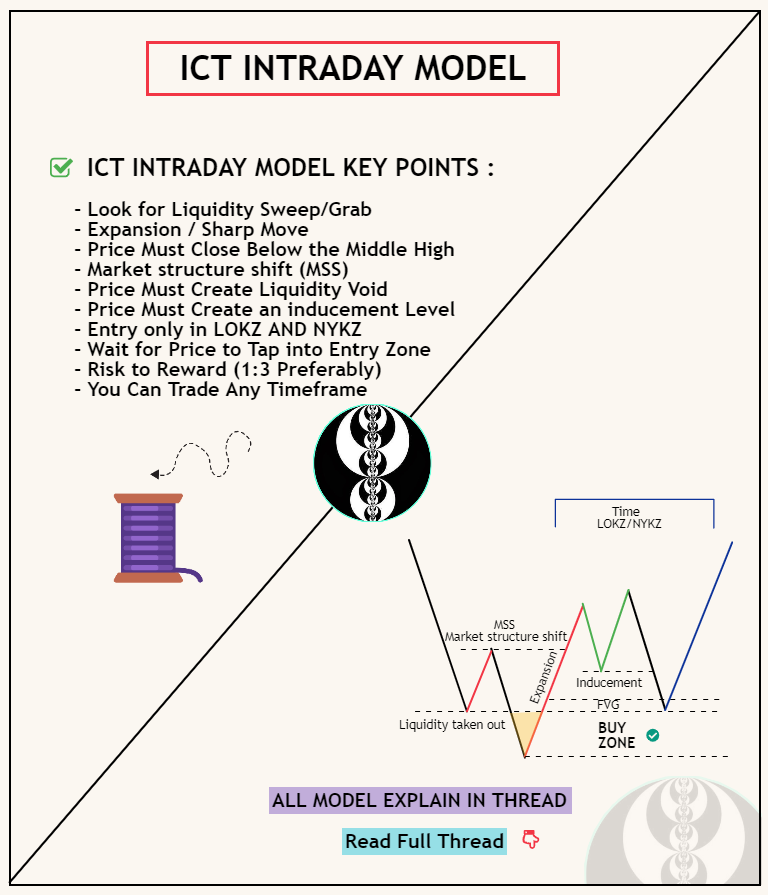

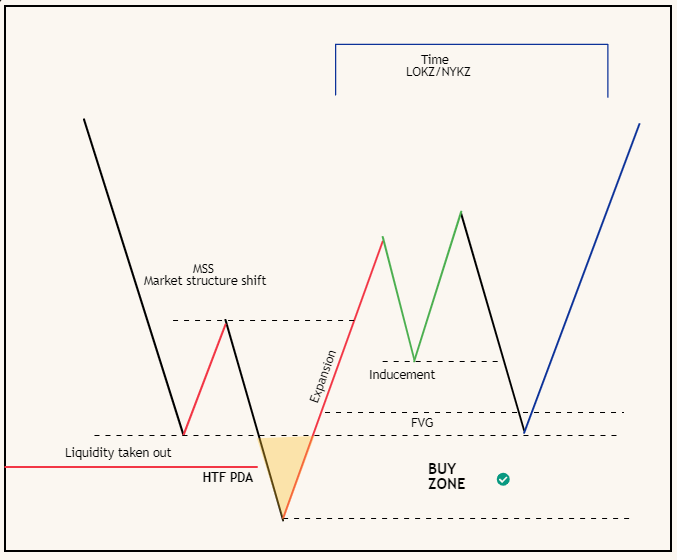

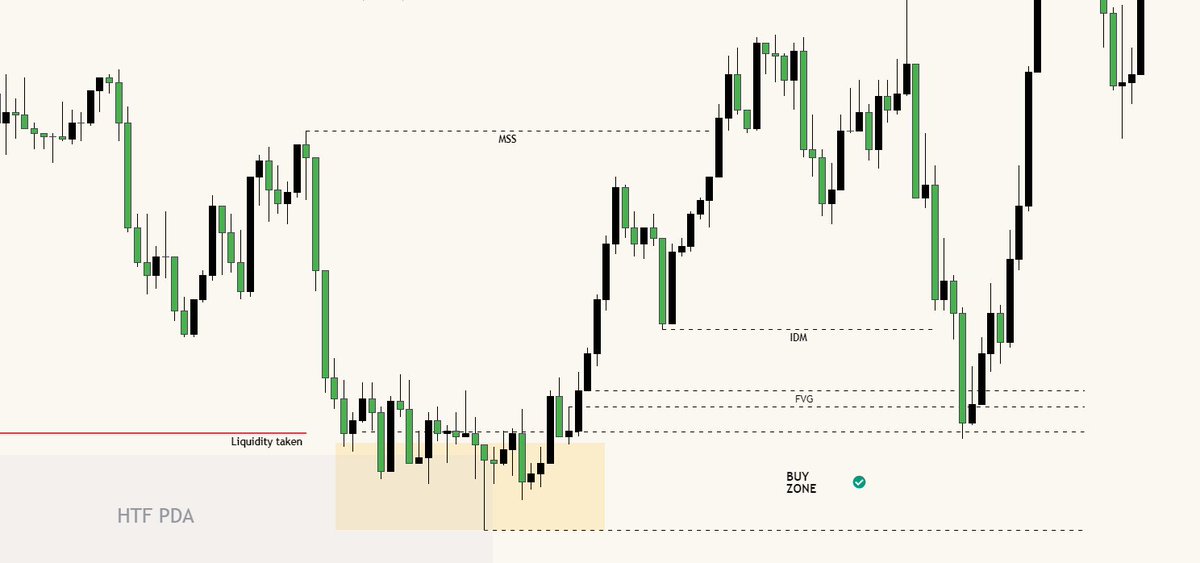

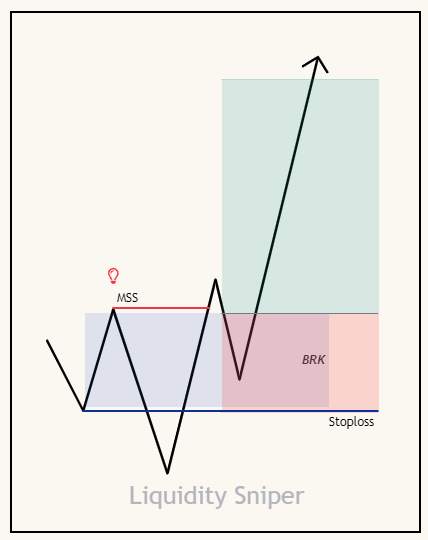

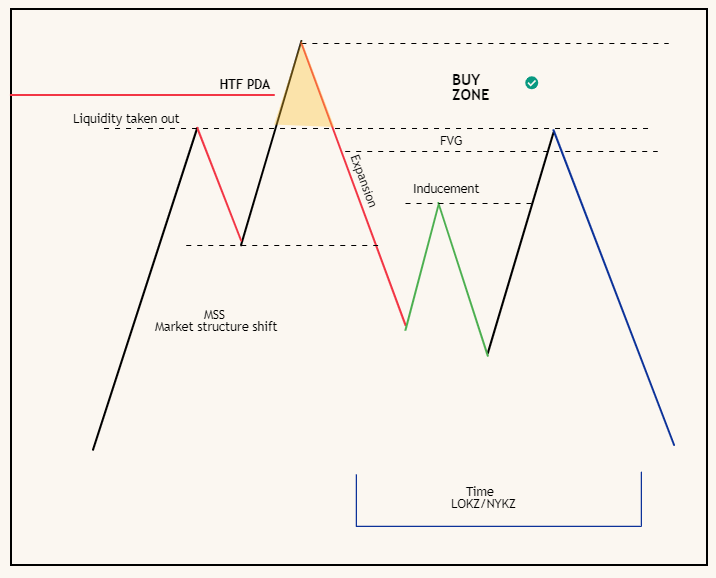

This strategy combines technical analysis, market structure observations, and specific entry criteria to guide trading decisions.

💎Free educational channel :

t.me

💎Free educational channel :

t.me

جاري تحميل الاقتراحات...