Before we start, I'd like to ask you a favor.

I've spent a significant amount of time into this research and sincerely appreciate any engagement you've had with this thread!

Add to your bookmarks, replie or just put a like if you can.

I've spent a significant amount of time into this research and sincerely appreciate any engagement you've had with this thread!

Add to your bookmarks, replie or just put a like if you can.

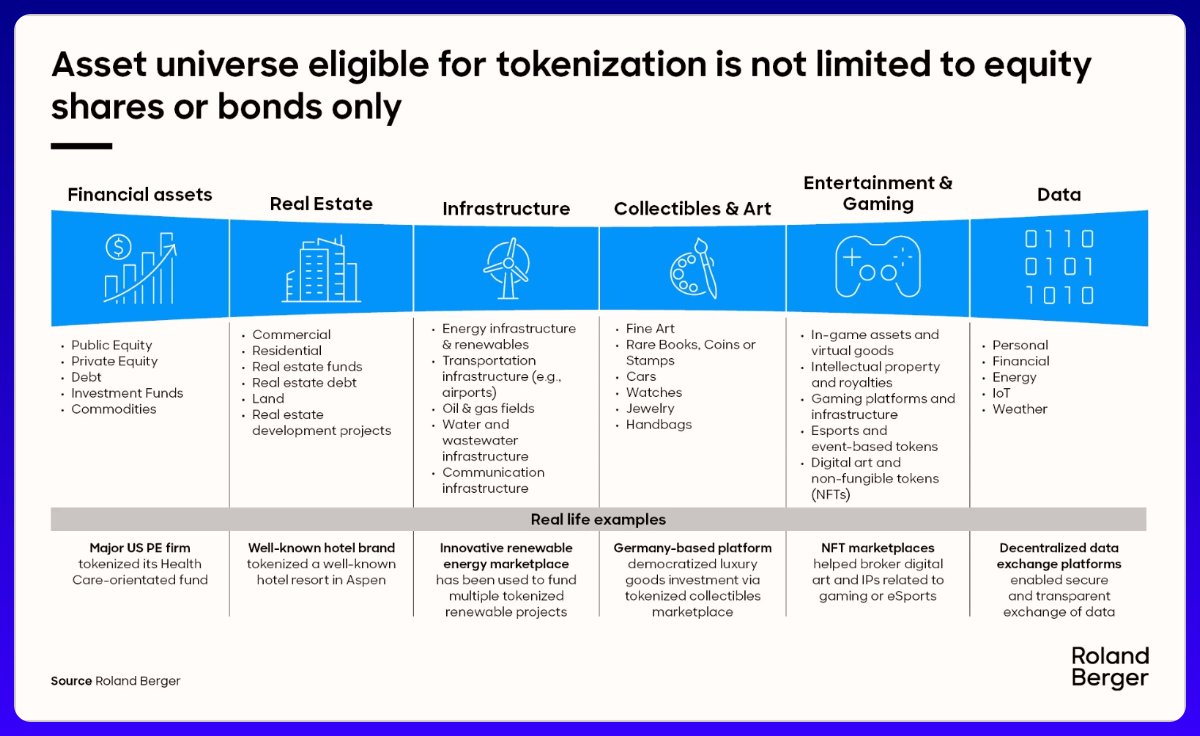

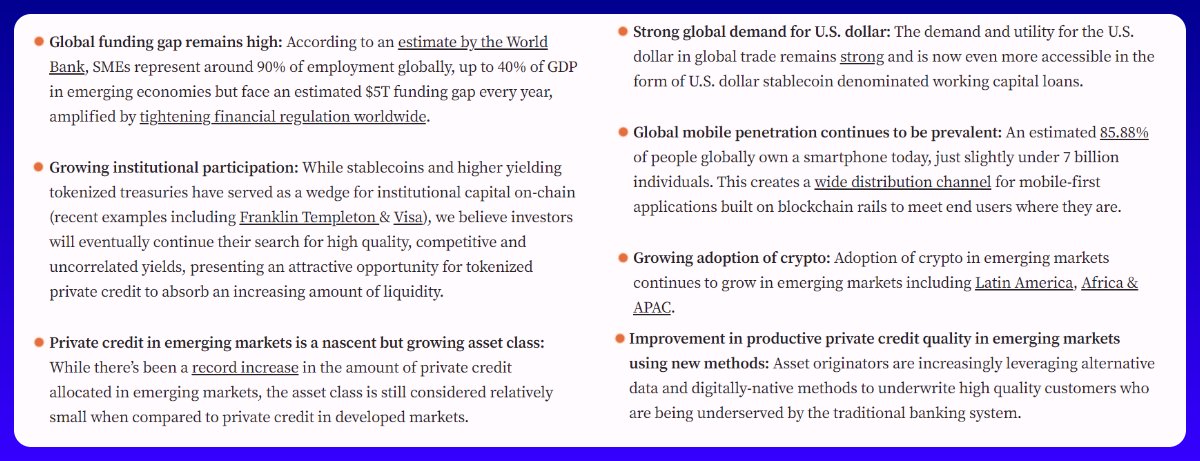

Real World Asset Tokenization is set to revolutionize the financing, trading, and management of assets.

Conservative estimates indicate that by 2030, the total market value of tokenized assets will surpass $10 trillion.

Conservative estimates indicate that by 2030, the total market value of tokenized assets will surpass $10 trillion.

Today, I will explore the main RWA sector's categories, discuss why RWA is expected to be in high demand, and highlight key projects within each category:

◦ Private Credit

◦ Treasuries

◦ Real Estate

◦ L1 Chains

◦ Commodities

◦ Stablecoins

◦ Insurance

◦ Carbon Credit

◦ Private Credit

◦ Treasuries

◦ Real Estate

◦ L1 Chains

◦ Commodities

◦ Stablecoins

◦ Insurance

◦ Carbon Credit

Now, I would like to highlight the projects that I believe are crucial in this category.

However, it is worth noting that some of these projects also have a significant impact in other RWA categories, which makes them even more intriguing ⇩

However, it is worth noting that some of these projects also have a significant impact in other RWA categories, which makes them even more intriguing ⇩

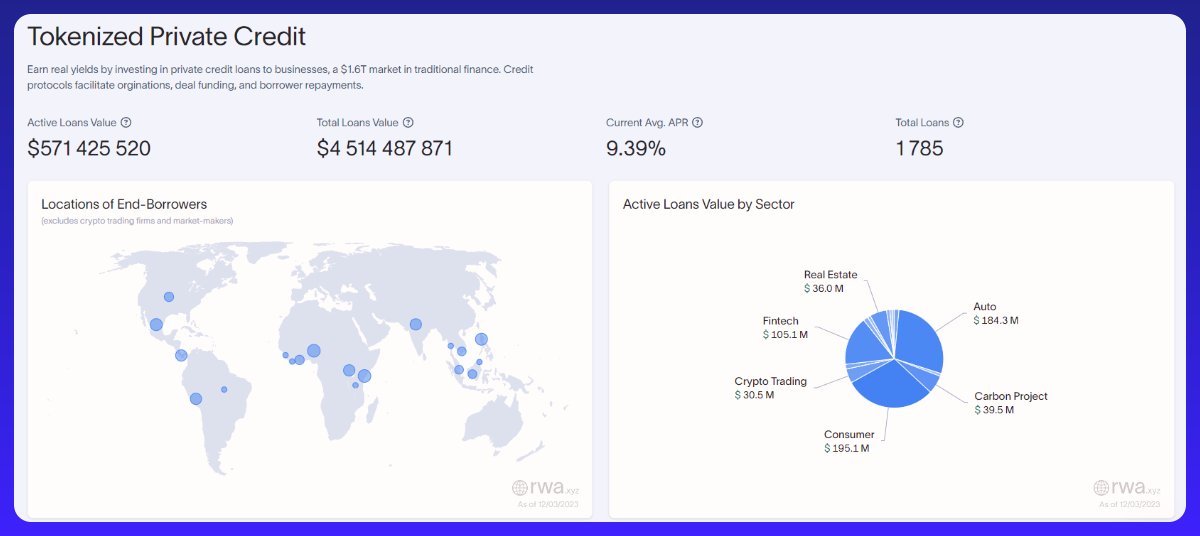

➜ $CFG - @centrifuge - On-chain credit ecosystem designed to provide a venue for SME owners to stake their assets on chain in exchange for liquidity.

➜ $CPOOL - @ClearpoolFin - DeFi lending protocol that provides pure credit loans to institutions.

➜ $CPOOL - @ClearpoolFin - DeFi lending protocol that provides pure credit loans to institutions.

➜ $MPL - @maplefinance - Corporate credit market built on ETH and SOL. Users can lend tokens to institutions, which repay with interest.

➜ $TRADE - @Polytrade_fin - Trading finance platform designed to provide seamless lending to businesses across multiple industries.

➜ $TRADE - @Polytrade_fin - Trading finance platform designed to provide seamless lending to businesses across multiple industries.

US government bonds are considered a risk-free rate. If you can earn 5% instead of 0%, why not?

Stables can be unstable, so tokenized Treasuries are a good hedge against de-peg risk.

Also, @jpmorgan tokenize US Treasury and include it in its strategy, which is a good driver.

Stables can be unstable, so tokenized Treasuries are a good hedge against de-peg risk.

Also, @jpmorgan tokenize US Treasury and include it in its strategy, which is a good driver.

These projects cover various categories, but their wide range of applications amplifies their advantages.

➜ $DEXTF - @DomaniProtocol - asset management protocol for minting, trading, redeeming, and providing liquidity on non-custodial oracle-less tokenized portfolios.

➜ $DEXTF - @DomaniProtocol - asset management protocol for minting, trading, redeeming, and providing liquidity on non-custodial oracle-less tokenized portfolios.

➜ $SMT - @SwarmMarkets - DeFi infrastructure that provides relevant compliance services for RWA token issuance, liquidity provision and trading

➜ $IXS - @IxSwap - Platform where users can trade and invest in SEC-registered security tokens.

➜ $IXS - @IxSwap - Platform where users can trade and invest in SEC-registered security tokens.

➜ $NXRA - @allianceblock - Building infrastructure for decentralized tokenized markets.

➜ $RVST - @RevestFinance - Protocol for the packaging, transfer, and storage of fungible ERC-20 tokens as non-fungible tokenized financial instruments.

➜ $RVST - @RevestFinance - Protocol for the packaging, transfer, and storage of fungible ERC-20 tokens as non-fungible tokenized financial instruments.

➜ $ACQ - @Acquire_Fi - M&A marketplace, that produces income from fractional equity of cryptocurrency companies, traditional businesses, and real-world assets.

➜ $BOSON - @BosonProtocol - Platform where users can transfer and trade of any physical thing as a redeemable NFT.

➜ $BOSON - @BosonProtocol - Platform where users can transfer and trade of any physical thing as a redeemable NFT.

However, it's important to note that the tokenized real estate faces obstacles like an uncertain regulatory framework, security concerns and centralized reporting needs.

This makes it a higher-risk sector due to infrastructure requirements, but it's likely just a matter of time.

This makes it a higher-risk sector due to infrastructure requirements, but it's likely just a matter of time.

➜ $PROPC - @PropChainGlobal - All-inclusive blockchain powered real estate investing marketplace.

➜ $BST - @blocksquare_io - Digitizes real estate value, launches investment platforms, and connects people to online tokenized real estate deals.

➜ $BST - @blocksquare_io - Digitizes real estate value, launches investment platforms, and connects people to online tokenized real estate deals.

➜ $PROPS - @PropbaseApp - Real estate tokenization platform that utilizes the power of the Aptos blockchain

➜ @BinaryxPlatform - Marketplace of tokenized real estate that provides property owners with a system of oracles that allows them to tokenize and retail their property.

➜ @BinaryxPlatform - Marketplace of tokenized real estate that provides property owners with a system of oracles that allows them to tokenize and retail their property.

Moreover, RWA tokenization-oriented chains offer the most comprehensive and advanced tools for this specific purpose.

Consequently, institutional investors can utilize these chains for any tokenization objective.

Here are some of them:

Consequently, institutional investors can utilize these chains for any tokenization objective.

Here are some of them:

➜ $RIO @realio_network - an end-to-end digital asset issuance and P2P trading platform focused on real estate private equity investments.

➜ $POLYX - @PolymeshNetwork - Institutional-grade L1 tailored for regulated assets, such as security-based tokens.

➜ $POLYX - @PolymeshNetwork - Institutional-grade L1 tailored for regulated assets, such as security-based tokens.

➜ @Paxos - Regulated blockchain infrastructure company building transparent and transformative financial solutions.

➜ @tethergold - Emitent of $XAUt - a digital token backed by physical gold.

➜ @cache_gold - Provides unparalleled infrastructure to digitalize physical assets.

➜ @tethergold - Emitent of $XAUt - a digital token backed by physical gold.

➜ @cache_gold - Provides unparalleled infrastructure to digitalize physical assets.

➜ @VROstablecoin - Gold-backed ERC20 stablecoin. Each $VRO is backed by one gram of gold.

➜ @KinesisMonetary - Monetary system making physical gold and silver globally accessible as $KAU and $KAG.

➜ @KinesisMonetary - Monetary system making physical gold and silver globally accessible as $KAU and $KAG.

➜ $agEUR - @angleprotocol -a decentralized protocol developed EUR stablecoin.

➜ $FRAX - @fraxfinance - decentralized stablecoins and DeFi infrastructure. Frax ecosystem is a self-sufficient DeFi economy.

➜ $FRAX - @fraxfinance - decentralized stablecoins and DeFi infrastructure. Frax ecosystem is a self-sufficient DeFi economy.

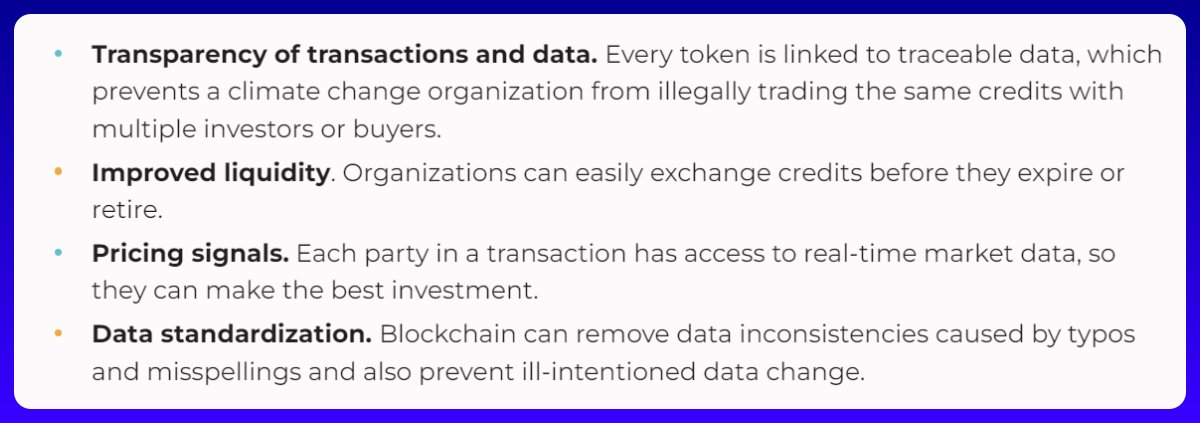

As you may have already guessed, this is one of the most promising sectors due to the increasing attention being given to the environment each year.

Blockchain technology, in turn, has the potential to enhance the transparency of all data.

Some projects ⇩

Blockchain technology, in turn, has the potential to enhance the transparency of all data.

Some projects ⇩

➜ $BCT - @ToucanProtocol: Converts carbon credits into tokens for decentralized trading, promoting carbon neutrality.

➜ @weareflowcarbon: Integrates the carbon credit lifecycle, offering strategies from origination to portfolio management.

➜ @weareflowcarbon: Integrates the carbon credit lifecycle, offering strategies from origination to portfolio management.

Although blockchain is not completely hack-proof, blockchain is currently the most secure method of storing information.

Blockchain registries are secure and time-stamped, allowing transparent tracking of actions. Possible tampering can be proven.

Blockchain registries are secure and time-stamped, allowing transparent tracking of actions. Possible tampering can be proven.

Here are some projects:

➜ $KLIMA - @KlimaDAO - Built Digital Carbon Market, which enables transparent and efficient climate markets of the future.

➜ $CBY - @Carbify_io - By bringing carbon credits on-chain, they leverage gamification to motivate and inspire eco-living.

➜ $KLIMA - @KlimaDAO - Built Digital Carbon Market, which enables transparent and efficient climate markets of the future.

➜ $CBY - @Carbify_io - By bringing carbon credits on-chain, they leverage gamification to motivate and inspire eco-living.

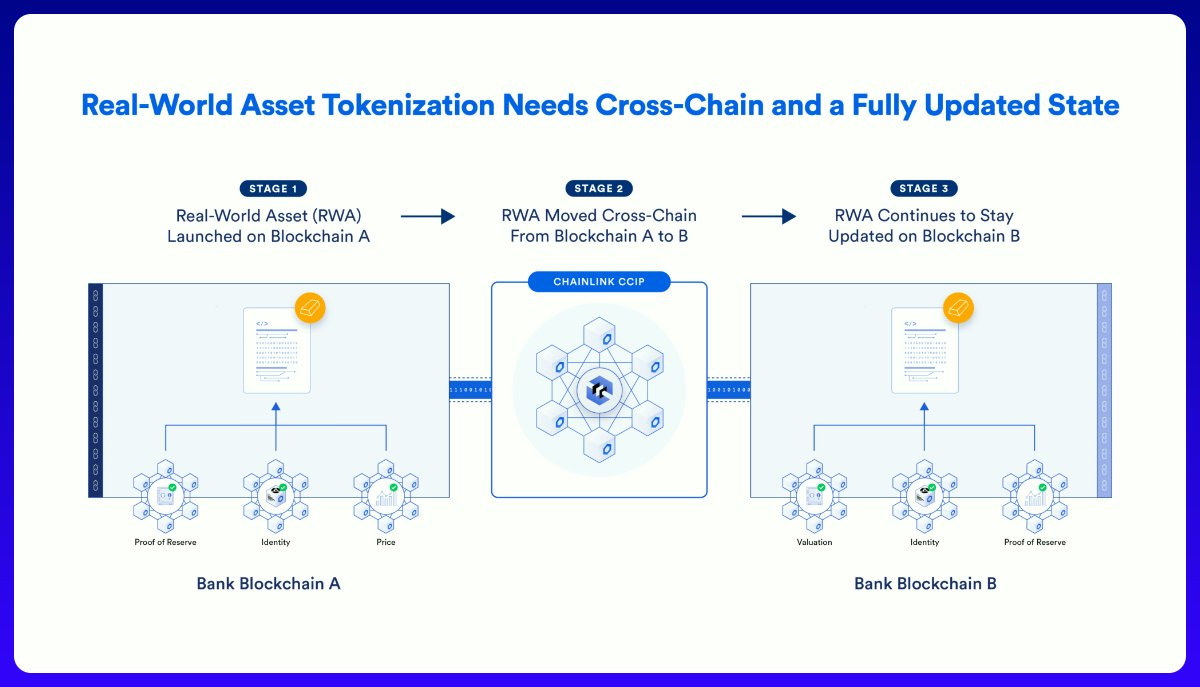

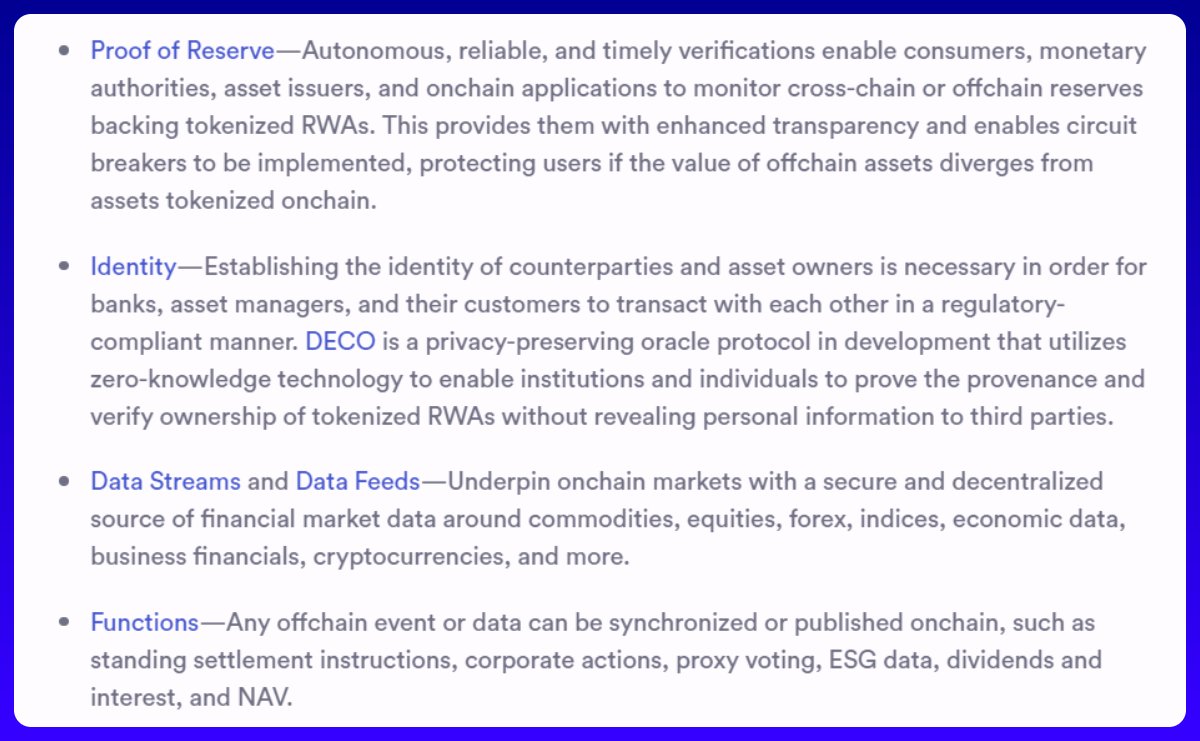

◢ @chainlink - $LINK

Chainlink deserves special recognition as one of the most crucial components of RWA infrastructure.

After all, tokenized RWAs require more than just an issued token to properly represent the underlying asset.

Chainlink deserves special recognition as one of the most crucial components of RWA infrastructure.

After all, tokenized RWAs require more than just an issued token to properly represent the underlying asset.

One of the main advantages of digital assets is that they are programmable containers of information that can be augmented with all the information and logic that banks, protocols, and customers need to interact with the asset.

Chainlink is already the leading platform for tokenized RWAs, powering TrueUSD, Pax Gold and more.

Swift and DTCC are exploring how CCIP can connect to their systems, making it a universal blockchain interoperability standard for tokenized RWAs.

Swift and DTCC are exploring how CCIP can connect to their systems, making it a universal blockchain interoperability standard for tokenized RWAs.

◢ @avax - $AVAX

Avalanche deserves a special mention for its current focus on building a robust RWA ecosystem.

Recognizing the potential in this industry, AVAX has spent the past year forging partnerships and actively supporting developments.

Avalanche deserves a special mention for its current focus on building a robust RWA ecosystem.

Recognizing the potential in this industry, AVAX has spent the past year forging partnerships and actively supporting developments.

It's also worth noting the meaningful partnerships with @jpmorgan, @Citi, @joinrepublic and many others.

All of these efforts are aimed at creating an RWA infrastructure that will benefit both institutional investors and the general public.

And the developments don't stop there

All of these efforts are aimed at creating an RWA infrastructure that will benefit both institutional investors and the general public.

And the developments don't stop there

That's a wrap!

RWA ecosystem is incredibly vast and to cover all the projects would, without hesitation, require an entire book. I have mentioned only a small portion of it.

So, feel free to talk about your favorite in replies. It will enable others to learn more about the eco.

RWA ecosystem is incredibly vast and to cover all the projects would, without hesitation, require an entire book. I have mentioned only a small portion of it.

So, feel free to talk about your favorite in replies. It will enable others to learn more about the eco.

I hope you found this deep dive useful.

Follow me @wacy_time1 for more. The ecosystem review series is just getting started!

Like/Repost the quote below if you can, I would be very grateful!

Follow me @wacy_time1 for more. The ecosystem review series is just getting started!

Like/Repost the quote below if you can, I would be very grateful!

جاري تحميل الاقتراحات...