The #Bitcoin halving is in 3 days 🤯

Let me explain what's happening 👇

Let me explain what's happening 👇

What is the halving?

The #Bitcoin blockchain consists of 839,495 blocks of data containing information about the movements of Bitcoin between addresses.

These blocks are created every 8-12 minutes.

Bitcoin miners create these blocks by running algorithms that are guessing a number out of a really big pool of numbers.

The miner who guesses the number first produces the next block on the blockchain and gets a reward for doing so.

The halving directly impacts this reward.

The miner for block 839,999 will receive 6.25 bitcoin as a reward.

Block 840,000 will receive half - 3.125 BTC - as a reward.

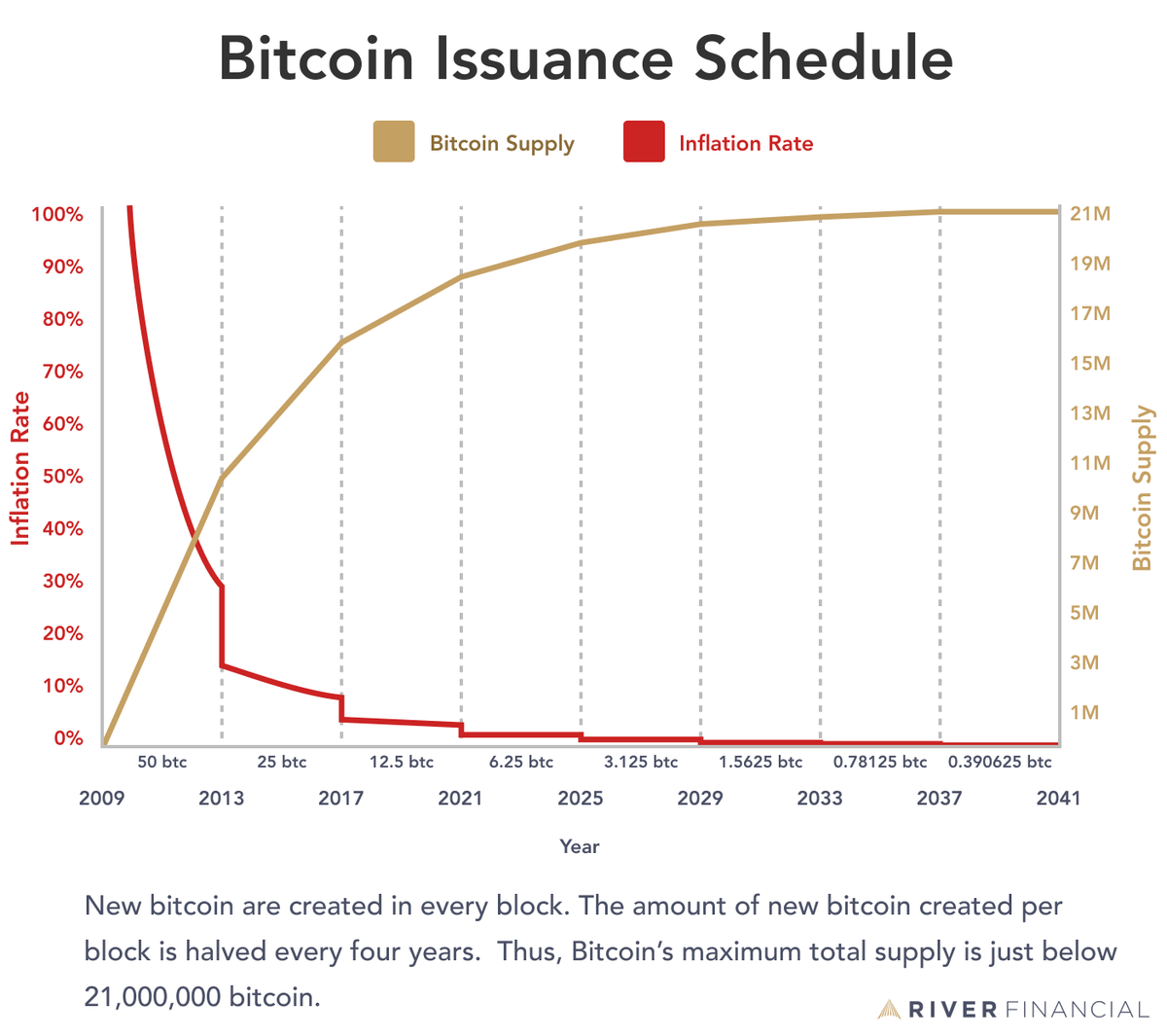

Halvings happen every 210,000 blocks.

This is the fourth halving - the first one was in 2012, the second one was in 2016, and the third one was in 2020.

The 50% cut in supply will be enforced by tens of thousands of nodes running Bitcoin Core around the world.

If the miner producing block 840,000 adds a reward that's higher than 3.125 bitcoin, the block will be rejected.

The #Bitcoin blockchain consists of 839,495 blocks of data containing information about the movements of Bitcoin between addresses.

These blocks are created every 8-12 minutes.

Bitcoin miners create these blocks by running algorithms that are guessing a number out of a really big pool of numbers.

The miner who guesses the number first produces the next block on the blockchain and gets a reward for doing so.

The halving directly impacts this reward.

The miner for block 839,999 will receive 6.25 bitcoin as a reward.

Block 840,000 will receive half - 3.125 BTC - as a reward.

Halvings happen every 210,000 blocks.

This is the fourth halving - the first one was in 2012, the second one was in 2016, and the third one was in 2020.

The 50% cut in supply will be enforced by tens of thousands of nodes running Bitcoin Core around the world.

If the miner producing block 840,000 adds a reward that's higher than 3.125 bitcoin, the block will be rejected.

How does this impact market supply?

Since bitcoin miners are the only ones who can produce bitcoin, we are going to see a supply shock.

The reward is halved instantaneously.

The cost of producing a block remains the same.

Healthy miners who produce block 840,000 onward won't sell their Bitcoin until the market price of Bitcoin matches their cost of production.

This means we will see an immediate decrease in the available supply of bitcoin.

Since bitcoin miners are the only ones who can produce bitcoin, we are going to see a supply shock.

The reward is halved instantaneously.

The cost of producing a block remains the same.

Healthy miners who produce block 840,000 onward won't sell their Bitcoin until the market price of Bitcoin matches their cost of production.

This means we will see an immediate decrease in the available supply of bitcoin.

How does demand come into play?

Bitcoin ETFs are buying more Bitcoin than the current supply almost every day.

What happens when the newly created supply of bitcoin is cut in half and demand is still there?

You have to remember that most people have zero allocation to this asset.

The price must go up to satisfy the demand for bitcoin in terms of $ if enough Bitcoin isn't available to be bought on exchanges and through OTC trading.

Eg. Someone wants to buy $100,000 of Bitcoin but only $20,000 worth is available at the current price. If a market buy for the entire $100,000 is executed, the price will be bumped up until sellers are found.

This probably won't happen immediately. Market participants don't use market orders to buy billions of dollars worth of Bitcoin.

They buy slowly and steadily until there is no supply left. Eventually, sellers at sub-$100k run out. Then sub $150k, then sub $200k, etc.

Bitcoin ETFs are buying more Bitcoin than the current supply almost every day.

What happens when the newly created supply of bitcoin is cut in half and demand is still there?

You have to remember that most people have zero allocation to this asset.

The price must go up to satisfy the demand for bitcoin in terms of $ if enough Bitcoin isn't available to be bought on exchanges and through OTC trading.

Eg. Someone wants to buy $100,000 of Bitcoin but only $20,000 worth is available at the current price. If a market buy for the entire $100,000 is executed, the price will be bumped up until sellers are found.

This probably won't happen immediately. Market participants don't use market orders to buy billions of dollars worth of Bitcoin.

They buy slowly and steadily until there is no supply left. Eventually, sellers at sub-$100k run out. Then sub $150k, then sub $200k, etc.

Conclusion:

Bitcoin is a long-term game, so a lot of coins will be held for decades.

Something that you have to consider is that we have never seen an all-time high before a halving in the past.

Bitcoin balances on exchanges are the lowest they've been since 2017.

Some people still think that the halving will be canceled.

None of this is priced in.

In January 2025, Bitcoin's price will very likely be much higher than it is today!

Bitcoin is a long-term game, so a lot of coins will be held for decades.

Something that you have to consider is that we have never seen an all-time high before a halving in the past.

Bitcoin balances on exchanges are the lowest they've been since 2017.

Some people still think that the halving will be canceled.

None of this is priced in.

In January 2025, Bitcoin's price will very likely be much higher than it is today!

I'm passionate about helping more people learn about #Bitcoin, but these threads take a long time to write.

If you found value in this post, make sure you like and retweet the first tweet, and subscribe to my FREE newsletter.

Rajatsonifinance.com

Thanks for reading!

If you found value in this post, make sure you like and retweet the first tweet, and subscribe to my FREE newsletter.

Rajatsonifinance.com

Thanks for reading!

جاري تحميل الاقتراحات...