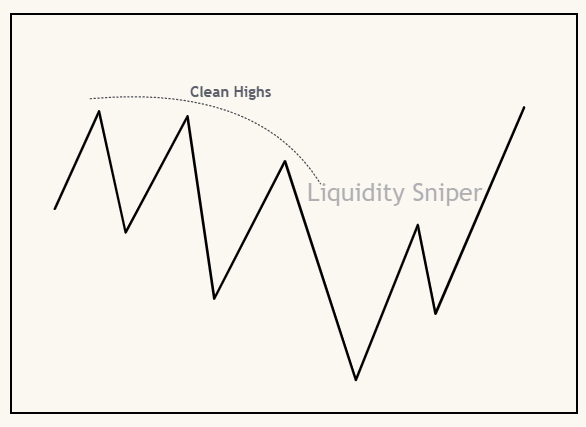

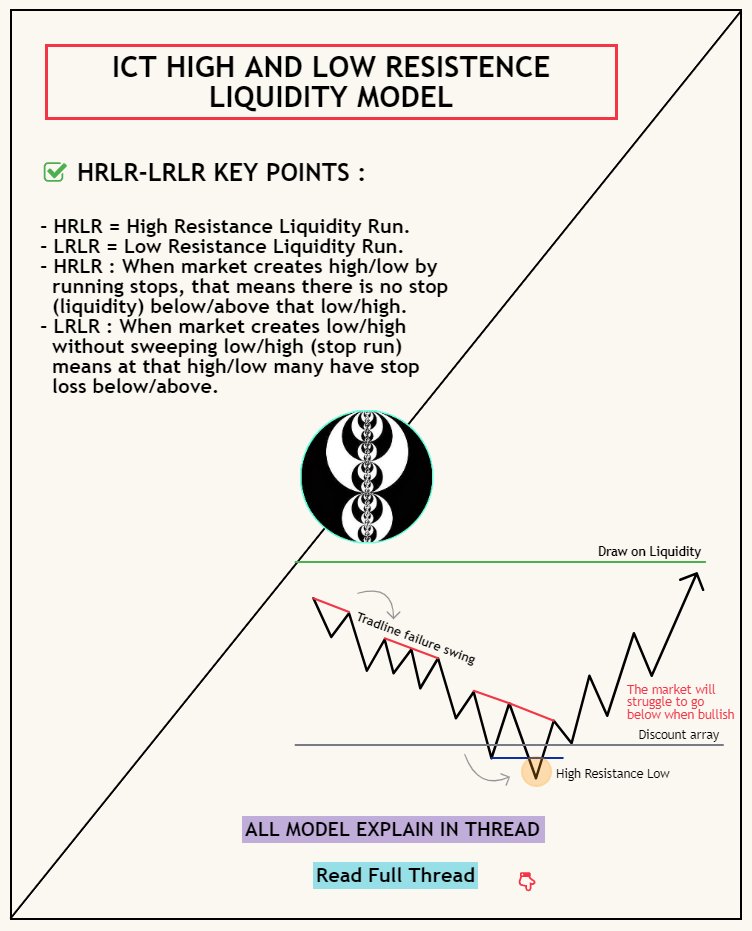

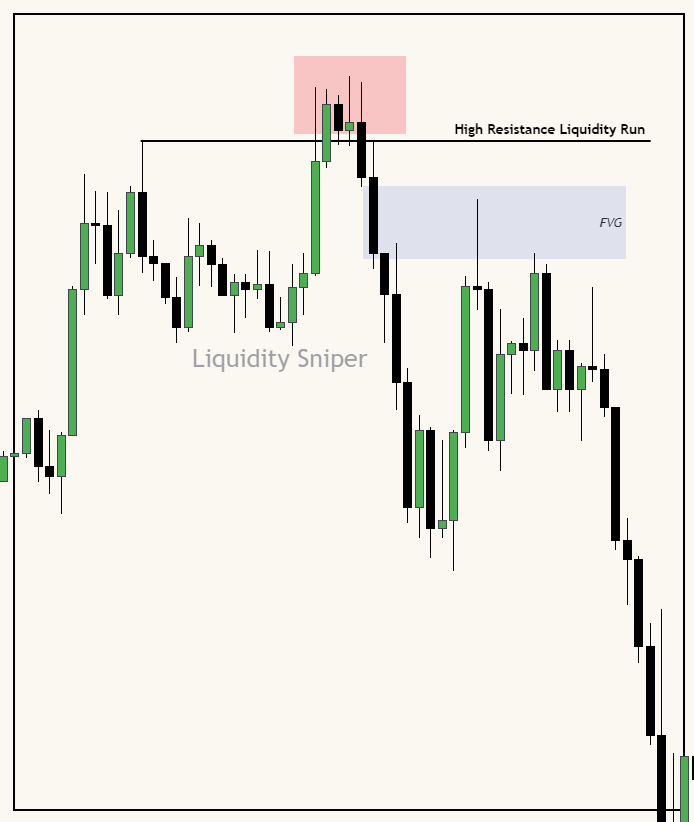

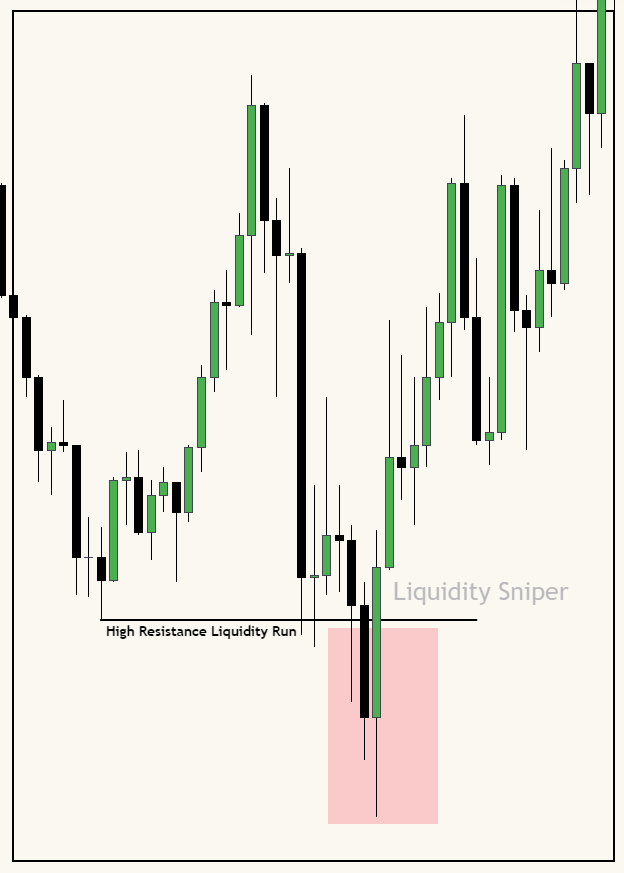

1. High Resistance Liquidity Run [HRLR] :

- When the market creates a high/low by running stops, that means there is no stop (liquidity) below/above that low/high.

- The algorithm takes time to target those liquidity in the market.

Credit : @I_Am_The_ICT

- When the market creates a high/low by running stops, that means there is no stop (liquidity) below/above that low/high.

- The algorithm takes time to target those liquidity in the market.

Credit : @I_Am_The_ICT

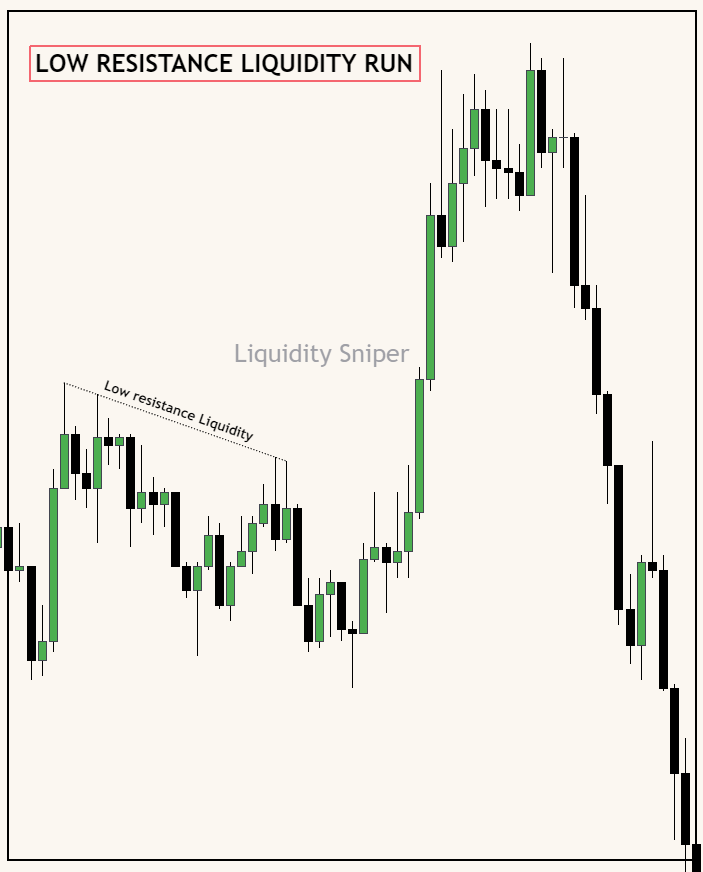

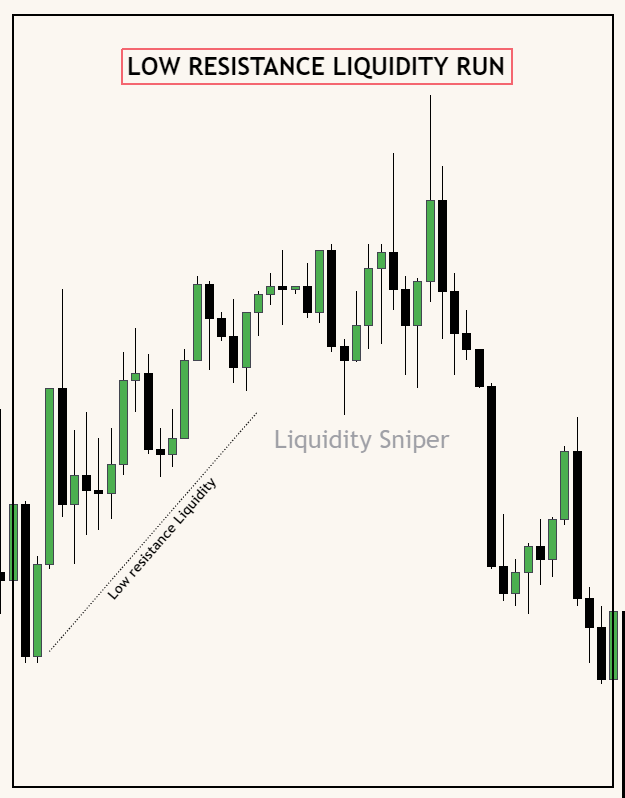

Always seek trades aligning with LRLR direction, such as recent LH-based buys.

Chart Example 4 :

💎𝗝𝗼𝗶𝗻 𝗺𝘆 𝘁𝗲𝗹𝗲𝗴𝗿𝗮𝗺 𝗴𝗿𝗼𝘂𝗽 𝗳𝗼𝗿 𝗱𝗮𝗶𝗹𝘆 𝗲𝗱𝘂𝗰𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗰𝗼𝗻𝘁𝗲𝗻𝘁 & 𝗪𝗲𝗲𝗸𝗹𝘆 𝗢𝘂𝘁𝗹𝗼𝗼𝗸 -> t.me

Chart Example 4 :

💎𝗝𝗼𝗶𝗻 𝗺𝘆 𝘁𝗲𝗹𝗲𝗴𝗿𝗮𝗺 𝗴𝗿𝗼𝘂𝗽 𝗳𝗼𝗿 𝗱𝗮𝗶𝗹𝘆 𝗲𝗱𝘂𝗰𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗰𝗼𝗻𝘁𝗲𝗻𝘁 & 𝗪𝗲𝗲𝗸𝗹𝘆 𝗢𝘂𝘁𝗹𝗼𝗼𝗸 -> t.me

جاري تحميل الاقتراحات...

![1. High Resistance Liquidity Run [HRLR] :

- When the market creates a high/low by running stops, th...](https://pbs.twimg.com/media/GEbv-MDaMAAflSu.png)

![2. Low Resistance Liquidity Run [LRLR] :

- When market create low/high without sweeping low/high (s...](https://pbs.twimg.com/media/GEbxCB2bUAAwA0T.png)