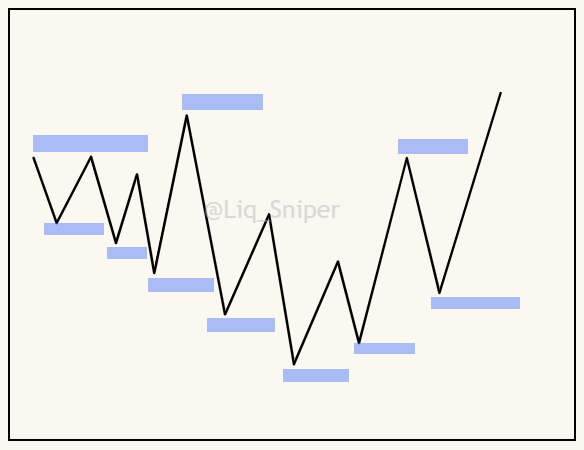

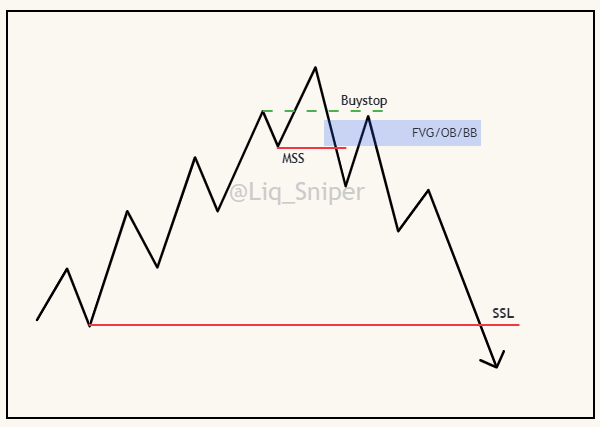

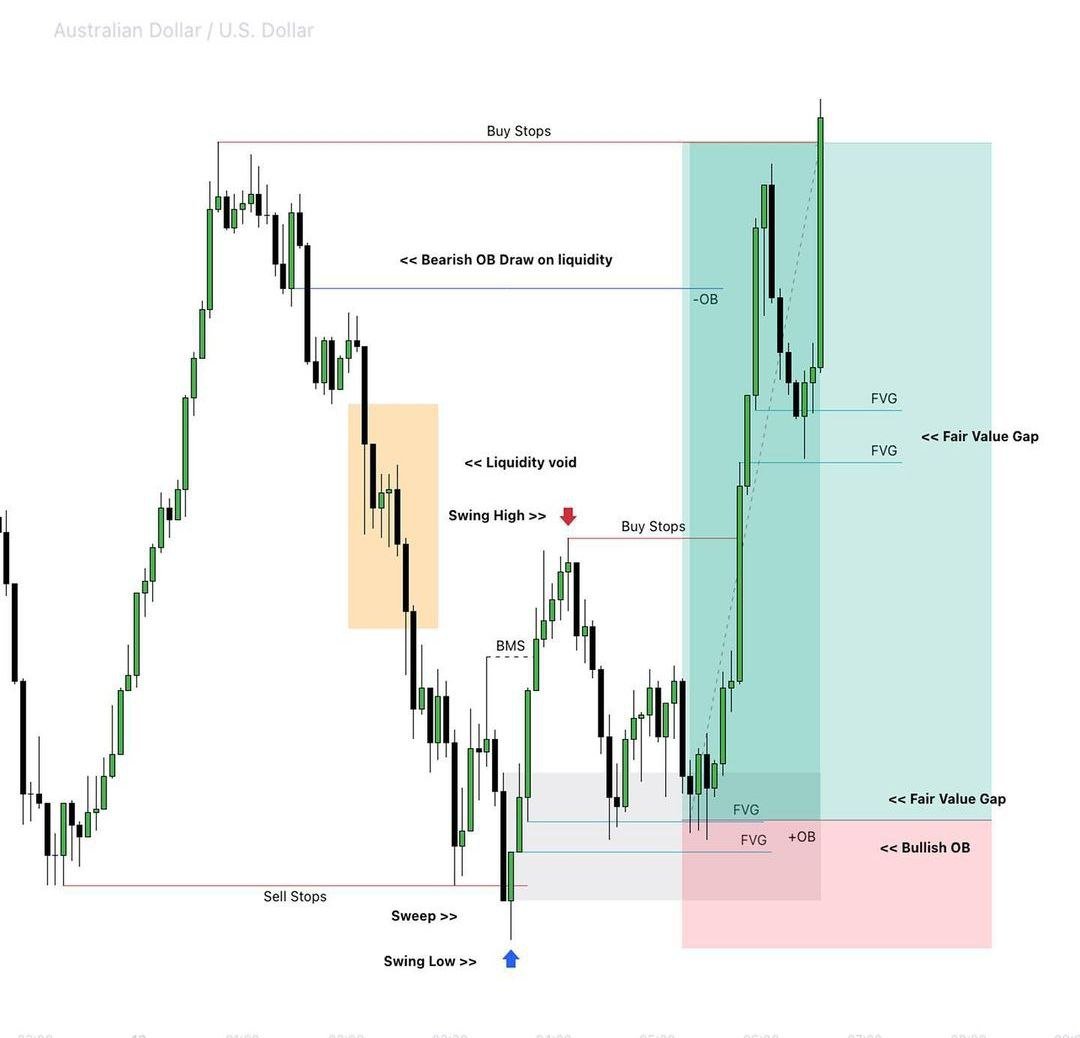

In the figure above, the zones marked In blue are the places where liquidity accumulates. This is where most trading systems place buy, sell and stop loss orders.

Credit : @I_Am_The_ICT

Credit : @I_Am_The_ICT

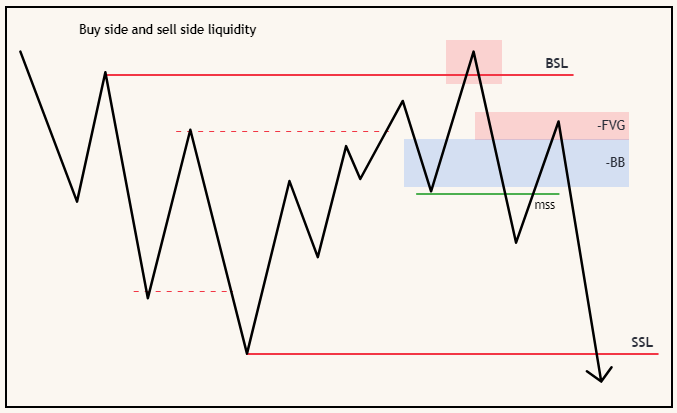

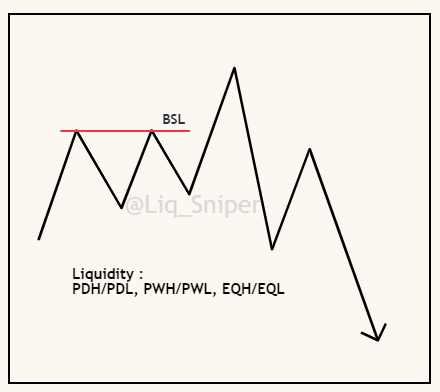

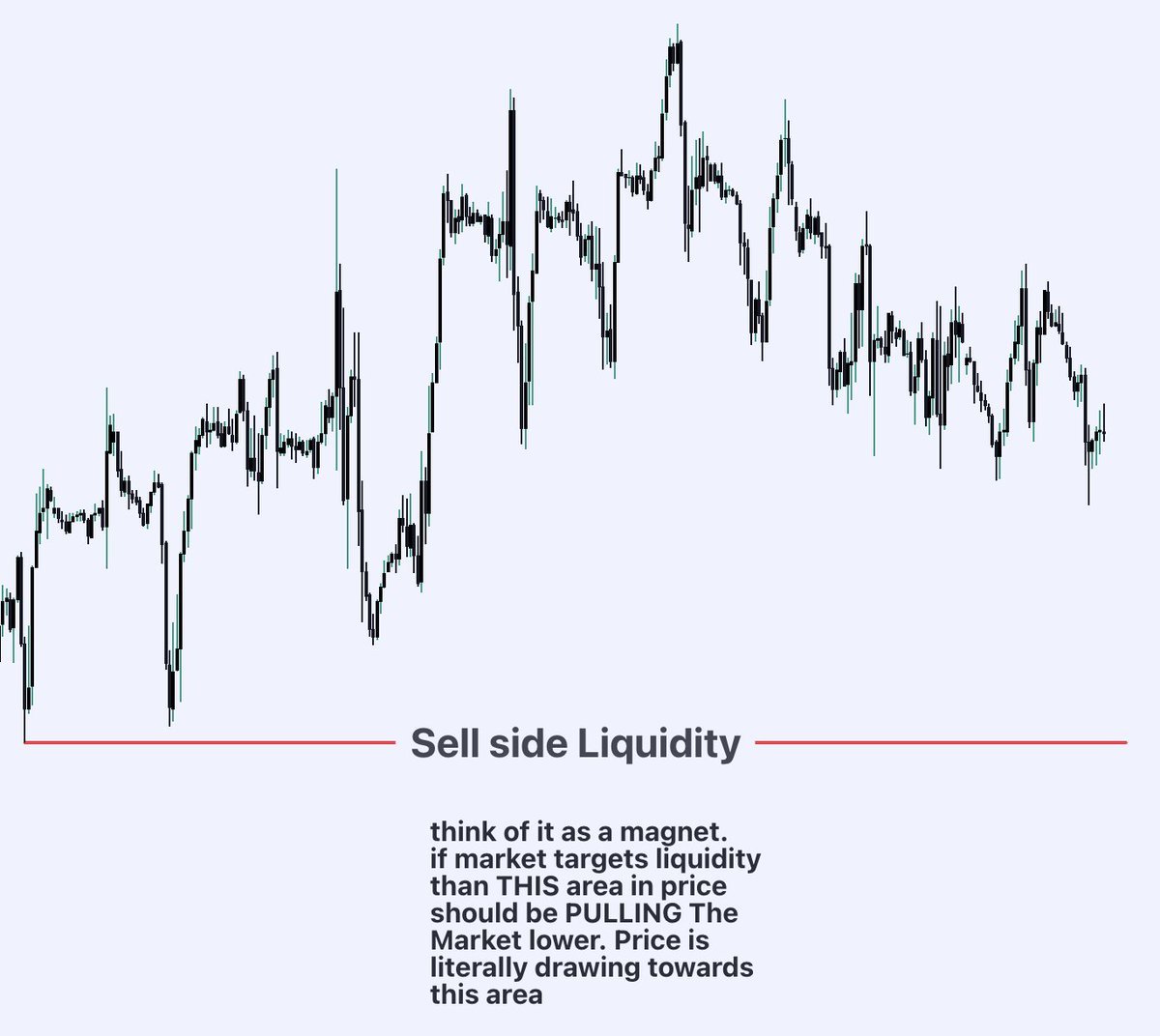

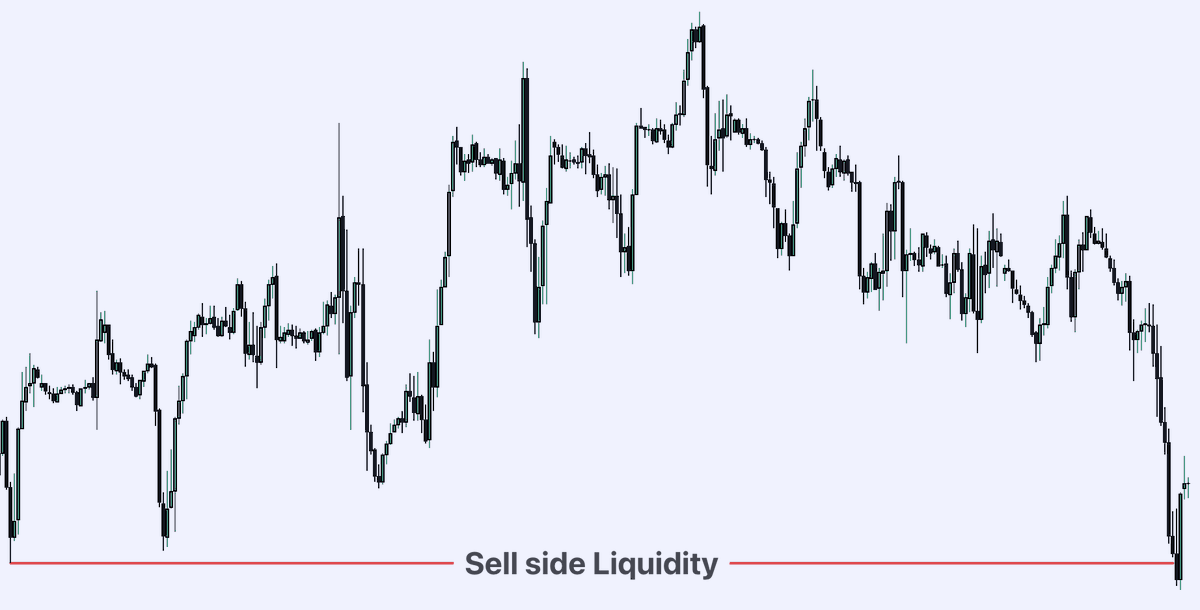

- Identify Buyside or Sellside Liquidity or imbalance on HTF, wait for price to reach to these levels and look for LTF entry models

chart ex. Credit : @uncTrades

chart ex. Credit : @uncTrades

This helps to understand what kind of liquidity will attract the price and where we should enter into the trade and where we should exit.

Join Telegram for more education content :

t.me

Join Telegram for more education content :

t.me

جاري تحميل الاقتراحات...