narrative, and only then use indicators and support levels to find best entries and exits.

If it were that easy, then many traders would become millionaires just by applying Fibonacci levels or any other indicator...

No indicator is a panacea, and I am generally skeptical of t/a.

I use them simply as auxiliary tools to find the best entry and tp.

Look at the bigger picture, evaluate fundamentals: vesting, community, narrative, and only then use indicators and support levels to find best entries and exits.

If it were that easy, then many traders would become millionaires just by applying Fibonacci levels or any other indicator...

I've created a Free Discord Server where u can find everything u've been missing in crypto:

✧ Community & mentorship

✧ Free airdrop software

✧ Shitcoin & NFT calls

✧ Daily news and airdrop to-do list

✧ Giveaways & WL raffles

Join for free

✧ Community & mentorship

✧ Free airdrop software

✧ Shitcoin & NFT calls

✧ Daily news and airdrop to-do list

✧ Giveaways & WL raffles

Join for free

➮ My TG channel has become too large to drop lowcaps and other moves with a small number of users, so I'll make it private very soon. Now is likely ur last chance to join:

t.me

t.me

➮ Liked this thread? I write educational threads daily, so don't forget to:

✧ Follow me @nobrainflip

✧ Join my tg t.me

✧ Like, RT, bookmark and leave a comment on the first tweet 👇

x.com

✧ Follow me @nobrainflip

✧ Join my tg t.me

✧ Like, RT, bookmark and leave a comment on the first tweet 👇

x.com

جاري تحميل الاقتراحات...