5 things that happened this week (Egypt special):

Big policy moves on 6 March:

- Lifting interest rates by 6 percentage points

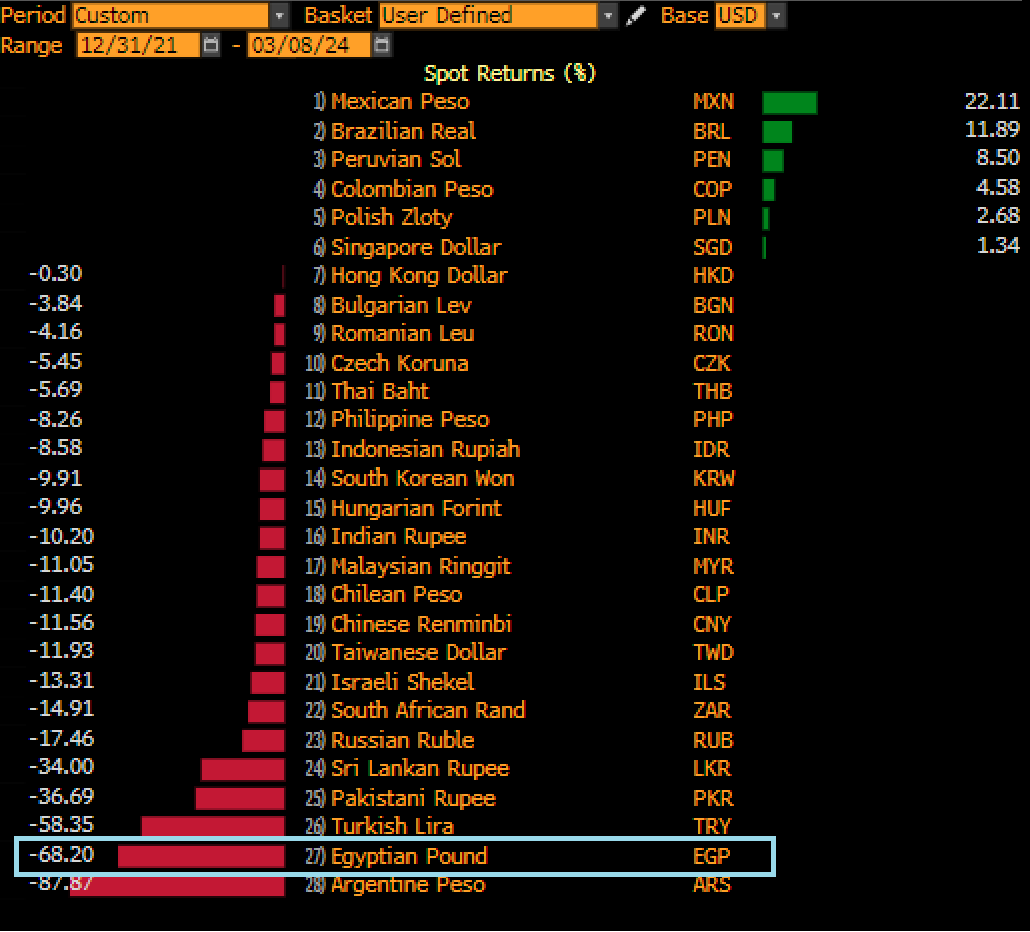

- Floating the currency, leading to a 38% decline on the day (chart)

- Agreeing on a loan with the IMF

1/5

bloomberg.com

Big policy moves on 6 March:

- Lifting interest rates by 6 percentage points

- Floating the currency, leading to a 38% decline on the day (chart)

- Agreeing on a loan with the IMF

1/5

bloomberg.com

Egypt expects the steps will unlock $20 bn of funding:

• $8 bn from the IMF loan

• $1.2 bn from the IMF's Resilience and Sustainability Facility

• Rest from: World Bank, EU, Japan, UK

2/5

bloomberg.com

• $8 bn from the IMF loan

• $1.2 bn from the IMF's Resilience and Sustainability Facility

• Rest from: World Bank, EU, Japan, UK

2/5

bloomberg.com

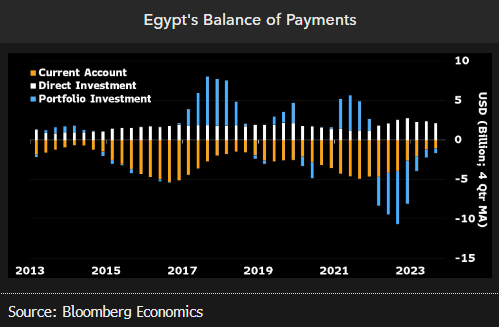

And hot money could return to Egypt:

- Hot money: borrows where interest rates are low, to invest where they're high

- Egypt was hot-money darling in 2017-21 (blue in chart)

- It's re-opening the path now by: raising rates, removing currency controls

3/5

bloomberg.com

- Hot money: borrows where interest rates are low, to invest where they're high

- Egypt was hot-money darling in 2017-21 (blue in chart)

- It's re-opening the path now by: raising rates, removing currency controls

3/5

bloomberg.com

The trigger for this week's events in Egypt was a mega UAE bailout on 23 Feb

Abu Dhabi will invest $35 bn in real-estate projects, mostly in an area called Ras El-Hekma

Saudi is also in talks to develop a Red Sea area, called Ras Gamila

4/5

bloomberg.com

Abu Dhabi will invest $35 bn in real-estate projects, mostly in an area called Ras El-Hekma

Saudi is also in talks to develop a Red Sea area, called Ras Gamila

4/5

bloomberg.com

جاري تحميل الاقتراحات...