What is an Order Blocks?

- Definition: Order blocks are significant zones in the market where major buy or sell orders from institutional traders have been executed.

- These clusters are located at specific price regions within the market.

- Order blocks exert significant influence over price action, market sentiment, and liquidity.

- Definition: Order blocks are significant zones in the market where major buy or sell orders from institutional traders have been executed.

- These clusters are located at specific price regions within the market.

- Order blocks exert significant influence over price action, market sentiment, and liquidity.

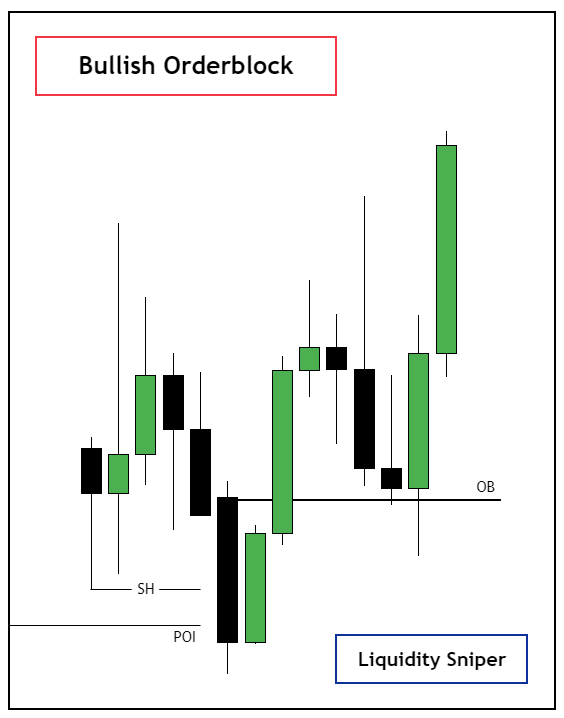

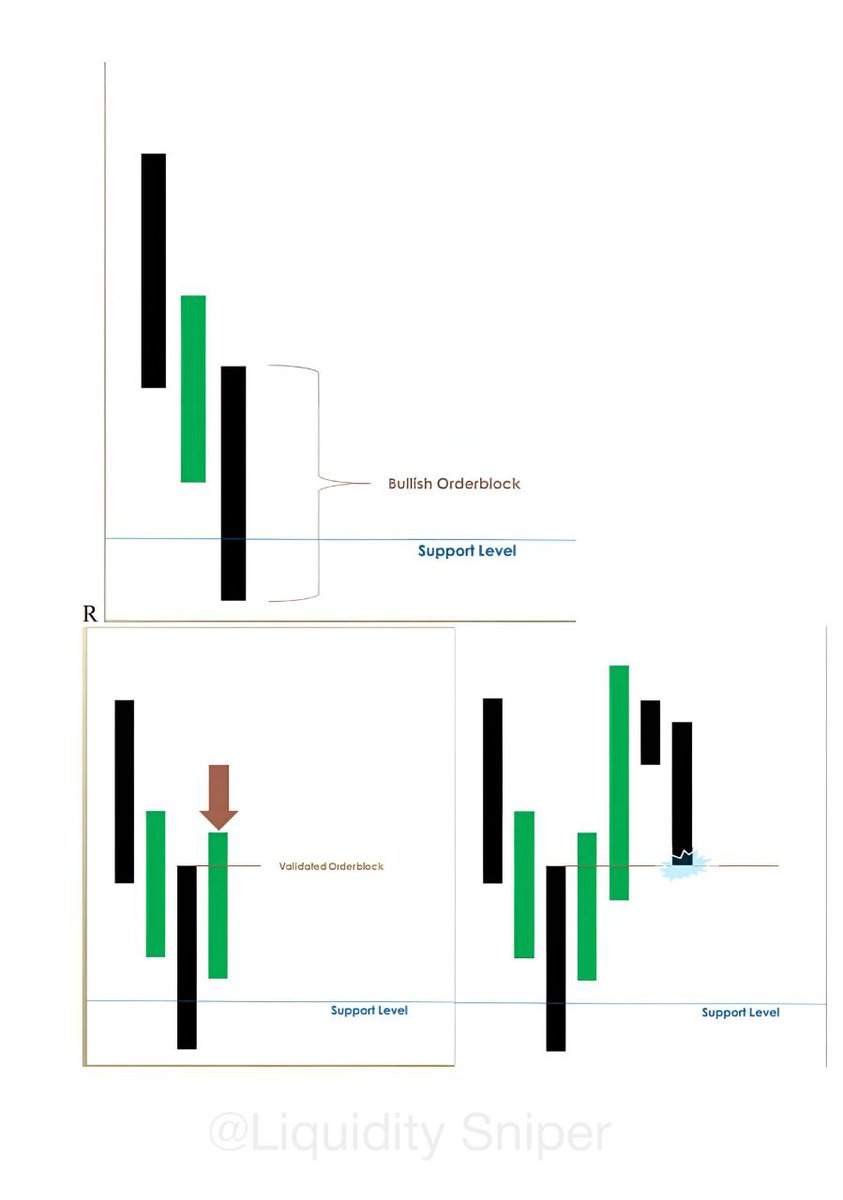

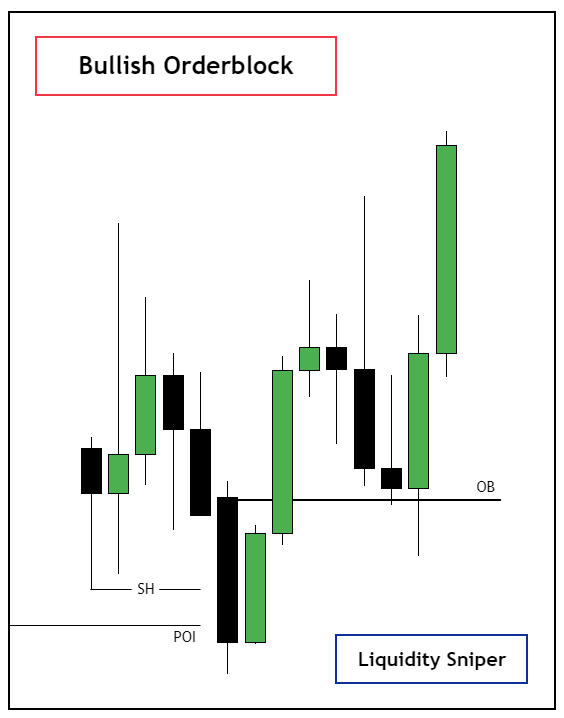

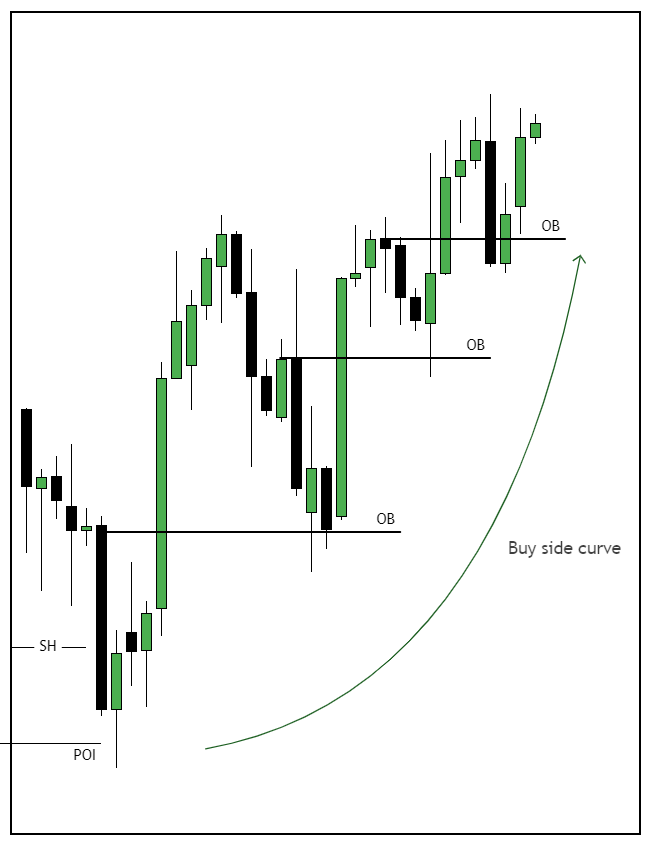

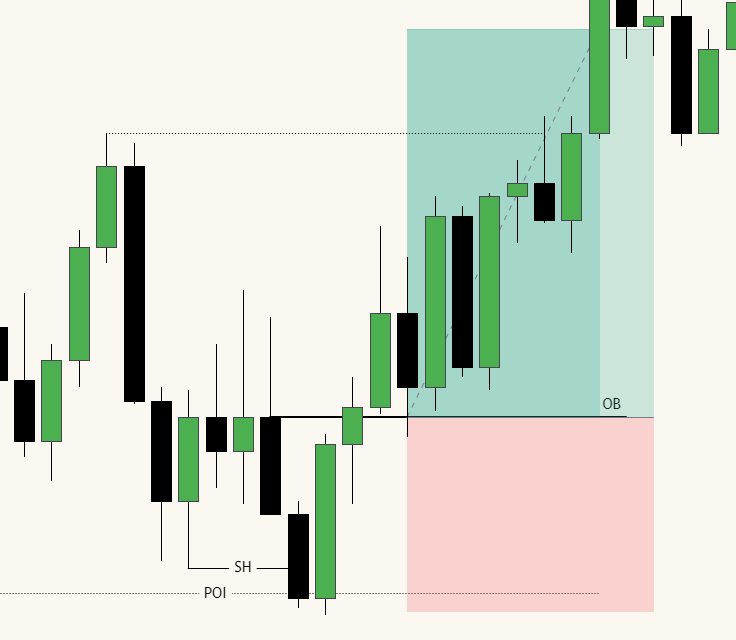

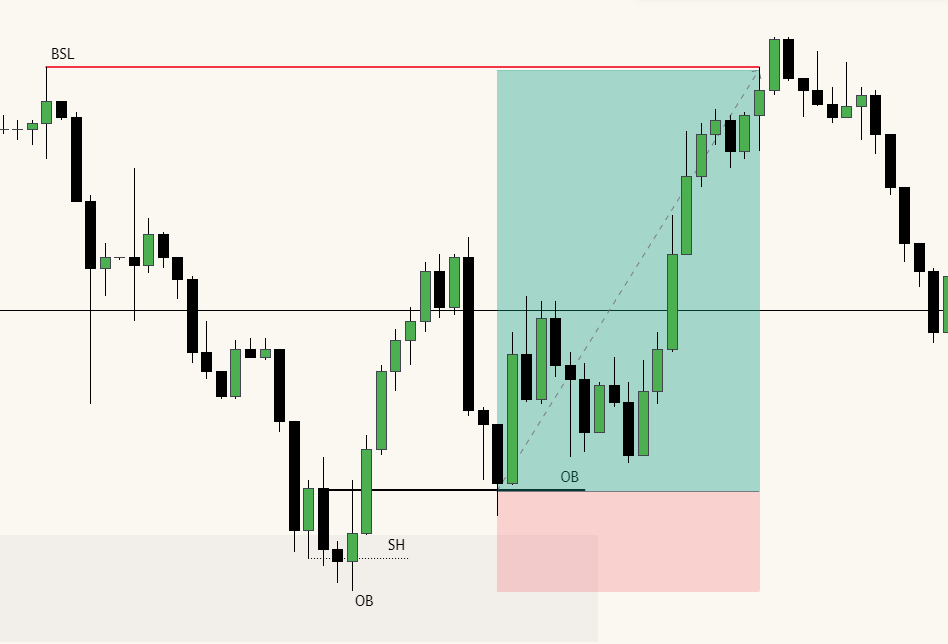

Bullish Order Block:

- Last downward candle before a significant upward movement.

- Indicates a key level where institutional traders placed substantial buy orders.

- Results in a strong market rally from that point.

- Before marking an Order Block for high probability, keep in mind some key points such as stop hunts, higher timeframe points of interest (like FVG, OB, etc.).

- Last downward candle before a significant upward movement.

- Indicates a key level where institutional traders placed substantial buy orders.

- Results in a strong market rally from that point.

- Before marking an Order Block for high probability, keep in mind some key points such as stop hunts, higher timeframe points of interest (like FVG, OB, etc.).

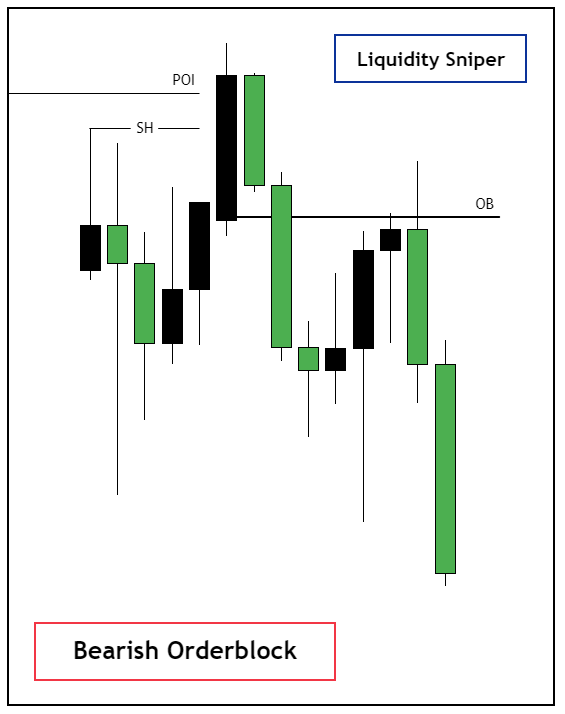

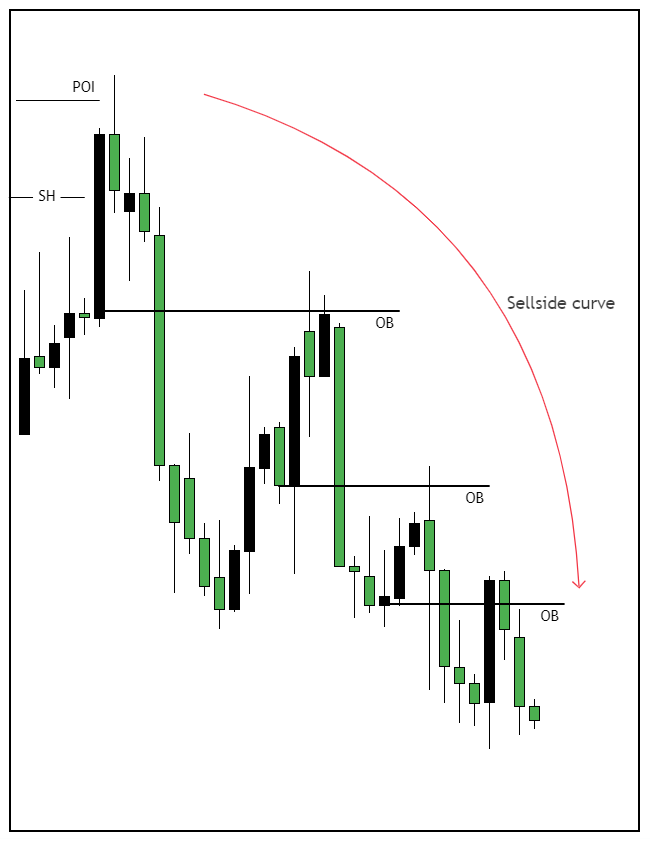

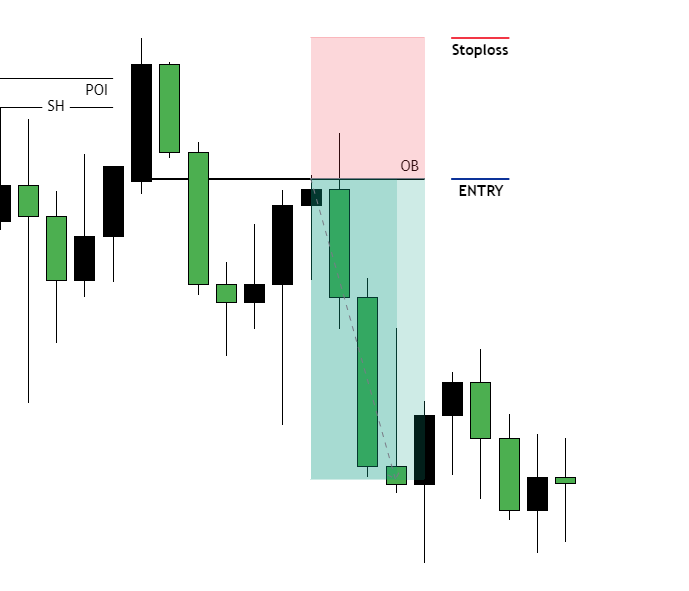

Bearish Order Block:

- Last upward closing candle before a sharp downward movement.

- Indicates a critical level where institutional traders placed significant sell orders.

- Leads to a significant decline in the market.

- Before marking an Order Block for high probability, keep in mind some key points such as stop hunts, higher timeframe points of interest (like FVG, OB, etc.).

- Last upward closing candle before a sharp downward movement.

- Indicates a critical level where institutional traders placed significant sell orders.

- Leads to a significant decline in the market.

- Before marking an Order Block for high probability, keep in mind some key points such as stop hunts, higher timeframe points of interest (like FVG, OB, etc.).

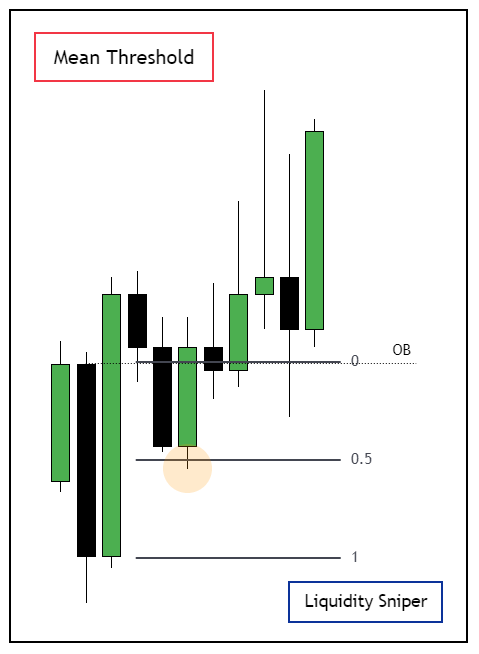

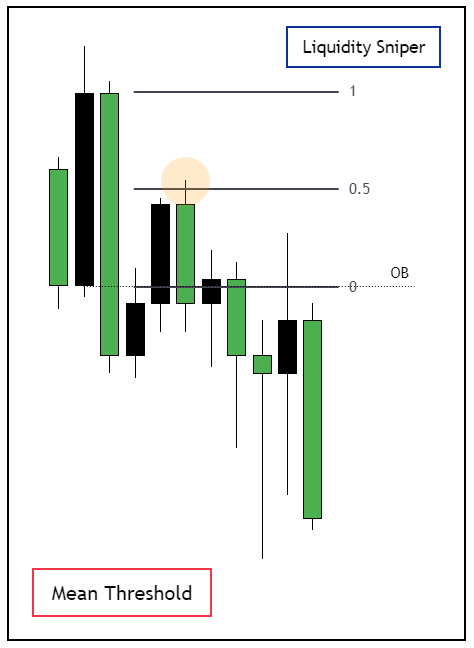

MEAN THRESHOLD :

- Understanding the mean threshold of the Opening Balance (OB) is a valuable tip in trading analysis.

- To determine the mean threshold, utilize a Fibonacci tool, placing it at the high and low points of the candle body, excluding the wicks.

- The mean threshold represents the midpoint, precisely at the 50% point, of the candle body.

- Understanding the mean threshold of the Opening Balance (OB) is a valuable tip in trading analysis.

- To determine the mean threshold, utilize a Fibonacci tool, placing it at the high and low points of the candle body, excluding the wicks.

- The mean threshold represents the midpoint, precisely at the 50% point, of the candle body.

- The significance of the mean threshold lies in its indication of the OB's strength. If the price closes below or above this mean threshold, the OB is more likely to fail in maintaining its position.

- Conversely, when the price respects the mean threshold, it suggests a higher probability of the OB holding firm.

- Conversely, when the price respects the mean threshold, it suggests a higher probability of the OB holding firm.

Join for Educational content and weekly layout : t.me

I use to trade @DeiFunded

𝗕𝘂𝘆 𝗼𝗻𝗲 𝗴𝗲𝘁 𝗼𝗻𝗲 𝗳𝗿𝗲𝗲 + 𝟱𝟬% OFF

Use code "BOGO50" and only 100 left checkout :

deifunded.com

𝗕𝘂𝘆 𝗼𝗻𝗲 𝗴𝗲𝘁 𝗼𝗻𝗲 𝗳𝗿𝗲𝗲 + 𝟱𝟬% OFF

Use code "BOGO50" and only 100 left checkout :

deifunded.com

جاري تحميل الاقتراحات...