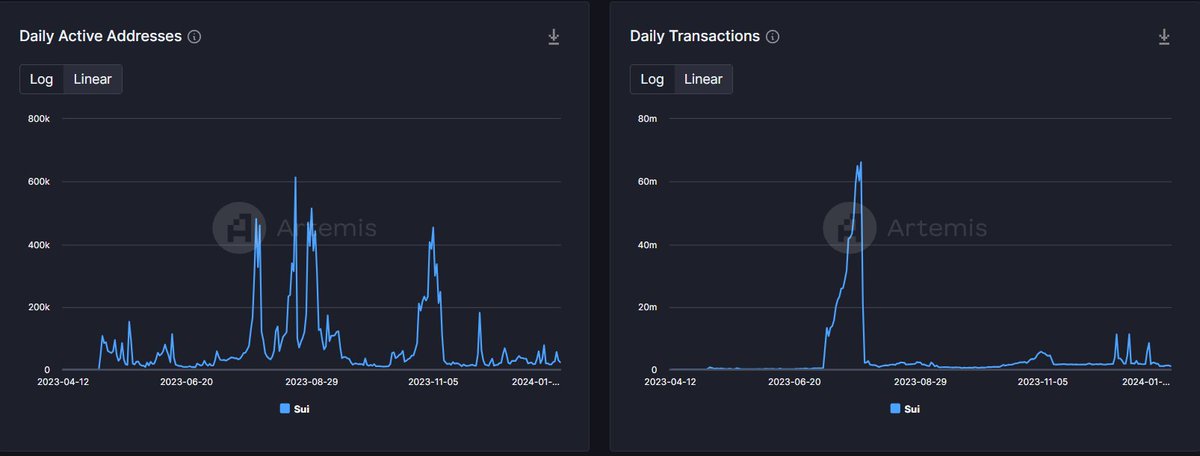

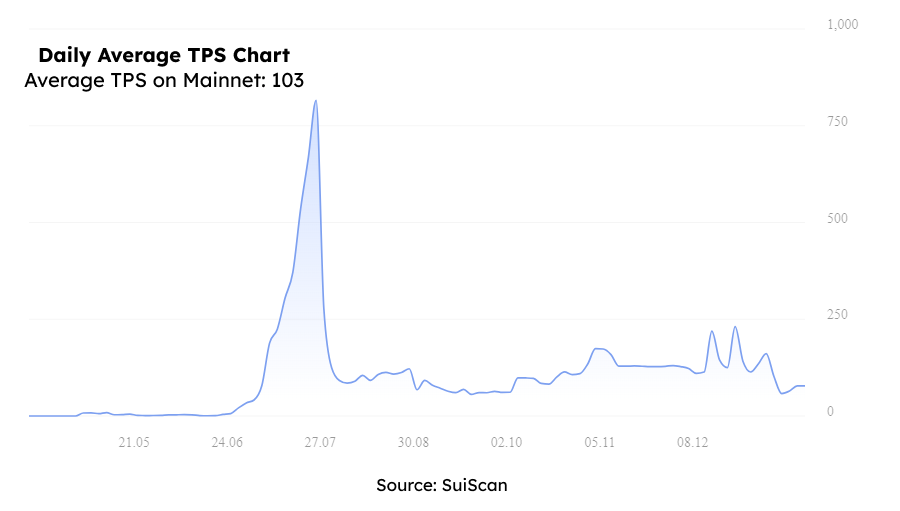

We've been talking a lot about @SuiNetwork's growth in on-chain metrics and price lately.

That being said, as asked by CT, we're now releasing an in-depth study of $SUI and its ecosystem.

Enjoy the thread!

Plenty of #Alpha here 🧵

That being said, as asked by CT, we're now releasing an in-depth study of $SUI and its ecosystem.

Enjoy the thread!

Plenty of #Alpha here 🧵

1/ Today's agenda:

1️⃣ Sui Explained

2️⃣ Metrics

3️⃣ Ecosystem

4️⃣ Final Notes

Let's go!

1️⃣ Sui Explained

2️⃣ Metrics

3️⃣ Ecosystem

4️⃣ Final Notes

Let's go!

2/ 1️⃣ Sui Explained

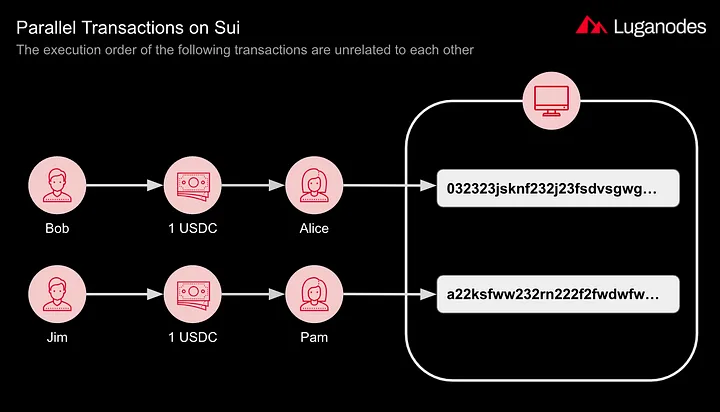

For those unfamiliar with @SuiNetwork, it is a Layer 1 blockchain designed to be completely scalable while maintaining robust security and decentralization principles.

For those unfamiliar with @SuiNetwork, it is a Layer 1 blockchain designed to be completely scalable while maintaining robust security and decentralization principles.

11/ 3️⃣ Ecosystem

Now, you might be curious about what projects are flourishing on the SUI blockchain.

We've separated a list of 7 promising protocols to keep an eye.

Moreover, most of them are still TOKENLESS, indicating the possibility of upcoming #airdrops! 💎

Now, you might be curious about what projects are flourishing on the SUI blockchain.

We've separated a list of 7 promising protocols to keep an eye.

Moreover, most of them are still TOKENLESS, indicating the possibility of upcoming #airdrops! 💎

12/ • @navi_protocol

NAVI is a lending protocol on SUI. Being inspired by AAVE, it aims to become the top money market of the ecosystem.

The protocol has recently reached $100M in TVL.

Currently, it does NOT have a token, but $NAVI has already been confirmed!

NAVI is a lending protocol on SUI. Being inspired by AAVE, it aims to become the top money market of the ecosystem.

The protocol has recently reached $100M in TVL.

Currently, it does NOT have a token, but $NAVI has already been confirmed!

13/ • @bucket_protocol

Bucket operates as a CDP protocol, allowing users to deposit collateral in $SUI, $ETH, and blue-chip stables to mint $BUCK dollars.

With a TVL exceeding $5M, the protocol has also officially announced a token.

Mint $BUCK for an #airdrop opportunity!

Bucket operates as a CDP protocol, allowing users to deposit collateral in $SUI, $ETH, and blue-chip stables to mint $BUCK dollars.

With a TVL exceeding $5M, the protocol has also officially announced a token.

Mint $BUCK for an #airdrop opportunity!

14/ • @bluefinapp

BlueFin is the Perpetuals DEX of SUI.

Having secured nearly $30M in funding from reputable VCs such as @polychaincap and @DeFianceCapital, the protocol, as of now, doesn't have a token.

Go trade perps there for a chance to qualify for an airdrop! 📈

BlueFin is the Perpetuals DEX of SUI.

Having secured nearly $30M in funding from reputable VCs such as @polychaincap and @DeFianceCapital, the protocol, as of now, doesn't have a token.

Go trade perps there for a chance to qualify for an airdrop! 📈

15/ • @AftermathFi

AfterMath aspires to be the "Financial HUB of Sui."

As of now, users can execute swaps, provide liquidity, and stake $SUI to earn $afSUI, an LST.

The protocol has gathered over $40M in TVL and does NOT have a token yet.

Keep an eye on them 👀

AfterMath aspires to be the "Financial HUB of Sui."

As of now, users can execute swaps, provide liquidity, and stake $SUI to earn $afSUI, an LST.

The protocol has gathered over $40M in TVL and does NOT have a token yet.

Keep an eye on them 👀

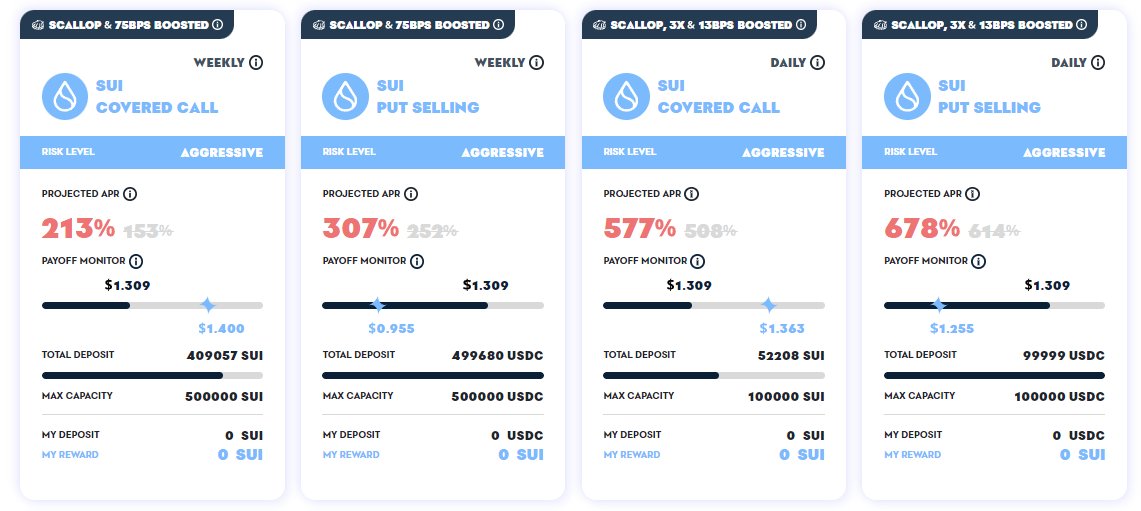

16/ • @TypusFinance

Typus stands as an Options-Vault protocol on SUI, enabling users to engage in real-yield strategies with just one click.

With a TVL approaching $3M, the protocol is yet to introduce its native token.

Wouldn't mind checking it out...

Typus stands as an Options-Vault protocol on SUI, enabling users to engage in real-yield strategies with just one click.

With a TVL approaching $3M, the protocol is yet to introduce its native token.

Wouldn't mind checking it out...

17/ • @Scallop_io

Scallop is a lending protocol being built on Sui.

Currently, it has close to $70M in TVL and still lacks a token!

Engaging in lending and borrowing transactions could potentially qualify you for an airdrop! 🌐

Scallop is a lending protocol being built on Sui.

Currently, it has close to $70M in TVL and still lacks a token!

Engaging in lending and borrowing transactions could potentially qualify you for an airdrop! 🌐

18/ • @kai_finance_sui

Kai Finance is a yield aggregator, meaning that you can deposit funds in Vaults that will get you the best yields on Sui!

The protocol now has $1M in TVL, more vaults are going to be launched soon.

Also, NO token YET!

Kai Finance is a yield aggregator, meaning that you can deposit funds in Vaults that will get you the best yields on Sui!

The protocol now has $1M in TVL, more vaults are going to be launched soon.

Also, NO token YET!

19/ 4️⃣ Final Notes

Despite having an extremely experienced team and substantial funding, @SuiNetwork is still a nascent chain with a very primitive ecosystem.

As attention and activity increase, a potential SUI Season could be on the horizon!

Despite having an extremely experienced team and substantial funding, @SuiNetwork is still a nascent chain with a very primitive ecosystem.

As attention and activity increase, a potential SUI Season could be on the horizon!

20/ If you want to stay closer to $SUI, follow the team! 🫡

@b1ackd0g

@kostascrypto

@EvanWeb3_

@EmanAbio

@jameellionaire

@alonsodegortari

@jinkwell

@seannyboy126

@GDanezis

@b1ackd0g

@kostascrypto

@EvanWeb3_

@EmanAbio

@jameellionaire

@alonsodegortari

@jinkwell

@seannyboy126

@GDanezis

21/ Want to read more threads like this?

Make sure to drop a follow, like, and RT to receive daily insights on the market!

In the crypto universe, we’re your preferred alpha source 💫

Make sure to drop a follow, like, and RT to receive daily insights on the market!

In the crypto universe, we’re your preferred alpha source 💫

جاري تحميل الاقتراحات...