1/ Macro Pulse Update 23.09.2023, covering the following topics:

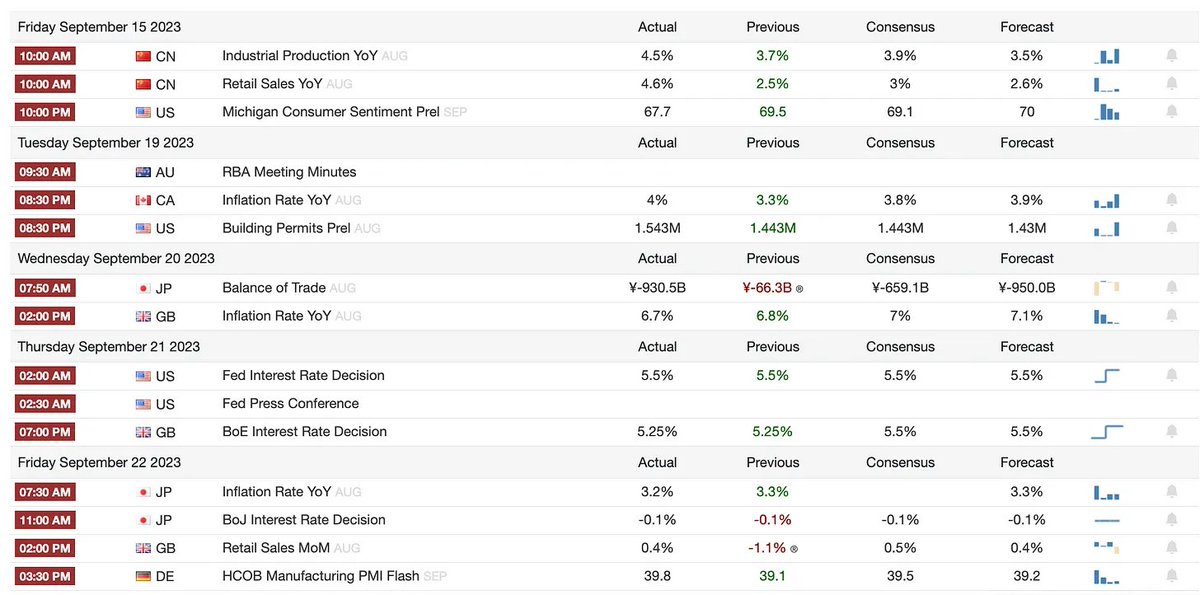

1️⃣ Macro events for the week

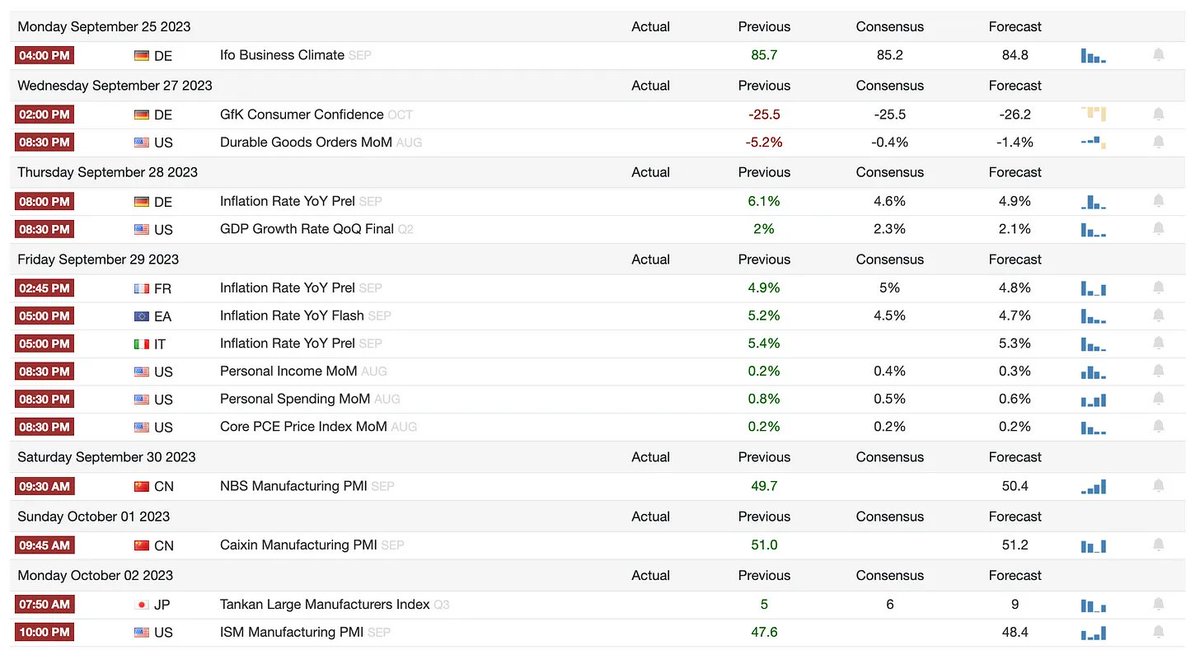

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

4/ 2️⃣ Bitcoin Buzz Indicator

Banking and Regulatory Updates

• Citigroup Dives into Tokenized Bonds with BBX

• Mt. Gox Credit Repayment Extension Shakes Crypto Market

• Laser Digital Launches Bitcoin Adoption Fund

• Binance Fights SEC Lawsuit with Dismissal Motion

Banking and Regulatory Updates

• Citigroup Dives into Tokenized Bonds with BBX

• Mt. Gox Credit Repayment Extension Shakes Crypto Market

• Laser Digital Launches Bitcoin Adoption Fund

• Binance Fights SEC Lawsuit with Dismissal Motion

5/ • FCA Tightens Crypto Advertising Rules in the UK

Crypto Exchanges and Legal Troubles

• JPEX Exchange Fraud Case Intensifies in Hong Kong

• Bankrupt FTX Sues Salameda to Recover Millions

• Bybit Suspends UK Operations Amid FCA Changes

Crypto Exchanges and Legal Troubles

• JPEX Exchange Fraud Case Intensifies in Hong Kong

• Bankrupt FTX Sues Salameda to Recover Millions

• Bybit Suspends UK Operations Amid FCA Changes

6/ Tech and Security News

• Google Cloud Adds 11 New Blockchains to BigQuery

• Nansen Discloses Security Breach Affecting Users

• Google Cloud Adds 11 New Blockchains to BigQuery

• Nansen Discloses Security Breach Affecting Users

8/ Altcoins:

• ApeCoin DAO voted to create a sister DAO for influential NFT acquisitions.

• Balancer's frontend suffered a DNS attack, losing over $250K.

• Wintermute transferred 7.3 million Blur tokens to two exchanges.

• ApeCoin DAO voted to create a sister DAO for influential NFT acquisitions.

• Balancer's frontend suffered a DNS attack, losing over $250K.

• Wintermute transferred 7.3 million Blur tokens to two exchanges.

9/ • Canto surged 13% after announcing a move to Ethereum as a layer 2 network.

• Polygon Labs suggested using CDK to help Celo migrate to Ethereum's layer 2.

• OPNX's $30M bid for Hodlnaut was turned down as FLEX token tanked by 90%.

• Polygon Labs suggested using CDK to help Celo migrate to Ethereum's layer 2.

• OPNX's $30M bid for Hodlnaut was turned down as FLEX token tanked by 90%.

10/ • ImmutableX rose 25% due to a price surge driven by South Korean traders.

• Nexo earned CSA STAR Level 1 Certification, boosting its security and transparency.

• MakerDAO's MKR approached a 16-month high, fueled by whale accumulation and a bullish crypto hedge fund.

• Nexo earned CSA STAR Level 1 Certification, boosting its security and transparency.

• MakerDAO's MKR approached a 16-month high, fueled by whale accumulation and a bullish crypto hedge fund.

11/ • Optimism Foundation's $157M token sale shook the market following its third airdrop.

• Toncoin entered the top 10, gaining 30% in a week.

• Circle launched its native USDC stablecoin on both Polkadot and NEAR.

• Toncoin entered the top 10, gaining 30% in a week.

• Circle launched its native USDC stablecoin on both Polkadot and NEAR.

12/ 3️⃣ Market overview

Central banks remain focused on tightening monetary policy to combat high inflation, though there are some early signs of inflation peaking. This is leading to market volatility as investors weigh recession risks.

Central banks remain focused on tightening monetary policy to combat high inflation, though there are some early signs of inflation peaking. This is leading to market volatility as investors weigh recession risks.

13/ The path of inflation and central bank policy will remain key drivers of markets in the months ahead.

• The Fed is expected to interest rates by 0.75% in 2023 and indicated rates will remain high through 2024 to combat inflation.

• The Fed is expected to interest rates by 0.75% in 2023 and indicated rates will remain high through 2024 to combat inflation.

14/ • UK inflation slowed more than expected in August, reducing pressure on the BoE to continue aggressive rate hikes. However, the BoE is still expected to raise rates.

• US stocks declined after the Fed announcement, with the Nasdaq down 1.5%.

• US stocks declined after the Fed announcement, with the Nasdaq down 1.5%.

15/ • Oil prices also declined, with WTI dropping below $90 and Brent below $93 per barrel, as recession fears mounted.

16/ 4️⃣ Key Economic Metrics

Key will be watching trends in core inflation and shelter costs. If those continue declining, it would support a less aggressive Fed stance.

But further energy price spikes could renew focus on headline inflation.

Key will be watching trends in core inflation and shelter costs. If those continue declining, it would support a less aggressive Fed stance.

But further energy price spikes could renew focus on headline inflation.

17/ • 🟡 Headline CPI inflation rebounded to 5.7% in August due to rising energy prices.

• 🔴 Shelter inflation continues to be high at 7.3% but has fallen from a peak of 8.2% in May. As housing prices stabilize, shelter inflation should continue to moderate.

• 🔴 Shelter inflation continues to be high at 7.3% but has fallen from a peak of 8.2% in May. As housing prices stabilize, shelter inflation should continue to moderate.

18/ • 🟡 Prices of durable goods fell 2% over the past year, while prices of nondurable goods rose just 0.6% excluding food.

• 🟢 Declines were seen in some services like airfares (-13.3%). This indicates underlying inflation pressures may be easing.

• 🟢 Declines were seen in some services like airfares (-13.3%). This indicates underlying inflation pressures may be easing.

19/ • 🟡 The rise in energy prices remains a concern that could feed into other prices. But supply restrictions have likely peaked.

• 🔴 Markets expect at least one more rate hike this year, but a pause in 2024 as the impacts of tightening are felt.

• 🔴 Markets expect at least one more rate hike this year, but a pause in 2024 as the impacts of tightening are felt.

20/ 5️⃣ China Spotlight

China Economy 🔴

While recent data shows a modest rebound, the economy faces persistent drags. Policy support so far has been cautious. More policy easing may be needed to stabilize growth.

China Economy 🔴

While recent data shows a modest rebound, the economy faces persistent drags. Policy support so far has been cautious. More policy easing may be needed to stabilize growth.

21/ • Retail sales and industrial production rebounded modestly in August, suggesting the economy is stabilizing somewhat after a weak July.

• However, fixed asset investment growth continues to decelerate, especially in the property sector

• However, fixed asset investment growth continues to decelerate, especially in the property sector

22/ • Residential property prices declined further in August, with sales of new homes falling as well.

• Inflation ticked up slightly in August, with CPI at 0.1% after dipping into deflation in July. But inflationary pressures remain muted overall.

• Inflation ticked up slightly in August, with CPI at 0.1% after dipping into deflation in July. But inflationary pressures remain muted overall.

23/ • Policymakers have taken some steps to support growth, including easing monetary policy, but face headwinds like a declining workforce and weak private investment.

China's electric vehicle strength and potential EU retaliation 🔴

China's electric vehicle strength and potential EU retaliation 🔴

24/ China is becoming a major exporter of electric vehicles, with exports quadrupling since early 2021. This comes as domestic demand is weak.

Europe is a key market, accounting for 20% of China's EV exports.

(...read more in newsletter below)

Europe is a key market, accounting for 20% of China's EV exports.

(...read more in newsletter below)

26/ Appreciate a subscribe to my daily notes at ToE on telegram with a totally different kind of alpha packed content.

t.me

t.me

29/ I hope you've found this thread helpful.

1. Follow me @arndxt_xo

2. Subscribe to Threading on the Edge newsletter

3. Join my telegram channel for more alpha!

Retweet, Comment and Like the first tweet below if you can:

1. Follow me @arndxt_xo

2. Subscribe to Threading on the Edge newsletter

3. Join my telegram channel for more alpha!

Retweet, Comment and Like the first tweet below if you can:

جاري تحميل الاقتراحات...