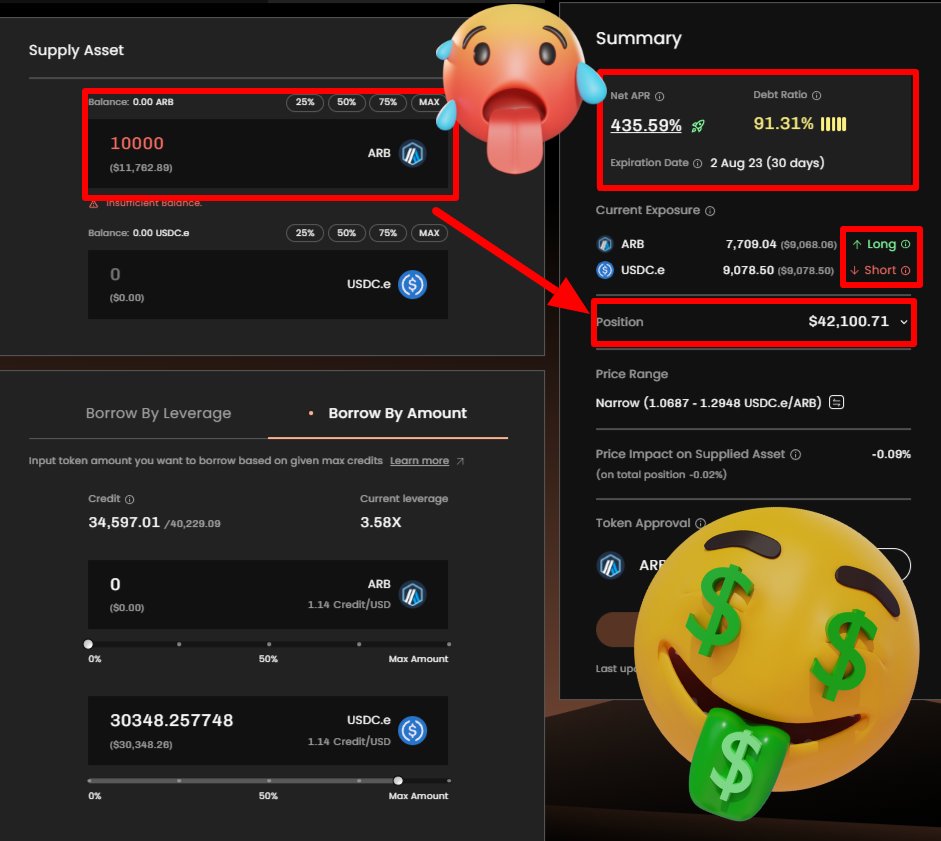

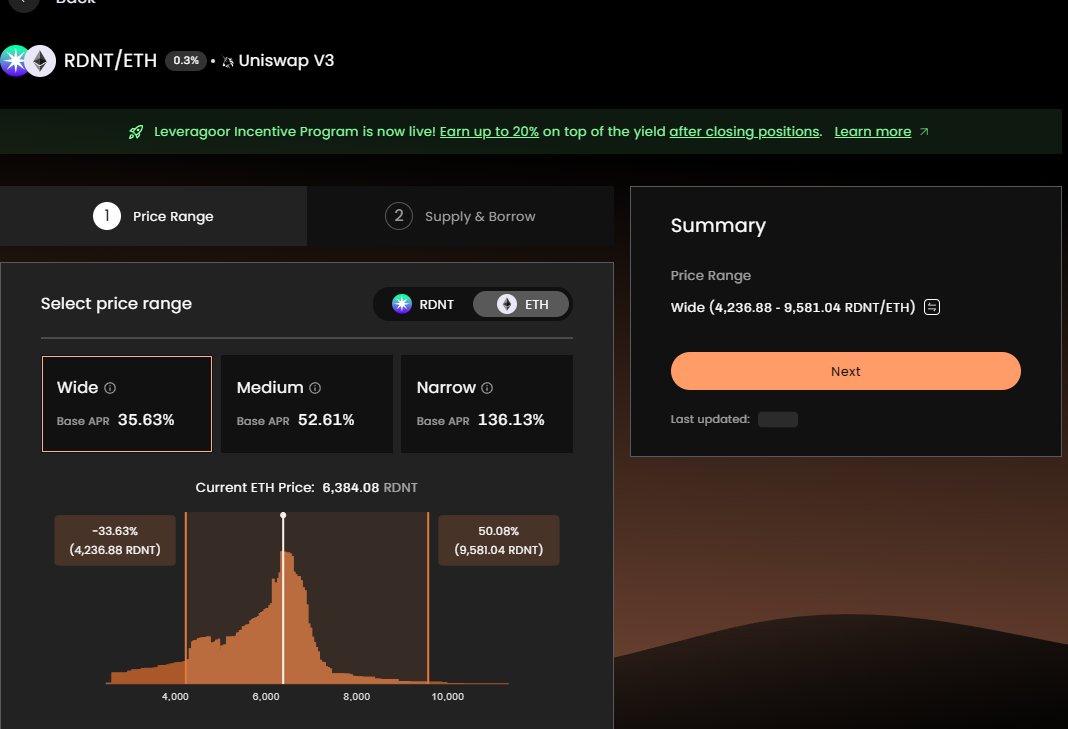

What in the world?🤯

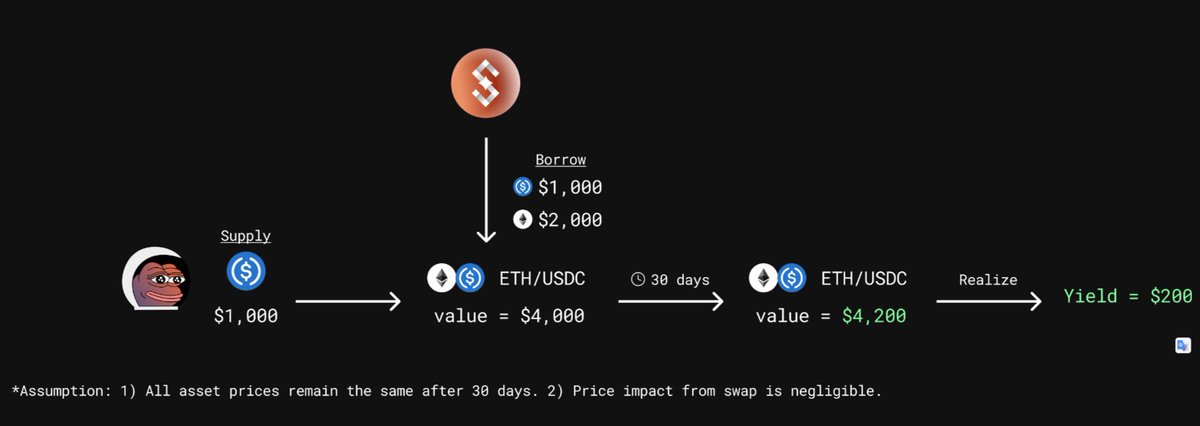

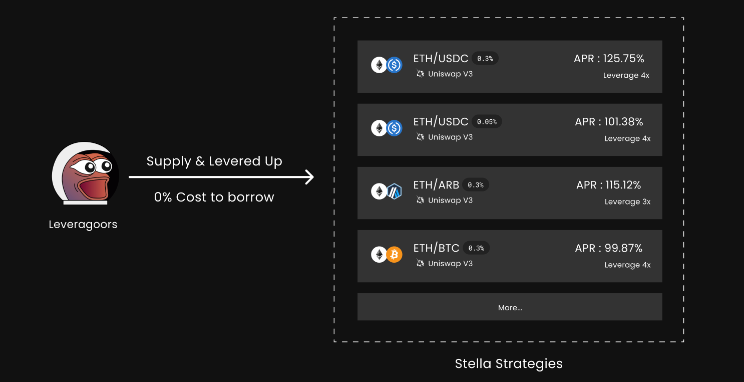

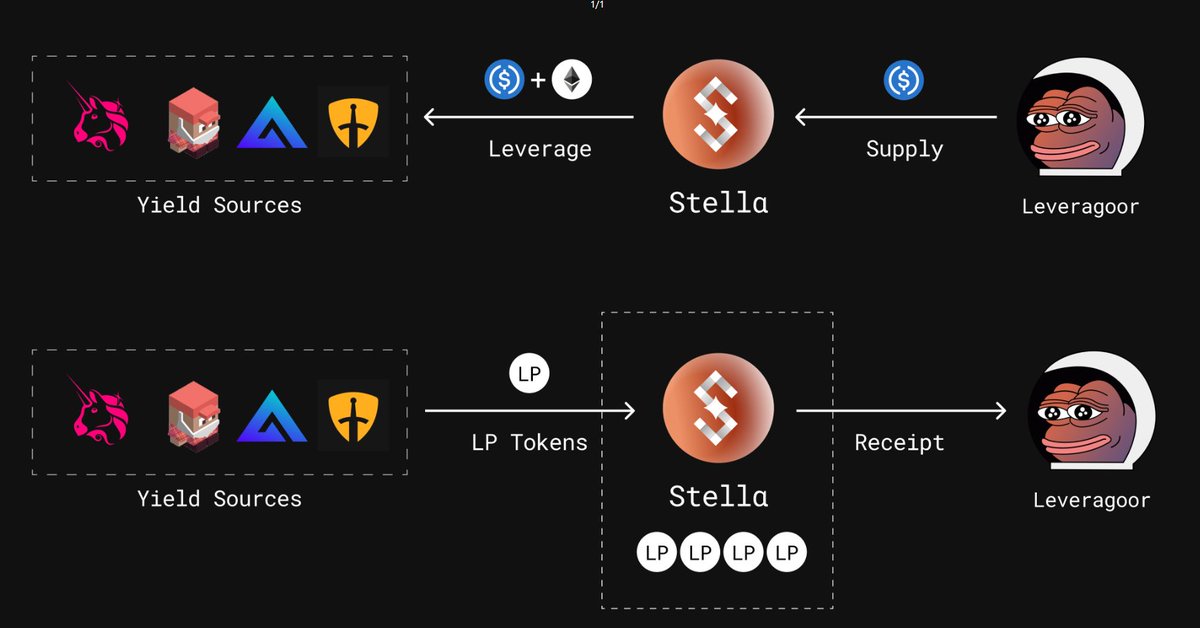

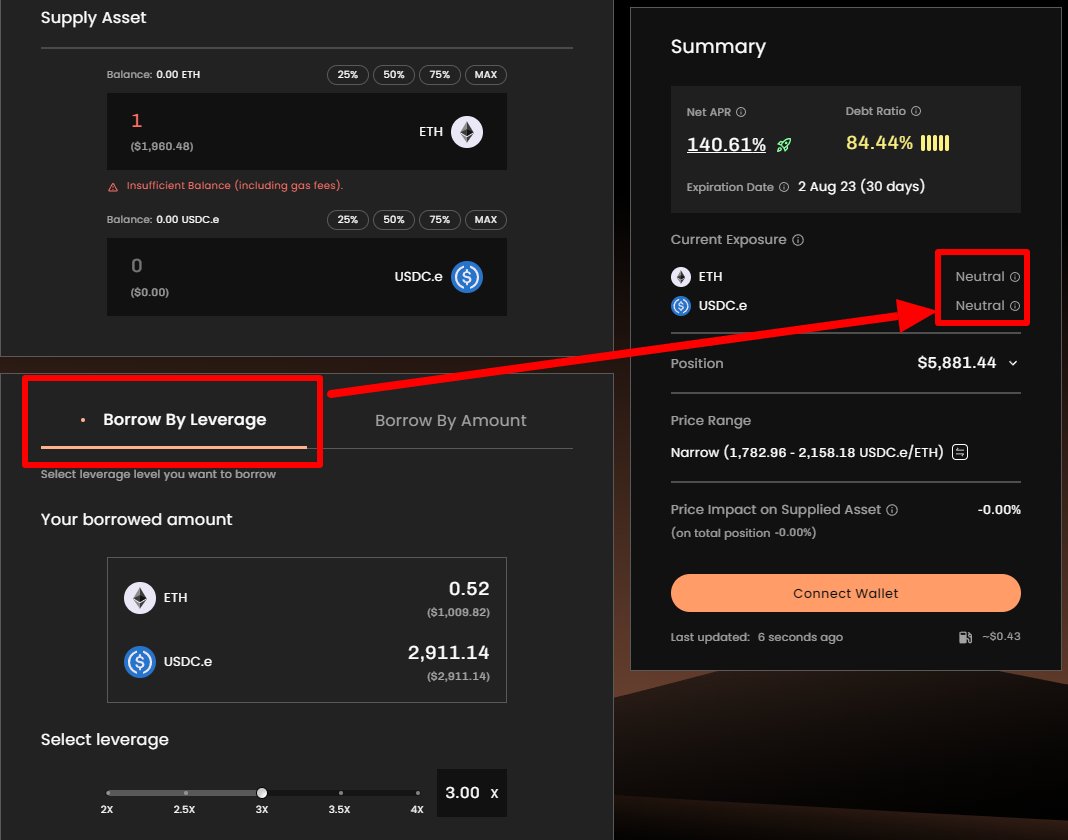

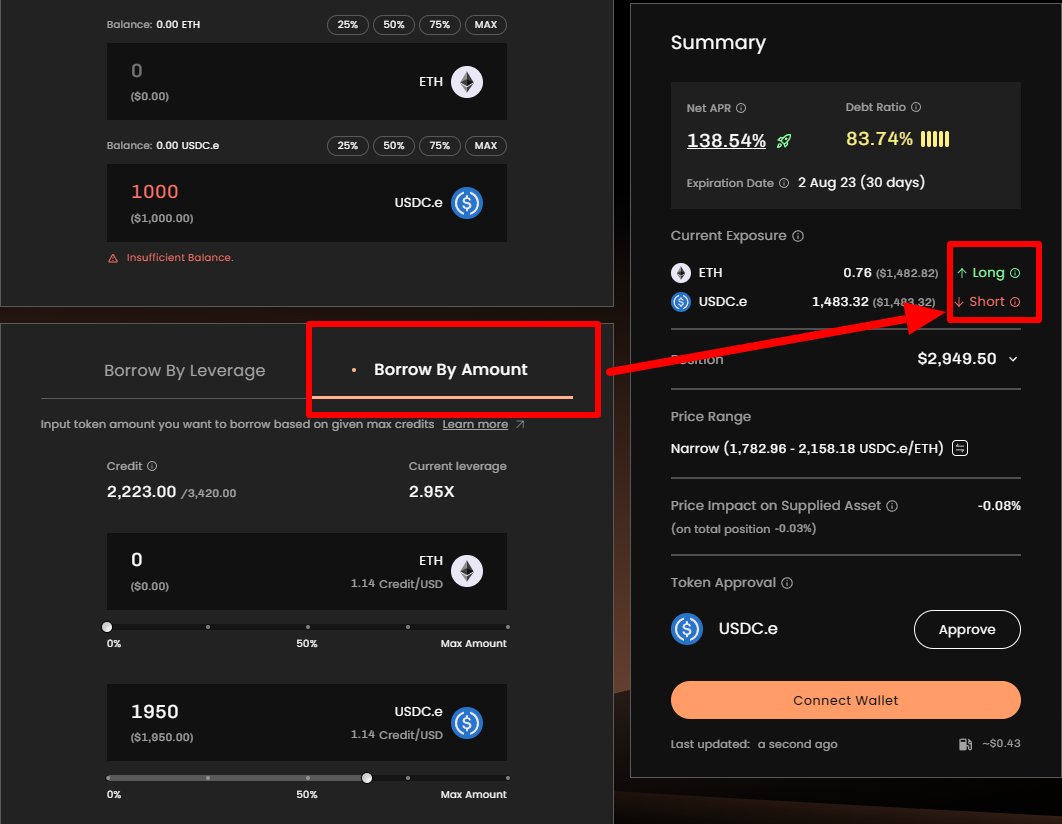

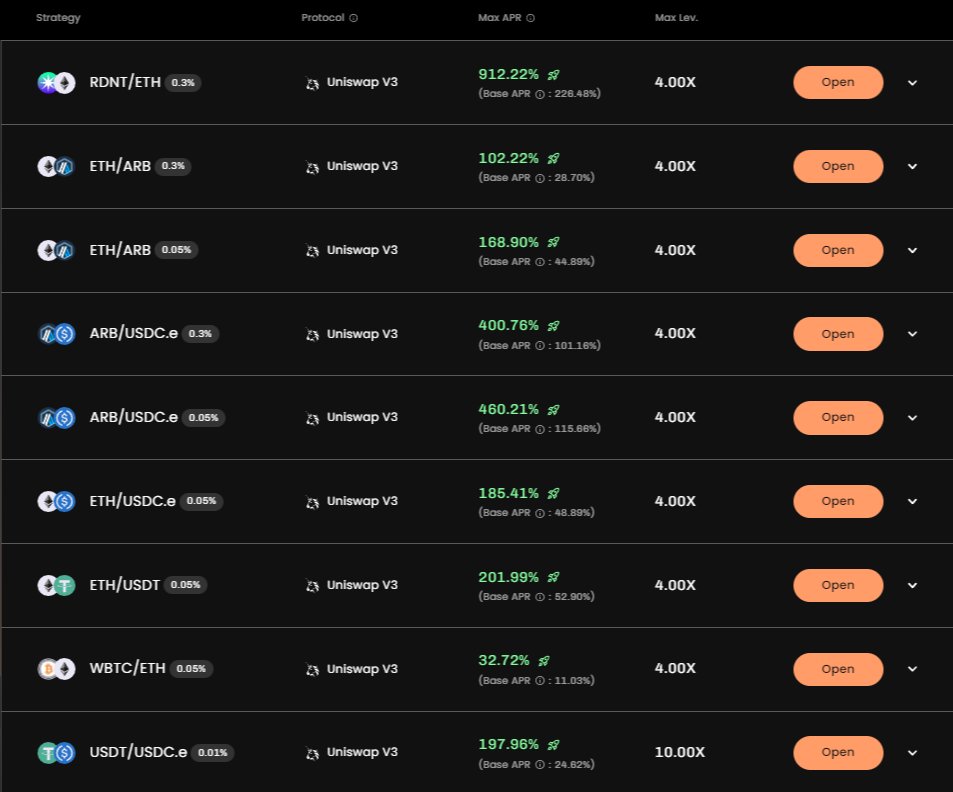

➡️You can supply $10k ARB/USDC on $UNI and get exposure to $42k+ with leverage?👀

All of this with:

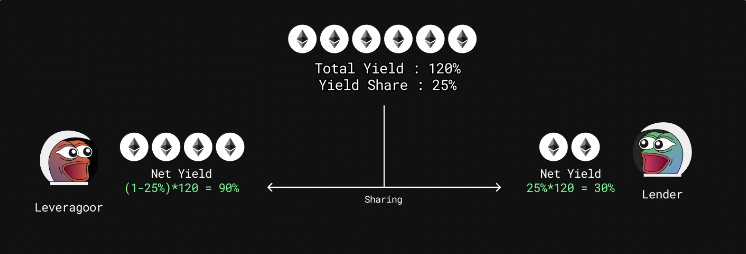

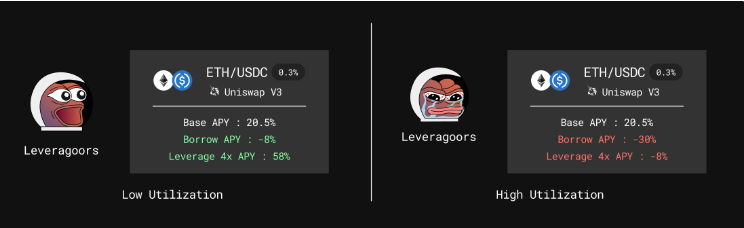

• 435% APR

• 0% borrow cost

You can also long $ARB at the same time for additional exposure/profit👌

No wonder #Binance is behind them💰

Real $ALPHA 👇

➡️You can supply $10k ARB/USDC on $UNI and get exposure to $42k+ with leverage?👀

All of this with:

• 435% APR

• 0% borrow cost

You can also long $ARB at the same time for additional exposure/profit👌

No wonder #Binance is behind them💰

Real $ALPHA 👇

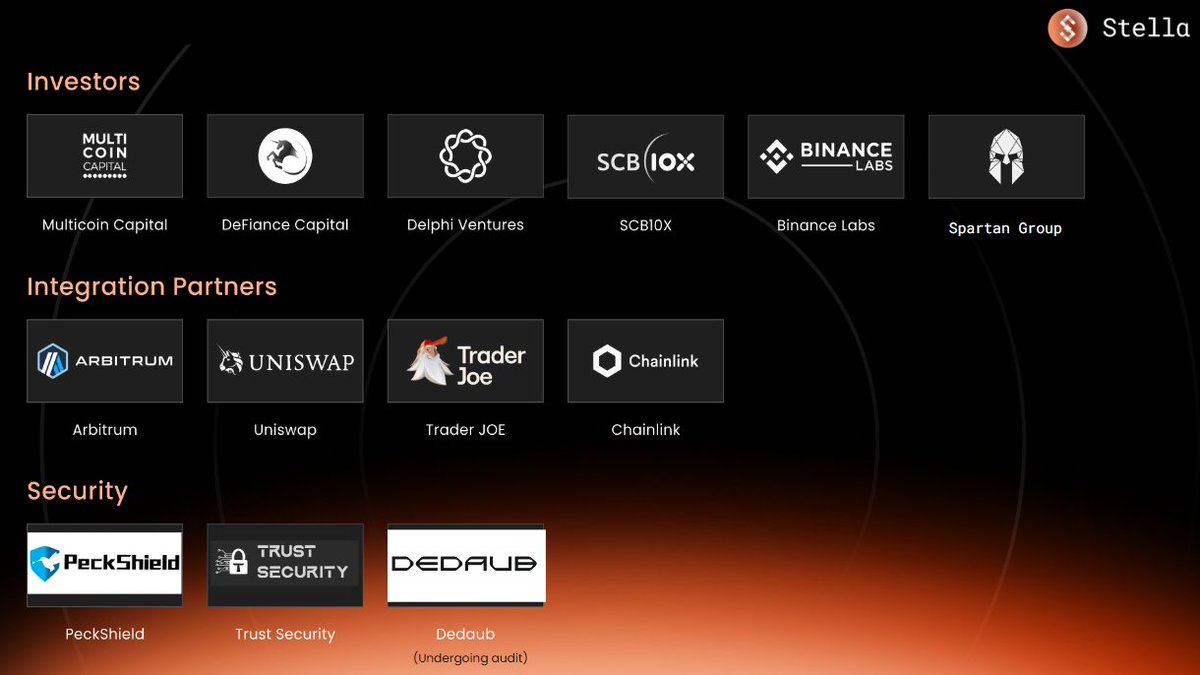

1️⃣5️⃣Audits & Investors

Audits were made by:🔎

• Peck Shield

• Trust security

They are backed by some well-known investors:💰

• @multicoincap

• @DeFianceCapital

• @Delphi_Digital

• @BinanceLabs

• @TheSpartanGroup

• @SCB10X_OFFICIAL

Audits were made by:🔎

• Peck Shield

• Trust security

They are backed by some well-known investors:💰

• @multicoincap

• @DeFianceCapital

• @Delphi_Digital

• @BinanceLabs

• @TheSpartanGroup

• @SCB10X_OFFICIAL

1️⃣6️⃣Transparency & conclusion

This thread was made in collaboration with Stella.🤝

I like their innovative product and plan to use it in the future.

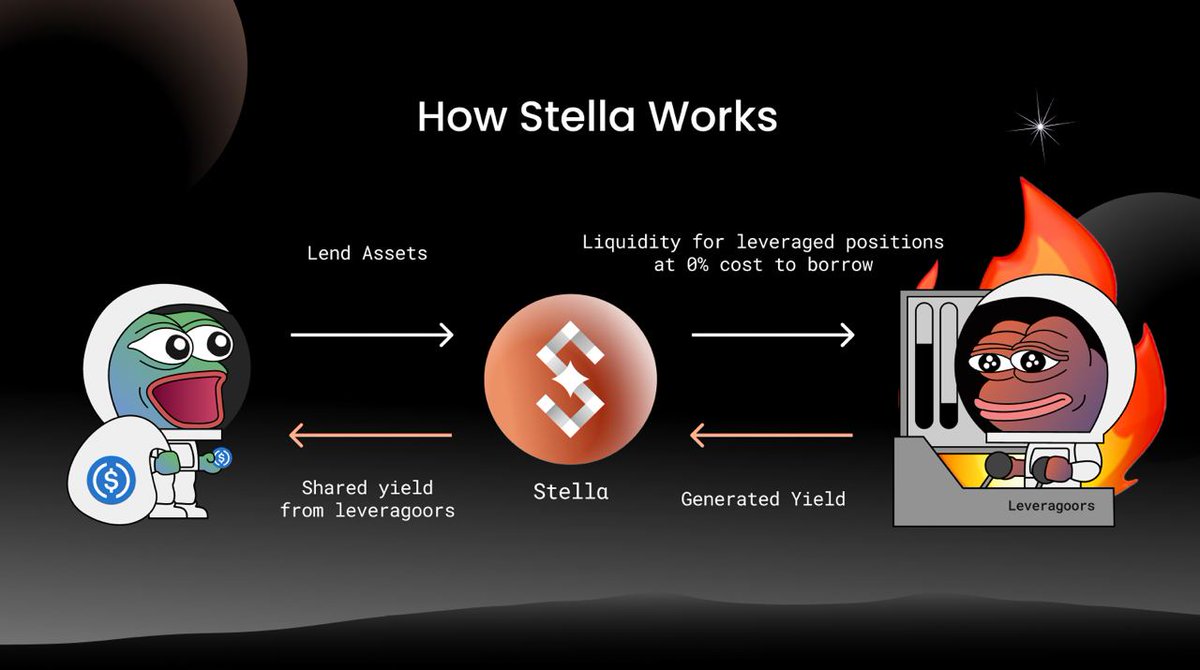

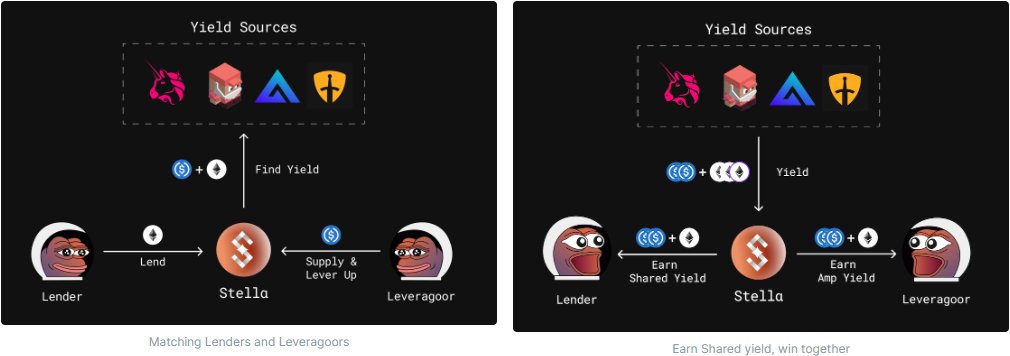

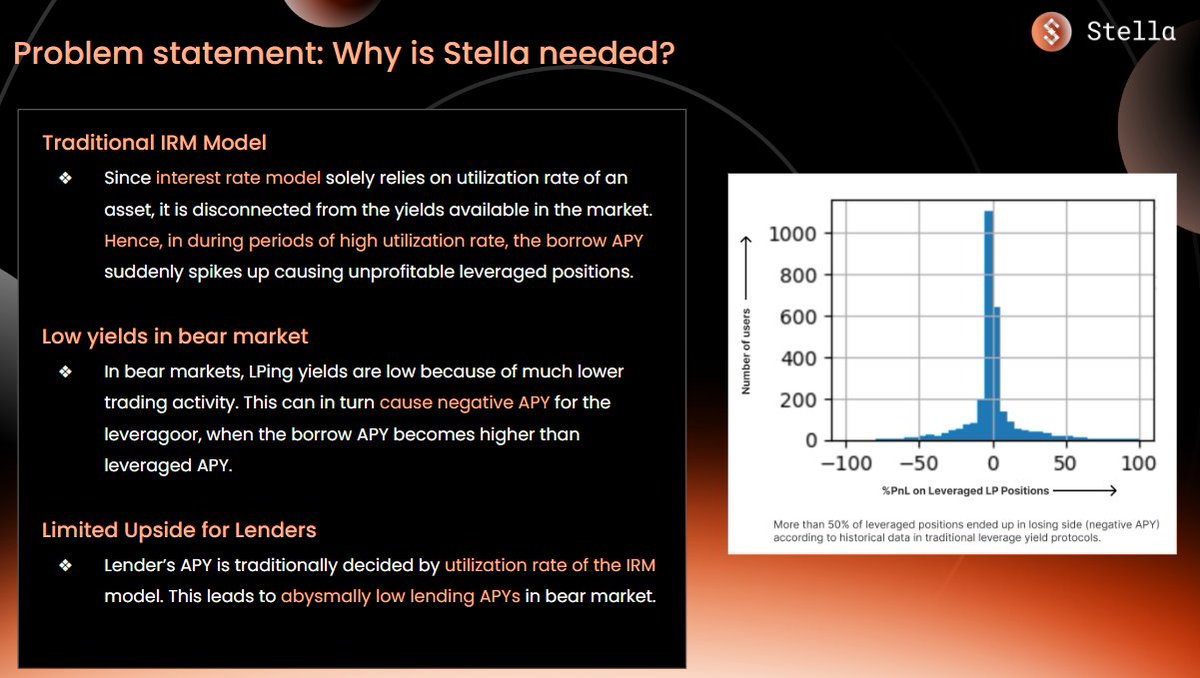

Degens are bored with 10% APRs on most LP pairs.

They want more.🤑

That's where Stella comes into play.👌

NFA.❌

DYOR. ⚠️

This thread was made in collaboration with Stella.🤝

I like their innovative product and plan to use it in the future.

Degens are bored with 10% APRs on most LP pairs.

They want more.🤑

That's where Stella comes into play.👌

NFA.❌

DYOR. ⚠️

If you made it this far, you are in the top 1%.💎

If you enjoyed:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

3. Subscribe to "Crypto Stoics" for ALPHA content🤫

If you enjoyed:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

3. Subscribe to "Crypto Stoics" for ALPHA content🤫

جاري تحميل الاقتراحات...