➜ First and foremost, I strongly suggest bookmarking this thread as the information shared here needs time to sink in.

Chances are, you will find yourself revisiting it multiple times.

✓ Also, since I may be blocked by various VCs for sharing what they don't reveal, any support you can offer would be greatly appreciated.

Chances are, you will find yourself revisiting it multiple times.

✓ Also, since I may be blocked by various VCs for sharing what they don't reveal, any support you can offer would be greatly appreciated.

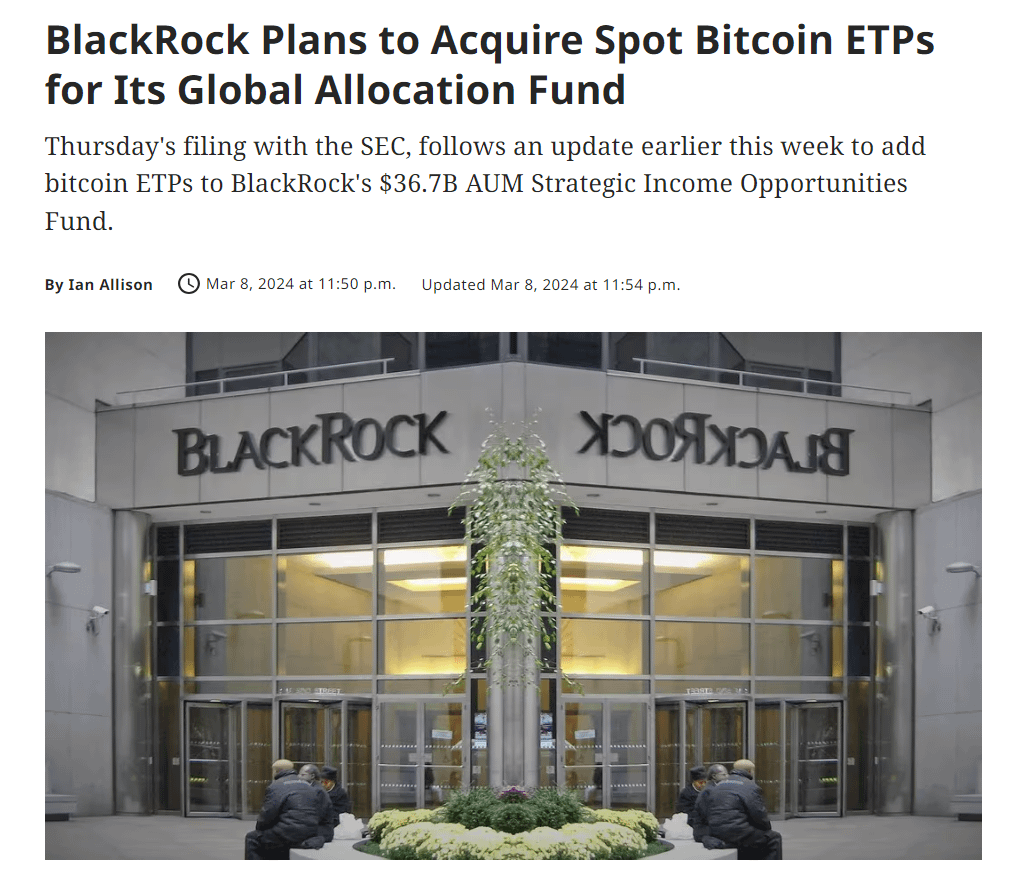

Funds feature experts in various fields who write compelling articles advising you to invest in different areas.

➜ However, the primary aim of any fund is to generate profits, not to provide financial recommendations.

They may advise you on what to buy and when to buy it, but rarely will they mention when the price has peaked and it's time to sell.

✓ If you encounter such advice, it's likely just another tactic to prompt people to sell their assets.

➜ However, the primary aim of any fund is to generate profits, not to provide financial recommendations.

They may advise you on what to buy and when to buy it, but rarely will they mention when the price has peaked and it's time to sell.

✓ If you encounter such advice, it's likely just another tactic to prompt people to sell their assets.

◢ @TheRoaringKitty saga made global market history, causing many funds to lose billions of dollars by shorting $GME.

➜ Roaring Kitty's wager on GameStop stock proved incredibly lucrative, turning $746k into $48M. This success was not due to a one-time purchase; he continued buying the stock as it surged.

However, his initial investment saw $56,000 grow into $16,000,000.

➜ Roaring Kitty's wager on GameStop stock proved incredibly lucrative, turning $746k into $48M. This success was not due to a one-time purchase; he continued buying the stock as it surged.

However, his initial investment saw $56,000 grow into $16,000,000.

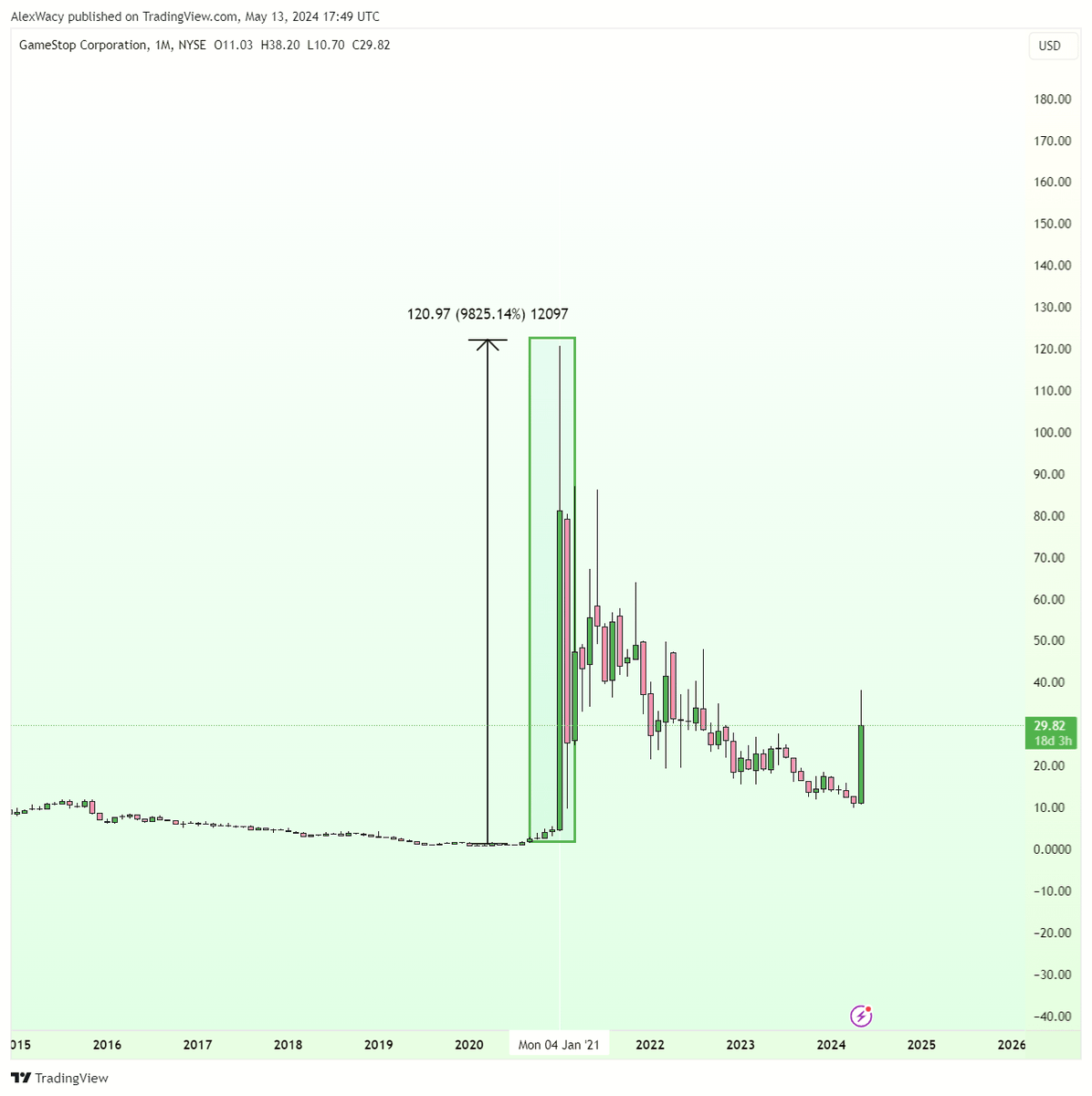

Examining the $GME chart reveals significant growth fueled by retail investors.

➜ However, the most intriguing observation emerges when we delve deeper.

Looking at this chart, we realize that it reminds the chart of a coin, which showed growth on an empty place and then followed by various news, it often happens in bull markets.

➜ However, the most intriguing observation emerges when we delve deeper.

Looking at this chart, we realize that it reminds the chart of a coin, which showed growth on an empty place and then followed by various news, it often happens in bull markets.

This can be described as manipulation.

I have discussed it in more detail in this thread. Feel free to check it out whenever you have the time ⇩

I have discussed it in more detail in this thread. Feel free to check it out whenever you have the time ⇩

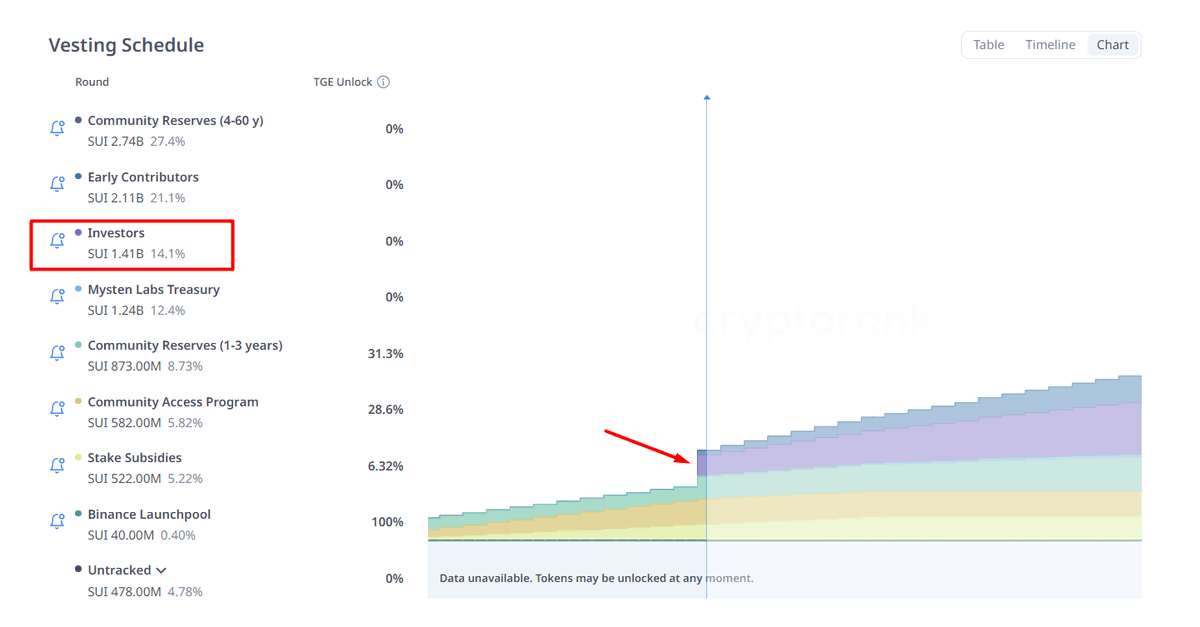

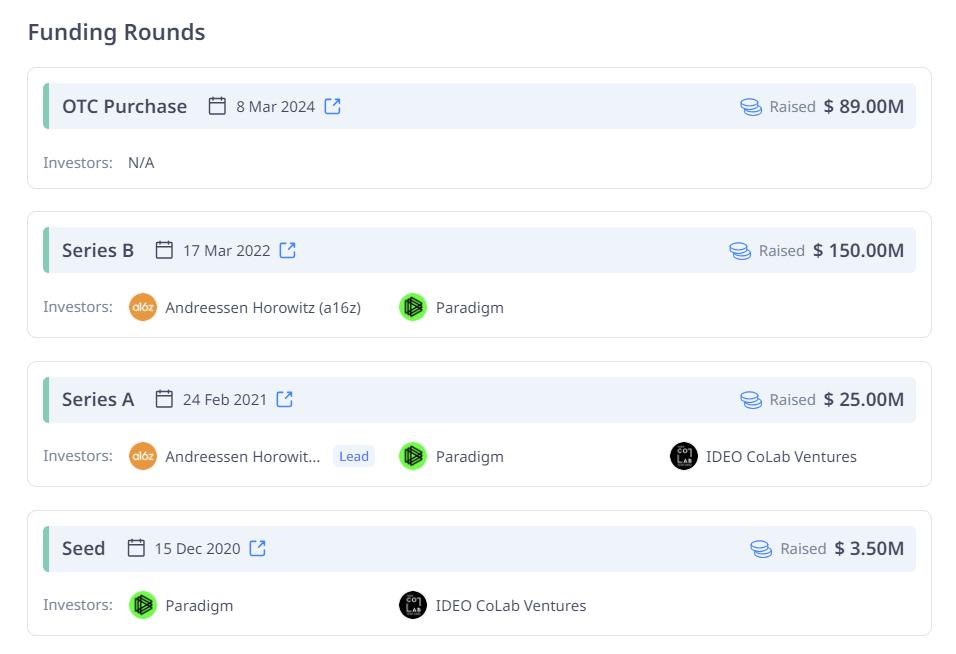

◢ In the crypto, a key role is played by VC funds that invest in early-stage projects and reap huge profits.

It's impossible to know for certain if there were any extra token distributions to VCs, such as from Ecosystem Funds or other sources.

VC has been turning profits since the project's launch, possibly from additional tokens, airdrops, or reselling allocations.

It's impossible to know for certain if there were any extra token distributions to VCs, such as from Ecosystem Funds or other sources.

VC has been turning profits since the project's launch, possibly from additional tokens, airdrops, or reselling allocations.

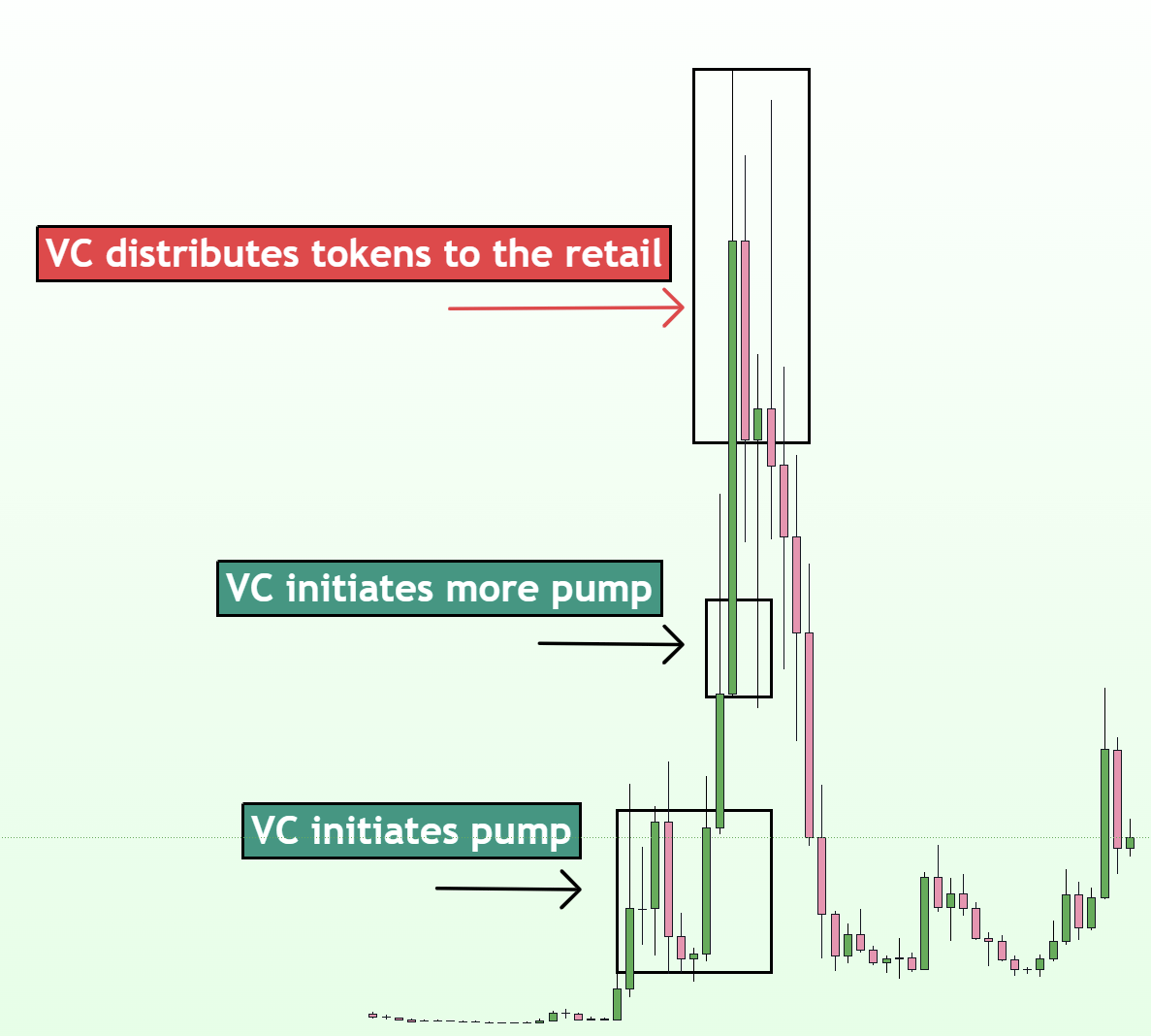

Here is an outline of the general model of price behavior for tokens with VC investments. Though the characteristics and intensity may vary, in bull markets, VC funds reap significant profits.

➜ As a result, projects initiated during bear markets frequently outperform those started during bull markets.

➜ As a result, projects initiated during bear markets frequently outperform those started during bull markets.

✓ The lower the funds involved in a project, the greater the chance of significant pump.

➜ This is because if just 2-3 funds collaborate to boost the price, they stand to gain from the increase.

➜ Conversely, with 10 funds in the project, reaching a unanimous agreement becomes more challenging for all parties involved.

➜ This is because if just 2-3 funds collaborate to boost the price, they stand to gain from the increase.

➜ Conversely, with 10 funds in the project, reaching a unanimous agreement becomes more challenging for all parties involved.

Essentially your main task is to buy tokens that meet the following criteria:

✓ Appeal to traders and the community for liquidity when exiting investments.

✓ Have the potential to be listed on Tier 1 CEX for increased liquidity.

✓ Are backed by a select few Tier 1-2 VCs with the resources to boost token value.

✓ Appeal to traders and the community for liquidity when exiting investments.

✓ Have the potential to be listed on Tier 1 CEX for increased liquidity.

✓ Are backed by a select few Tier 1-2 VCs with the resources to boost token value.

After reading this, you should realize that funds aim to profit significantly from your investments. The example of Roaring Kitty and $GME illustrates the substantial financial positions that funds can hold.

To succeed, you need to think ahead, adopt the mindset of funds, and strategize like a major player.

To succeed, you need to think ahead, adopt the mindset of funds, and strategize like a major player.

That's why I always emphasize that when you begin to think like a major player, your perception of the market undergoes a complete transformation.

You will no longer hold onto the idea of limitless growth but instead develop a genuine understanding of the market environment.

You will no longer hold onto the idea of limitless growth but instead develop a genuine understanding of the market environment.

That's all for today!

The market is a competitive arena where everyone aims to outperform each other, and money doesn't appear out of nowhere.

➜ When one person profits, it often means someone else loses. In many instances, the bigger player makes money, but just because you witness a public loss doesn't necessarily mean it's genuine.

✓ Sometimes, they want you to believe they lost to make you feel smarter than them, only to deceive you.

The market is a competitive arena where everyone aims to outperform each other, and money doesn't appear out of nowhere.

➜ When one person profits, it often means someone else loses. In many instances, the bigger player makes money, but just because you witness a public loss doesn't necessarily mean it's genuine.

✓ Sometimes, they want you to believe they lost to make you feel smarter than them, only to deceive you.

I hope you've found this thread helpful.

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

جاري تحميل الاقتراحات...