ICT Charter Price Action Model 1 - Intraday Scalping Model Summary

Buy Model

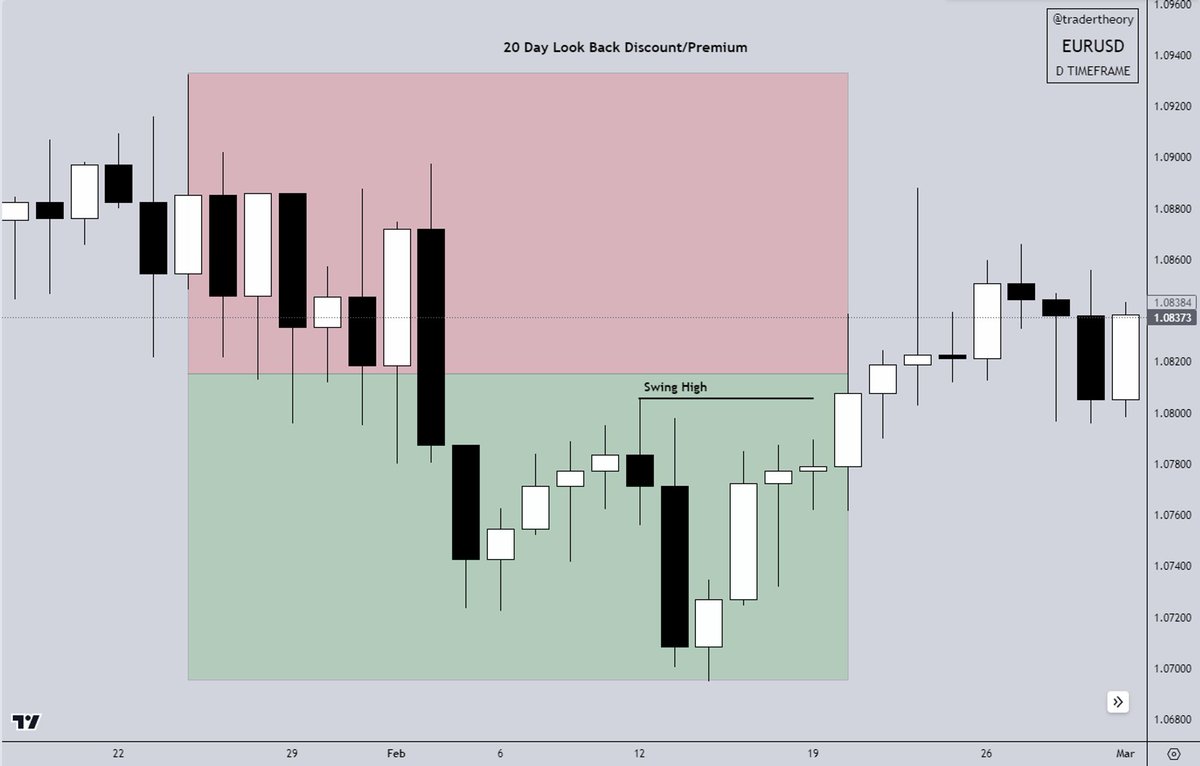

Buying only when the daily chart has taken out a swing high in the last 20 days and the price is not in a premium zone.

Buying can be considered at the Equilibrium of the 20 Day Look Back.

Ideal buys are Monday, Tuesday, and Wednesday New York Session.

Trade only in the NY Session 7-11am EST (a time when price is most likely to create movement and seek liquidity).

Use the bullish Optimal Trade Entry (OTE) on the 5 minute chart at the 62% retracement level on the fib (anchored on a NY Session swing low/high) - plus 5 pips for spread.

Aim for 10-20 pips.

Sell Model

Taking short positions only once the daily chart has taken out a swing low in the last 20 days and is not in a discount zone.

Buy Model

Buying only when the daily chart has taken out a swing high in the last 20 days and the price is not in a premium zone.

Buying can be considered at the Equilibrium of the 20 Day Look Back.

Ideal buys are Monday, Tuesday, and Wednesday New York Session.

Trade only in the NY Session 7-11am EST (a time when price is most likely to create movement and seek liquidity).

Use the bullish Optimal Trade Entry (OTE) on the 5 minute chart at the 62% retracement level on the fib (anchored on a NY Session swing low/high) - plus 5 pips for spread.

Aim for 10-20 pips.

Sell Model

Taking short positions only once the daily chart has taken out a swing low in the last 20 days and is not in a discount zone.

The Inner Circle Trader YouTube References

‘ICT Charter Price Action Model 1’

‘ICT - Mastering High Probability Scalping Vol. 1 to 3’

‘ICT OTE Pattern Recognition Series’

‘ICT Mentorship Core Content - Month 1 - Equilibrium Vs. Discount.’

‘ICT Mentorship Core Content - Month 1 - Equilibrium Vs. Premium’

‘ICT Mentorship Core Content - Month 05 - Using IPDA Data Ranges’

‘ICT Charter Price Action Model 1’

‘ICT - Mastering High Probability Scalping Vol. 1 to 3’

‘ICT OTE Pattern Recognition Series’

‘ICT Mentorship Core Content - Month 1 - Equilibrium Vs. Discount.’

‘ICT Mentorship Core Content - Month 1 - Equilibrium Vs. Premium’

‘ICT Mentorship Core Content - Month 05 - Using IPDA Data Ranges’

If this helped you learn ICT concepts be sure to follow me @Trader_Theory for more charter model summaries.

جاري تحميل الاقتراحات...