1/9 Do you remember the #realyield narrative?

It gained significant attention last year. But now it's rarely mentioned.

But did the narrative have a lasting impact?

In other words, did the #realyield tokens outperform other #DeFi tokens since then?

Let's find out: 🧵

It gained significant attention last year. But now it's rarely mentioned.

But did the narrative have a lasting impact?

In other words, did the #realyield tokens outperform other #DeFi tokens since then?

Let's find out: 🧵

2/9 I researched if high protocol fee projects led to better token performance before the #realyield narrative gained popularity a year ago.

At that time, the answer was no.

Yet, just 2 months later, the #Realyield narrative picked up, and the tokens started outperforming.

At that time, the answer was no.

Yet, just 2 months later, the #Realyield narrative picked up, and the tokens started outperforming.

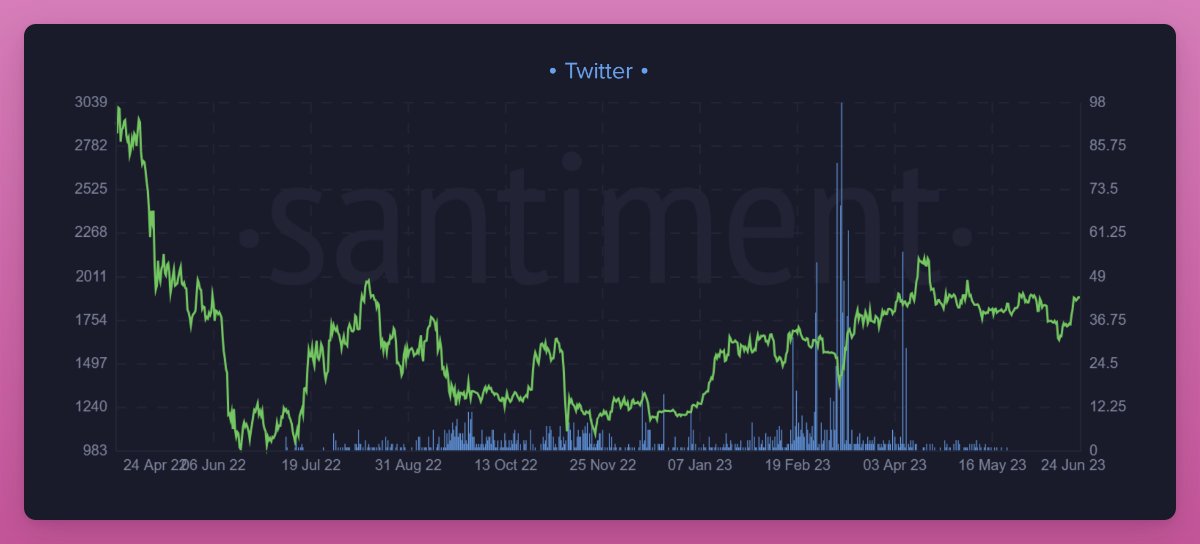

3/9 Currently, there is limited mention of the #realyield narrative on Twitter.

The blue line represents #realyield mentions on Twitter, while the green line is the ETH/USD price.

The blue line represents #realyield mentions on Twitter, while the green line is the ETH/USD price.

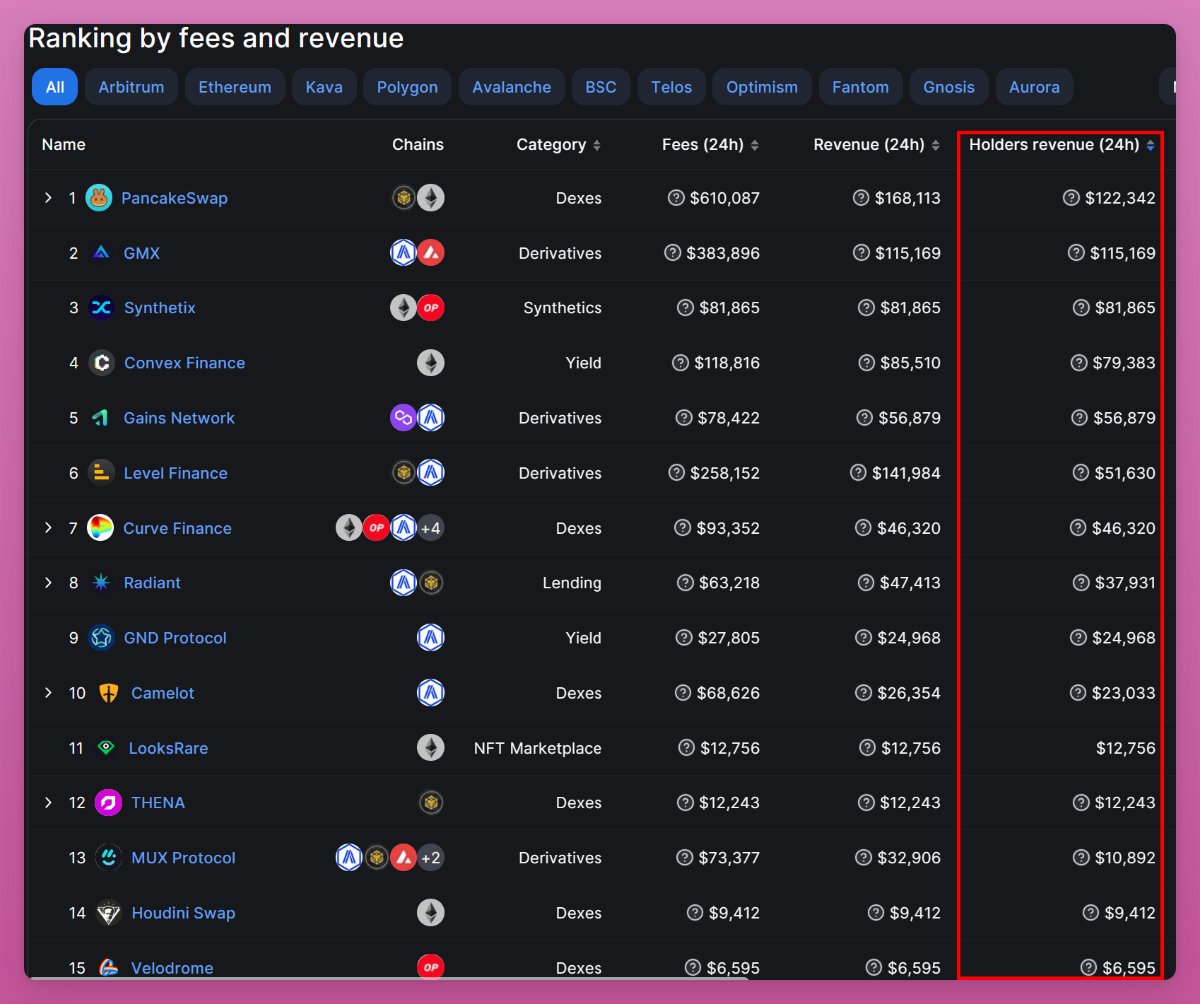

4/9 Below are the top protocols by fees & revenue.

But what we really care is the token holder revenue, making these protocols the real #realyield tokens.

The top projects are $CAKE, $GMX, $SNX, $CVX, $GNS, $LVL, $CRV, etc.

But what we really care is the token holder revenue, making these protocols the real #realyield tokens.

The top projects are $CAKE, $GMX, $SNX, $CVX, $GNS, $LVL, $CRV, etc.

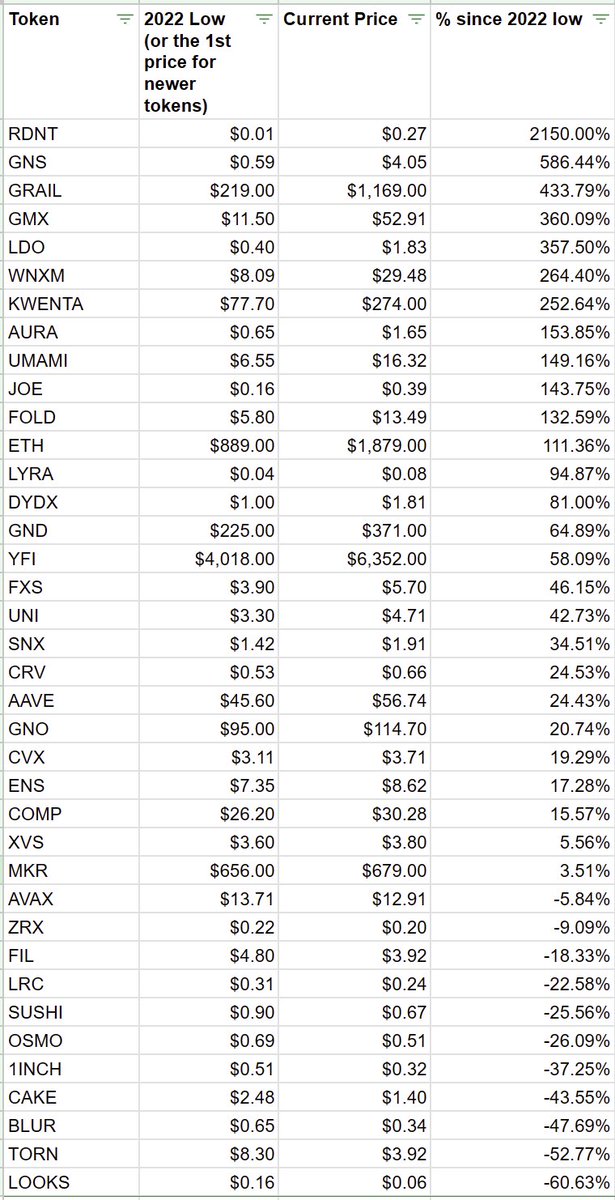

5/9 The big question is: Have these protocols outperformed since the narrative began?

As a proxy, I examine the lowest prices in 2022.

These prices were the catalyst for the emergence of the realyield narrative, as the community sought value tokens to buy at discounted prices.

As a proxy, I examine the lowest prices in 2022.

These prices were the catalyst for the emergence of the realyield narrative, as the community sought value tokens to buy at discounted prices.

6/9 The answer is... not really 😅

Yes, #realyield tokens like $RDNT, $GRAIL, $GMX, and $GNS performed extremely well, which would make us believe that the #realyield is, well, real.

But other #realyield tokens like $SNX, $CRV, and $CVX have underperformed non-realyield tokens.

Yes, #realyield tokens like $RDNT, $GRAIL, $GMX, and $GNS performed extremely well, which would make us believe that the #realyield is, well, real.

But other #realyield tokens like $SNX, $CRV, and $CVX have underperformed non-realyield tokens.

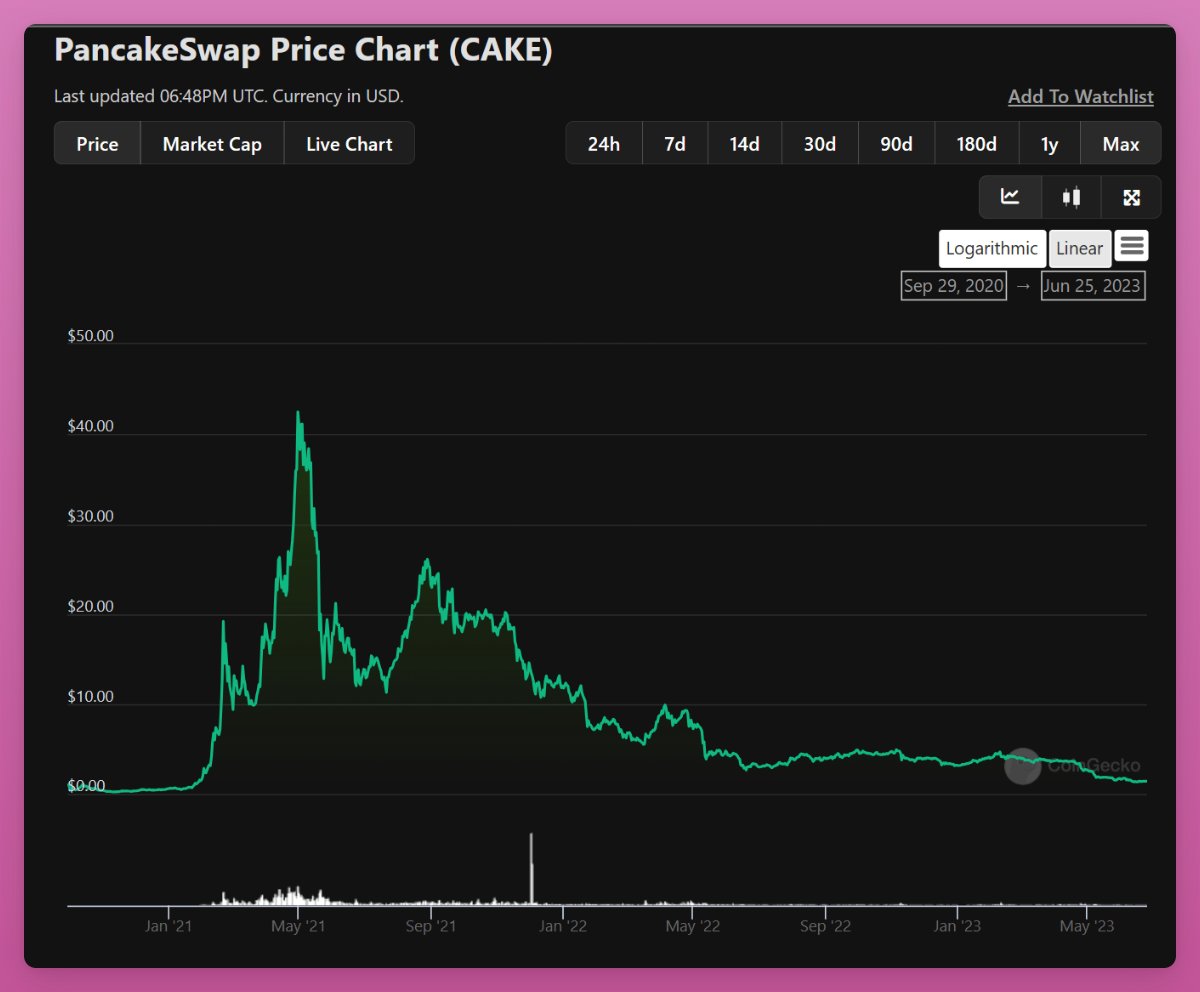

8/9 Many more elements are needed to evaluate the token's potential.

Just to mention a few:

• Token inflation

• Other narratives

• Project development

• Competition

In short, for a long-term investment, don't fall for a simple narrative, but take a holistic market view.

Just to mention a few:

• Token inflation

• Other narratives

• Project development

• Competition

In short, for a long-term investment, don't fall for a simple narrative, but take a holistic market view.

9/9 I hope you've found this thread helpful.

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

جاري تحميل الاقتراحات...