1/n

RSI, developed in 1978, is still the most widely used indicator.

There’s a reason that it has remained AGELESS.

Let’s explore the secrets.

A 🧵

#NIFTYFUTURE #banknifty #stockmarketcrash

RSI, developed in 1978, is still the most widely used indicator.

There’s a reason that it has remained AGELESS.

Let’s explore the secrets.

A 🧵

#NIFTYFUTURE #banknifty #stockmarketcrash

2/n

In this thread, we will see

1.Significance of RSI

2.RSI divergence

3.RSI in strong trends

4.RSI near support/resistance

5.RSI trendline breakouts

Some golden Nuggets at the end of thread

In this thread, we will see

1.Significance of RSI

2.RSI divergence

3.RSI in strong trends

4.RSI near support/resistance

5.RSI trendline breakouts

Some golden Nuggets at the end of thread

6/n

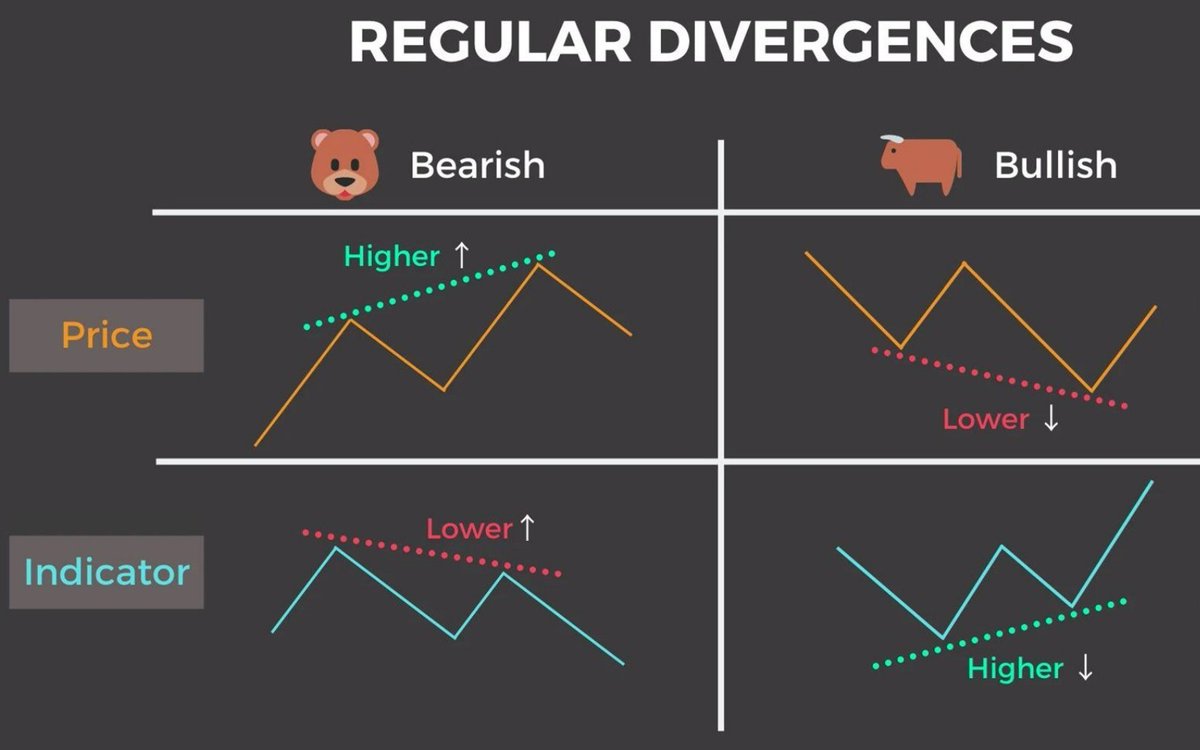

RSI divergence indicates when a trend is fading giving early signal for entry/exit.

There are two types of divergence - Bullish and Bearish divergence

Image: @TheBirbNest

RSI divergence indicates when a trend is fading giving early signal for entry/exit.

There are two types of divergence - Bullish and Bearish divergence

Image: @TheBirbNest

13/n

Golden Nuggets:

Keep in Mind that RSI is a lagging indicator. It helps you get info that your naked eye can’t see

RSI should always be clubbed with Price Action/ other indicators for better results

Golden Nuggets:

Keep in Mind that RSI is a lagging indicator. It helps you get info that your naked eye can’t see

RSI should always be clubbed with Price Action/ other indicators for better results

We keep posting such content for Stock Market.

If you liked the thread Please follow @RupeezyOfficial

Like and retweet the first tweet for max reach.

If you liked the thread Please follow @RupeezyOfficial

Like and retweet the first tweet for max reach.

جاري تحميل الاقتراحات...