I should say that this story is a mere recollection of what my poor memory was able to produce, all opinions are my own, the way the events are described here is the most I can disclose without violating non-disclosures.

I feel I should start from when I first met Sam...

2/25

I feel I should start from when I first met Sam...

2/25

…they were glancing at each other throughout the whole meeting as if it was some kind of a game, needless to mention that both were also wearing cargo shorts. It was hard to take them seriously amidst a sea of white-collar ex-trad fi crypto wannabes of 2019.

5/25

5/25

Sam had been building FTX in stealth mode for months and clearly had no intention to make any market besides his own, but fishing for insights from a potential competitor was apparently worth his time.

6/25

6/25

So Sam sat through the pitch with a bored face, never making eye contact, just barely nodding in response to my words and shrugging shoulders when I was asking questions about Alameda trading strategies and things they wanted from an exchange.

7/25

7/25

However, when it was Sam’s turn to speak, he became quite excited, asking questions about our architecture and liquidity program, and debating our go-to-market strategy as if we were partners already.

8/25

8/25

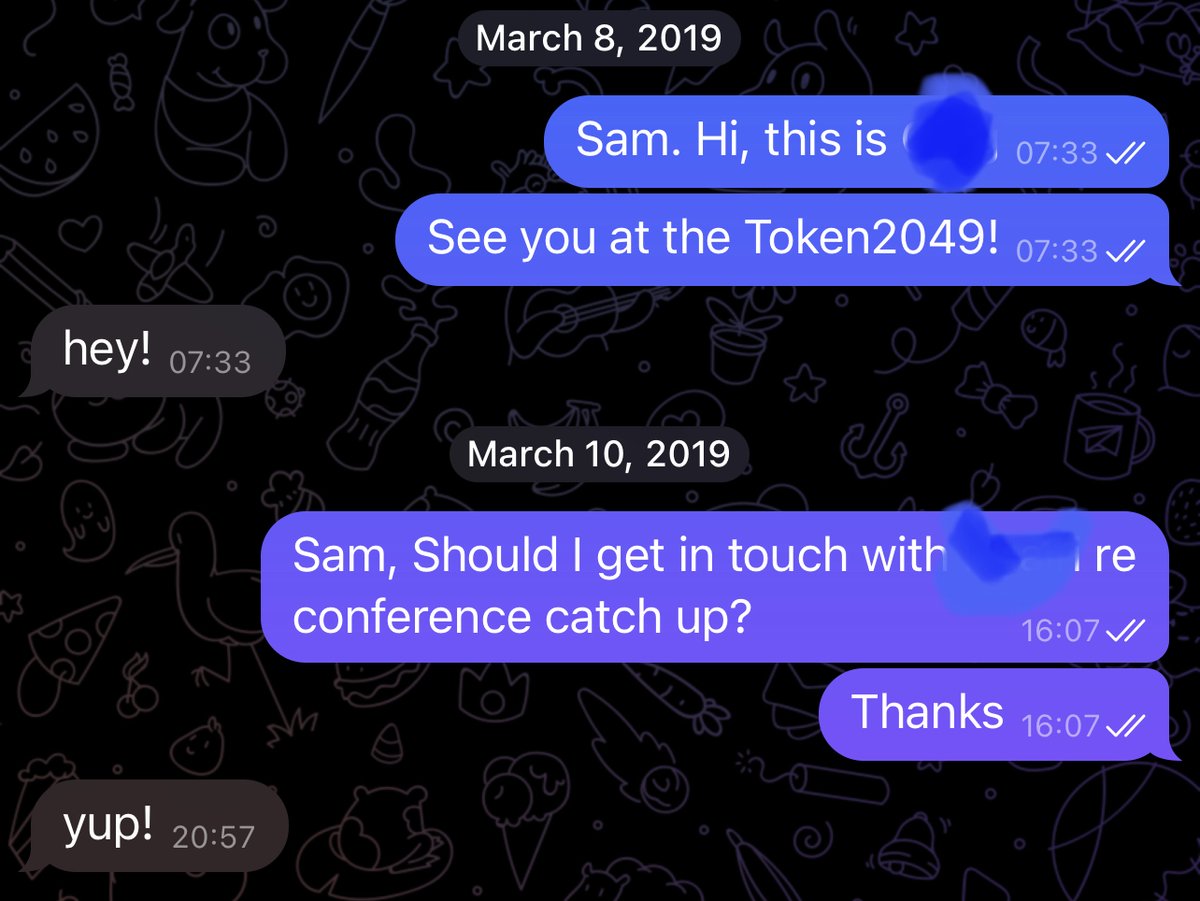

Instead of being alarmed by his clearly intrusive questions, I just thought he was a very bright and open individual. In the end, Sam wished me luck and promised to get back after the conference, however, it would be two long years before our paths crossed again...

9/25

9/25

Users instantly fell in love with FTX for its simple design, “light” KYC, and shitcoin perps leveraged trading, but allegedly there was something else that drew liquidity in...

11/25

11/25

Several big makers revealed that their strategies just worked better on FTX vs other exchanges, as if someone was losing money to them on purpose to draw liquidity to FTX… a smart go-to-market strategy by Sam? I wonder if Alameda investors were on board with it…

12/25

12/25

Several months would pass, and FTX was quickly becoming a unicorn, while we had only just received the license and were clearly late to the game. Struggling to attract liquidity and with little funding left, we decided to look for a strategic buyer.

13/25

13/25

We sent our deck to FTX and jumped on a call. Immediately I had a weird flashback to our first meeting, only now Sam was the buyer and not the client. I saw Sam's face on the screen and his eyes were sporadically running around what I thought were the trading monitors...

15/25

15/25

Shortly after the call, Sam came back with an offer and promised to close the deal quickly if we agreed to his terms immediately (you guessed it, FTT payment to founders held at FTX custody) – with little leverage for negotiation, we agreed reluctantly.

17/25

17/25

Both Mr. Bankman-Fried and Mr. Bankman were very soft-spoken on that call and explained that it was very important for them to also have our crypto license as part of the deal scope. They also for whatever reason seemed to be very concerned about the timing of the deal...

19/25

19/25

I recall Sam’s dad ending the conversation by saying "Sam, I certainly would sleep much better if this deal happens", I actually quite liked him that day and still think he was genuinely concerned for his son’s enterprise, trying to mitigate regulatory risks.

20/25

20/25

Things got ugly on a few calls when FTX team screamed at us and later apologized privately saying that it was Sam who was putting pressure on them, so they had no choice but to stream the aggression down - great corporate culture... But Sam was just getting started...

23/25

23/25

We received an email from Sam, who was calling us all sorts of names, saying that the deal amount was not worth his time and promising to cut the price by 5% every day until the documents were signed… we were shocked - was the deal off the table?

24/25

24/25

Twitter has a limit of 25 tweets per 🧵, so I will have to share the second part of the story in the next 🧵 very shortly and explain how Sam shot himself in a foot by acquiring our business.

Stay tuned and drop a reply here if you found this interesting 🫶🏻

25/25

Stay tuned and drop a reply here if you found this interesting 🫶🏻

25/25

PART II

جاري تحميل الاقتراحات...