2/23 Mathematicians might choose 2 as it's the only even prime number, but true crypto minds on CT will opt for 69.

All thanks to the memes associated with it.

This idea is the backbone of "Schelling points".

All thanks to the memes associated with it.

This idea is the backbone of "Schelling points".

3/23 Schelling points are game theory concepts pointing to solutions or choices people default to without clear communication.

They're influenced by shared knowledge, common sense, and societal norms.

Essentially, they represent our collective psychology.

They're influenced by shared knowledge, common sense, and societal norms.

Essentially, they represent our collective psychology.

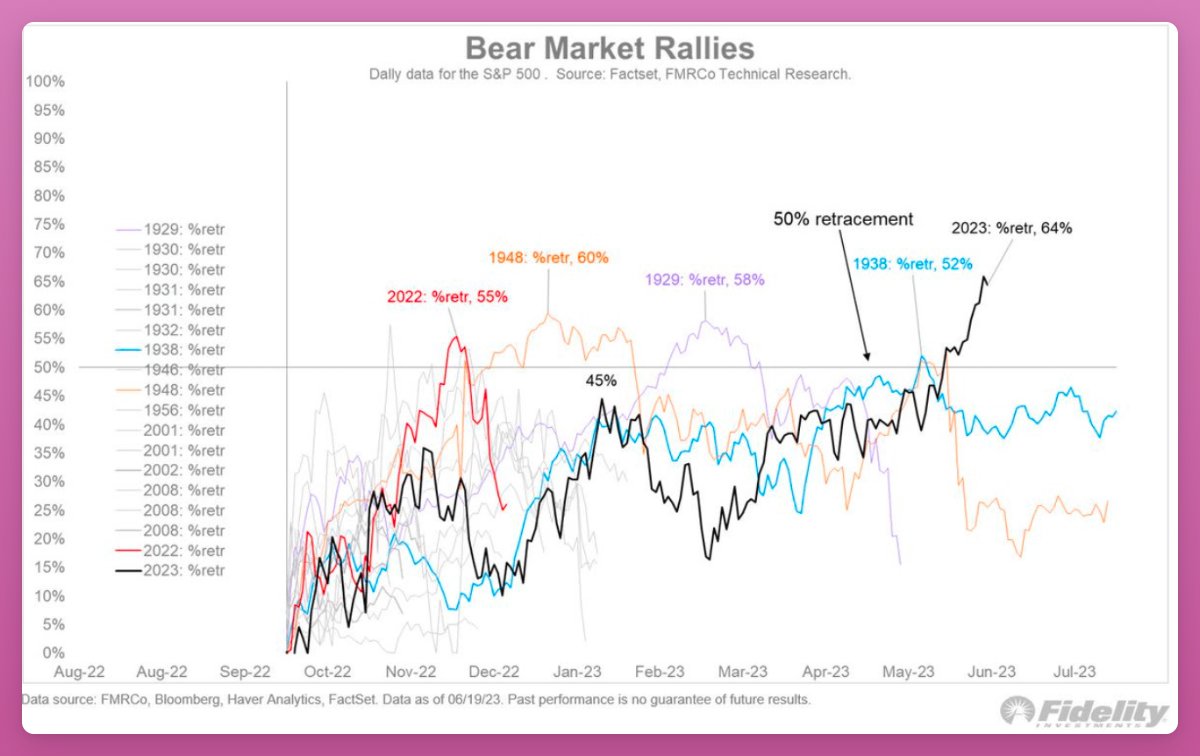

7/23 Investing often boils down to a mix of skill, timing, and luck.

The real trick is identifying powerful “heavyweight narratives”.

These are overarching trends affecting all asset classes, like:

• Fed liquidity cycles

• Wars

• New government policies

The real trick is identifying powerful “heavyweight narratives”.

These are overarching trends affecting all asset classes, like:

• Fed liquidity cycles

• Wars

• New government policies

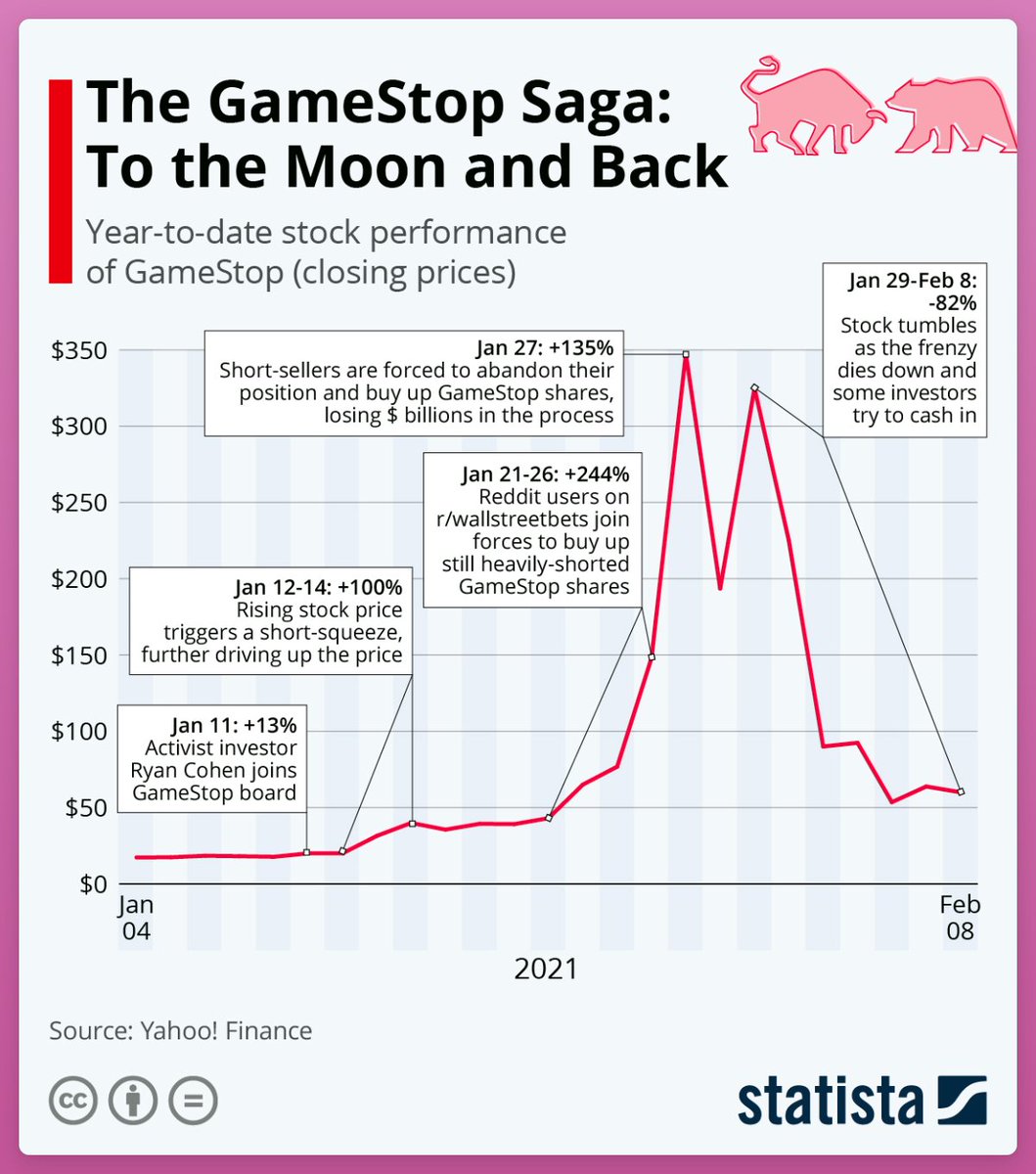

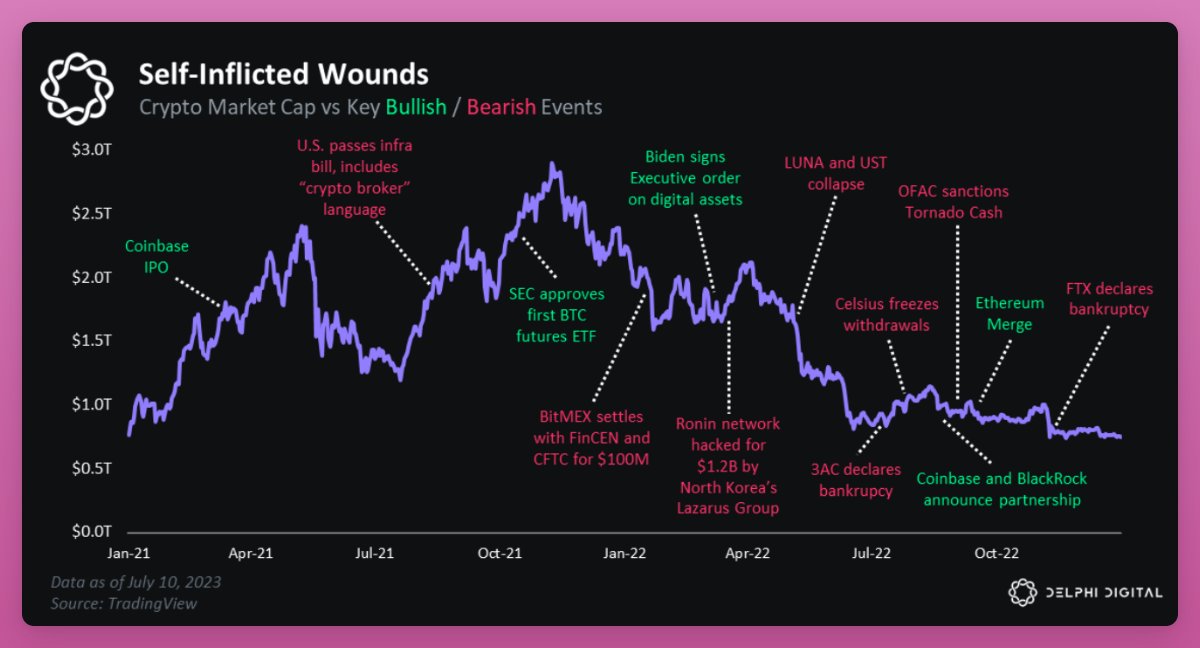

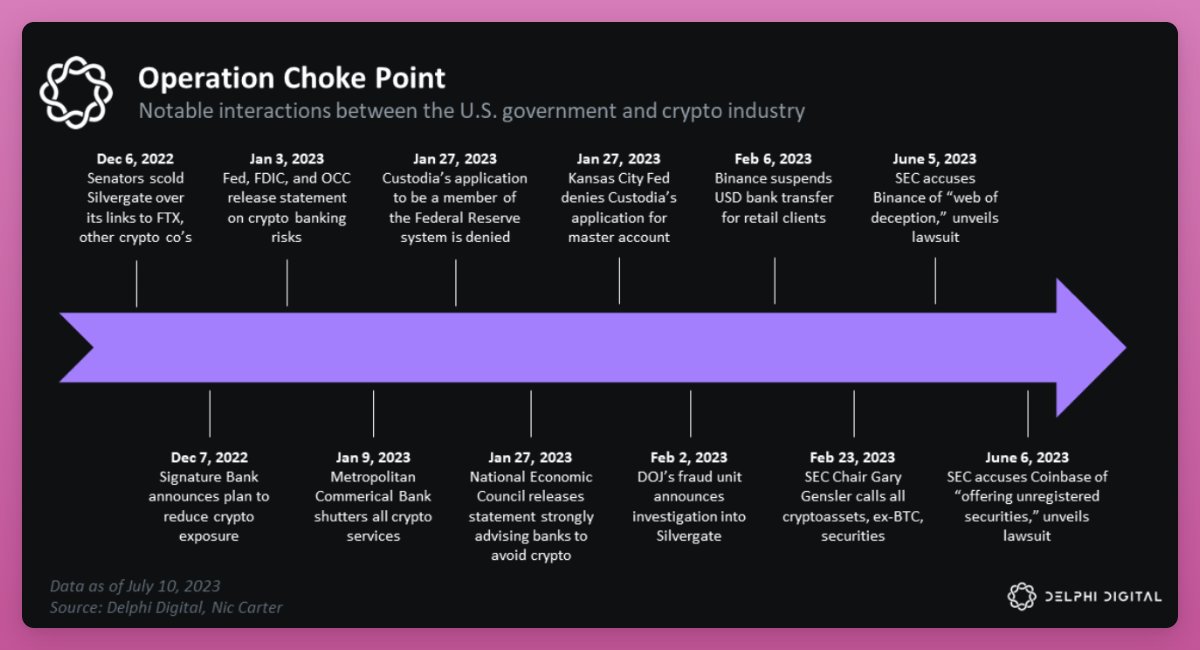

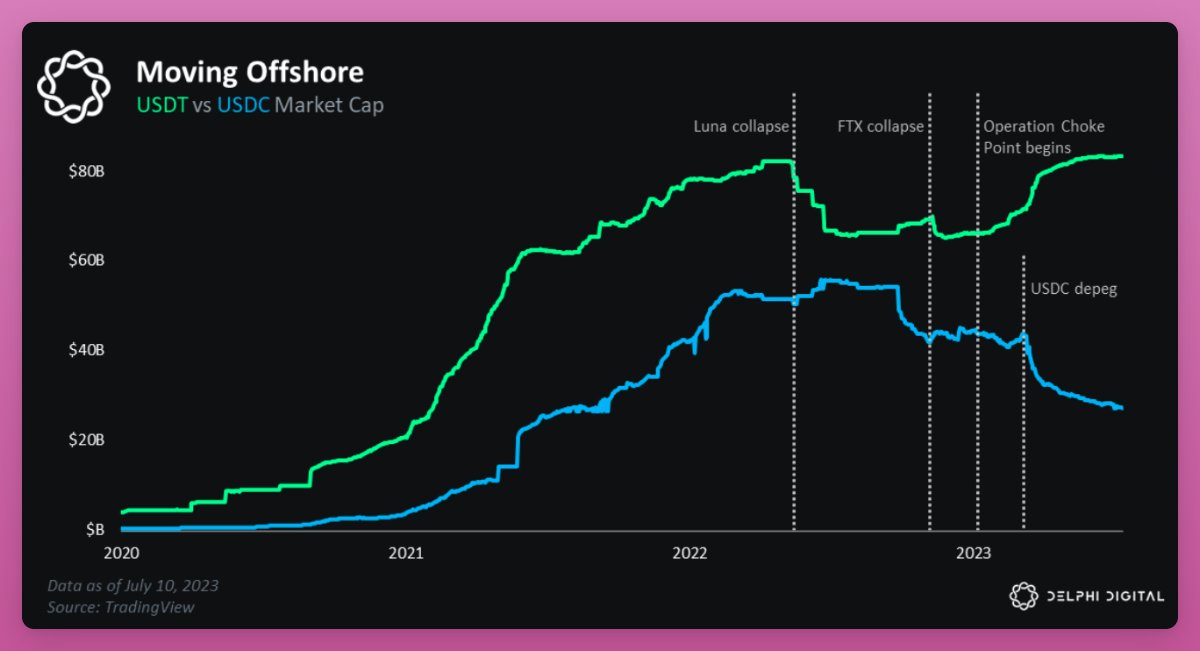

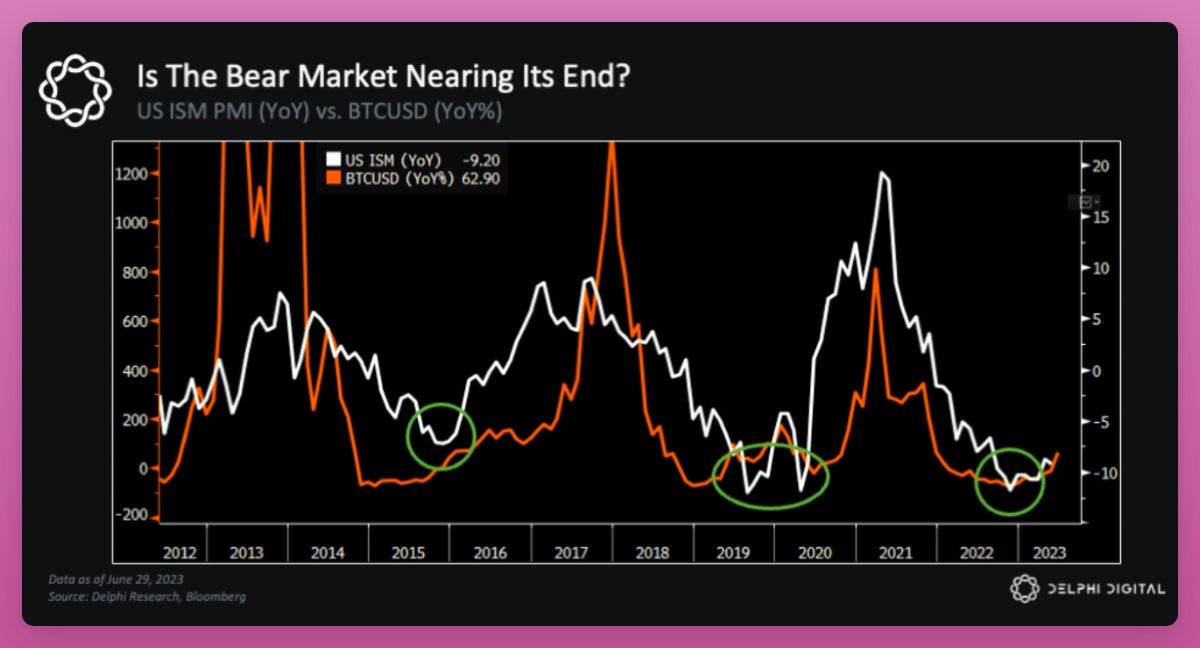

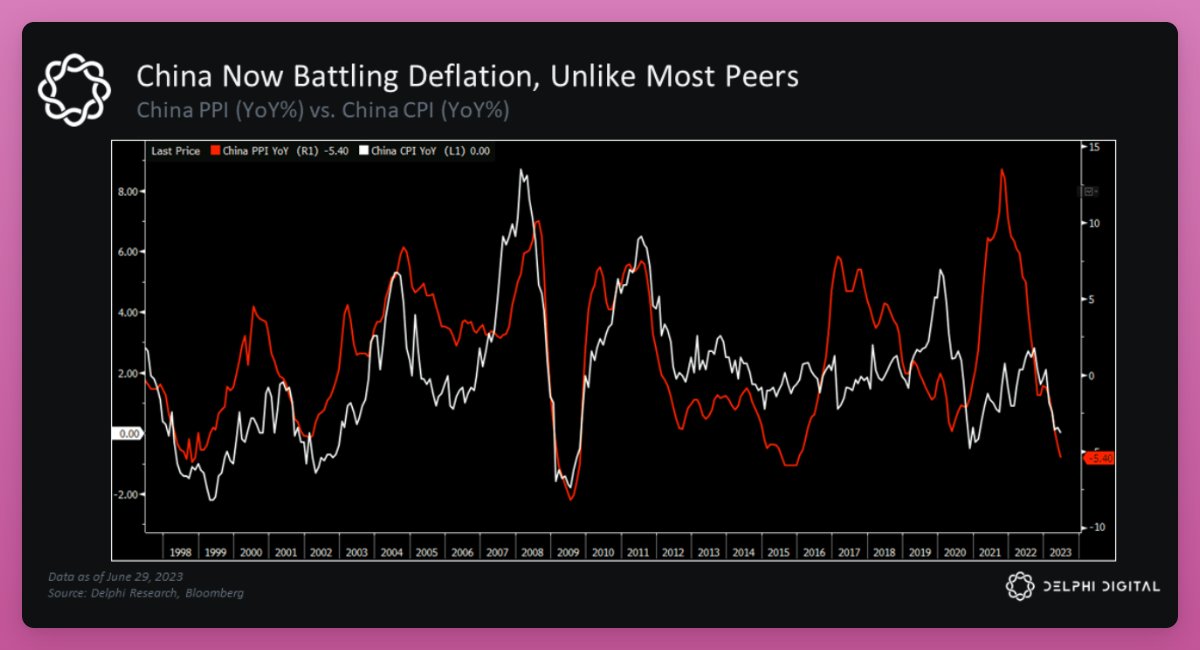

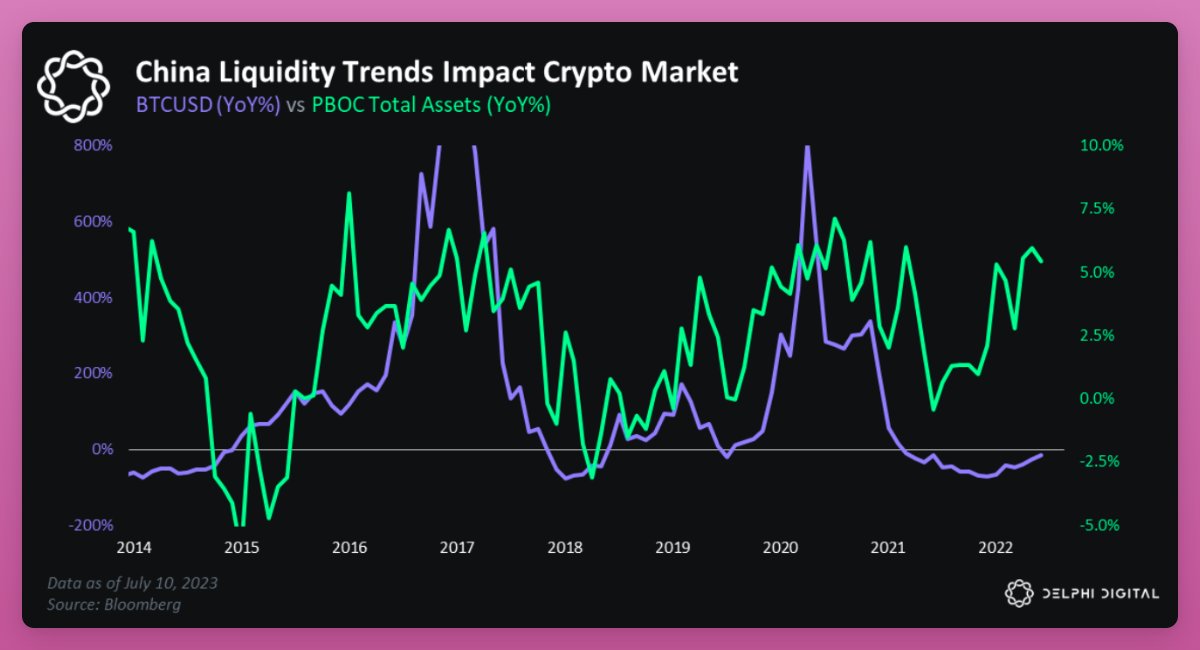

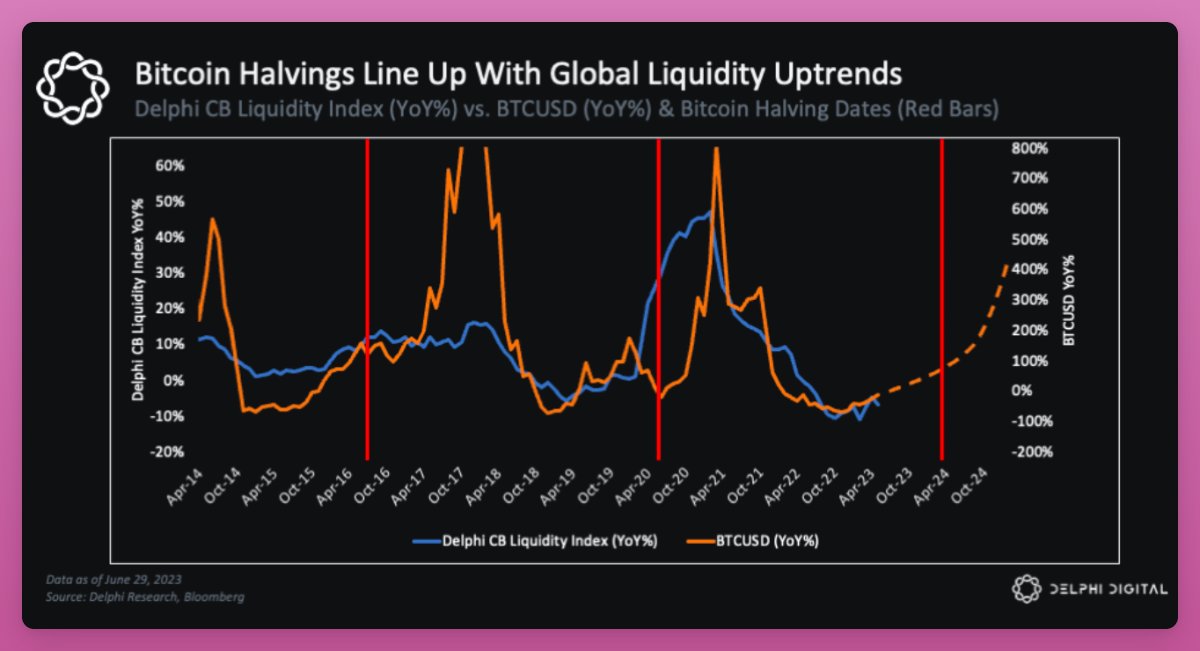

8/23 In crypto since 2022, we've felt the weight of all three narratives.

It's been a tough time.

But things are changing, and these big stories might start helping instead of hurting.

Here are the top two heavyweight narratives to follow, according to @Delphi_Digital.

It's been a tough time.

But things are changing, and these big stories might start helping instead of hurting.

Here are the top two heavyweight narratives to follow, according to @Delphi_Digital.

10/23

Powell's take on stablecoins, SEC’s green light to a leveraged Bitcoin futures ETF, and Hong Kong pushing for crypto client adoption.

Seems like the tide is turning.

Powell's take on stablecoins, SEC’s green light to a leveraged Bitcoin futures ETF, and Hong Kong pushing for crypto client adoption.

Seems like the tide is turning.

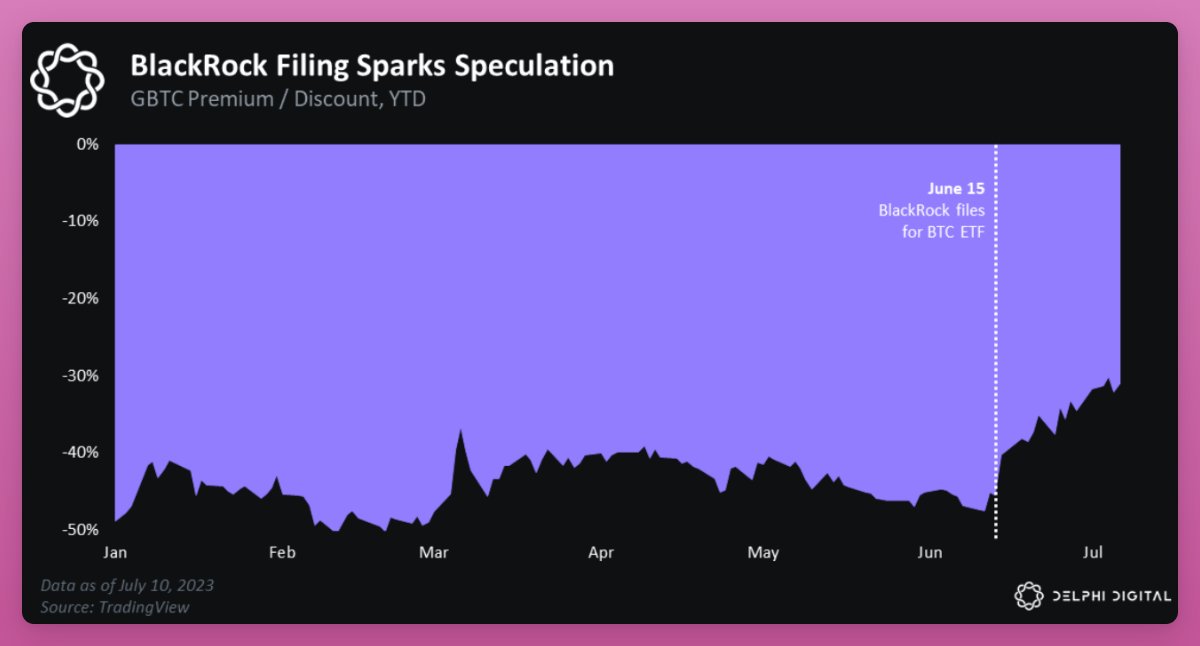

13/23 Short-term: Grayscale's legal win vs SEC might pave the way for a BTC ETF.

Long-term: With the U.S.'s tech Cold War, crypto's geopolitical role will be pivotal.

If China keeps favoring crypto, the U.S. might follow suit.

Long-term: With the U.S.'s tech Cold War, crypto's geopolitical role will be pivotal.

If China keeps favoring crypto, the U.S. might follow suit.

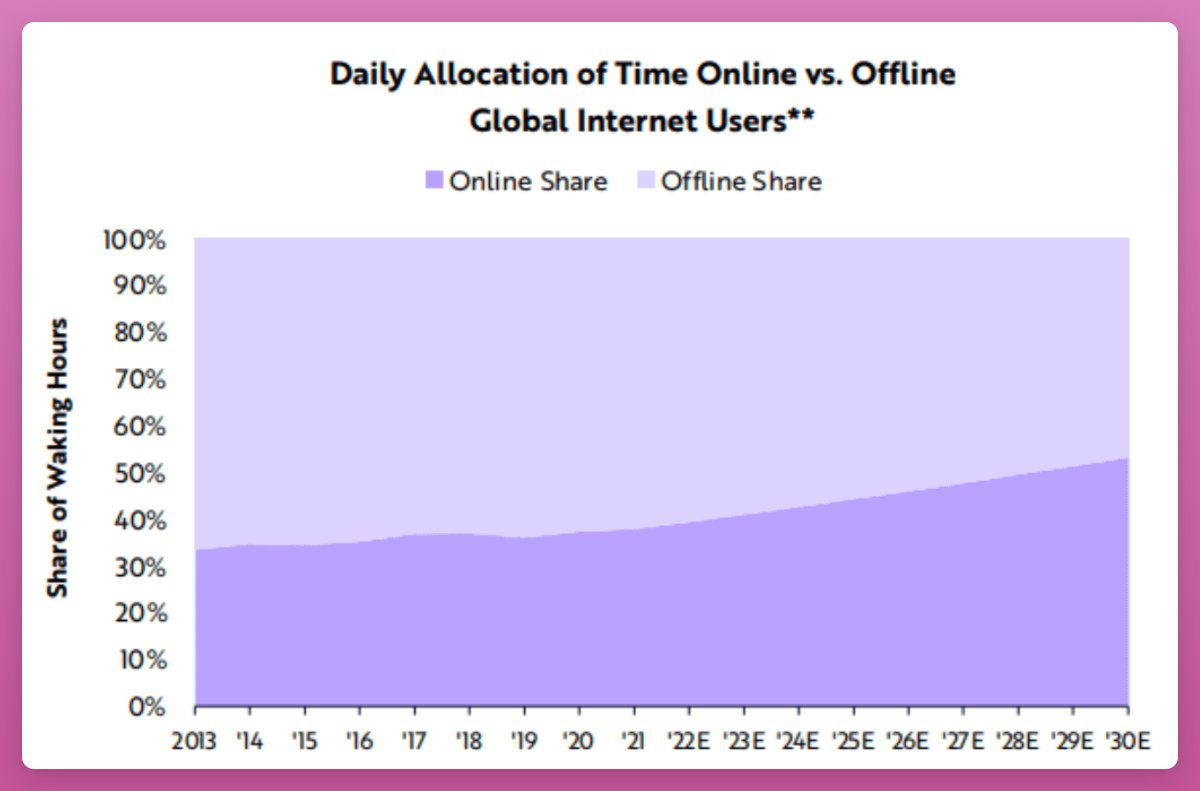

19/23 As macro narratives play out, their impact on the crypto space is evident.

Understanding and leveraging these major narratives is crucial, and they pave the way for smaller "lightweight" narratives.

Below are just a few that are likely to dominate in the bull run:

Understanding and leveraging these major narratives is crucial, and they pave the way for smaller "lightweight" narratives.

Below are just a few that are likely to dominate in the bull run:

20/23 Three Bitcoin narratives:

• New use-cases for BTC - Ordinals, BRC-20s, Stacks sBTC, and Bitcoin's DeFi integration

• "BTC as Outside Money" amid the Banking Crisis Panic

• Bitcoin Spot ETF Approval

• New use-cases for BTC - Ordinals, BRC-20s, Stacks sBTC, and Bitcoin's DeFi integration

• "BTC as Outside Money" amid the Banking Crisis Panic

• Bitcoin Spot ETF Approval

21/23 In a bull market, the following crypto-centric narratives can bubble to the surface:

• The merge of AI x Crypto

• LSTs

• Memecoins

• EIP-4844 for L2 narrative

• New spot & derivative DEX

• The merge of AI x Crypto

• LSTs

• Memecoins

• EIP-4844 for L2 narrative

• New spot & derivative DEX

22/23 Finally, not all narratives are equally impactful.

The Liquidity Narrative will likely influence asset markets until 2024, while smaller narratives emerge.

I recommend reading the full @Delphi_Digital report on "Will Narratives Drive Fundamentals?"

The Liquidity Narrative will likely influence asset markets until 2024, while smaller narratives emerge.

I recommend reading the full @Delphi_Digital report on "Will Narratives Drive Fundamentals?"

23/23 I wanted to share this insightful research by Delphi because we're at a turning point for macro narratives.

As always, I'd really appreciate if you could like and retweet the first tweet below.

And follow me @DefiIgnas for more:

As always, I'd really appreciate if you could like and retweet the first tweet below.

And follow me @DefiIgnas for more:

جاري تحميل الاقتراحات...

![1/23 Choose a number from this list:

[2, 5, 9, 25, 69, 73, 82, 96, 100, 126, 150]

If you and someo...](https://pbs.twimg.com/media/F27U9lSbAAAqT1T.jpg)