Just a year ago, clicking 'hide small balances', made my entire #crypto portfolio disappear...

Today, it hit $420k. Over $100k was made just last week.

My secret? A set of cognitive biases.

I've studied hundreds of them before I formed 20 that I use daily 👇🧵

Today, it hit $420k. Over $100k was made just last week.

My secret? A set of cognitive biases.

I've studied hundreds of them before I formed 20 that I use daily 👇🧵

Before I start, make sure to bookmark 1st tweet and follow me @nobrainflip so u don't lose these biases later 👆

This thread is for u if u've ever:

✧ Bought top and sold bottom due to FOMO

✧ Held onto -99,9% loss because u didn't want to accept a -10% loss

✧ Forgot to take profit and ended up back at McDonald's

All these mistakes are due to lack of knowing essential cognitive biases.

✧ Bought top and sold bottom due to FOMO

✧ Held onto -99,9% loss because u didn't want to accept a -10% loss

✧ Forgot to take profit and ended up back at McDonald's

All these mistakes are due to lack of knowing essential cognitive biases.

Curious how I know?

I turned $1k into $130k last bull market, then dropped to $8k not taking profits 😁

Spent months working on mistakes, created rules I've already shared in thread below.

By using them & cognitive biases in current thread I grow $8k to $300k in bear market👇

I turned $1k into $130k last bull market, then dropped to $8k not taking profits 😁

Spent months working on mistakes, created rules I've already shared in thread below.

By using them & cognitive biases in current thread I grow $8k to $300k in bear market👇

2/➮ Recency Bias (Prioritizing recent events)

Don't let recent price swings dictate ur moves.

BTC's sharp fall doesn't guarantee further decline, nor does a sudden surge ensure more gains.

Zoom out the chart: see long-term potential, not just what happened few hours ago.

Don't let recent price swings dictate ur moves.

BTC's sharp fall doesn't guarantee further decline, nor does a sudden surge ensure more gains.

Zoom out the chart: see long-term potential, not just what happened few hours ago.

However, knowing you could have bought cheaper stops you from buying.

Then the price rockets to $45k, and u realize that u're idiot...

Focus on the present, assess whether it is worth it now.

In 2010, u could have bought 5,000 BTC for a pizza, do u expect that to happen again?

Then the price rockets to $45k, and u realize that u're idiot...

Focus on the present, assess whether it is worth it now.

In 2010, u could have bought 5,000 BTC for a pizza, do u expect that to happen again?

4/➮ Bandwagon Effect (Following popular trends)

Bought tokens because of the hype, but they crashed right after?

Any token acts like a Ponzi scheme; once it reaches its peak, it will drop because early buyers want to cash out.

Simply put: buy fear, sell greed.

Bought tokens because of the hype, but they crashed right after?

Any token acts like a Ponzi scheme; once it reaches its peak, it will drop because early buyers want to cash out.

Simply put: buy fear, sell greed.

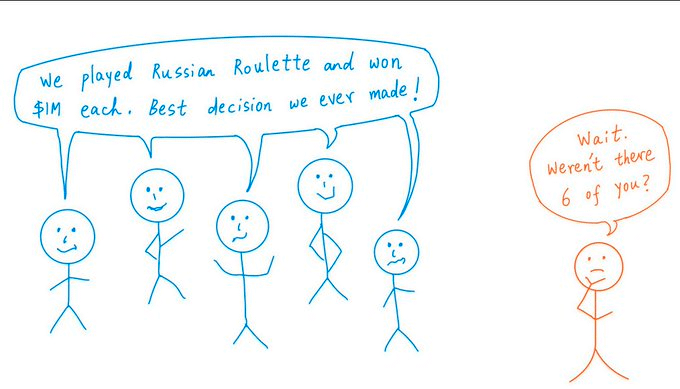

5/➮ Gambler's Fallacy (Misinterpreting random sequences)

The fact that Bitcoin has been falling oh 1h time-frame doesn't always mean it'll rise soon, or vice versa.

Many market moves are independent, focus on analysis, not just assumptions. Check big time-frame first.

The fact that Bitcoin has been falling oh 1h time-frame doesn't always mean it'll rise soon, or vice versa.

Many market moves are independent, focus on analysis, not just assumptions. Check big time-frame first.

6/➮ Sunk Cost Fallacy (Ignoring losses, continuing investments)

Bought a coin for short-term speculation based on smth, it didn't pay off, but u kept holding?

This space changes rapidly. If narrative shifts - sell; if idea doesn't pan out - sell

Adapt quickly here, or die.

Bought a coin for short-term speculation based on smth, it didn't pay off, but u kept holding?

This space changes rapidly. If narrative shifts - sell; if idea doesn't pan out - sell

Adapt quickly here, or die.

7/➮ Overoptimism Bias (Unrealistically high expectations)

Being overly confident, often resulting in risky bets.

Don't overlook risks, assuming ur bags will consistently grow.

I turned 130k into 8k primarily due to this bias.

Being overly confident, often resulting in risky bets.

Don't overlook risks, assuming ur bags will consistently grow.

I turned 130k into 8k primarily due to this bias.

To avoid that: create risk management rules, and ALWAYS follow them.

I never risk more than 1% of my net worth on a single trade/asset.

I either set stop losses or simply don't buy more than 1% of my current net worth.

Exceptions: long-term holding bags (eth/btc).

I never risk more than 1% of my net worth on a single trade/asset.

I either set stop losses or simply don't buy more than 1% of my current net worth.

Exceptions: long-term holding bags (eth/btc).

8/➮ Framing Effect (Word choice affects judgment)

Imagine being told, "This coin could double!" versus "This coin might drop by half."

Both suggest volatility, but the first sounds enticing while the second scary. This is the framing effect in crypto.

Imagine being told, "This coin could double!" versus "This coin might drop by half."

Both suggest volatility, but the first sounds enticing while the second scary. This is the framing effect in crypto.

To avoid it, ignore the hype or fear and base decisions on thorough research and analysis, not just on how information is framed.

Remember, a coin's real value isn't in its presentation!

Remember, a coin's real value isn't in its presentation!

9/➮ Self-Serving Bias

Blaming ur cat for selling Bitcoin low but taking full credit when taking profit from eth?

Self-serving bias: successes are ur genius but failures someone else's fault.

Remember, even ur cat knows it's about balanced responsibility, not just lucky clicks

Blaming ur cat for selling Bitcoin low but taking full credit when taking profit from eth?

Self-serving bias: successes are ur genius but failures someone else's fault.

Remember, even ur cat knows it's about balanced responsibility, not just lucky clicks

10/➮ Status Quo Bias (Sticking to known paths)

Holding XRP cause it's what you know, ignoring other coins?

Congratulations, u're in a trap

1: 99,9% old alts are losing ETH over the long term. Holding them is already REKT.

2: New alts always have bigger potential on new cycle

Holding XRP cause it's what you know, ignoring other coins?

Congratulations, u're in a trap

1: 99,9% old alts are losing ETH over the long term. Holding them is already REKT.

2: New alts always have bigger potential on new cycle

14/➮ Loss Aversion (Preferring no loss to gain)

Didn't want to lock in a 5% loss, even though u realize holding on no longer makes sense?

That's Loss Aversion bias playing against you.

Don't be afraid to lose, but also don't be greedy, it's not worth it...

Didn't want to lock in a 5% loss, even though u realize holding on no longer makes sense?

That's Loss Aversion bias playing against you.

Don't be afraid to lose, but also don't be greedy, it's not worth it...

I know insane number of people who lost everything cause they didn't want to lock in 1% loss, setting a break-even limit order that price never reached.

Also many missed out on massive profit simply cause they REKTed once.

Assess the risk/reward ratio, not just potential losses

Also many missed out on massive profit simply cause they REKTed once.

Assess the risk/reward ratio, not just potential losses

15/➮ Representativeness Heuristic (Judging by appearance)

If a project slaps 'L2' in its name but doesn't even have a working blockchain (aka @Blast_L2 😁), don't compare its valuation to other L2s.

If a project slaps 'L2' in its name but doesn't even have a working blockchain (aka @Blast_L2 😁), don't compare its valuation to other L2s.

Dig deeper, evaluate multiple criteria: compare TVL, ecosystem, audience, potential, and more, not just category on CoinGecko.

Another dog-themed coin won't reach DOGE's cap just because it's also a meme coin with a dog; after all, it's not the dog design that shapes valuation.

Another dog-themed coin won't reach DOGE's cap just because it's also a meme coin with a dog; after all, it's not the dog design that shapes valuation.

16/➮ Optimism Bias (Overestimating positive outcomes)

Having outplayed the market a few times (often by chance), we begin to believe in our own genius, which leads to taking higher risks and REKT in the end.

Write down your rules and refer to them regularly to avoid this.

Having outplayed the market a few times (often by chance), we begin to believe in our own genius, which leads to taking higher risks and REKT in the end.

Write down your rules and refer to them regularly to avoid this.

17/➮ Neglect of Probability

Buying a 'moonshot' crypto just because it's cheap, without considering its low success probability?

Avoid this by realistically assessing the chances of a coin's success, factoring in market trends, technology, and team credibility, not just price.

Buying a 'moonshot' crypto just because it's cheap, without considering its low success probability?

Avoid this by realistically assessing the chances of a coin's success, factoring in market trends, technology, and team credibility, not just price.

18/➮ Hindsight Bias

Saying 'I knew Bitcoin would crash' after it happens? That's it...

I'm sure that past events were not as predictable as they seem now.

Keep a decision journal to track ur predictions versus outcomes, helping u gauge ur forecasting accuracy realistically.

Saying 'I knew Bitcoin would crash' after it happens? That's it...

I'm sure that past events were not as predictable as they seem now.

Keep a decision journal to track ur predictions versus outcomes, helping u gauge ur forecasting accuracy realistically.

19/➮ Choice-Supportive Bias

That's when u bought crypto and constantly defending it despite poor performance.

To counter it, regularly review ur investments objectively, assessing current data and trends.

Stay open to new info that may challenge ur initial choice.

That's when u bought crypto and constantly defending it despite poor performance.

To counter it, regularly review ur investments objectively, assessing current data and trends.

Stay open to new info that may challenge ur initial choice.

I've created Free Discord Server where u can find everything u've been missing in crypto:

• Community & mentorship

• Free airdrop software

• Shitcoin & NFT calls

• Daily news and to-do list

• Yield strategies

Join right now absolutely for free: discord.com

• Community & mentorship

• Free airdrop software

• Shitcoin & NFT calls

• Daily news and to-do list

• Yield strategies

Join right now absolutely for free: discord.com

➮ Liked this thread? I write educational threads daily, so don't forget to:

✧ Follow me @nobrainflip

✧ Join my tg t.me

✧ Like, RT, bookmark and leave a comment on the first tweet 👇

✧ Follow me @nobrainflip

✧ Join my tg t.me

✧ Like, RT, bookmark and leave a comment on the first tweet 👇

جاري تحميل الاقتراحات...