Define Smart Money Technique (SMT) Divergence

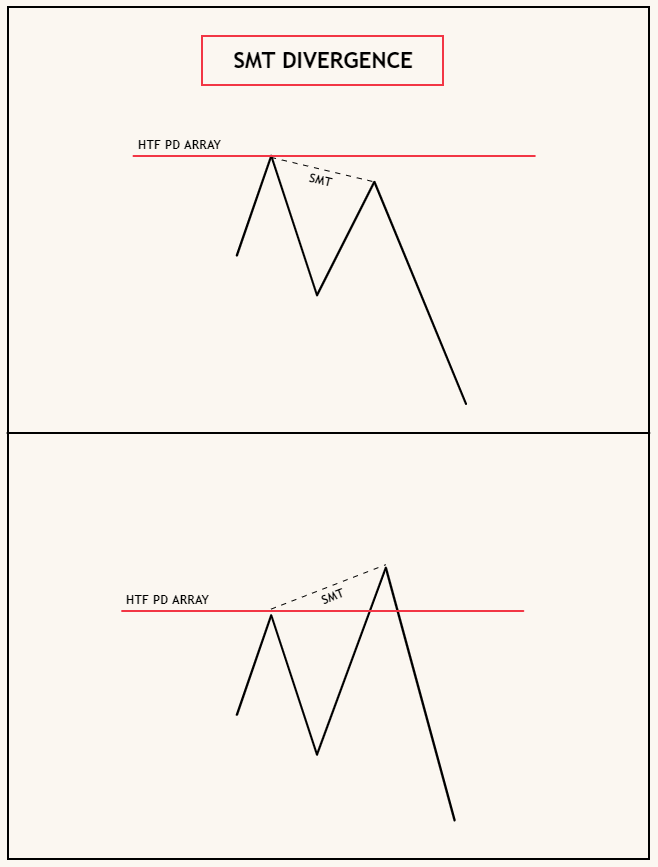

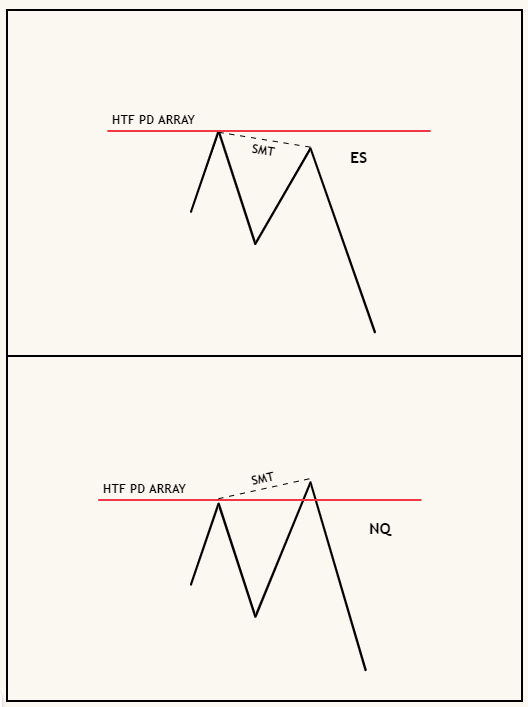

- SMT Divergence and HTF PD Arrays: SMT Divergence, an ICT concept, is most effective when combined with HTF PD Arrays rather than used alone. This collaboration can lead to significant profits.

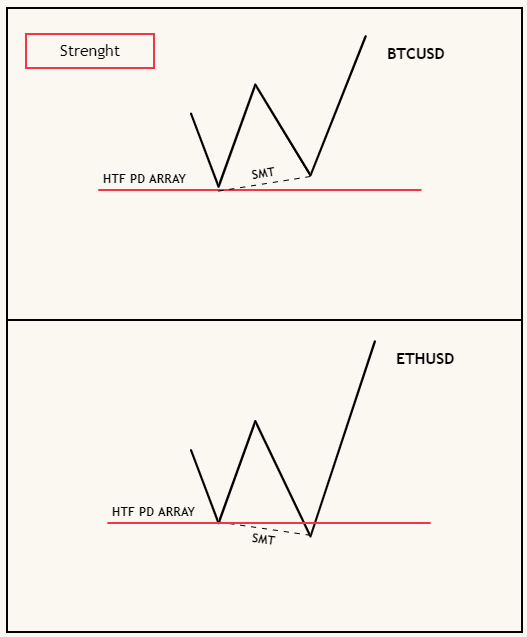

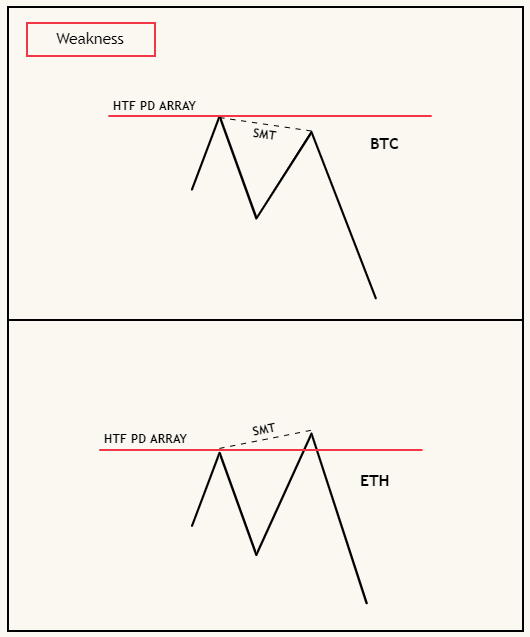

- SMT Divergence is not just a trading strategy, but a tool to assess market strength or weakness.

- Early Positioning Advantage: Traders who monitor SMT Divergences gain an advantage by positioning themselves earlier compared to those who focus solely on one market pair.

- SMT Divergence and HTF PD Arrays: SMT Divergence, an ICT concept, is most effective when combined with HTF PD Arrays rather than used alone. This collaboration can lead to significant profits.

- SMT Divergence is not just a trading strategy, but a tool to assess market strength or weakness.

- Early Positioning Advantage: Traders who monitor SMT Divergences gain an advantage by positioning themselves earlier compared to those who focus solely on one market pair.

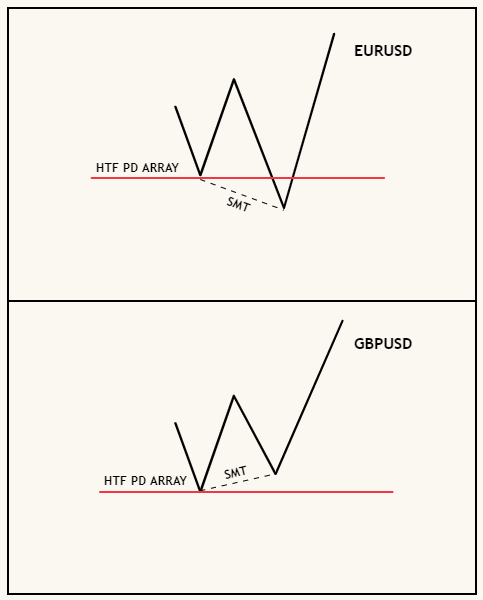

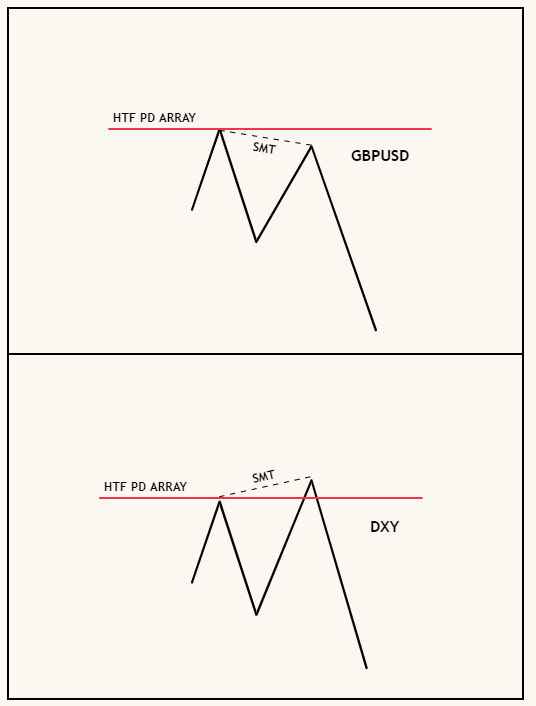

- EURUSD and GBPUSD typically move together most of the time due to their direct correlation.

- Ideally, both currency pairs should trigger their High Time Frame Price Distribution Arrays (HTF PD Arrays) simultaneously, but this doesn't always occur.

- In instances where EURUSD activates its HTF PD Array while GBPUSD doesn't, a divergence is created.

- If you're a trader solely focusing on GBPUSD in such situations, your orders may lag behind.

- However, if you understand the (SMT) and observe that EURUSD has activated its HTF PD Array and is showing strength, you can anticipate this movement and initiate long positions on GBPUSD at the indicated optimal moment.

- Ideally, both currency pairs should trigger their High Time Frame Price Distribution Arrays (HTF PD Arrays) simultaneously, but this doesn't always occur.

- In instances where EURUSD activates its HTF PD Array while GBPUSD doesn't, a divergence is created.

- If you're a trader solely focusing on GBPUSD in such situations, your orders may lag behind.

- However, if you understand the (SMT) and observe that EURUSD has activated its HTF PD Array and is showing strength, you can anticipate this movement and initiate long positions on GBPUSD at the indicated optimal moment.

Join for Educational content and weekly layout : t.me

جاري تحميل الاقتراحات...