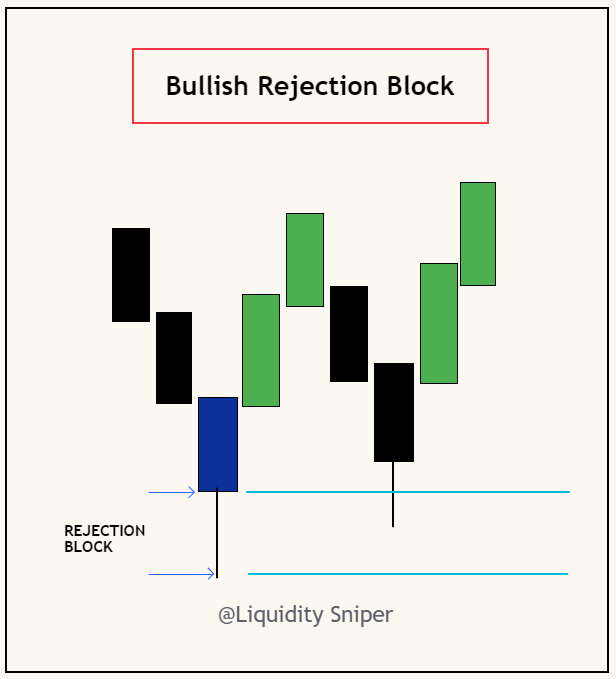

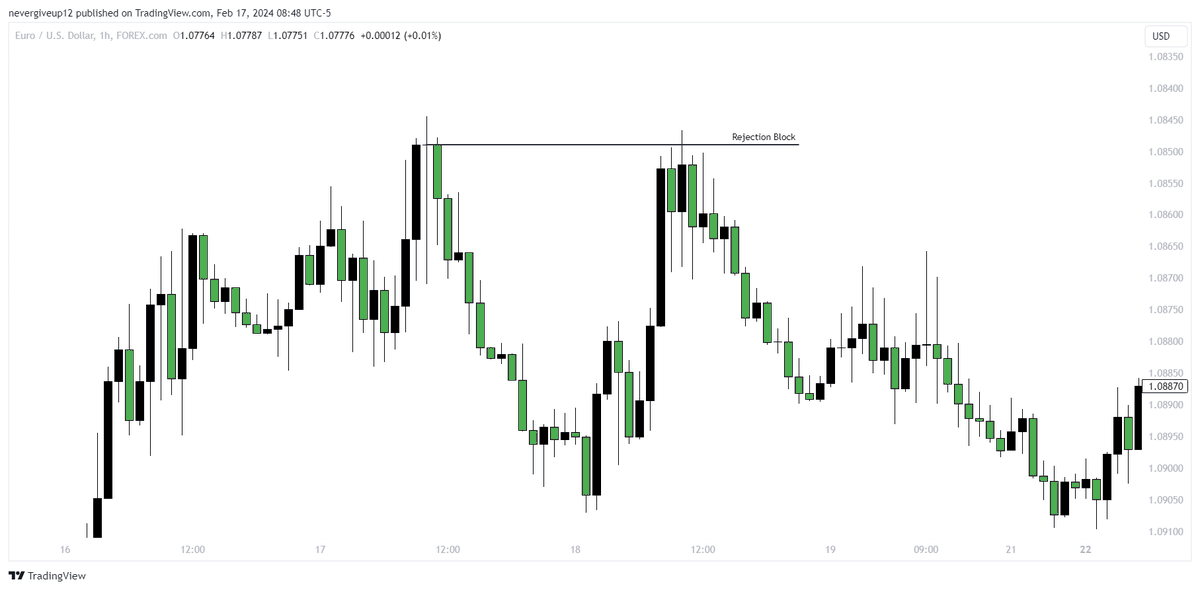

- This marks a shift into a Premium array and often signals a bull flag formation. Remember, price doesn't always need to make higher highs for a failure swing.

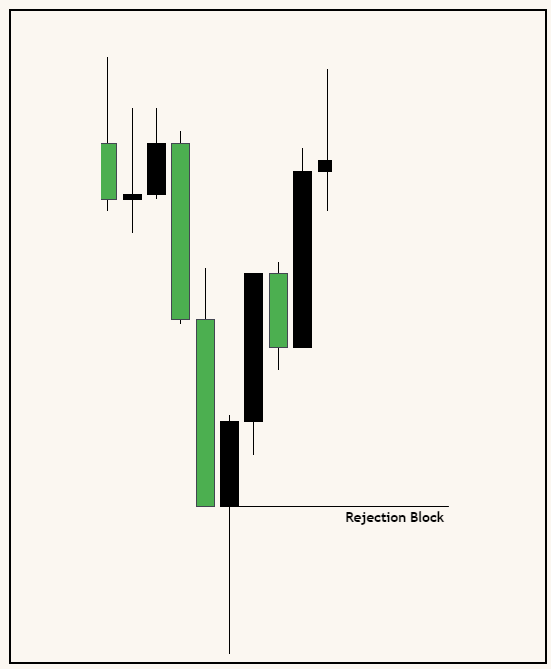

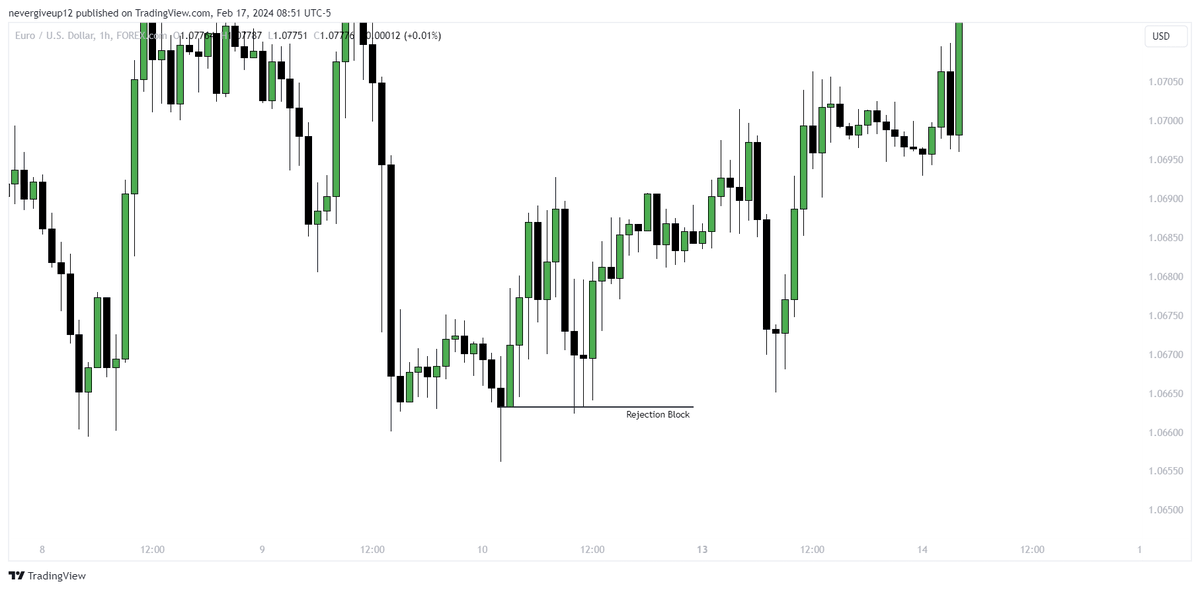

- Understanding price action basics - open, high, low, close - and focusing on swing highs and lows can reveal distribution and accumulation patterns at turning points.

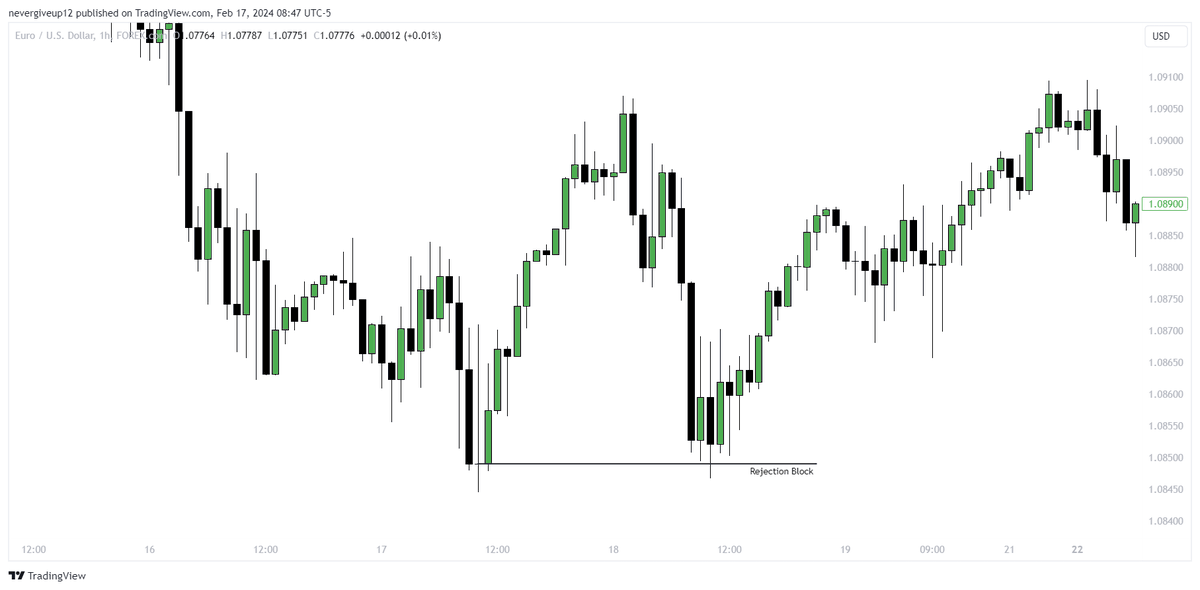

Example :

- Understanding price action basics - open, high, low, close - and focusing on swing highs and lows can reveal distribution and accumulation patterns at turning points.

Example :

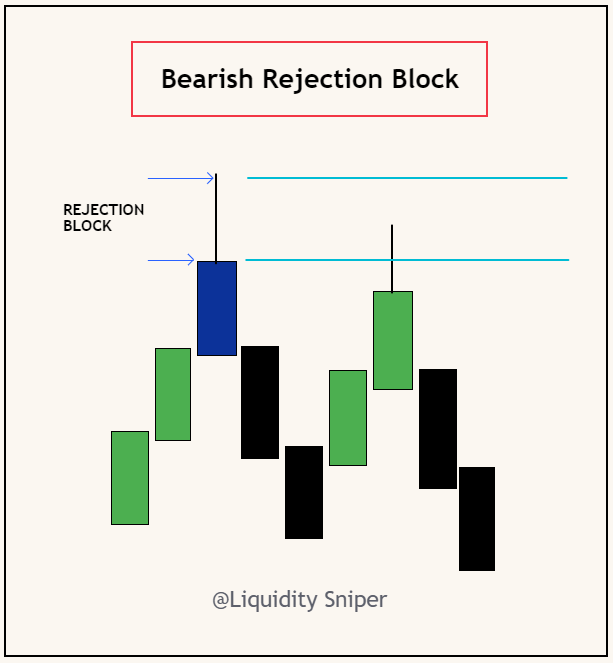

- While wicks indicate pattern formation, focus on the highest close/open at the swing high. It's not about whether the candle closes bullish or bearish - the wick signifies a Bearish Order Block.

- This is one of the few instances where selling on a stop order is used as an entry pattern. Alternatively, enter on the close or wait for a bit of downward movement.

- This is one of the few instances where selling on a stop order is used as an entry pattern. Alternatively, enter on the close or wait for a bit of downward movement.

Join for Educational content and weekly layout👇 :

t.me

t.me

جاري تحميل الاقتراحات...