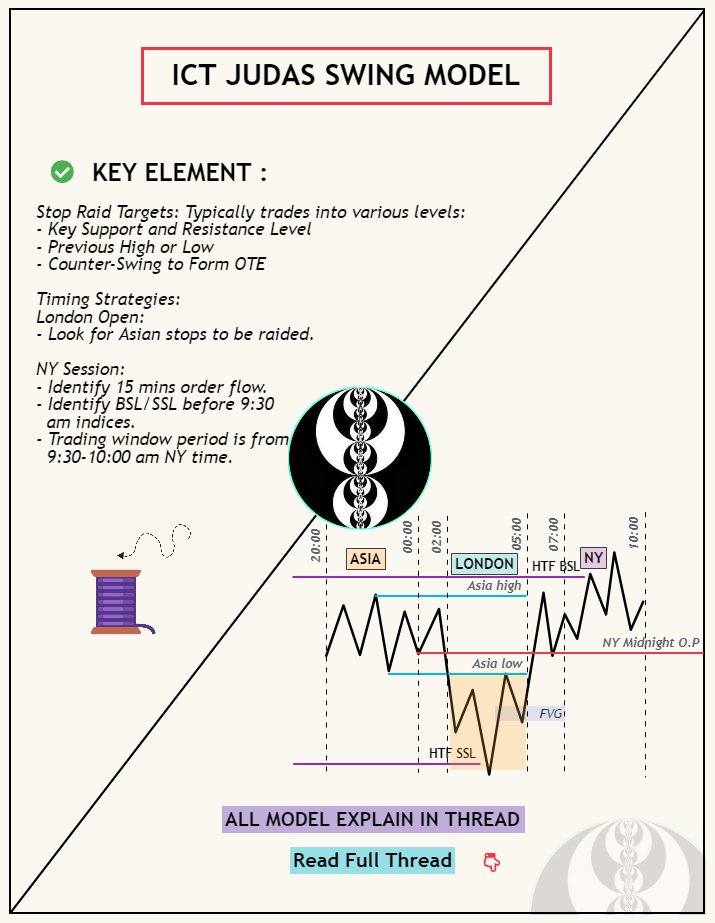

Do you no what is Ict judas swing?

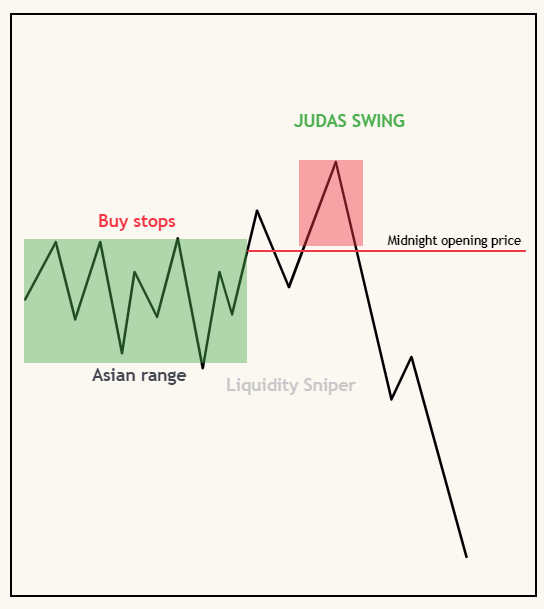

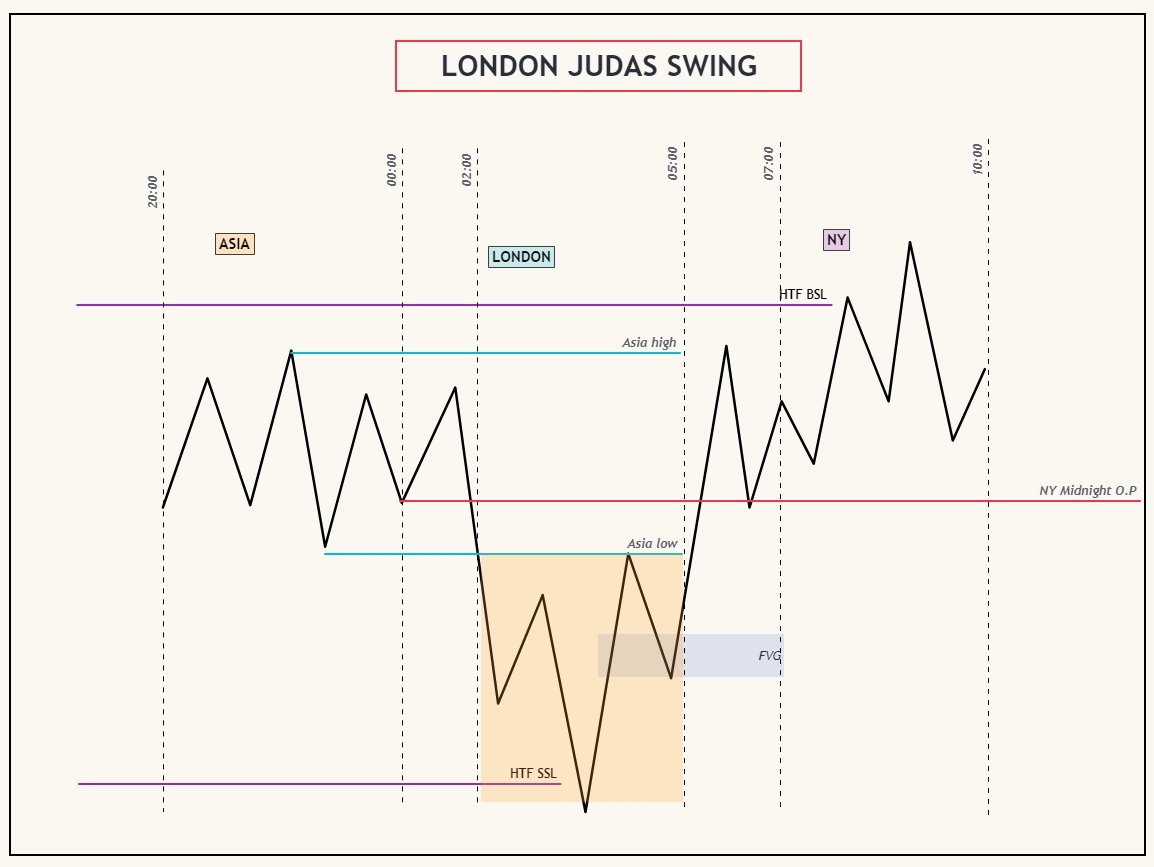

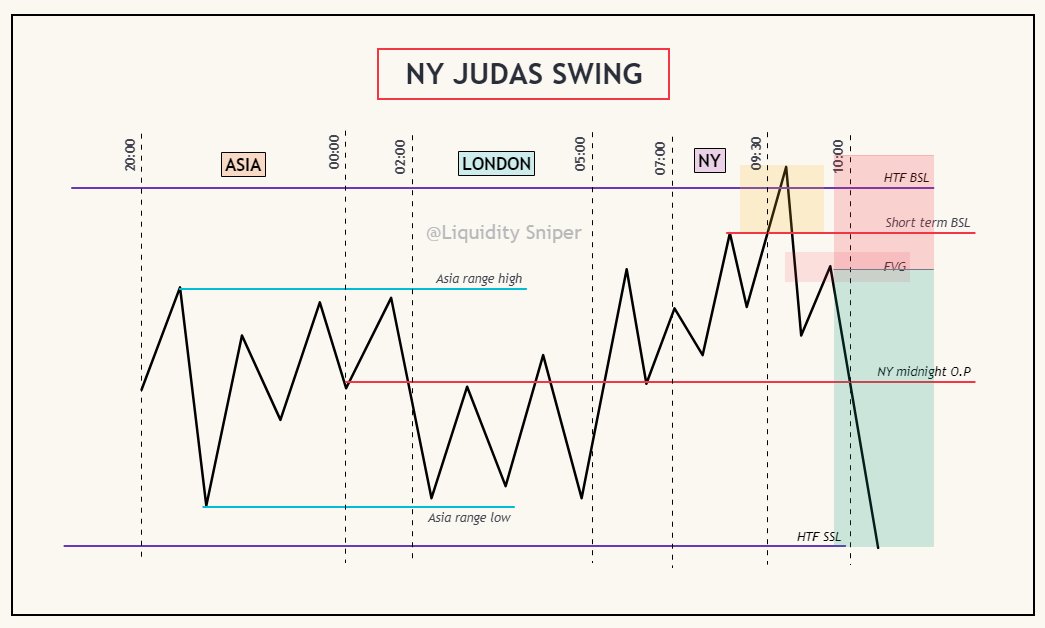

- "Judas Swing" is a term used in trading to describe a deceptive price move intended to shake out retail traders before the market turns in the desired direction.

Credit : @I_Am_The_ICT

- "Judas Swing" is a term used in trading to describe a deceptive price move intended to shake out retail traders before the market turns in the desired direction.

Credit : @I_Am_The_ICT

Join for Free education and weekly outlook : t.me

جاري تحميل الاقتراحات...