They have the following benefits:

• Speed

• Improved UX

• Automation

• Easier to use for new users

• Security (MEV & rug protection)

• Speed

• Improved UX

• Automation

• Easier to use for new users

• Security (MEV & rug protection)

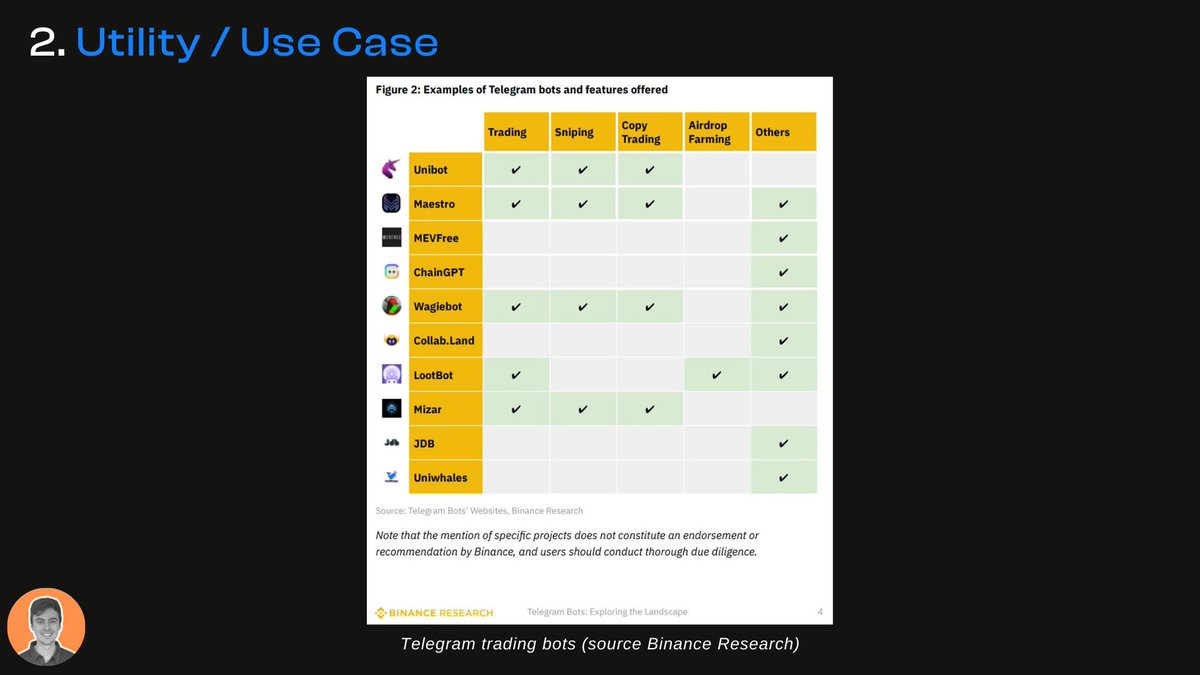

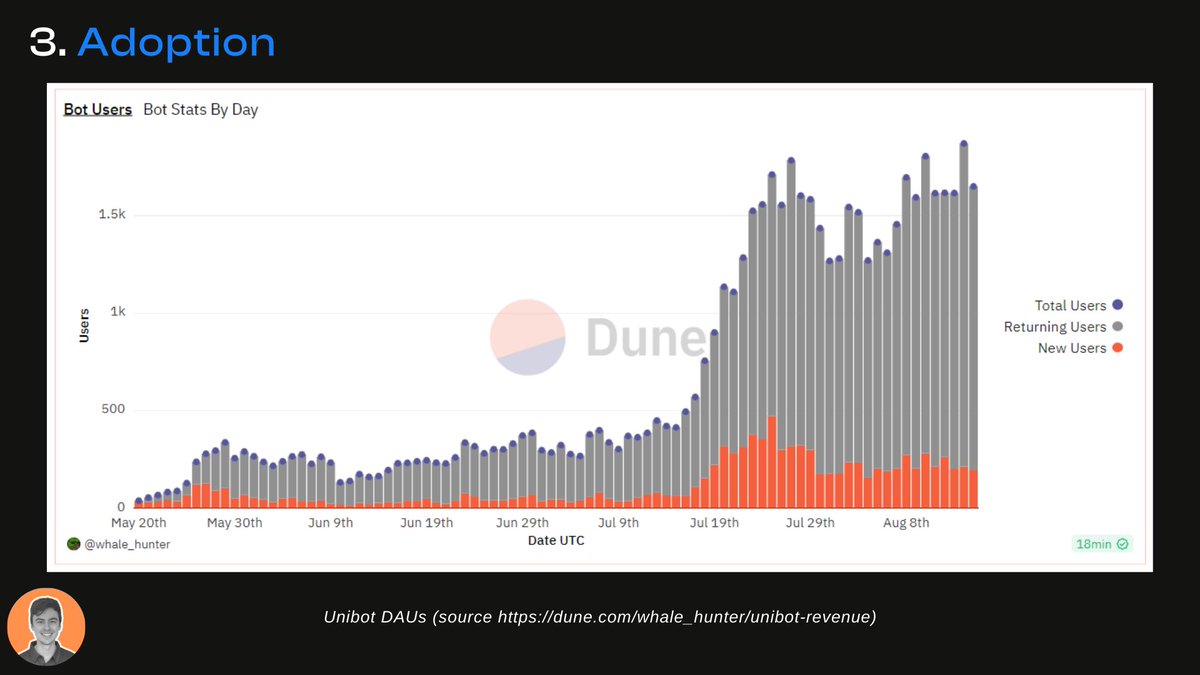

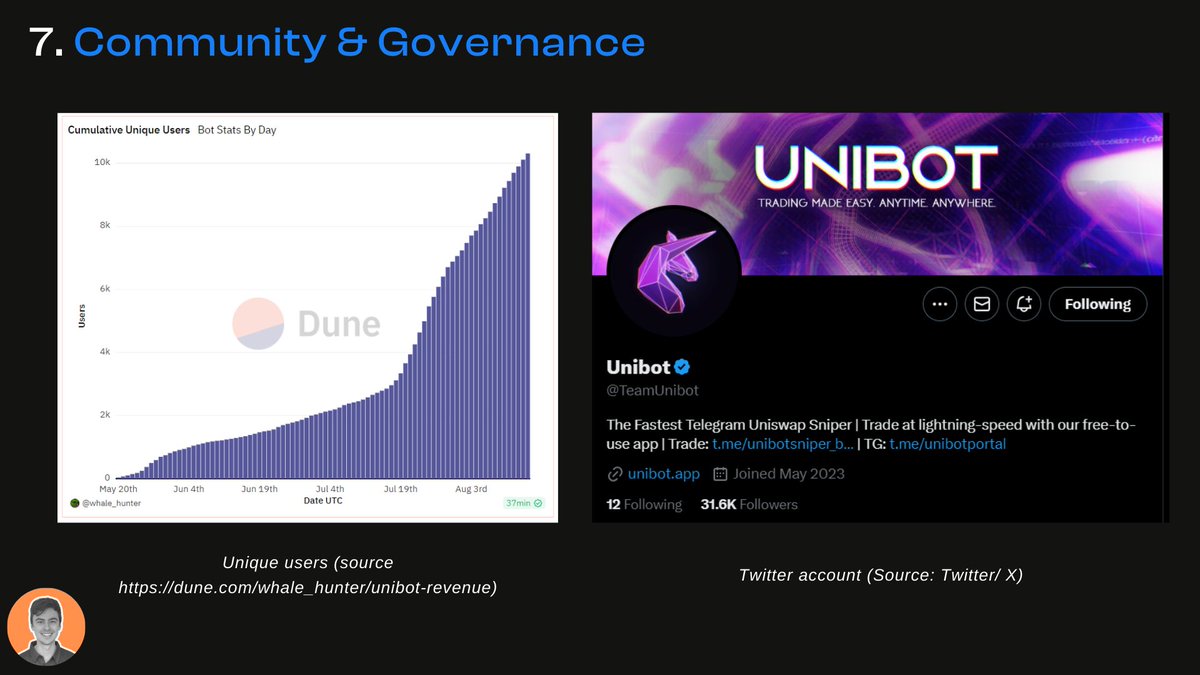

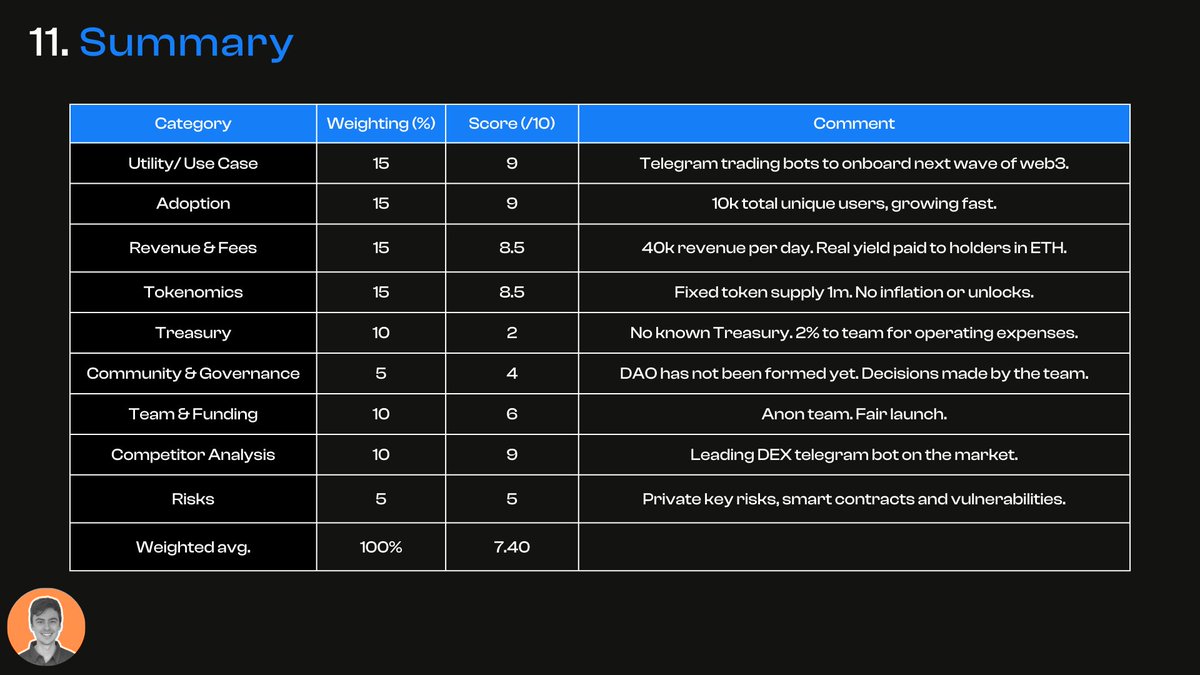

Unibot has dominated the market and currently has around a 71% market share.

I think this is just the beginning for this sector as telegram bots will help to onboard more users and investors into the web3 space.

I think this is just the beginning for this sector as telegram bots will help to onboard more users and investors into the web3 space.

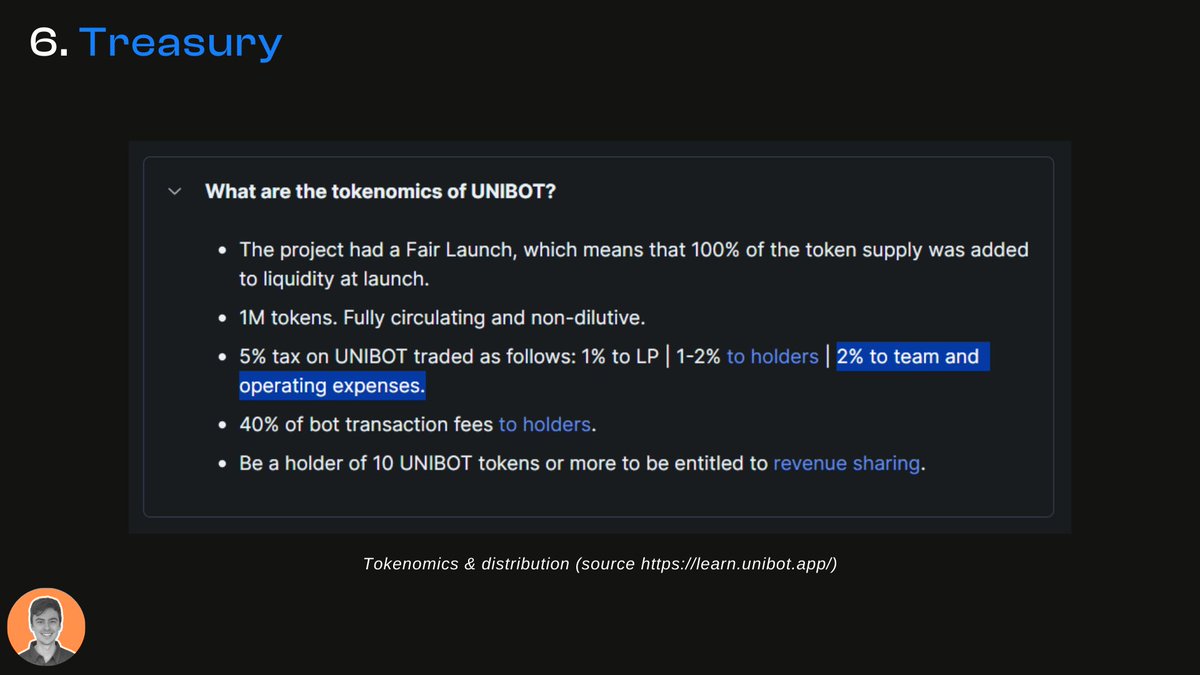

Revenue distributed to holders:

• 40% of all bot transaction fees incurred

• 1% of all UNIBOT volume traded. (2% till Sep for participants in token migration)

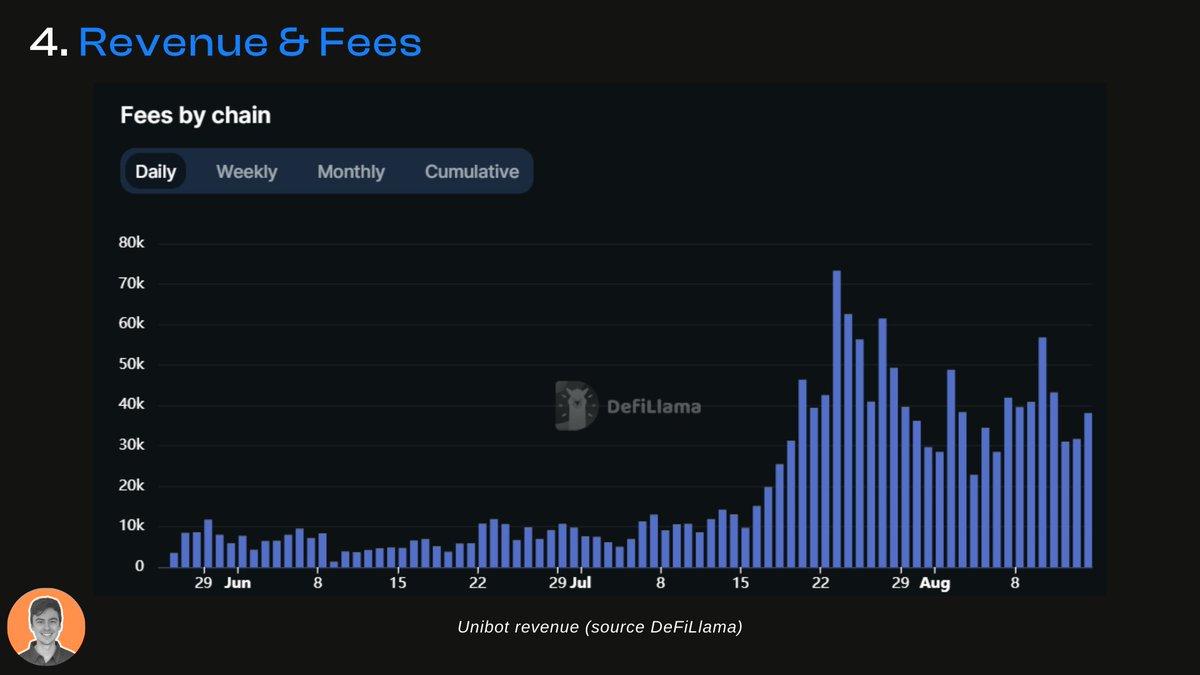

Unibot is consistently generating $40k in revenue per day- 26th place amongst all protocols according to DeFi Llama.

• 40% of all bot transaction fees incurred

• 1% of all UNIBOT volume traded. (2% till Sep for participants in token migration)

Unibot is consistently generating $40k in revenue per day- 26th place amongst all protocols according to DeFi Llama.

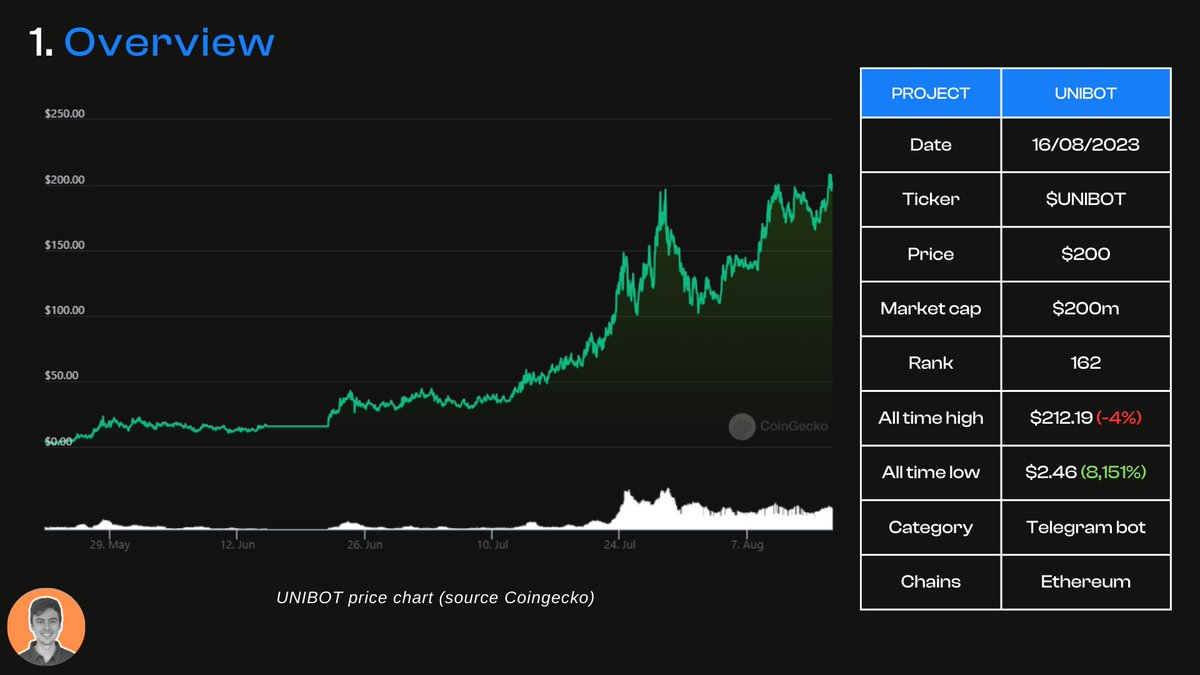

These are the current supply stats:

• Circulating & Max supply = 1m

• Market cap = $200m

• FDV = $200m

• Market cap/ FDV = 1

• Circulating & Max supply = 1m

• Market cap = $200m

• FDV = $200m

• Market cap/ FDV = 1

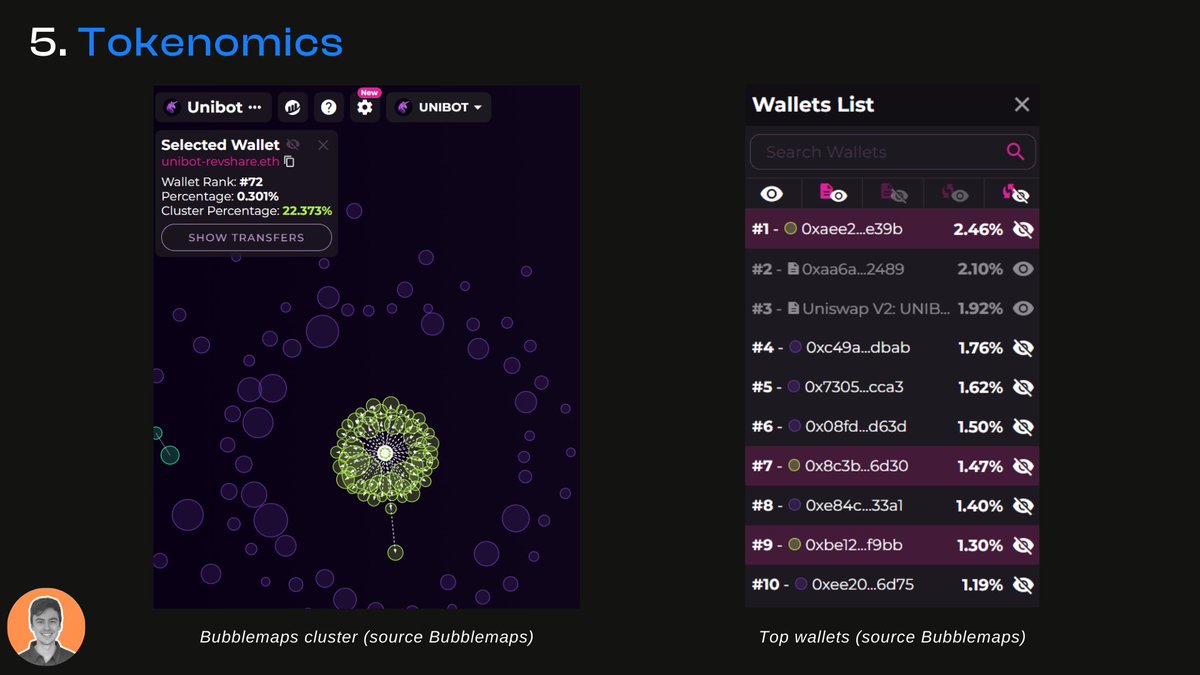

The green bubblemaps cluster is the revenue share distribution (a healthy cluster).

As you can see, largest wallet only holds 2.46% of supply (24.7k UNIBOT = $4.7m).

Check out the Bubblemaps thread for more detailed analysis.

As you can see, largest wallet only holds 2.46% of supply (24.7k UNIBOT = $4.7m).

Check out the Bubblemaps thread for more detailed analysis.

However, Unibot is dominating since it launched. They now command about a 71% share of total market cap dominance (according to Coingecko).

Won't be long before they overtake Maestro in total numbers.

Won't be long before they overtake Maestro in total numbers.

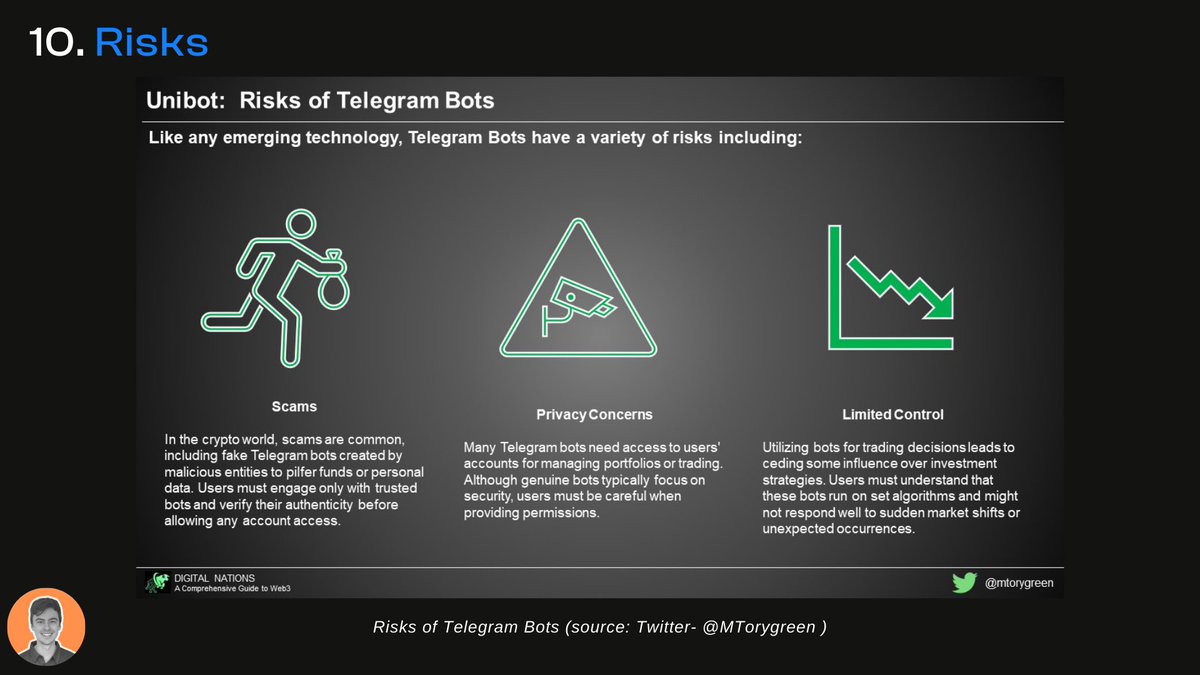

Unibot states in their documentation that:

• Private keys are encrypted using industry standard symmetric key encryption/decryption. (No-one has access to your keys)

• Unlike CEX, users have access to their private keys of Unibot generated trading wallets.

• Private keys are encrypted using industry standard symmetric key encryption/decryption. (No-one has access to your keys)

• Unlike CEX, users have access to their private keys of Unibot generated trading wallets.

• You can import your keys to Metamask and have full control over your funds in Unibot at any time.

• Always treat your wallet as a hot wallet.

Other risks include- smart contract vulnerabilities, exploits and hacks.

H/t to @MTorygreen for his excellent thread.

• Always treat your wallet as a hot wallet.

Other risks include- smart contract vulnerabilities, exploits and hacks.

H/t to @MTorygreen for his excellent thread.

Note: I am NOT an ambassador or advisor of Unibot. This is NFA.

Tagging some accounts that I used as research/ inspiration:

@MTorygreen

@thedefivillain

@Dynamo_Patrick

@thehiddenmaze

@LouisCooper_

@_FabianHD

@RiddlerDeFi

@DeFiSurfer808

@TeamUnibot

@bubblemaps

@whale_hunter_

Tagging some accounts that I used as research/ inspiration:

@MTorygreen

@thedefivillain

@Dynamo_Patrick

@thehiddenmaze

@LouisCooper_

@_FabianHD

@RiddlerDeFi

@DeFiSurfer808

@TeamUnibot

@bubblemaps

@whale_hunter_

If you enjoyed this thread, then:

→ Follow me @jake_pahor for weekly info like this.

→ RT the first tweet to share it with others.

→ Follow me @jake_pahor for weekly info like this.

→ RT the first tweet to share it with others.

جاري تحميل الاقتراحات...