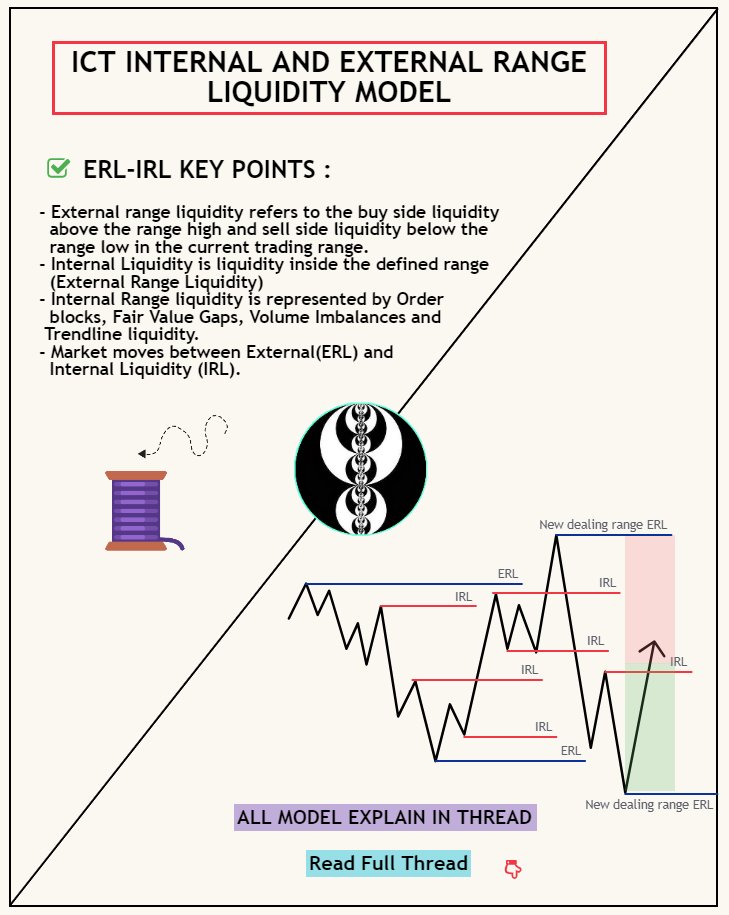

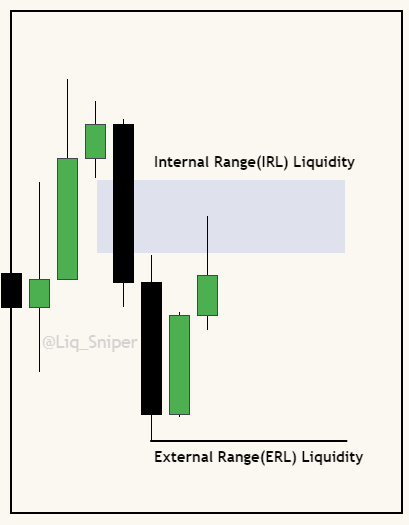

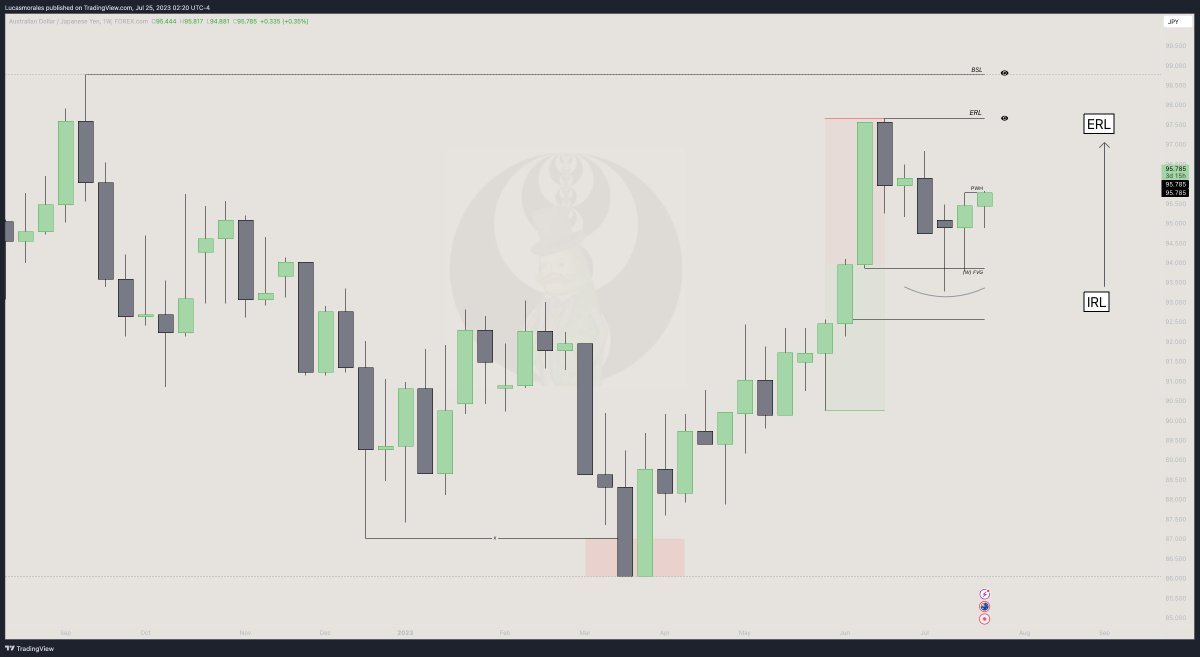

What is External and Internal Range Liquidity?

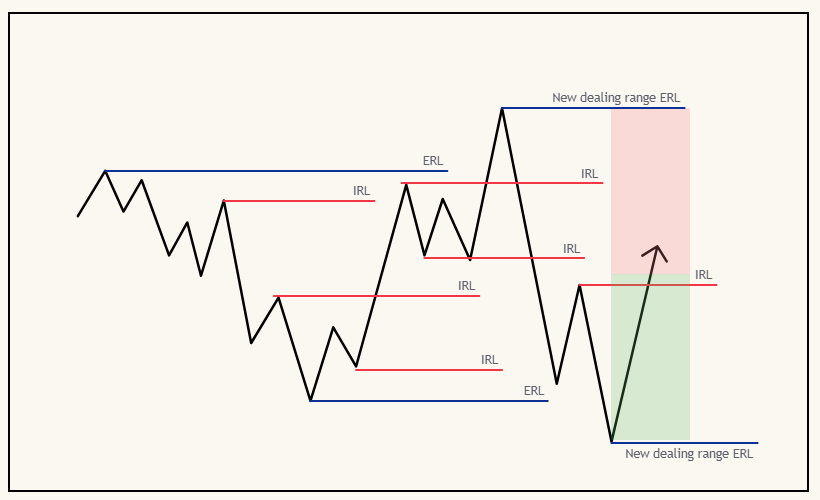

Ans - External range liquidity refers to the buy side liquidity above the range high and sell side liquidity below the range low in the current trading range.

Credit : @I_Am_The_ICT

Ans - External range liquidity refers to the buy side liquidity above the range high and sell side liquidity below the range low in the current trading range.

Credit : @I_Am_The_ICT

- It is associated with liquidity runs that seek to pair orders with pending order liquidity, which is in the form of a liquidity pool.

- External range liquidity runs can be low resistance or high resistance in nature.

Credit : @SirPickle_

- External range liquidity runs can be low resistance or high resistance in nature.

Credit : @SirPickle_

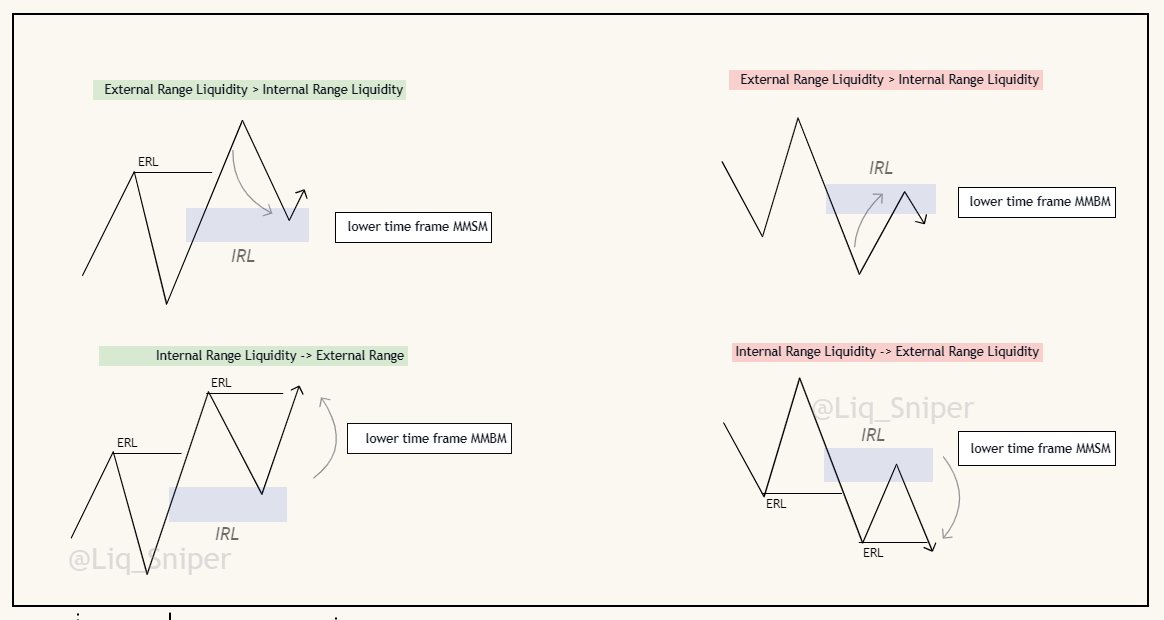

Market moves between external range liquidity (ERL) to internal Range Liquidity (IRL).

✍️Join my telegram group for daily educational content & Weekly Outlook-> t.me

✍️Join my telegram group for daily educational content & Weekly Outlook-> t.me

جاري تحميل الاقتراحات...