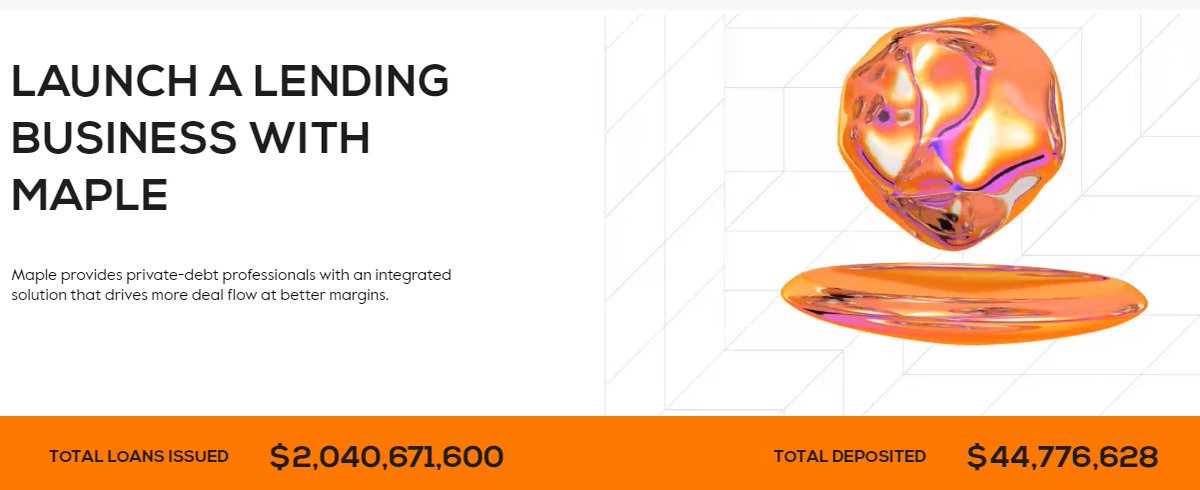

5/ @maplefinance is a decentralized credit market that allows users to lend and borrow money against the value of real-world assets.

@maplefinance is built on the Ethereum blockchain and uses smart contracts to automate the lending and borrowing process.

@maplefinance is built on the Ethereum blockchain and uses smart contracts to automate the lending and borrowing process.

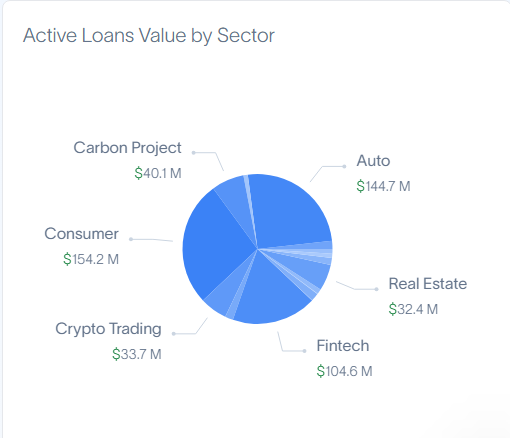

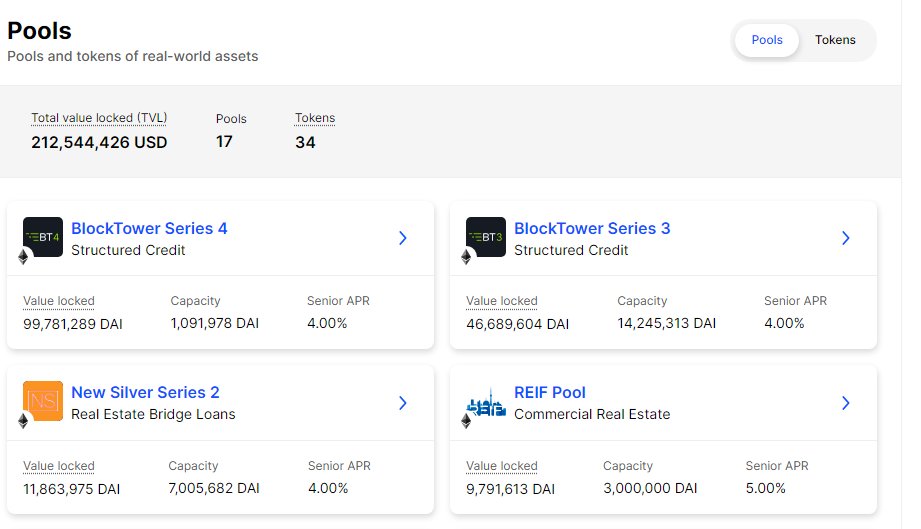

6/ @maplefinance works by creating lending pools backed by real-world assets.

Lenders deposit their assets into these pools and earn interest. Borrowers can take out loans using these pools.

Pool delegates manage the pools and are rewarded with a share of the interest earned.

Lenders deposit their assets into these pools and earn interest. Borrowers can take out loans using these pools.

Pool delegates manage the pools and are rewarded with a share of the interest earned.

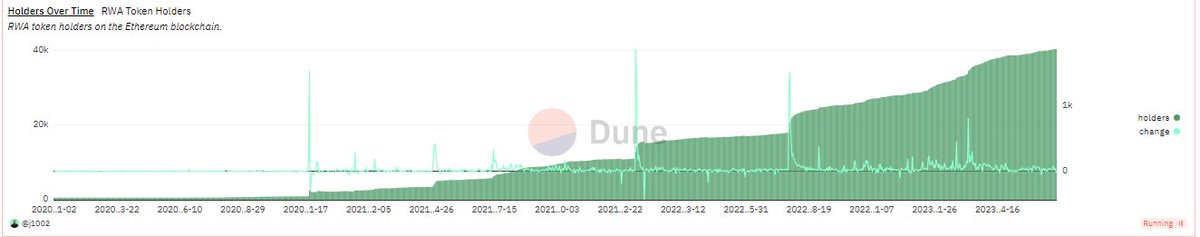

8/ @centrifuge is also a decentralized credit market that focuses on lending and borrowing money against the value of RWA.

The key difference is Centrifuge allows RWA to be tokenized and represented as non-fungible tokens (NFTs) on the blockchain.

The key difference is Centrifuge allows RWA to be tokenized and represented as non-fungible tokens (NFTs) on the blockchain.

9/ @centrifuge’s dApp is known as Tinlake allows users to collateralize assets to generate an NFT for financing, with each asset pool having two tokens, TIN and DROP.

DROP token holders get a guaranteed return based on a fixed interest per pool, compounded every second.

DROP token holders get a guaranteed return based on a fixed interest per pool, compounded every second.

10/ TIN token holders don't have a guaranteed return. They receive a variable yield based on investment returns, which could be higher than holding DROP tokens.

TIN token holders take the first loss if a borrower defaults, bearing higher risk.

TIN token holders take the first loss if a borrower defaults, bearing higher risk.

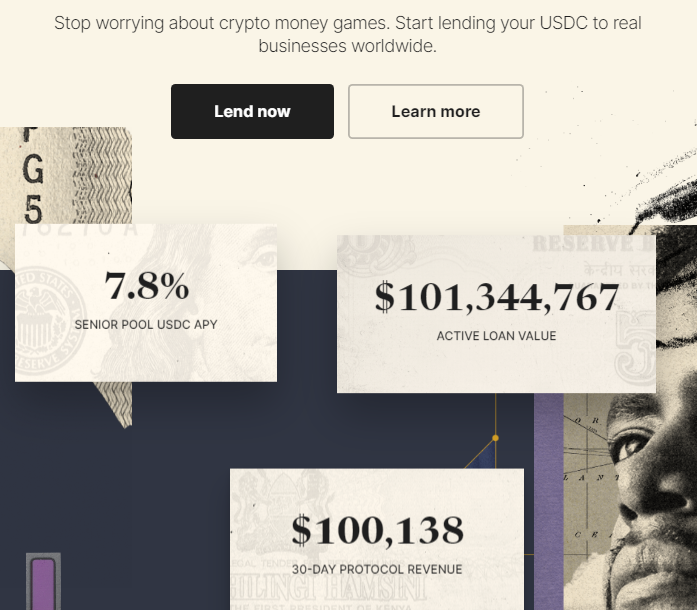

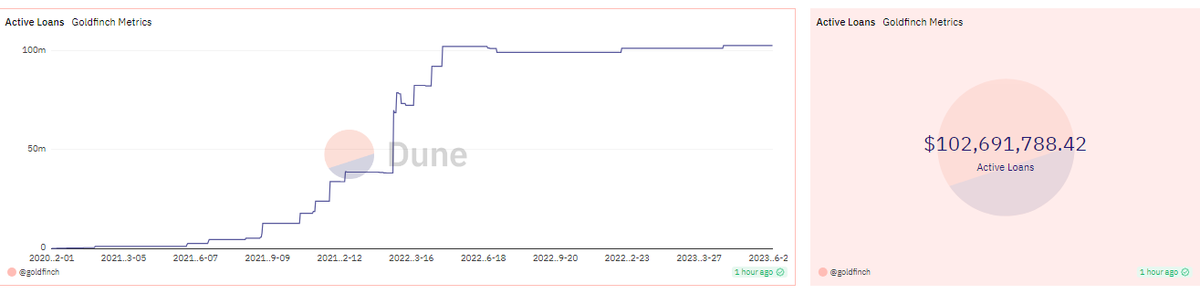

11/ @goldfinch_fi primarily focuses on providing loans to real-world businesses, specifically targeting borrowers like debt funds and fintech companies, with a particular emphasis on businesses within emerging markets.

They offer credit lines in USDC.

They offer credit lines in USDC.

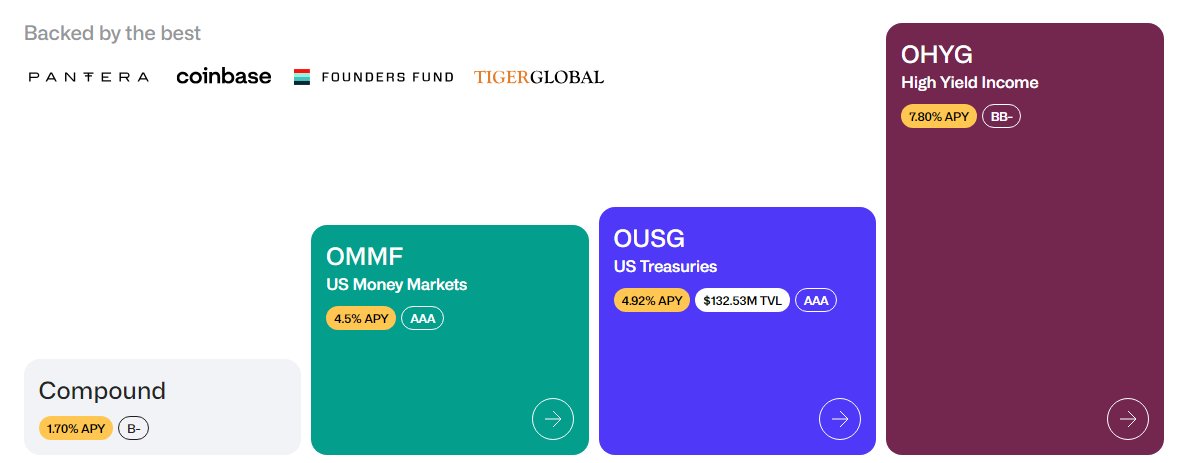

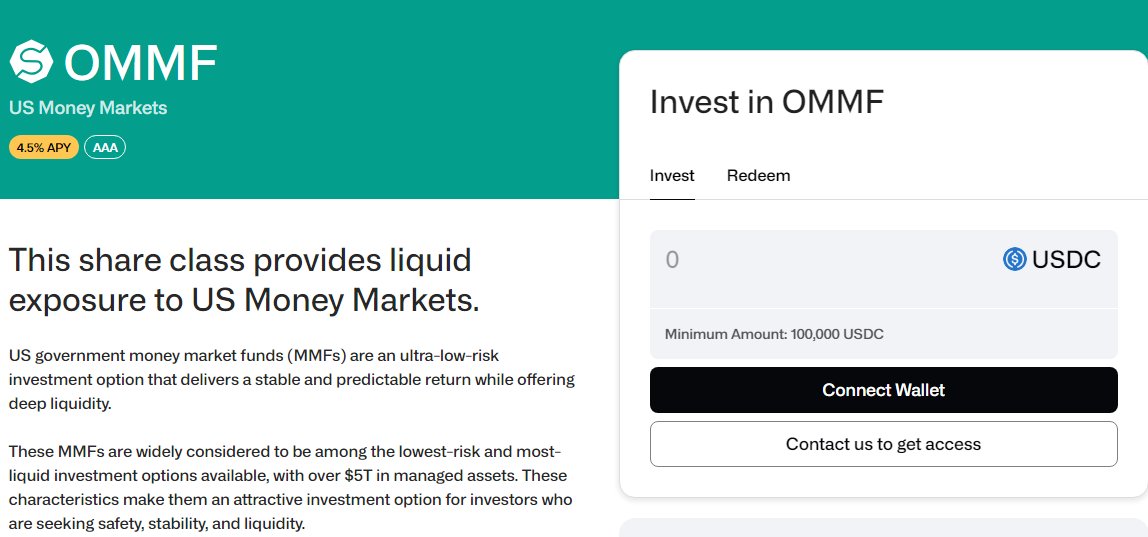

13/ @OndoFinance has a tokenized fund that allows stablecoin holders to invest in Money Markets, bonds, and US Treasuries.

By leveraging blockchain technology and smart contracts, Ondo Finance seeks to make traditional capital markets more accessible than ever before.

By leveraging blockchain technology and smart contracts, Ondo Finance seeks to make traditional capital markets more accessible than ever before.

14/ The fund has four share classes of yield offerings :

- US Money Market (OMMF)

- Ondo US Short-Term Government Bond Fund (OUSG)

- Ondo Short-Term Investment Grade Bond Fund (OSTB)

- Ondo High Yield Corporate Bond Fund (OHYG)

- US Money Market (OMMF)

- Ondo US Short-Term Government Bond Fund (OUSG)

- Ondo Short-Term Investment Grade Bond Fund (OSTB)

- Ondo High Yield Corporate Bond Fund (OHYG)

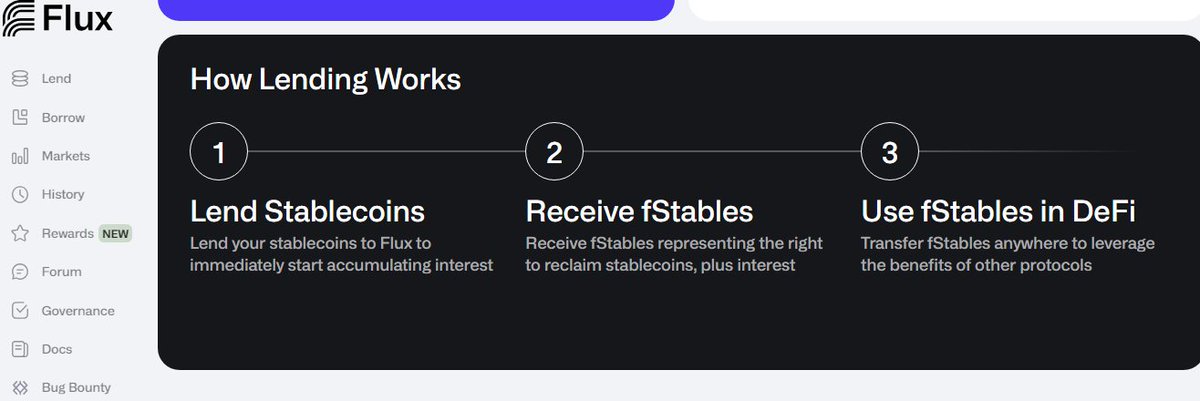

15/ @OndoFinance is utilizing @FluxDeFi, a decentralized finance protocol supported by Ondo.

This protocol serves as a permissionless touchpoint that enables retail investors to lend and borrow stablecoins against U.S Treasuries.

This protocol serves as a permissionless touchpoint that enables retail investors to lend and borrow stablecoins against U.S Treasuries.

16/ How it works:

Users deposit USDC to Ondo and receive OUSG for TradFi yields. OUSG tokens are deposited to Flux to borrow USDC at a lower rate.

Repeatable process. Alternatively, users can borrow other cryptos with USDC for different DeFi protocols.

Users deposit USDC to Ondo and receive OUSG for TradFi yields. OUSG tokens are deposited to Flux to borrow USDC at a lower rate.

Repeatable process. Alternatively, users can borrow other cryptos with USDC for different DeFi protocols.

17/ @OndoFinance has also launched a stablecoin (OMMF) that will pay interest to its holders via a tokenized money market fund.

Investors will be able to mint and redeem OMMF tokens on business days, and they will receive daily interest in the form of new OMMF tokens.

Investors will be able to mint and redeem OMMF tokens on business days, and they will receive daily interest in the form of new OMMF tokens.

18/ Closing thoughts:

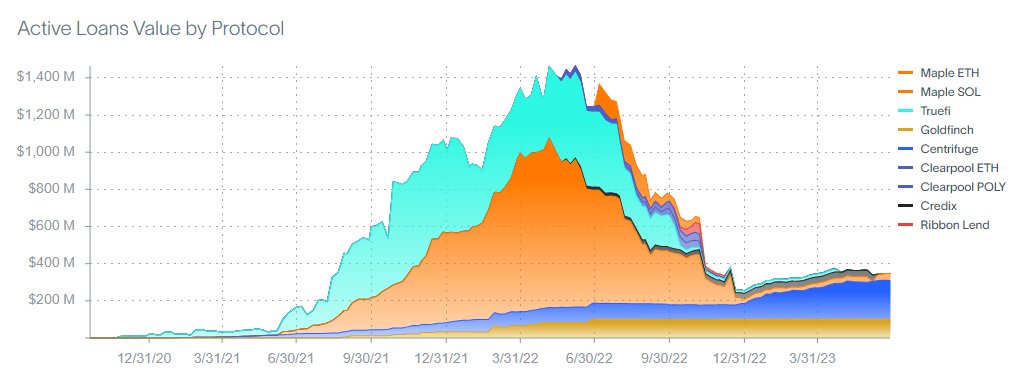

The RWA sector has immense potential in the traditional finance market. Multiple credit protocols have emerged, each with unique approaches.

It will be fascinating to see how this space evolves with rapid advancements and more adoption from the market.

The RWA sector has immense potential in the traditional finance market. Multiple credit protocols have emerged, each with unique approaches.

It will be fascinating to see how this space evolves with rapid advancements and more adoption from the market.

I hope you found this content useful.

If you enjoy it and want more crypto content, please like, retweet, and follow @0xPragmatism.

Always love to hear feedback and suggestion!

Like/Retweet the first tweet below if you can:

If you enjoy it and want more crypto content, please like, retweet, and follow @0xPragmatism.

Always love to hear feedback and suggestion!

Like/Retweet the first tweet below if you can:

جاري تحميل الاقتراحات...