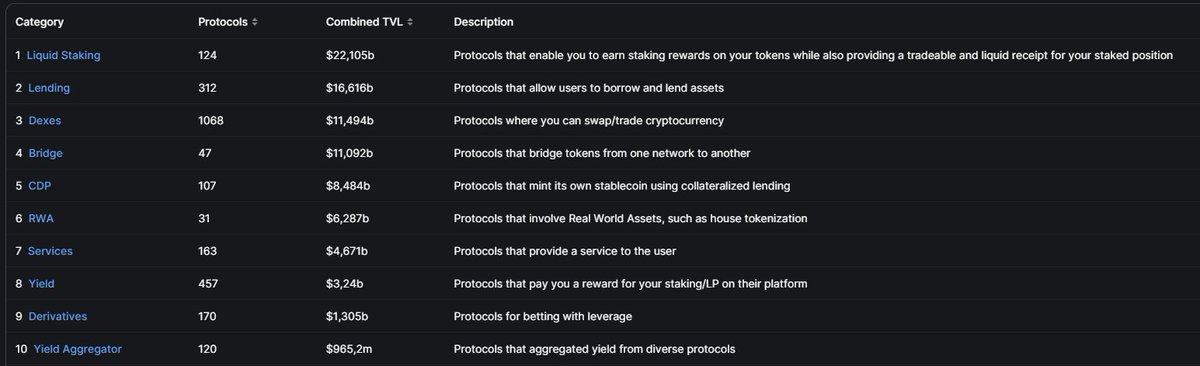

1️⃣ LSD & LSDfi

𝗟𝗦𝗗

Here we are mainly talking about Ethereum Liquid Staking, but it can be extended to EVM & Non-EVM Chains.

Liquid staking is an upgrade over traditional staking that functions by enabling continued access to your staked assets.

𝗟𝗦𝗗

Here we are mainly talking about Ethereum Liquid Staking, but it can be extended to EVM & Non-EVM Chains.

Liquid staking is an upgrade over traditional staking that functions by enabling continued access to your staked assets.

Liquid Staking Derivatives (LSD) are synthetic assets that represent another asset.

Their value is based on the underlying value of the asset that they represent.

You can use an LSD to trade, lend or provide as collateral to DeFi dApps.

Their value is based on the underlying value of the asset that they represent.

You can use an LSD to trade, lend or provide as collateral to DeFi dApps.

𝗟𝗦𝗗𝗳𝗶

Combining LSD and DeFi:

LSDfi builds on top of LSD tokens increasing the utility and opening up yield opportunities to LSD token holders.

These opportunities come in the form of borrowing against these LSD, speculation, hedging against the yield of LSD, etc.

Combining LSD and DeFi:

LSDfi builds on top of LSD tokens increasing the utility and opening up yield opportunities to LSD token holders.

These opportunities come in the form of borrowing against these LSD, speculation, hedging against the yield of LSD, etc.

2️⃣ Omnichain & LayerZero

𝗢𝗺𝗻𝗶𝗰𝗵𝗮𝗶𝗻

In today's crypto environment we have many chains, not easily connected to each other.

Because of that, liquidity eventually became fragmented across the various chains, resulting in chains being siloed from one another.

𝗢𝗺𝗻𝗶𝗰𝗵𝗮𝗶𝗻

In today's crypto environment we have many chains, not easily connected to each other.

Because of that, liquidity eventually became fragmented across the various chains, resulting in chains being siloed from one another.

Omnichain connects all chains, regardless of their smart contract technology, by creating a base layer (Layer 0) on which all other networks and dApps can be located.

Omnichain interoperability is all about developing multichain solutions which encompasses both EVM and non EVM.

Omnichain interoperability is all about developing multichain solutions which encompasses both EVM and non EVM.

3️⃣ Seneca & CDP

After all that, it's easy to see why Omnichain and LSDfi are crucial Narratives.

A project fitting these narratives with strong fundamentals and a long-term vision should be a winner.

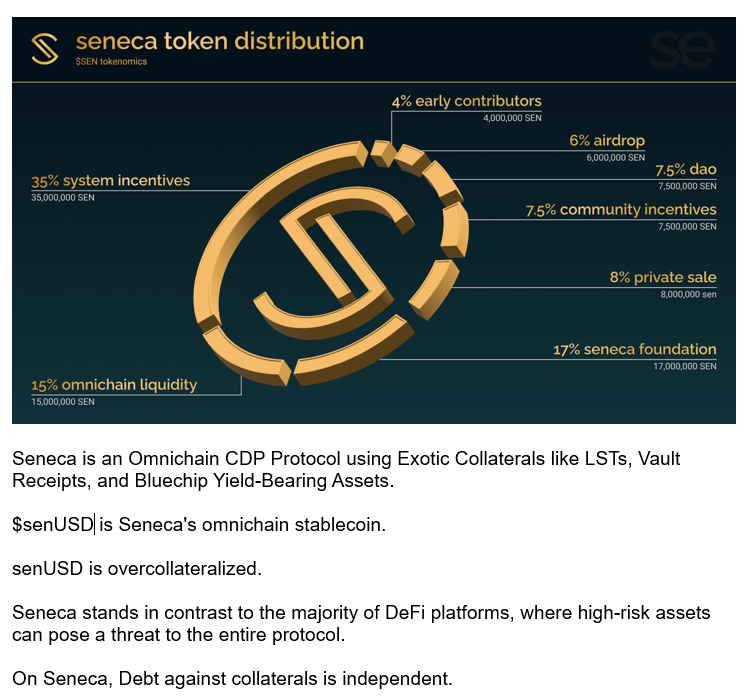

Introducing @SenecaUSD, an Omnichain CDP Protocol using Yield-Bearing Assets.

After all that, it's easy to see why Omnichain and LSDfi are crucial Narratives.

A project fitting these narratives with strong fundamentals and a long-term vision should be a winner.

Introducing @SenecaUSD, an Omnichain CDP Protocol using Yield-Bearing Assets.

𝗖𝗗𝗣

A Collateralized Debt Position (CDP) is held by locking collateral in smart contracts to generate stablecoins.

CDP protocols are projects that generate their own stablecoin through collateralized lending.

A Collateralized Debt Position (CDP) is held by locking collateral in smart contracts to generate stablecoins.

CDP protocols are projects that generate their own stablecoin through collateralized lending.

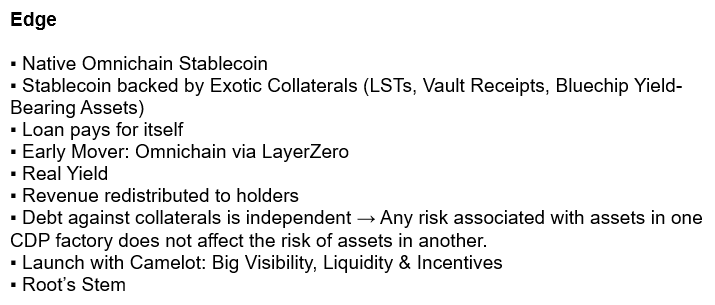

What sets Seneca apart from other CDP protocols is the fact that we can provide exotic collaterals.

And it's far from being only limited to Liquid Staking Assets:

• LSTs (stETH, rETH, frxETH, and more)

• Yield-Bearing Stablecoins

• Vault Receipts (GLP and more)

• And More

And it's far from being only limited to Liquid Staking Assets:

• LSTs (stETH, rETH, frxETH, and more)

• Yield-Bearing Stablecoins

• Vault Receipts (GLP and more)

• And More

▪️ Debt against collaterals is independent → Any risk associated with assets in one CDP factory does not affect the risk of assets in another.

▪️ Launch with @CamelotDEX: Big Visibility, Liquidity & Incentives

▪️ @Root_Genesis's Stem

▪️ Launch with @CamelotDEX: Big Visibility, Liquidity & Incentives

▪️ @Root_Genesis's Stem

𝗛𝗼𝘄 𝘁𝗼 𝗴𝗲𝘁 𝗔𝗵𝗲𝗮𝗱 & 𝗕𝗲𝗻𝗲𝗳𝗶𝘁 𝗳𝗿𝗼𝗺 𝗦𝗲𝗻𝗲𝗰𝗮

▪️ Try the Testnet, there might be some rewards 👀

▪️ Follow @SenecaUSD to get Alpha as soon as announced, Join the Discord & TG Channels.

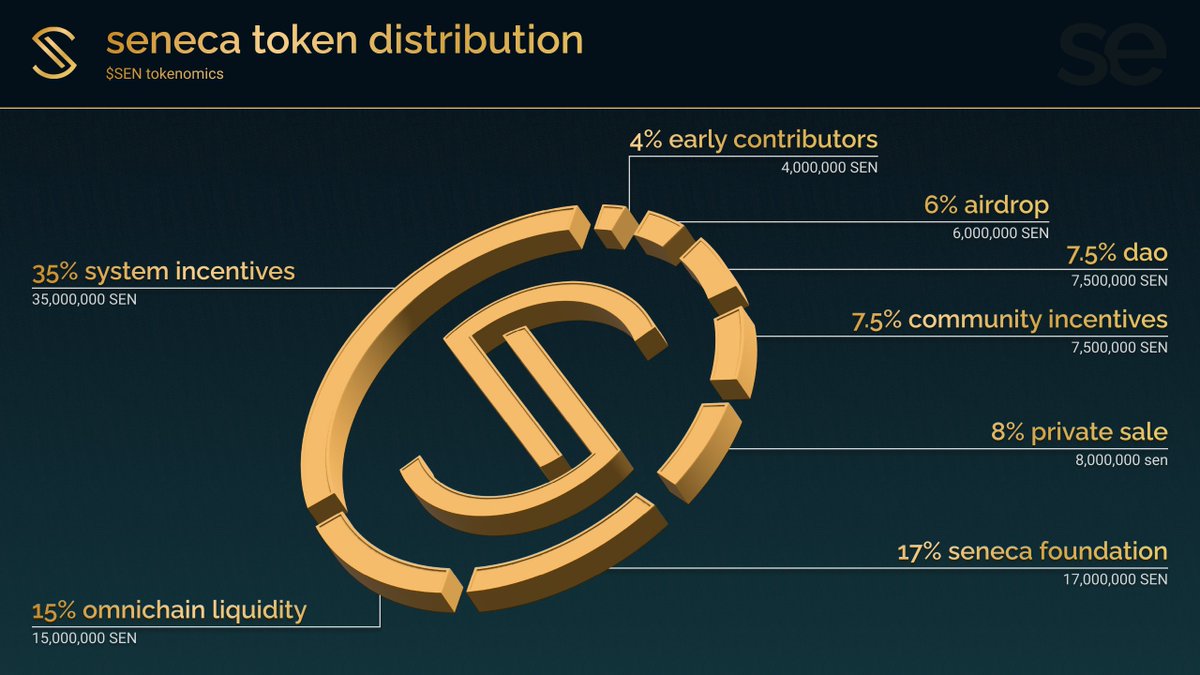

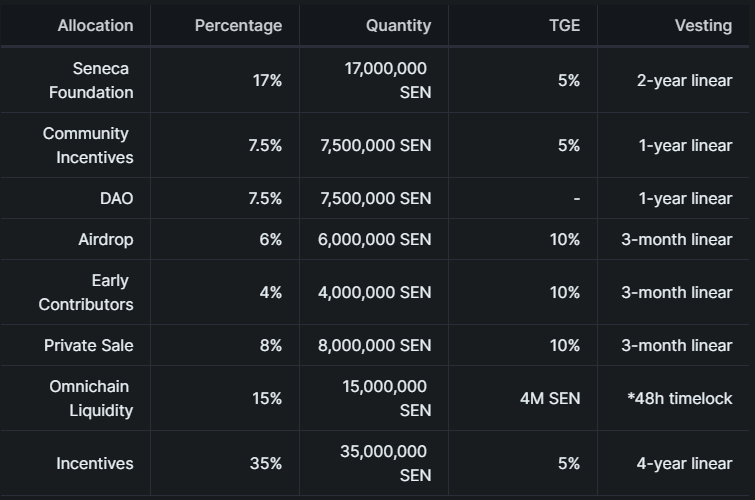

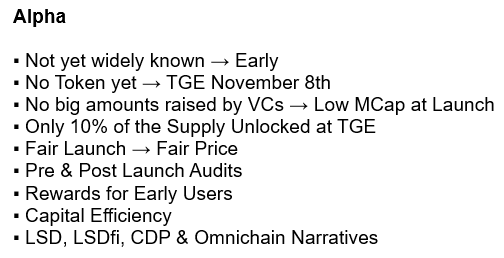

▪️ Be Ready for the TGE & Purchase $SEN Early.

NFA & DYOR

▪️ Try the Testnet, there might be some rewards 👀

▪️ Follow @SenecaUSD to get Alpha as soon as announced, Join the Discord & TG Channels.

▪️ Be Ready for the TGE & Purchase $SEN Early.

NFA & DYOR

8️⃣ Conclusion

This thread was made in collaboration with @SenecaUSD.

I'm working with them because Seneca is a project fitting multiple great Narratives for the next Bullrun, with Innovations & Edges.

And we're early.

As always it's NFA.

This thread was made in collaboration with @SenecaUSD.

I'm working with them because Seneca is a project fitting multiple great Narratives for the next Bullrun, with Innovations & Edges.

And we're early.

As always it's NFA.

🔸 Official Links 🔸

X: @SenecaUSD

Discord: discord.gg

Telegram: t.me

Docs: seneca-protocol-docs.gitbook.io

Website: senecaprotocol.com

X: @SenecaUSD

Discord: discord.gg

Telegram: t.me

Docs: seneca-protocol-docs.gitbook.io

Website: senecaprotocol.com

seneca-protocol-docs.gitbook.io

Seneca Protocol

Seneca Protocol is a CDP platform for yield-bearing assets. Seneca provides senUSD borrowing against...

discord.gg/senecaprotocol

Join the Seneca Discord Server!

Check out the Seneca community on Discord - hang out with 1018 other members and enjoy free voice an...

t.me/seneca_protocol

Seneca Announcements

An omni-chain isolated lending platform. Borrow, leverage & hedge with ease. https://linktr.ee/senec...

senecaprotocol.com

Seneca

Use your favourite assets as collateral to borrow senUSD, Seneca's collateral-backed stablecoin. OMN...

Find more Alpha about Promising Projects in my Newsletter:

tinyurl.com

Stay Updated on Seneca & Also find Live Alpha in my TG Channel:

bit.ly

Find out about the Catalysts & Alpha early, have your edge on the Market.

tinyurl.com

Stay Updated on Seneca & Also find Live Alpha in my TG Channel:

bit.ly

Find out about the Catalysts & Alpha early, have your edge on the Market.

That's it for today frens!

If you've found this thread useful you can follow @CryptoShiro_ for Alpha, Knowlegde & Airdrop content.

I would appreciate if you support my content by Liking/RTing the first Tweet of the thread. 👇

If you've found this thread useful you can follow @CryptoShiro_ for Alpha, Knowlegde & Airdrop content.

I would appreciate if you support my content by Liking/RTing the first Tweet of the thread. 👇

جاري تحميل الاقتراحات...