Big Boss (Part V)

Following leaks of a SEC campaign seeking to investigate the security status of ETH, I have some thoughts as to how this may fit into the current SEC landscape

Following leaks of a SEC campaign seeking to investigate the security status of ETH, I have some thoughts as to how this may fit into the current SEC landscape

Paul gives a good overview on the SEC’s historical acknowledgements re: ETH non-security status. This is the current landscape that the market has relied - including the CFTC, CME, ETFs, exchanges and investors. Reliance interests are incredibly high

Beyond simple anti-crypto animus, it’s worth thinking about why the SEC is choosing this moment to potentially reassess ETH’s status as non-security and what may be specifically motivating them. Motive meets opportunity.

My view, and there are other reasonable takes, is that the SEC needs a non-correlation objection to deny ETH spot ETFs this year and has a desire to avoid undermining the args in the CB/Binance actions – together representing the two biggest crypto issues the agency is managing.

On the ETH ETFs, My initial view in January concluded that, given approval would be the most stark/explicit endorsement of ETH’s non-security status to date, it did in fact risk undermining CB/Binance and the SEC’s entire crypto theory broadly/permanently.

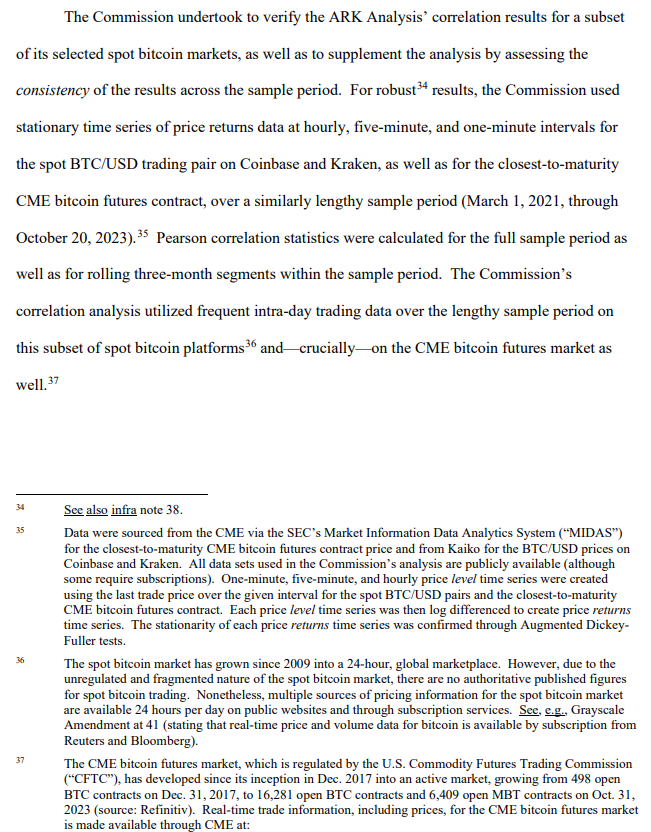

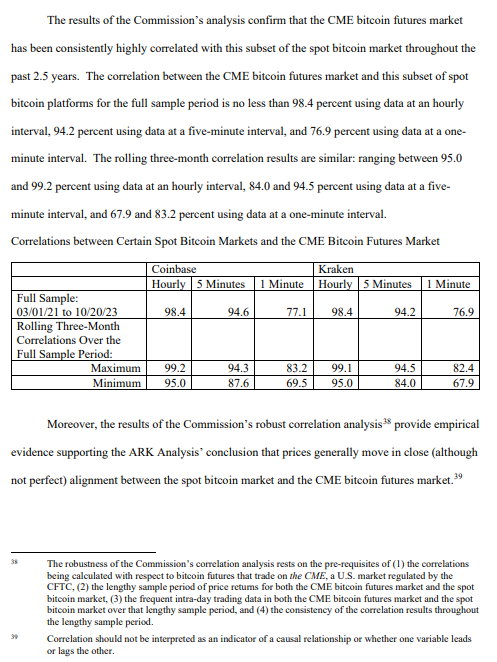

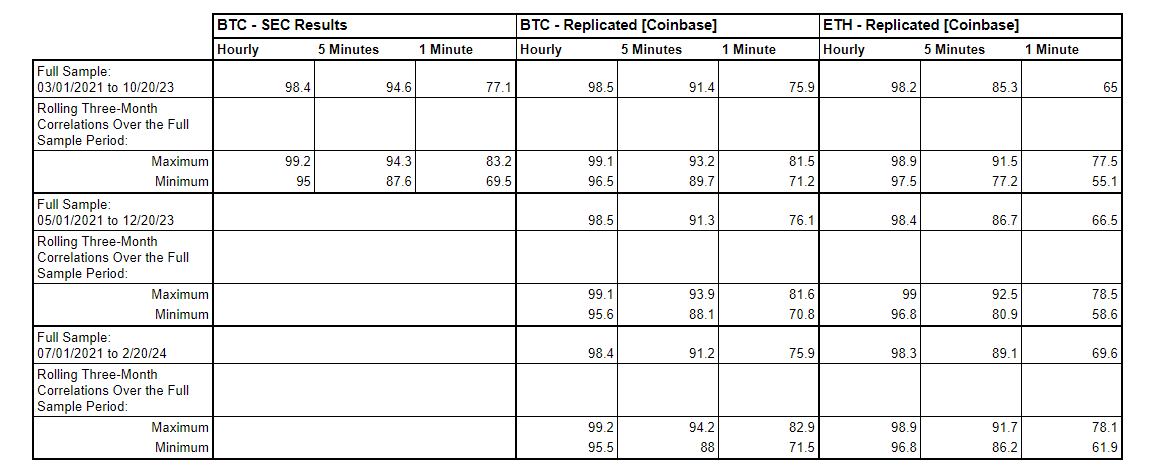

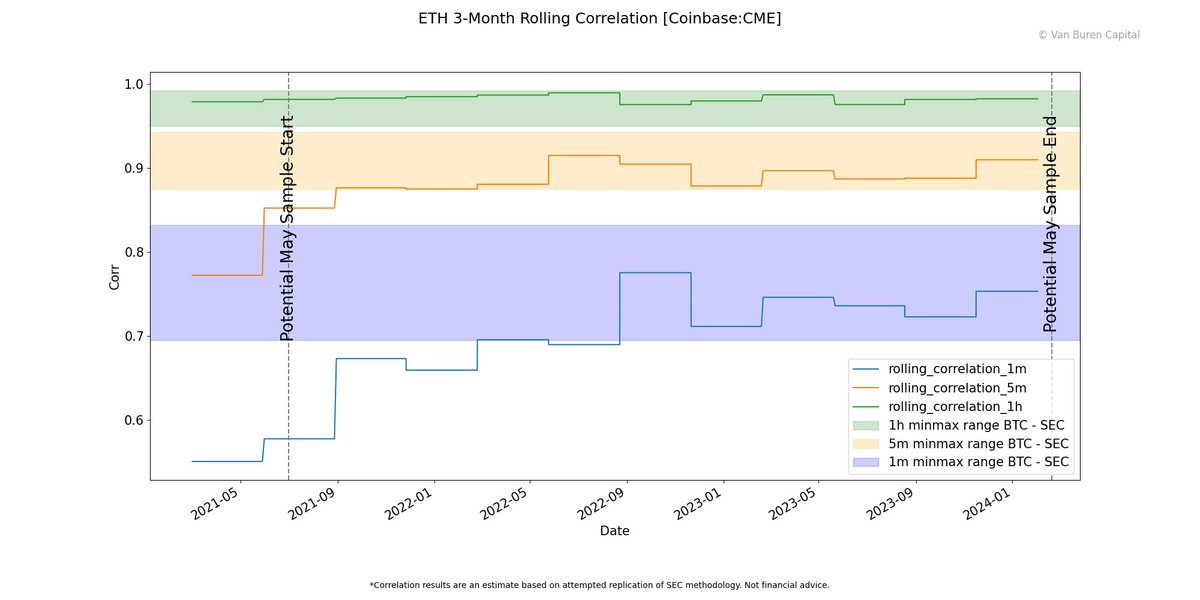

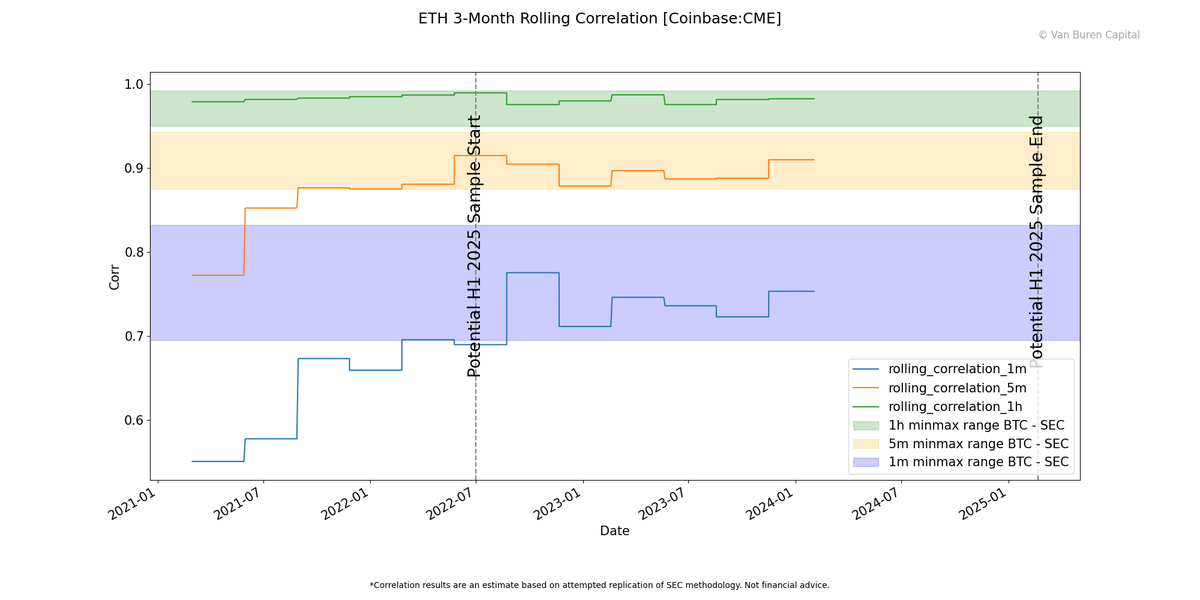

And, despite reasonable analysis by CB/Fidelity, I have high confidence the SEC COULD deny on correlation alone. Unfortunately, I don't think the SEC will find them persuasive. I’ll avoid detailing why here, since I don’t do the SEC’s dirty work, but certain parties can reach out

In any event, a denial based solely on correlation presents a couple of problems for the SEC.

That’s not to say the SEC couldn’t approve on 2024 corr levels, but it provides discretion imo. I mentioned this earlier this year, but my thoughts again assumed the SEC would stay away from the third rail – ETH security status.

(2) The follow up to this state of affairs is that if the SEC desires further optionality to deny into 2025 and beyond (perhaps to avoid undermining CB/Binance further out), correlation on its own is only a temporary/waning solution. Further optionality would require a rethink.

And if the SEC learned anything from BTC ETFs, it’s to be *very* careful in the *reasoning* provided in denials and specifically that it form a coherent whole across similar orders. Grayscale won bc the SEC made logical errors when approving futures and denying spot across time.

And failure to raise non-correlation analysis objection in a May denial could prove costly in the future once correlation came in line with BTC, and arguments might be made in another APA appeal for “arbitrary and capricious” action if they continue to deny.

So, if we take this information, in the context of an impending May deadline to force the SEC’s hand, imo we find motivation in the present for the SEC to further an investigation into ETH security status as an additional pretense to deny approval.

Two other recent events bolster the view: (1) SEC being wishy washy with CFTC regarding Prometheum using its SPBD license to custody ETH

And (2) Gary receiving a lot of flak from backers for not denying spot BTC ETFs (apparently in his refusal to use raw power to deny)

جاري تحميل الاقتراحات...