#Alpha

Knowledge Marine & Engineering Works Ltd

📢About co.

Knowledge Marine & Engineering Works Ltd is a company specializing in the ownership, chartering, and manning of marine crafts, as well as the operation and technical maintenance of these vessels.

Additionally, the company is involved in the repair and maintenance of marine crafts and associated infrastructure in India.

Knowledge Marine & Engineering Works Ltd

📢About co.

Knowledge Marine & Engineering Works Ltd is a company specializing in the ownership, chartering, and manning of marine crafts, as well as the operation and technical maintenance of these vessels.

Additionally, the company is involved in the repair and maintenance of marine crafts and associated infrastructure in India.

📢 About the management:

- Mr. Sujay Kewalramani, the founder of KMEW, is credited with the company's success due to his grit, determination, vision, and perseverance.

- As a first-generation technocrat entrepreneur, he has played a pivotal role in establishing KMEW as a leading player in the complex marine and engineering industry.

- Recognized for his exceptional professional achievements and contributions to nation-building, Mr. Kewalramani was awarded the "CEO of the Year" title by the Indian Achievers Award for the years 2022-23 & 2023-24.

- Specializing in capital dredging projects, he has showcased expertise in managing large-scale port deepening operations.

- Mr. Kewalramani has a proven track record in order book management, having built significant order books worth Rs. 600 Cr for Mercator in 2015 and Rs. 500 Cr for APSEZ in 2017.

- In terms of asset management, he has effectively managed assets worth Rs. 400 Cr for Mercator Ltd and Rs. 3,000 Cr for Adani Ports and Special Economic Zone Ltd (APSEZ).

- With extensive experience in team leadership, Mr. Kewalramani has led teams of varying sizes, ranging from 150 to 400 employees, showcasing his ability to manage and motivate teams in the shipbuilding and dredging industry.

- Mr. Sujay Kewalramani, the founder of KMEW, is credited with the company's success due to his grit, determination, vision, and perseverance.

- As a first-generation technocrat entrepreneur, he has played a pivotal role in establishing KMEW as a leading player in the complex marine and engineering industry.

- Recognized for his exceptional professional achievements and contributions to nation-building, Mr. Kewalramani was awarded the "CEO of the Year" title by the Indian Achievers Award for the years 2022-23 & 2023-24.

- Specializing in capital dredging projects, he has showcased expertise in managing large-scale port deepening operations.

- Mr. Kewalramani has a proven track record in order book management, having built significant order books worth Rs. 600 Cr for Mercator in 2015 and Rs. 500 Cr for APSEZ in 2017.

- In terms of asset management, he has effectively managed assets worth Rs. 400 Cr for Mercator Ltd and Rs. 3,000 Cr for Adani Ports and Special Economic Zone Ltd (APSEZ).

- With extensive experience in team leadership, Mr. Kewalramani has led teams of varying sizes, ranging from 150 to 400 employees, showcasing his ability to manage and motivate teams in the shipbuilding and dredging industry.

📢 Service Offerings:

The company provides three main services:

1)Dredging Services, Ownership, Operation, and

2)Chartering of Port Ancillary Crafts, and

3)Ship Building and Repair of Marine Crafts.

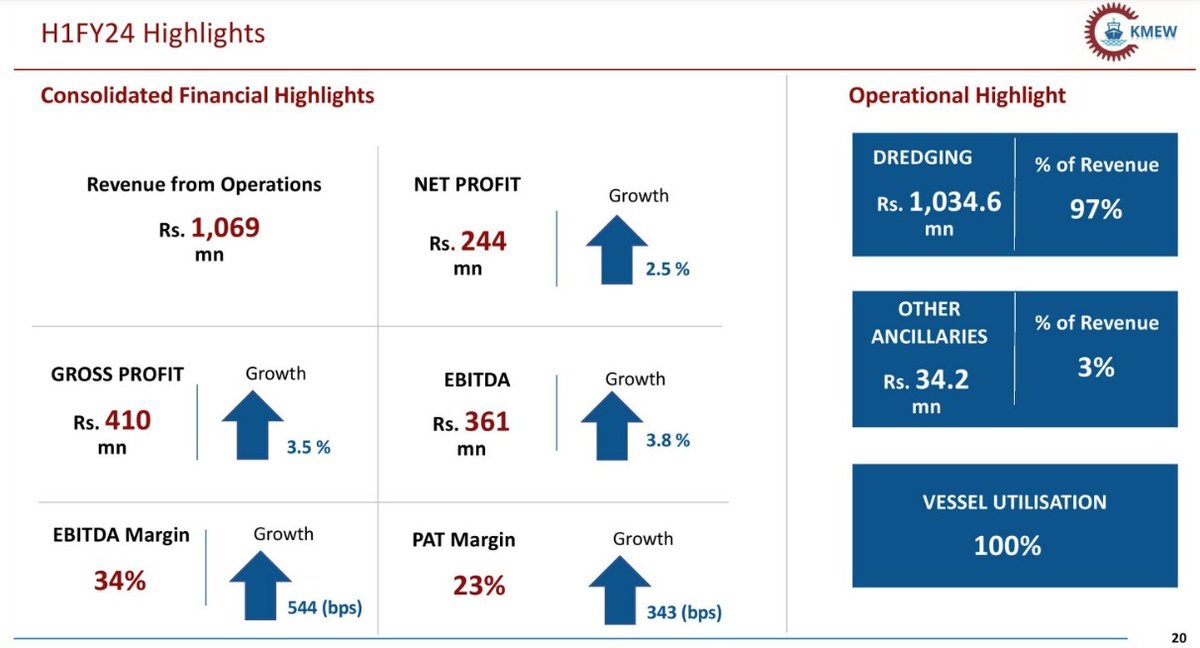

Notably, Dredging Services constituted 97% of the total revenue in FY23, reflecting a significant increase from the 80% share in FY22.

The company provides three main services:

1)Dredging Services, Ownership, Operation, and

2)Chartering of Port Ancillary Crafts, and

3)Ship Building and Repair of Marine Crafts.

Notably, Dredging Services constituted 97% of the total revenue in FY23, reflecting a significant increase from the 80% share in FY22.

👉About Dredging :

Dredging is the process of removing sediments and debris from the bottom of oceans, harbors, rivers, or other water bodies.

This is done to create navigable waterways for shipping traffic at ports, reclaim dredged material to form new land, and undertake environmental dredging to remove pollutants from water bodies.

Additionally, dredging is employed for underwater excavation to mine minerals, sand, gravel, and gold. It is also utilized in the dredging of dams and rivers to remove sediments from reservoirs.

Dredging Process:

1. *Excavation:* The material is excavated from the sea or riverbed using specialized equipment.

2. *Transportation:* The loosened material is transported to the desired location using a dredger.

3. *Deposition:* The dredged material is deposited to a designated spoil area, either for disposal or land reclamation purposes.

Dredging Types:

1. Capital Dredging: Involves the removal of sediments that have not been previously dredged. This includes virgin sediments and the creation of channels for accommodating larger vessels.

2. Maintenance Dredging: Focuses on the removal of sediments that have accumulated in a channel since the previous dredging project. This is essential for maintaining navigable waterways.

KMEW Projects:

1. Sittwe Port, Myanmar: Dredging project likely aimed at enhancing the port's capacity and navigability.

2. Mangrol Fishing Harbour: Dredging for improving access to the fishing harbor, possibly to accommodate larger vessels.

3. Veraval Fishing Harbour: Similar to Mangrol, dredging is likely aimed at improving navigation for fishing vessels.

4. Kolkata Port and Haldia Port: Dredging projects to maintain or enhance the channels for shipping traffic.

5. Yangon Port, Myanmar: Undertaking dredging activities to improve access and capacity at the Yangon Port.

Dredging is the process of removing sediments and debris from the bottom of oceans, harbors, rivers, or other water bodies.

This is done to create navigable waterways for shipping traffic at ports, reclaim dredged material to form new land, and undertake environmental dredging to remove pollutants from water bodies.

Additionally, dredging is employed for underwater excavation to mine minerals, sand, gravel, and gold. It is also utilized in the dredging of dams and rivers to remove sediments from reservoirs.

Dredging Process:

1. *Excavation:* The material is excavated from the sea or riverbed using specialized equipment.

2. *Transportation:* The loosened material is transported to the desired location using a dredger.

3. *Deposition:* The dredged material is deposited to a designated spoil area, either for disposal or land reclamation purposes.

Dredging Types:

1. Capital Dredging: Involves the removal of sediments that have not been previously dredged. This includes virgin sediments and the creation of channels for accommodating larger vessels.

2. Maintenance Dredging: Focuses on the removal of sediments that have accumulated in a channel since the previous dredging project. This is essential for maintaining navigable waterways.

KMEW Projects:

1. Sittwe Port, Myanmar: Dredging project likely aimed at enhancing the port's capacity and navigability.

2. Mangrol Fishing Harbour: Dredging for improving access to the fishing harbor, possibly to accommodate larger vessels.

3. Veraval Fishing Harbour: Similar to Mangrol, dredging is likely aimed at improving navigation for fishing vessels.

4. Kolkata Port and Haldia Port: Dredging projects to maintain or enhance the channels for shipping traffic.

5. Yangon Port, Myanmar: Undertaking dredging activities to improve access and capacity at the Yangon Port.

📢 Client Base :

The company's major clientele includes prominent entities such as 👇

-Deendayal Port Authority,

-Haldia Port Authority,

-Kolkata Port Authority, and

-the Dredging Corporation of India.

Additionally, the company serves an international customer 👇

-the Kaladan Multi-Modal Transit Transport Project (KMTTP) in Sittwe, Myanmar.

The company's major clientele includes prominent entities such as 👇

-Deendayal Port Authority,

-Haldia Port Authority,

-Kolkata Port Authority, and

-the Dredging Corporation of India.

Additionally, the company serves an international customer 👇

-the Kaladan Multi-Modal Transit Transport Project (KMTTP) in Sittwe, Myanmar.

📢 Growth Opportunities :

1. Order Book Visibility:

- The company has expressed interest in projects worth Rs. 1,100 crore.

- Plans to tie up with private organizations, including ITD Cementation and L&T, for dredging works.

- Actively participating in bidding for several National Waterway projects.

2. Other Initiatives:

- Successfully participated in bidding for various contracts with a noteworthy success ratio of more than 50%.

- Exploring markets related to dam desiltation.

- Targeting dredging contracts with a minimum EBITDA margin of 30%.

These initiatives demonstrate KMEW's strategic approach to expanding its order book, forming collaborations, and exploring diverse market segments for sustainable growth.

1. Order Book Visibility:

- The company has expressed interest in projects worth Rs. 1,100 crore.

- Plans to tie up with private organizations, including ITD Cementation and L&T, for dredging works.

- Actively participating in bidding for several National Waterway projects.

2. Other Initiatives:

- Successfully participated in bidding for various contracts with a noteworthy success ratio of more than 50%.

- Exploring markets related to dam desiltation.

- Targeting dredging contracts with a minimum EBITDA margin of 30%.

These initiatives demonstrate KMEW's strategic approach to expanding its order book, forming collaborations, and exploring diverse market segments for sustainable growth.

📢 Growth Strategies for KMEW in New Segments:

1. Cutter Suction Dredgers (CSDs):

- CSDs are hydraulic dredgers with the capability to dredge various soil types.

- Ideal for locations where the ground is too hard for trailing suction hopper dredgers.

- Strategic plans to leverage CSDs for dam desiltation projects across multiple rivers.

2. National Waterways Contracts:

- The company is positioned to tap into the vast network of 111 National Waterways in Indian inland water systems.

- National Waterways contracts offer opportunities for dredging and infrastructure development.

3. Fishing Harbour Development:

- Engagement in dredging projects related to fishing harbors, ensuring improved navigation for fishing vessels.

- Enhancing accessibility and operational efficiency in key fishing harbor locations.

4. Dam Desiltation:

- Active engagement in dam desiltation projects across multiple rivers.

- Recognizing the value of removing sediment from dams to improve water flow and prevent erosion.

5. River Harbour Disiltation:

- Utilizing dredging expertise for harbor disiltation in rivers, ensuring optimal conditions for maritime activities.

- Addressing sediment-related challenges to enhance the efficiency of river harbors.

Additional Insights:

- Indian Inland Waterways:

- The company acknowledges the extensive network of 111 National Waterways, including rivers, canals, and creeks, as a significant opportunity.

- Recognizing the potential for dredging projects, infrastructure development, and maritime services in these waterways.

- Suction Hopper Dredgers:

- Acknowledges the importance of sand carried downstream by rivers, considering it a valuable resource.

- Indicates the company's awareness of the environmental and economic aspects of dredging activities.

These growth strategies reflect KMEW's diversification into new segments, showcasing adaptability to different types of dredging projects and a strategic approach to capitalize on emerging opportunities in various sectors.

1. Cutter Suction Dredgers (CSDs):

- CSDs are hydraulic dredgers with the capability to dredge various soil types.

- Ideal for locations where the ground is too hard for trailing suction hopper dredgers.

- Strategic plans to leverage CSDs for dam desiltation projects across multiple rivers.

2. National Waterways Contracts:

- The company is positioned to tap into the vast network of 111 National Waterways in Indian inland water systems.

- National Waterways contracts offer opportunities for dredging and infrastructure development.

3. Fishing Harbour Development:

- Engagement in dredging projects related to fishing harbors, ensuring improved navigation for fishing vessels.

- Enhancing accessibility and operational efficiency in key fishing harbor locations.

4. Dam Desiltation:

- Active engagement in dam desiltation projects across multiple rivers.

- Recognizing the value of removing sediment from dams to improve water flow and prevent erosion.

5. River Harbour Disiltation:

- Utilizing dredging expertise for harbor disiltation in rivers, ensuring optimal conditions for maritime activities.

- Addressing sediment-related challenges to enhance the efficiency of river harbors.

Additional Insights:

- Indian Inland Waterways:

- The company acknowledges the extensive network of 111 National Waterways, including rivers, canals, and creeks, as a significant opportunity.

- Recognizing the potential for dredging projects, infrastructure development, and maritime services in these waterways.

- Suction Hopper Dredgers:

- Acknowledges the importance of sand carried downstream by rivers, considering it a valuable resource.

- Indicates the company's awareness of the environmental and economic aspects of dredging activities.

These growth strategies reflect KMEW's diversification into new segments, showcasing adaptability to different types of dredging projects and a strategic approach to capitalize on emerging opportunities in various sectors.

📢Macro View On Opportunities:

1. Growth Prospects:

- The India dredging market is expected to grow at a CAGR of nearly 4.4% during 2020-2026.

- Increasing demand for dredging from major and non-major ports drives the industry.

2. Market Size:

- Expected annual Indian market size of $300 Mn for maintenance dredging and $100 Mn for capital dredging.

3. Trade Volume Potential:

- 95% of Indian foreign trade volume is through ports, indicating significant potential for dredging and ship repair services.

4. Long-Term Contracts:

- Prevailing market practice involves clients providing long-term contracts, enhancing revenue viability.

5. Dredging Potential:

- India has a substantial potential for dredging activities, given the large number of dams and lakes.

6. Inland Waterways:

- India has 111 National Waterways, consisting of rivers, canals, and creeks.

- The country has 14.5K km of inland waterways and 7.5K km of coastline.

The policy support measures and market opportunities indicate a favorable environment for the growth and development of the dredging and marine infrastructure sector in India.

1. Growth Prospects:

- The India dredging market is expected to grow at a CAGR of nearly 4.4% during 2020-2026.

- Increasing demand for dredging from major and non-major ports drives the industry.

2. Market Size:

- Expected annual Indian market size of $300 Mn for maintenance dredging and $100 Mn for capital dredging.

3. Trade Volume Potential:

- 95% of Indian foreign trade volume is through ports, indicating significant potential for dredging and ship repair services.

4. Long-Term Contracts:

- Prevailing market practice involves clients providing long-term contracts, enhancing revenue viability.

5. Dredging Potential:

- India has a substantial potential for dredging activities, given the large number of dams and lakes.

6. Inland Waterways:

- India has 111 National Waterways, consisting of rivers, canals, and creeks.

- The country has 14.5K km of inland waterways and 7.5K km of coastline.

The policy support measures and market opportunities indicate a favorable environment for the growth and development of the dredging and marine infrastructure sector in India.

📢Financials :

Here's a brief summary :

1. Financials:

- Market Cap: ₹1,607 Cr.

- Current Price: ₹1,488

- High / Low: ₹1,815 / ₹845

- Stock P/E: 33.8

- Book Value: ₹146

- Dividend Yield: 0%

- ROCE : 55.5%

- ROE : 52.0%

- Face Value: ₹10

- Intrinsic Value: ₹1,734

- Promoter Holding: 67.1%

- Pledged Percentage: 0%

- Price to Book Value: 10.2

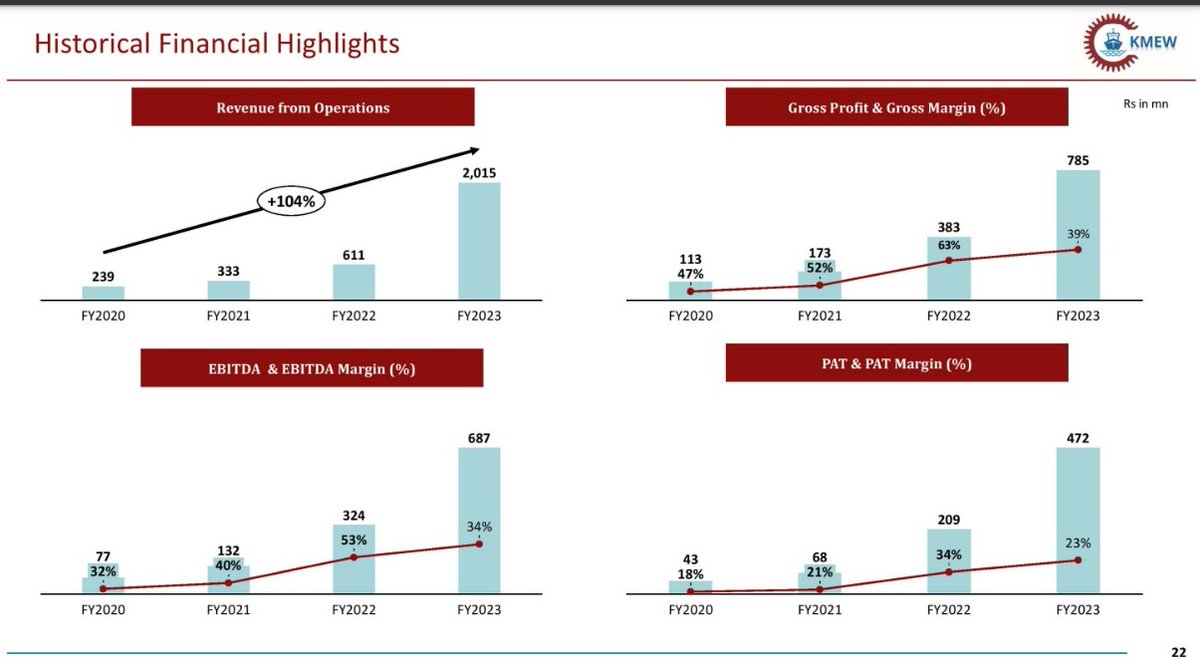

2. Financial Performance:

- EPS (Earnings Per Share): ₹44.1

- CMP (Current Market Price) / FCF (Free Cash Flow): 328

- Industry PE: 34.0

- Enterprise Value: ₹1,610 Cr.

- PEG Ratio: 0.32

- Sales Growth (3 Years): 104%

- Profit Growth (3 Years): 118%

Here's a brief summary :

1. Financials:

- Market Cap: ₹1,607 Cr.

- Current Price: ₹1,488

- High / Low: ₹1,815 / ₹845

- Stock P/E: 33.8

- Book Value: ₹146

- Dividend Yield: 0%

- ROCE : 55.5%

- ROE : 52.0%

- Face Value: ₹10

- Intrinsic Value: ₹1,734

- Promoter Holding: 67.1%

- Pledged Percentage: 0%

- Price to Book Value: 10.2

2. Financial Performance:

- EPS (Earnings Per Share): ₹44.1

- CMP (Current Market Price) / FCF (Free Cash Flow): 328

- Industry PE: 34.0

- Enterprise Value: ₹1,610 Cr.

- PEG Ratio: 0.32

- Sales Growth (3 Years): 104%

- Profit Growth (3 Years): 118%

📢Disclaimer: The above details are for educational purposes only and please consult your financial advisor before taking any decision.

جاري تحميل الاقتراحات...