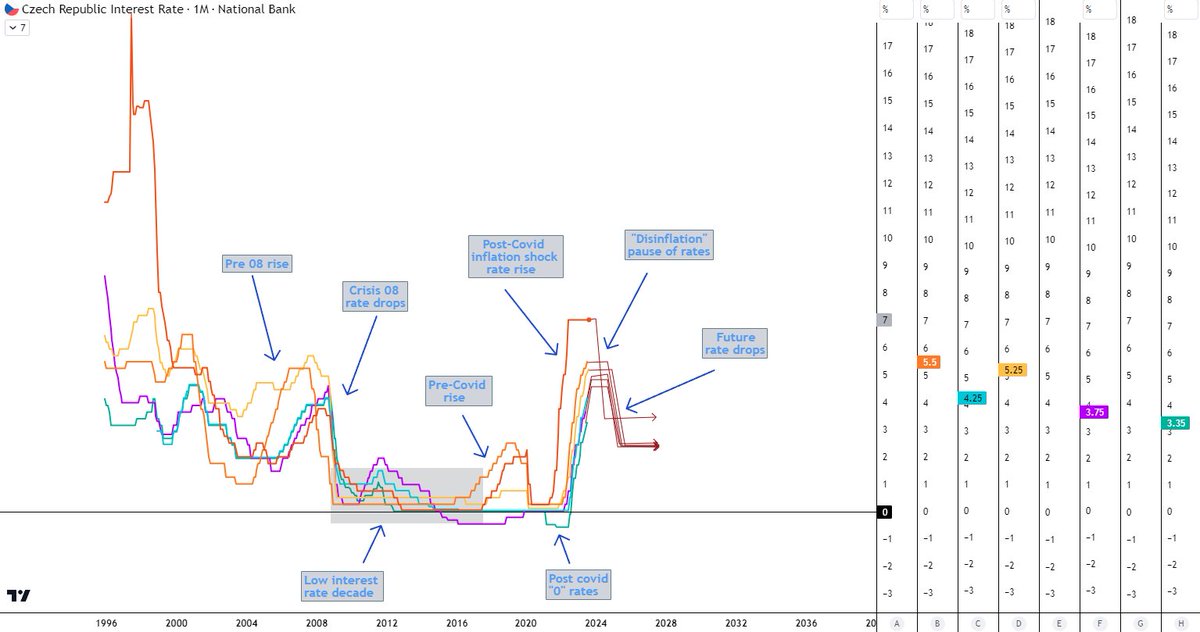

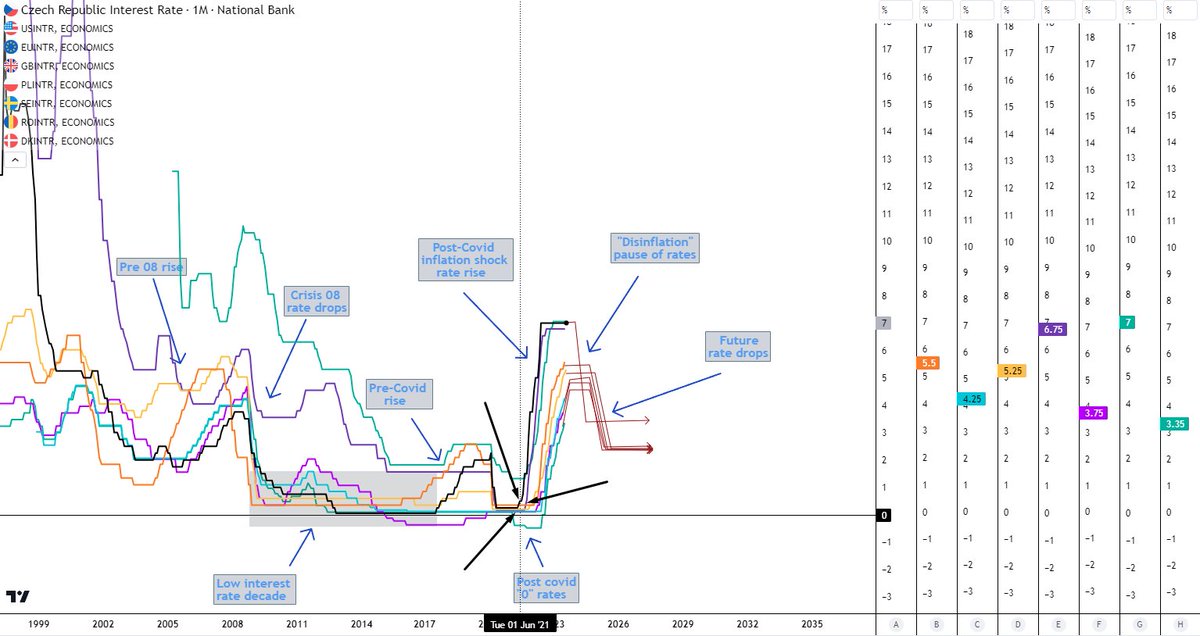

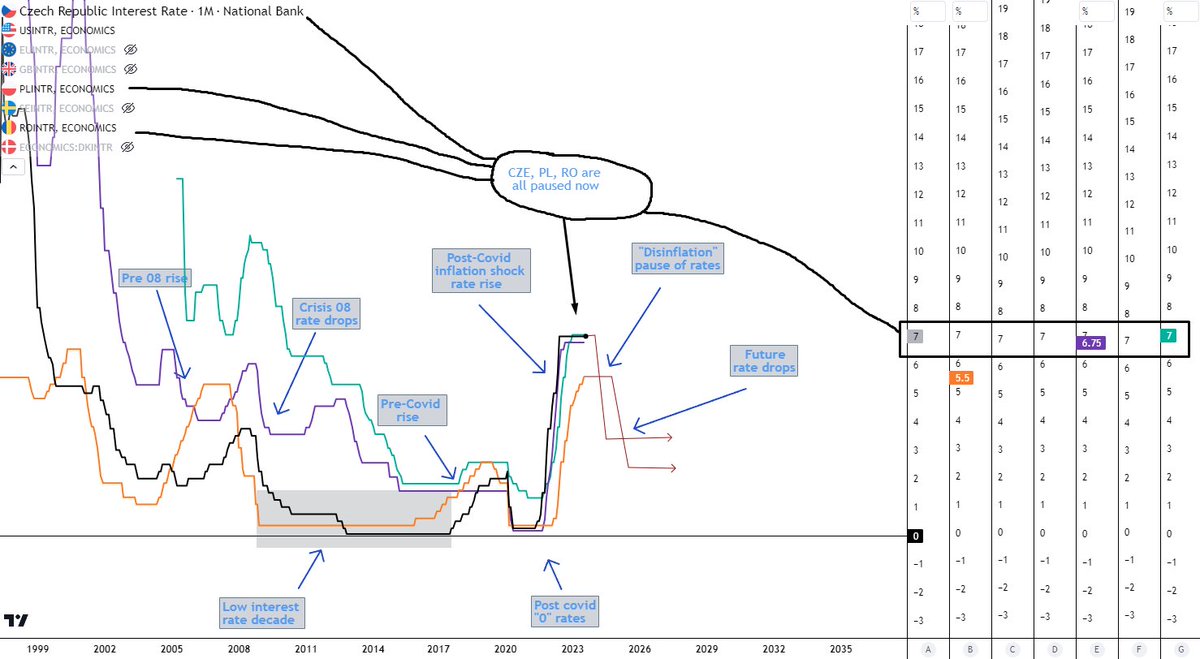

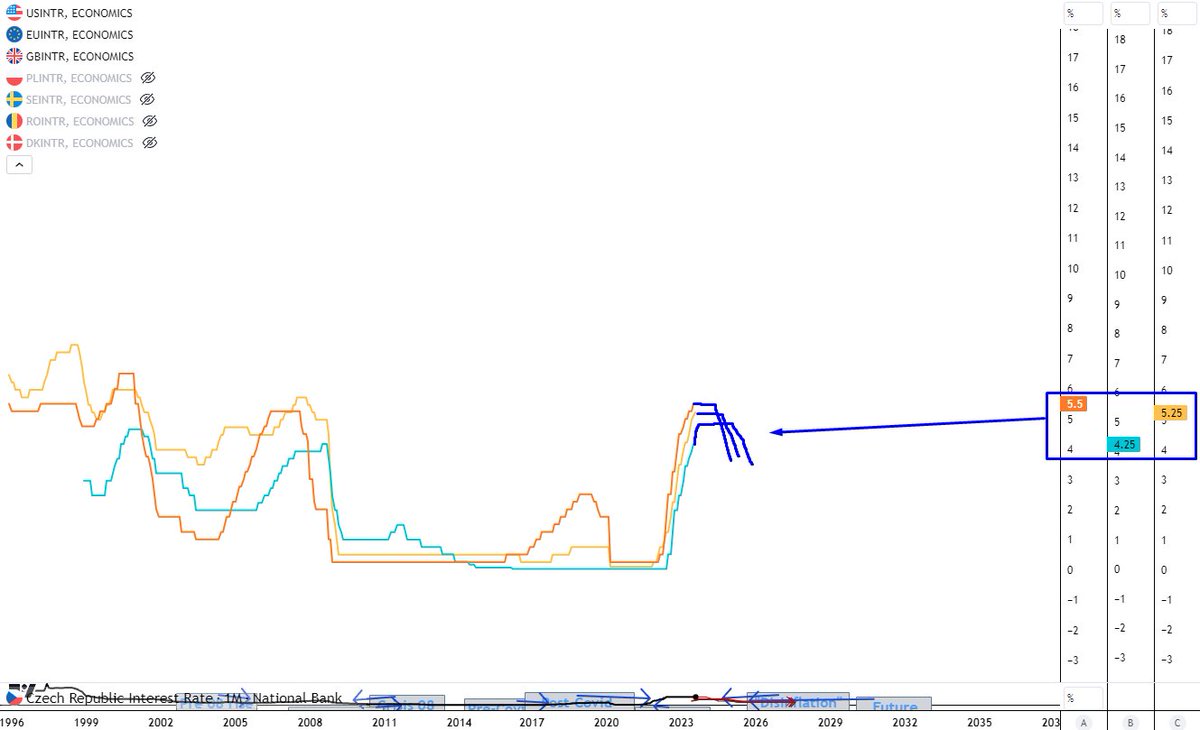

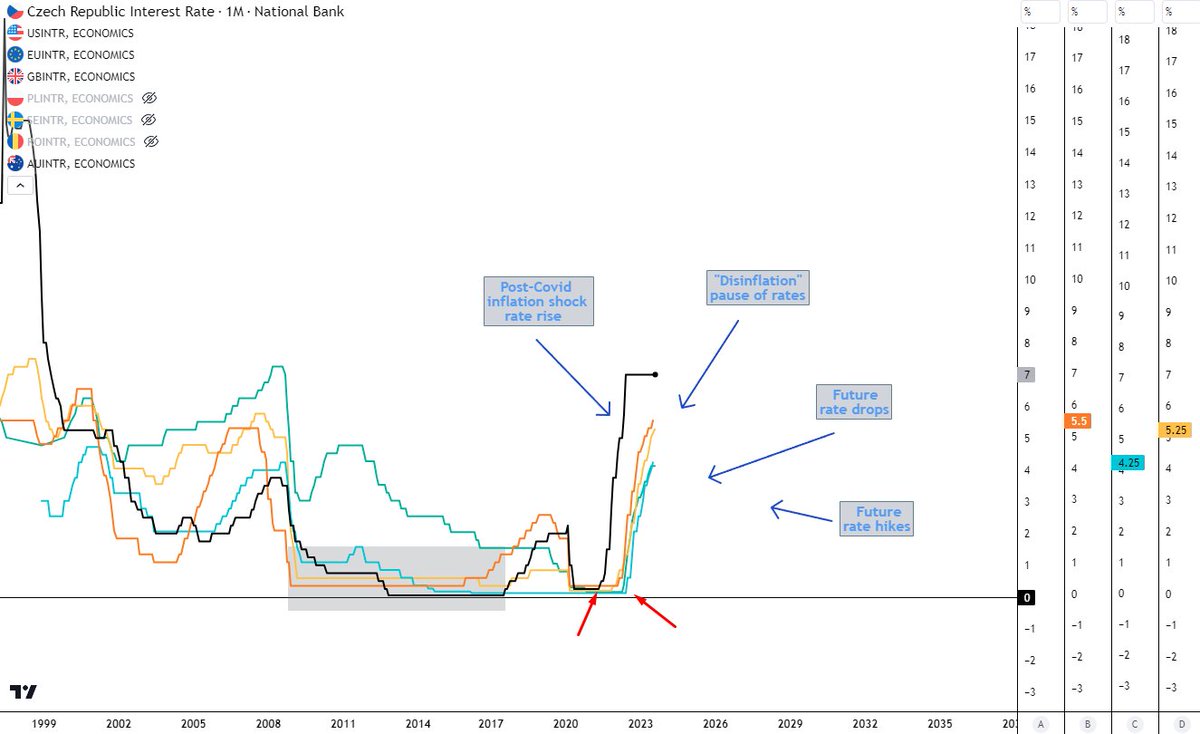

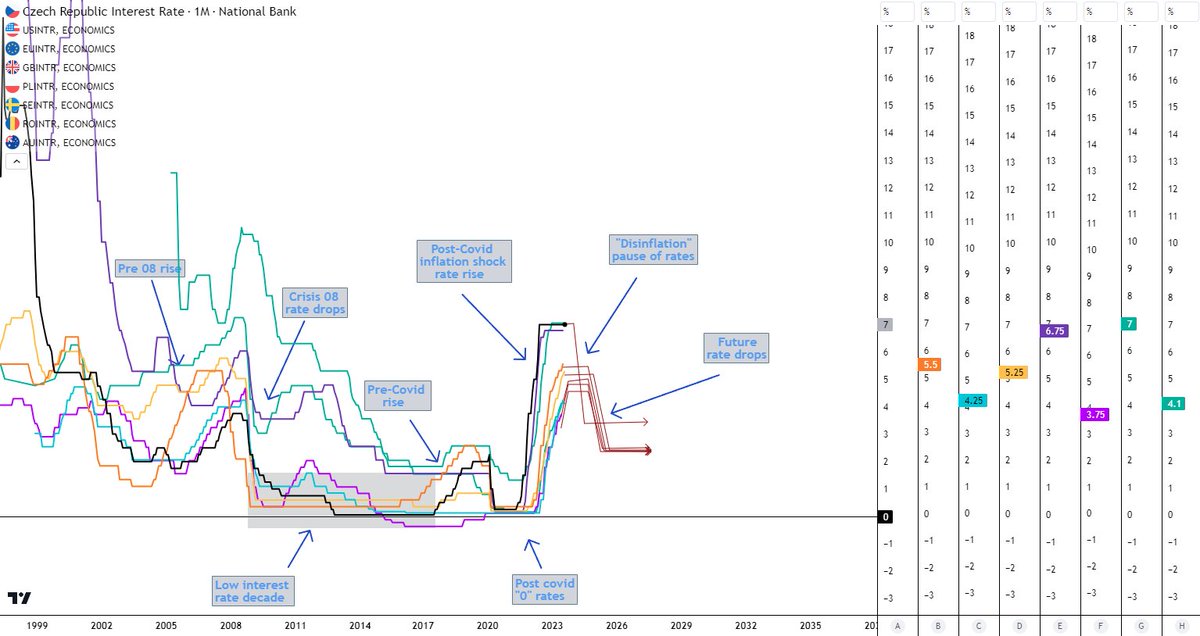

Each economy has its own factors & issues that come to play in each country of course, which is the reason why we see some deviations here & there on a lower quarterly or yearly scale. But the general trend stays

So why is it that they all move together on average? 👇

So why is it that they all move together on average? 👇

My explanation is mainly due to the fact that all these economies are nowadays so connected to each other in trade that what affects one, affects the others too

However, it is always some big event that causes a major shift across all of them like the 08 crisis, Covid & so on

However, it is always some big event that causes a major shift across all of them like the 08 crisis, Covid & so on

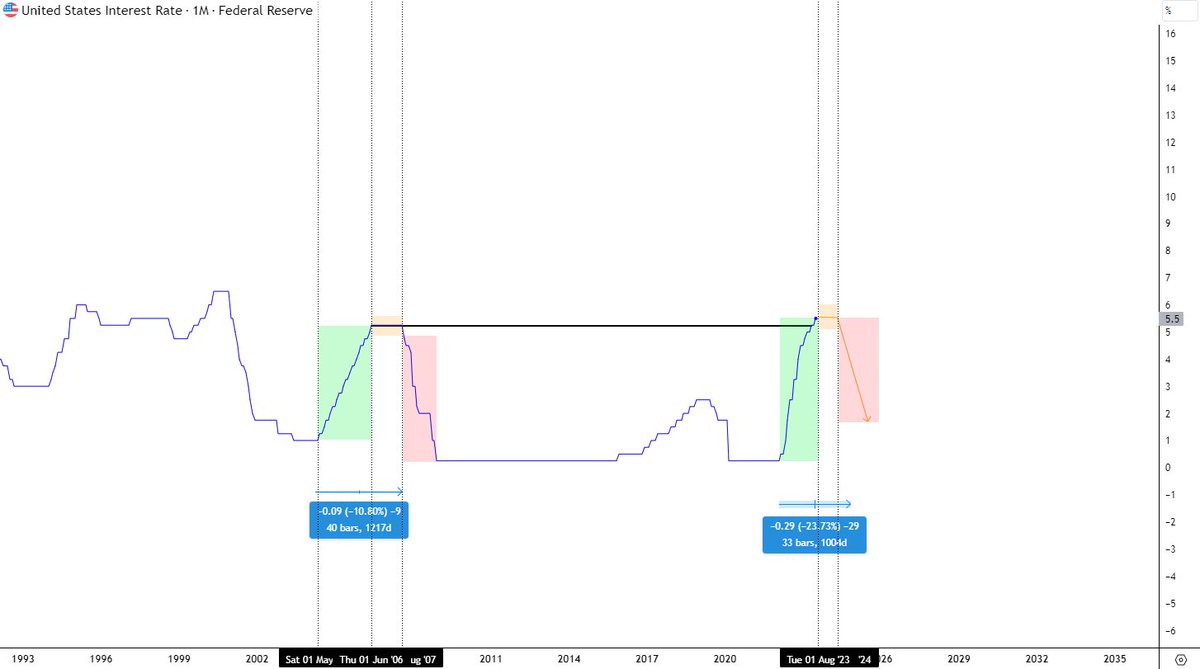

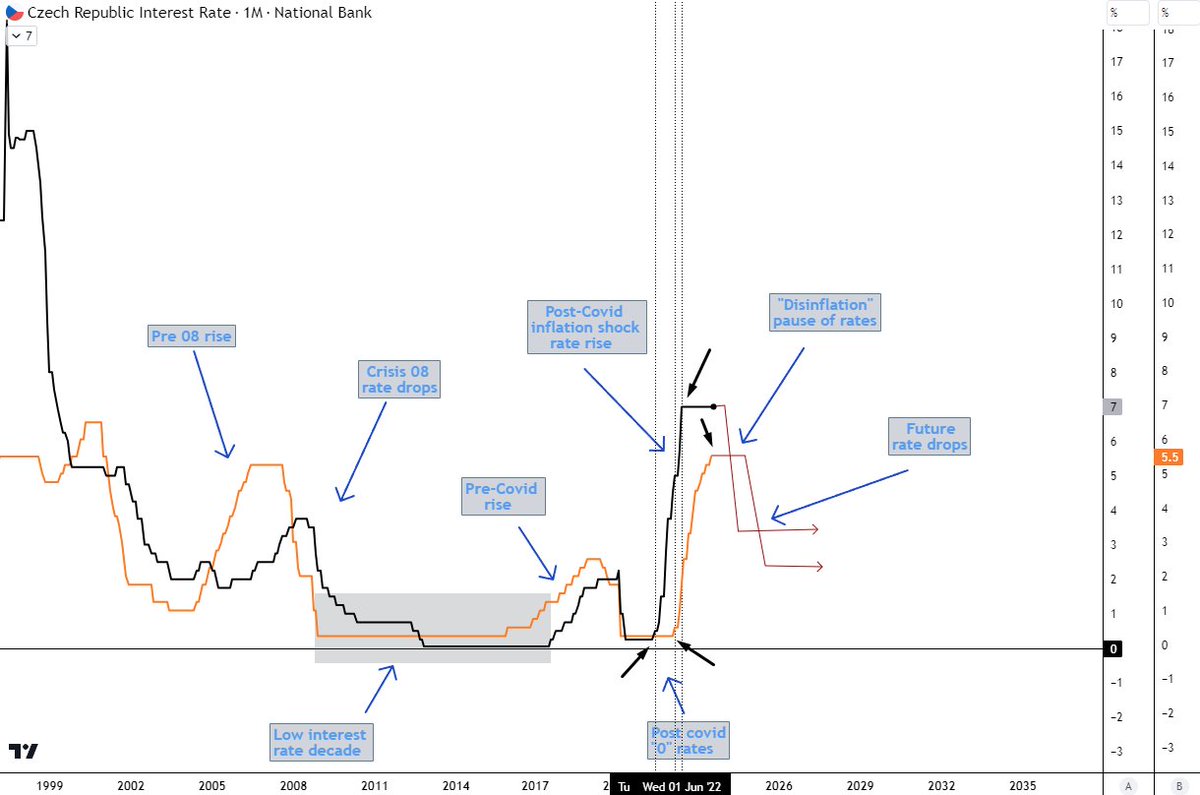

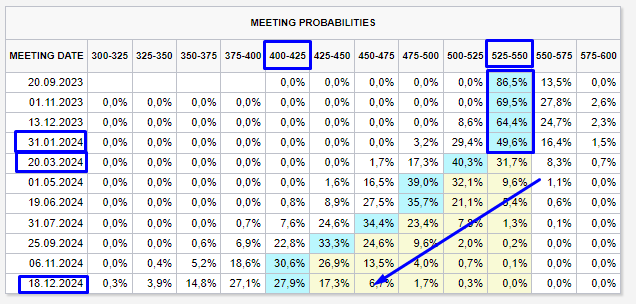

If we take in the 1-year lag and assume that this was the last rate hike in July, FED probably keeps the funds rate the same for the next year at 5.5% just like CZE

That is approximately till July/August 24, then starts rates cuts going into the end of the year

That is approximately till July/August 24, then starts rates cuts going into the end of the year

Interestingly that nicely aligns with US presidential elections 🤔 Coincidence?

My personal opinion is that we cannot exactly tell the month but we can get an idea of the trend very well

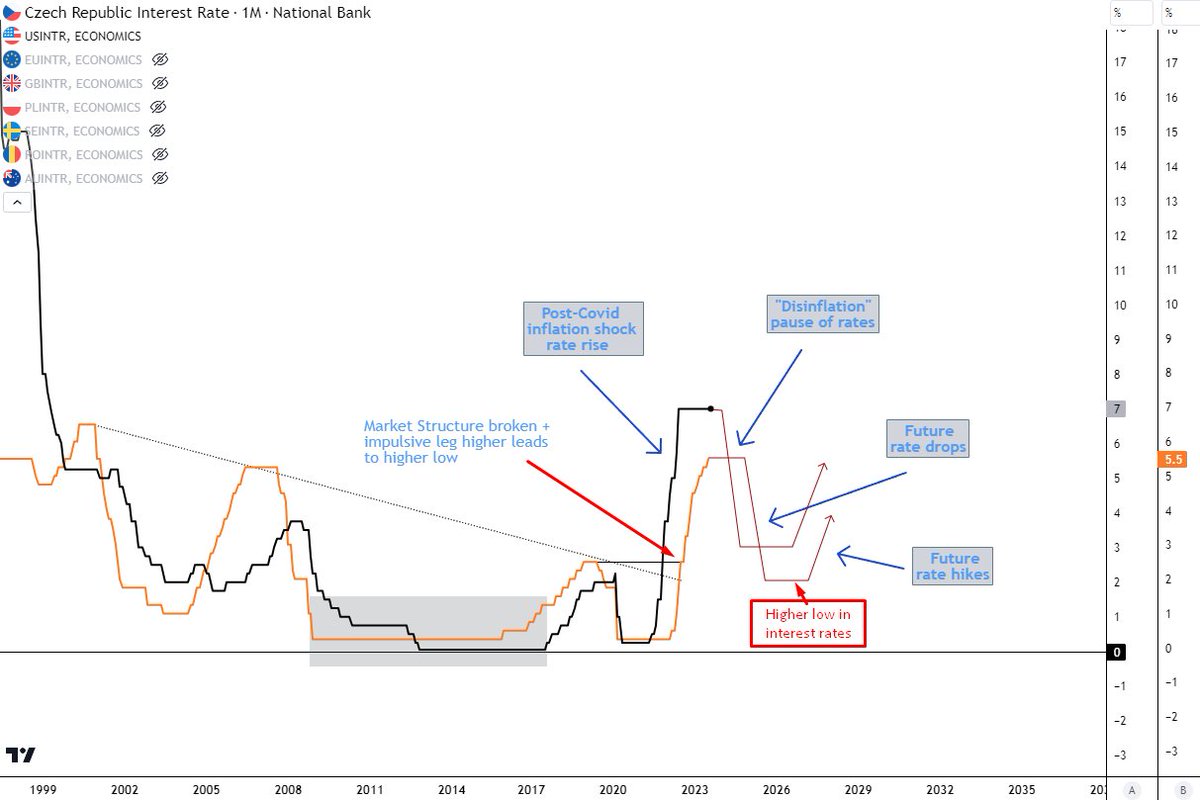

The moment we start seeing rate cuts in frontrunning countries is the time to pay attention

My personal opinion is that we cannot exactly tell the month but we can get an idea of the trend very well

The moment we start seeing rate cuts in frontrunning countries is the time to pay attention

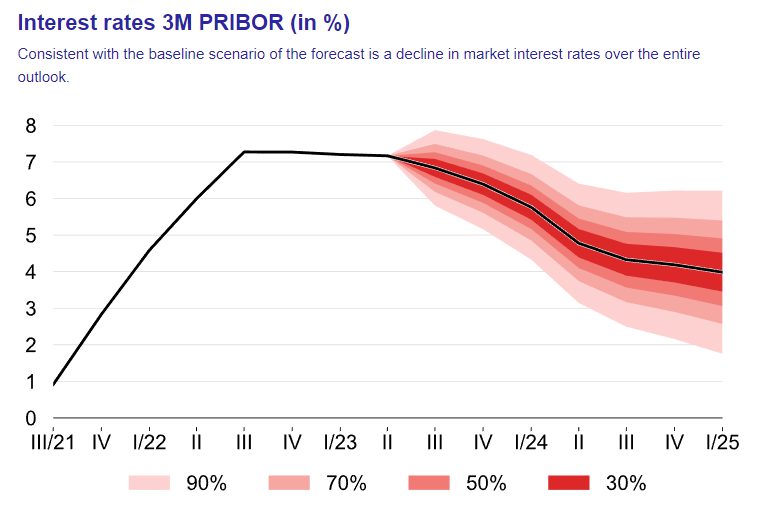

What we cannot say exactly is when & how low we go with the rates

What we can say is the general trend

I expect some troubles to come to the US around the end of 24, or early 25 which will cause the rate cuts. How deep we shall see but not back to 0. My estimate is 2-3%

What we can say is the general trend

I expect some troubles to come to the US around the end of 24, or early 25 which will cause the rate cuts. How deep we shall see but not back to 0. My estimate is 2-3%

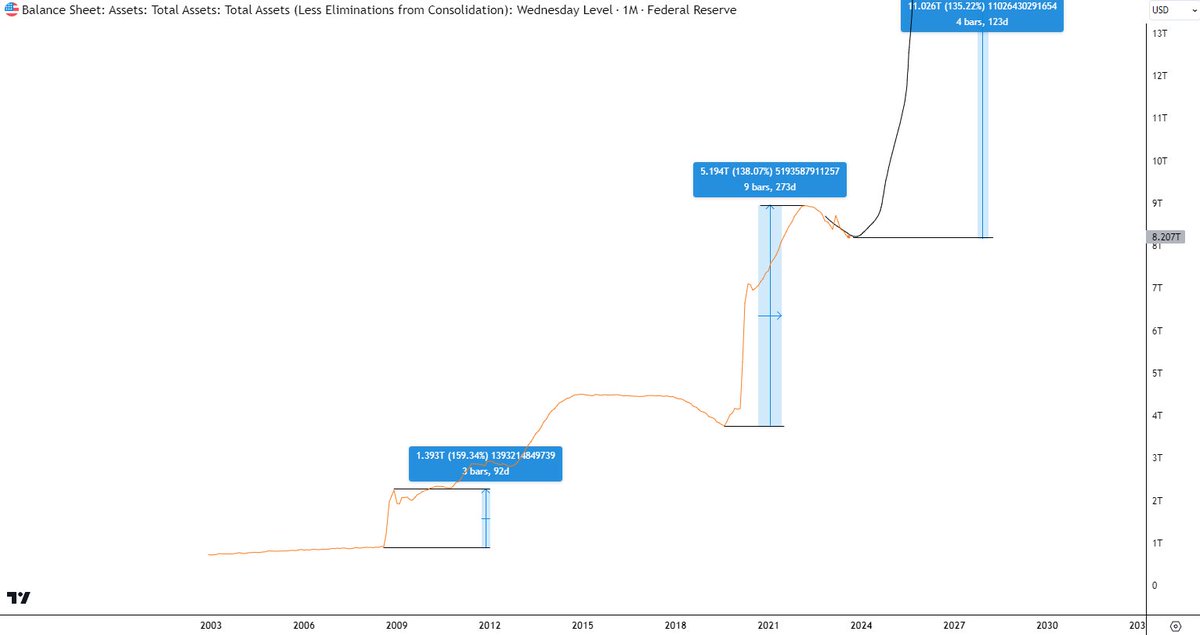

It will probably be followed by some QE as well to support the economies, which will possibly lead a to new waves of CPI rise in the future, which will then cause secular leg of rate hikes

But that's too far in the future now and we gotta go from "level to level"

But that's too far in the future now and we gotta go from "level to level"

Here is also my estimate of how it affects the markets if you wanna see more👇

While I'm heavily confident in the levels, the timing is the hardest to predict and can be a bit off. Still think I did a pretty decent job of giving good estimates

While I'm heavily confident in the levels, the timing is the hardest to predict and can be a bit off. Still think I did a pretty decent job of giving good estimates

I also think we see some credit failures in 24/25 due to the highest interest rates in 20 years which causes higher unemployment which will force the FED to cut the rates which will cause the yield curve to go back above 0 which leads to a major drop in stocks

Lastly, these threads take me many hours to put together & write them down. I do it for free & receive nothing in return

Please consider the least you can do & engage with them in any way possible. It does help the algo, which then helps me, which then helps you again, thq u 🙏

Please consider the least you can do & engage with them in any way possible. It does help the algo, which then helps me, which then helps you again, thq u 🙏

جاري تحميل الاقتراحات...