Advantages of Trigger Basis SL -

⭐️The biggest advantage of this type of SL is that you can take a larger position size as your SL is already defined.

⭐️Larger position size will lead to greater gains as compared to trades with closing basis sl.

⭐️You can avoid big losses by exiting the trades instantly after the price reaches the SL. Whereas in the case of Closing basis SL, if you enter with the same position size then your risk will be greater as the price may close below your SL by a huge margin.

⭐️Avoiding market crashes becomes relatively easier as you exit your trades instantly.

⭐️Equity curve will have very small dips as compared to when the equity curve starts trending up sharply due to heavier position size.

⭐️The biggest advantage of this type of SL is that you can take a larger position size as your SL is already defined.

⭐️Larger position size will lead to greater gains as compared to trades with closing basis sl.

⭐️You can avoid big losses by exiting the trades instantly after the price reaches the SL. Whereas in the case of Closing basis SL, if you enter with the same position size then your risk will be greater as the price may close below your SL by a huge margin.

⭐️Avoiding market crashes becomes relatively easier as you exit your trades instantly.

⭐️Equity curve will have very small dips as compared to when the equity curve starts trending up sharply due to heavier position size.

Disadvantages of Trigger Basis SL -

🔴If the SL is too close to your entry price then it may get triggered during sudden volatile days.

This is the only disadvantage that is worth considering while going with a trigger basis SL.

🔴If the SL is too close to your entry price then it may get triggered during sudden volatile days.

This is the only disadvantage that is worth considering while going with a trigger basis SL.

Example of Trigger Basis SL

#ITI - Here let's assume we kept our SL at 300 and our entry was 326. As you can see that price eventually dropped and hit the SL at 300.

If we waited for the price to close below 300 then our exit would have been at 281 which is almost below 6.3% from our SL level. This would lead to a grater loss as compared to exiting at 300.

#ITI - Here let's assume we kept our SL at 300 and our entry was 326. As you can see that price eventually dropped and hit the SL at 300.

If we waited for the price to close below 300 then our exit would have been at 281 which is almost below 6.3% from our SL level. This would lead to a grater loss as compared to exiting at 300.

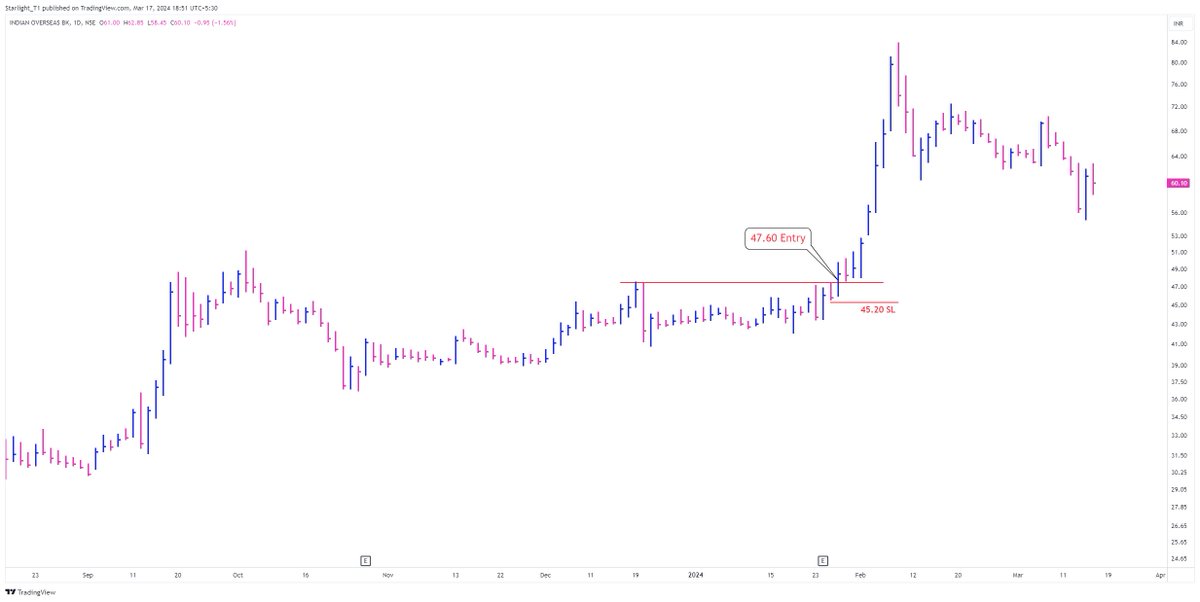

#IOB - Assuming we entered at 47.60 with SL at 45.20, as we can see that after the entry price went up significantly. By having a trigger basis SL, we are allowed to have a bigger position size which will lead to a big impact on your portfolio.

If we used Closing Basis SL then it would lead to a lower position size to manage the risk. And here in the case of IOB, that would mean missing out on a huge profit.

If we used Closing Basis SL then it would lead to a lower position size to manage the risk. And here in the case of IOB, that would mean missing out on a huge profit.

Now it's time to shift our focus to Closing Basis SL and why you should not use it other than for trailing your SL.

Here's a thread on How to trail your SL? x.com

Here's a thread on How to trail your SL? x.com

Advantages of Closing Basis SL -

⭐️Chances of getting thrown out of a trade because of a whipsaw are quite low.

⭐️Equity curve may end up being smooth.

And that wraps up the advantages :)

⭐️Chances of getting thrown out of a trade because of a whipsaw are quite low.

⭐️Equity curve may end up being smooth.

And that wraps up the advantages :)

Disadvantages of Closing Basis SL -

🔴Position size needs to be low to manage the risk and to avoid large drawdowns.

🔴Lower position size will lead to missing out on potential gains.

🔴Stock may end up faller further than your pre-defined exit level, leading to a big loss.

🔴During a market crash, most of your holding may end up being locked in the Lower Circuit.

🔴Using a monthly or a weekly Closing Basis SL can easily leave a big dent in your account.

🔴If the price falls 20% from your entry price, it needs to recover by 25% just to reach your entry level and be at breakeven. This leads to wasting time and money in a trade.

🔴Position size needs to be low to manage the risk and to avoid large drawdowns.

🔴Lower position size will lead to missing out on potential gains.

🔴Stock may end up faller further than your pre-defined exit level, leading to a big loss.

🔴During a market crash, most of your holding may end up being locked in the Lower Circuit.

🔴Using a monthly or a weekly Closing Basis SL can easily leave a big dent in your account.

🔴If the price falls 20% from your entry price, it needs to recover by 25% just to reach your entry level and be at breakeven. This leads to wasting time and money in a trade.

Example of Closing Basis SL

#ADSL - Here let's say you took a pullback entry and entered at 160 with a closing basis SL at 145. As you can see that price closed at 128.70. Which is more than 11% below 145 and almost 20% below the entry price of 160.

This clearly shows why Trigger Basis SL wins over Closing Basis SL.

Now Imagine using a monthly closing basis SL, the stock could easily fall more than 50% within a month if the conditions of the market aren't great. And in case there is a crash then closing more than 50% or all of it is quite possible.

#ADSL - Here let's say you took a pullback entry and entered at 160 with a closing basis SL at 145. As you can see that price closed at 128.70. Which is more than 11% below 145 and almost 20% below the entry price of 160.

This clearly shows why Trigger Basis SL wins over Closing Basis SL.

Now Imagine using a monthly closing basis SL, the stock could easily fall more than 50% within a month if the conditions of the market aren't great. And in case there is a crash then closing more than 50% or all of it is quite possible.

I hope you've found this thread helpful.

Follow me @Starlight_T1 for more.

Like/Retweet the first tweet below if you can: x.com

Follow me @Starlight_T1 for more.

Like/Retweet the first tweet below if you can: x.com

جاري تحميل الاقتراحات...